Our top level software engineers worked hard to set-up the PDF editor we are now extremely pleased to deliver to you. This application enables you to quickly complete what is business partner number in florida and saves valuable time. You need to simply adhere to this specific procedure.

Step 1: To begin the process, choose the orange button "Get Form Now".

Step 2: After you have accessed the what is business partner number in florida editing page you can discover the whole set of functions you may carry out with regards to your document in the upper menu.

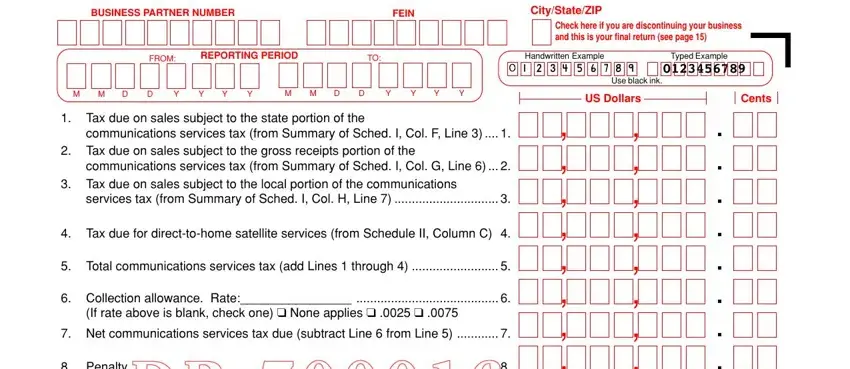

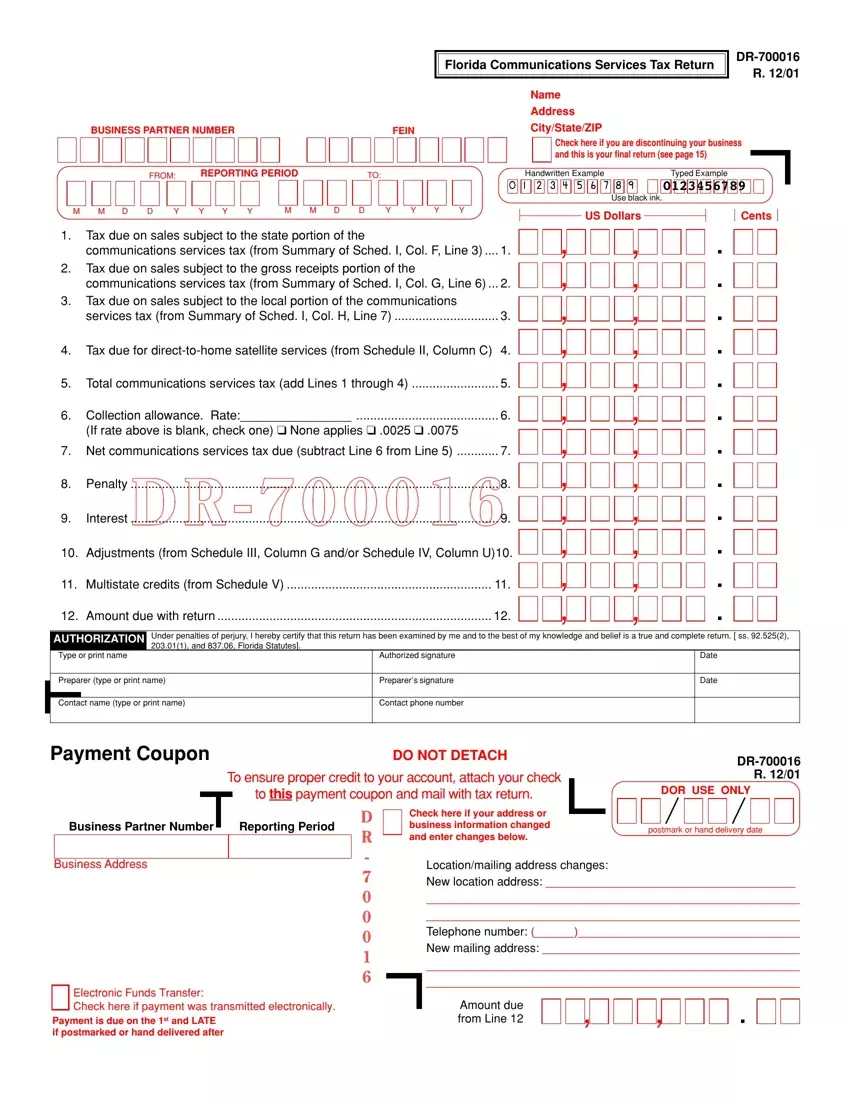

You'll have to enter the next details so that you complete the template:

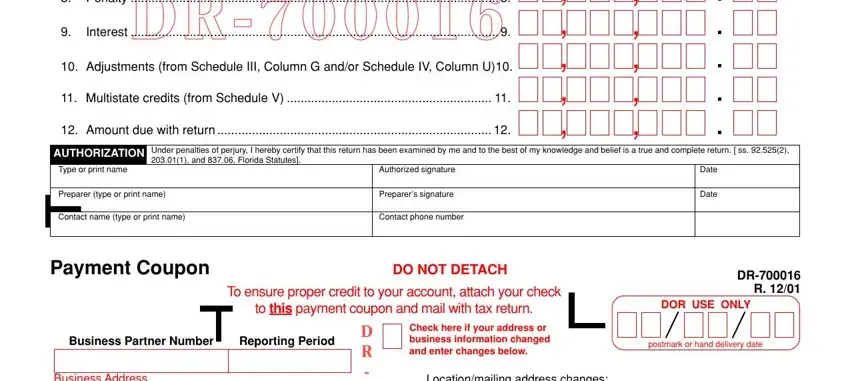

Provide the requested data in the field Penalty, Interest, Adjustments from Schedule III, Multistate credits from Schedule, Amount due with return, Under penalties of perjury I, AUTHORIZATION, Type or print name, Preparer type or print name, Contact name type or print name, Authorized signature, Preparers signature, Contact phone number, Date, and Date.

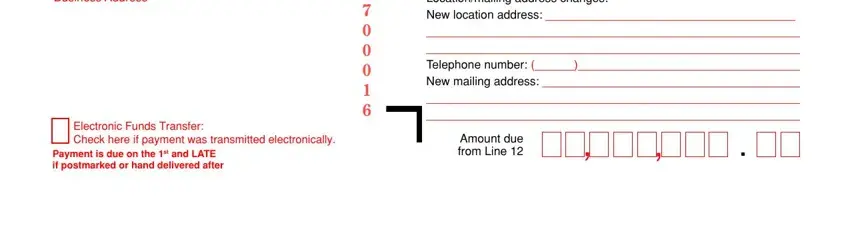

Put together the key particulars in the Business Address, Electronic Funds Transfer Check, Payment is due on the st and LATE, D R, Locationmailing address changes, and Amount due from Line section.

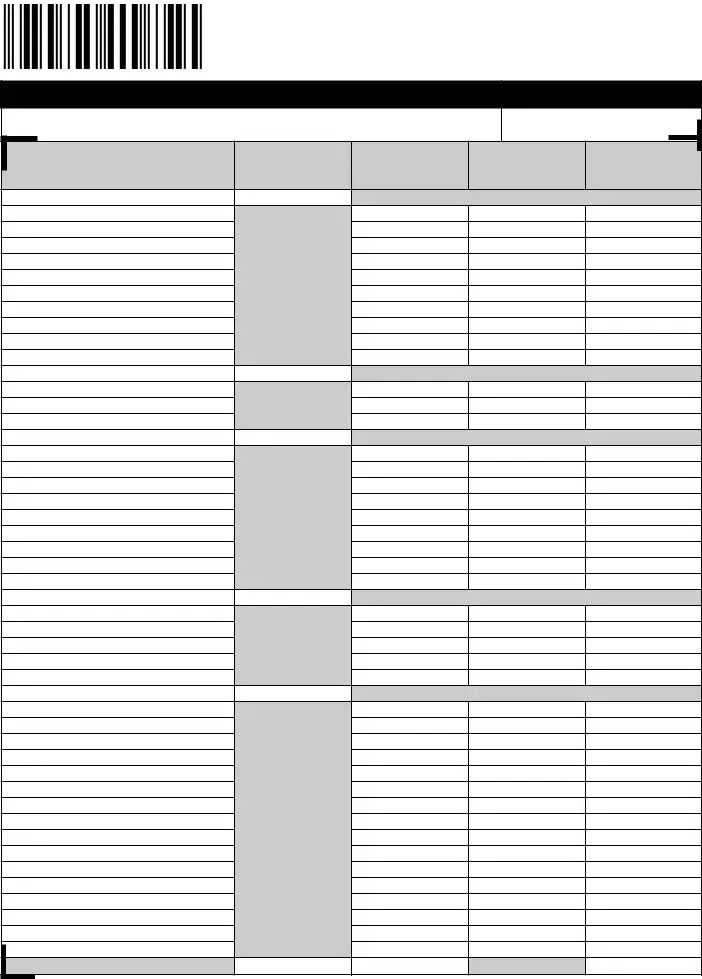

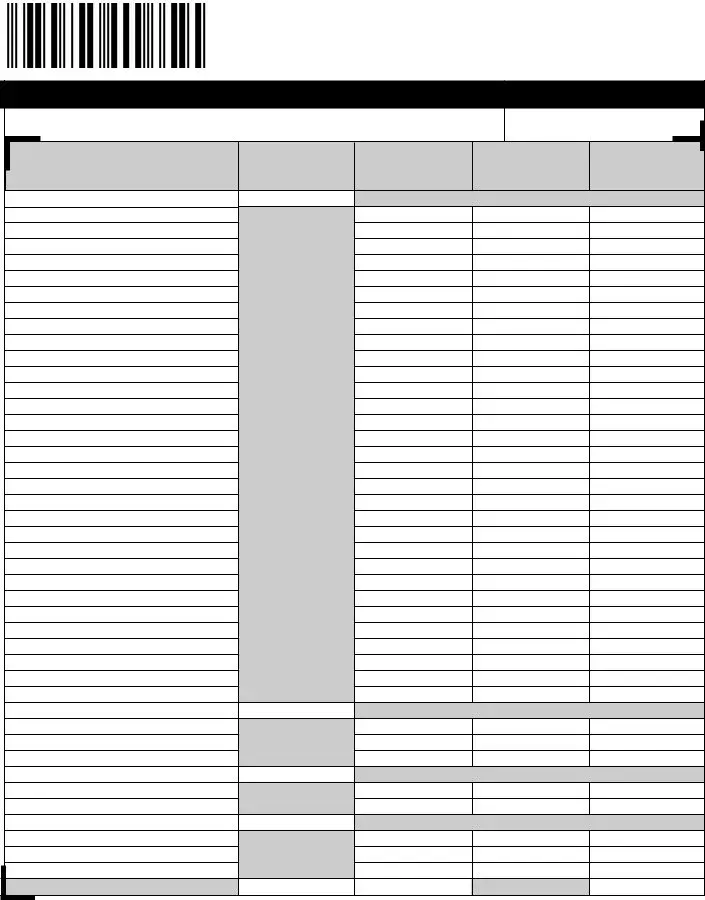

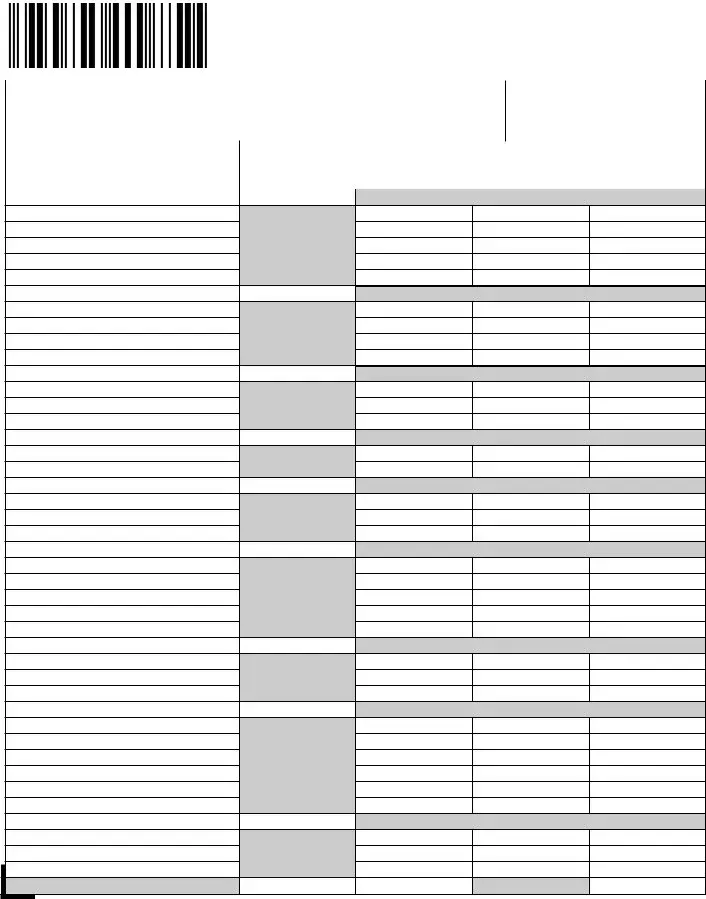

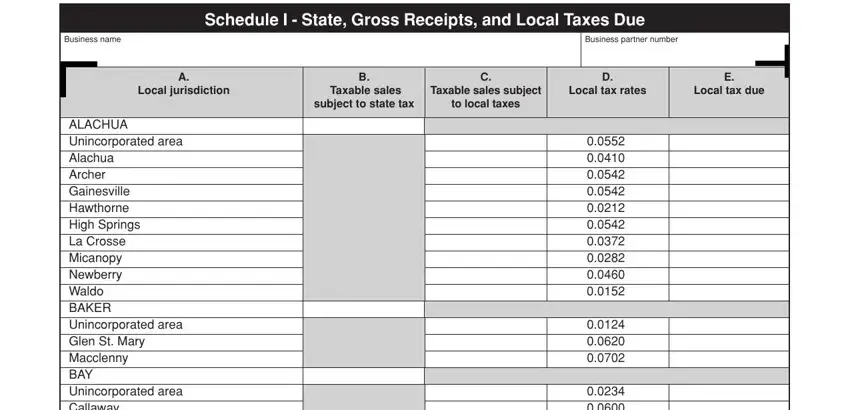

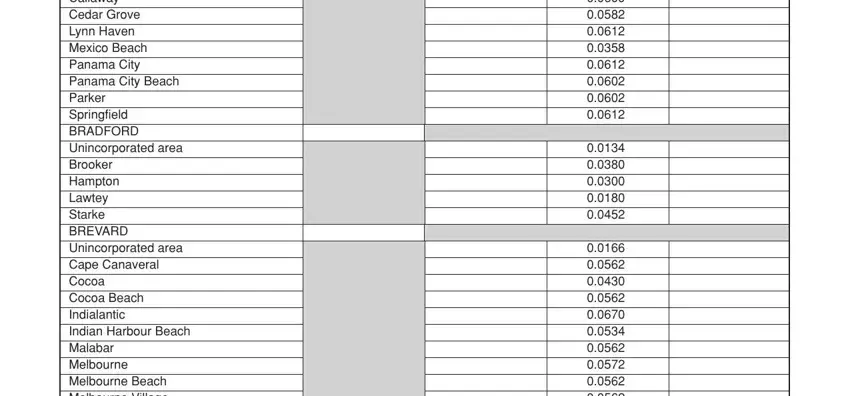

You will have to spell out the rights and obligations of each party in section Business name, Business partner number, Schedule I State Gross Receipts, A Local jurisdiction, B Taxable sales subject to state, C Taxable sales subject to local, D Local tax rates, E Local tax due, and ALACHUA Unincorporated area.

Finalize by checking the next sections and completing them as needed: ALACHUA Unincorporated area.

Step 3: After you have selected the Done button, your document should be obtainable for export to any kind of gadget or email you specify.

Step 4: It may be more convenient to keep duplicates of the form. You can rest assured that we won't distribute or see your data.

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,