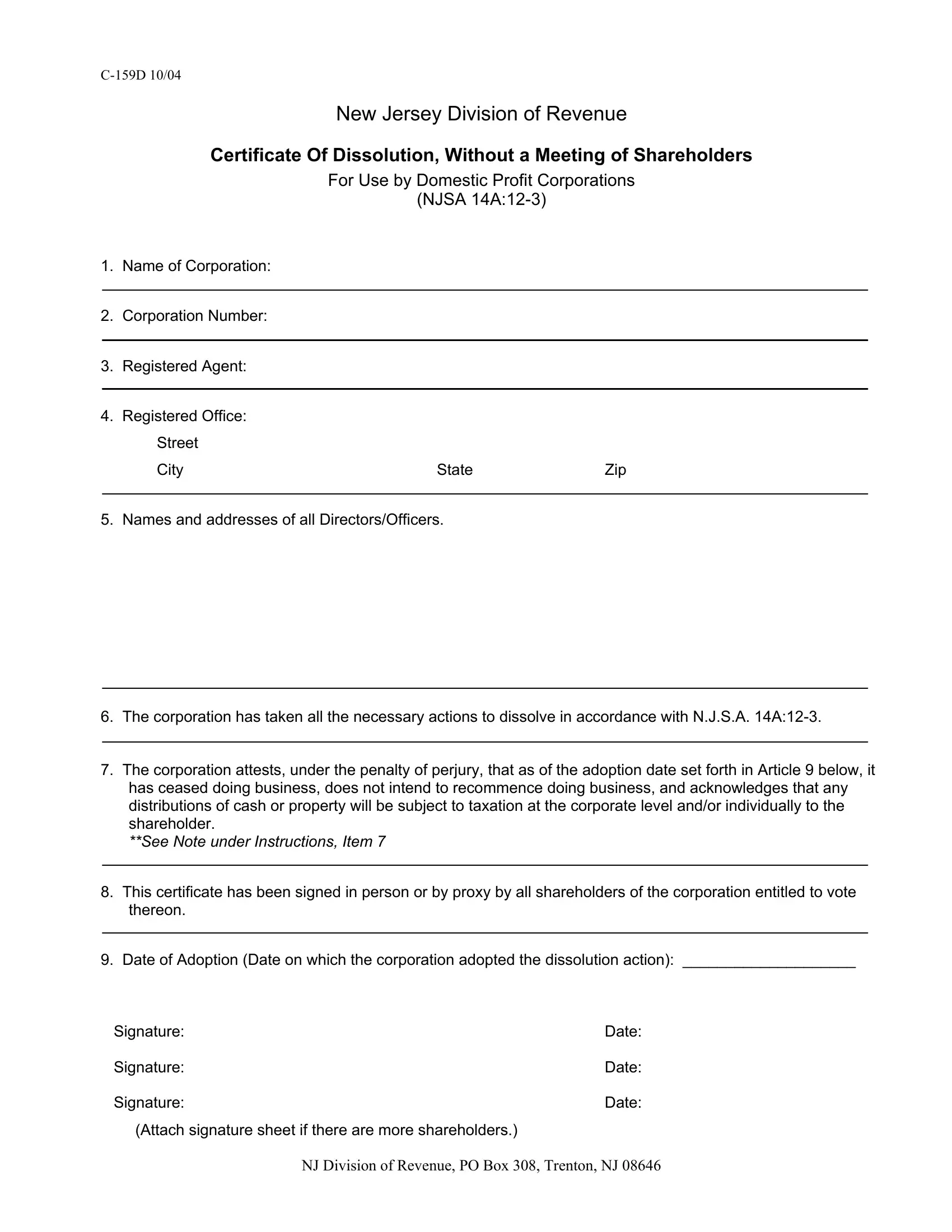

C-159D 10/04

New Jersey Division of Revenue

Certificate Of Dissolution, Without a Meeting of Shareholders

For Use by Domestic Profit Corporations

(NJSA 14A:12-3)

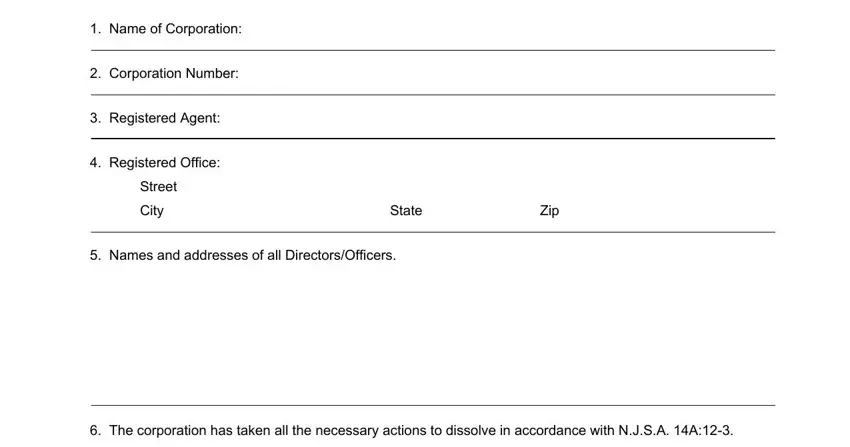

1.Name of Corporation:

2.Corporation Number:

3.Registered Agent:

4.Registered Office: Street

5. Names and addresses of all Directors/Officers.

6.The corporation has taken all the necessary actions to dissolve in accordance with N.J.S.A. 14A:12-3.

7.The corporation attests, under the penalty of perjury, that as of the adoption date set forth in Article 9 below, it has ceased doing business, does not intend to recommence doing business, and acknowledges that any distributions of cash or property will be subject to taxation at the corporate level and/or individually to the shareholder.

**SEE NOTE UNDER INSTRUCTIONS, ITEM 7

8.This certificate has been signed in person or by proxy by all shareholders of the corporation entitled to vote thereon.

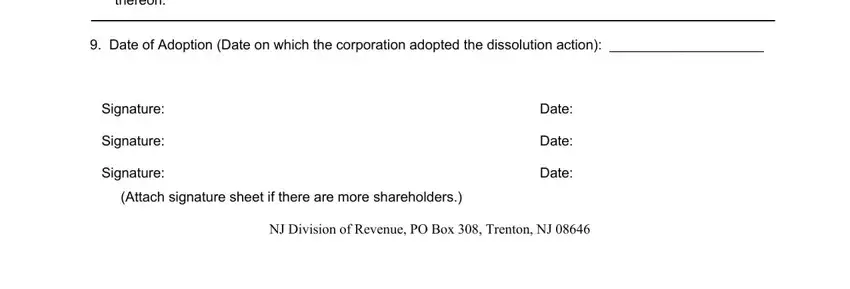

9.Date of Adoption (Date on which the corporation adopted the dissolution action): ____________________

Signature:Date:

Signature:Date:

Signature:Date:

(Attach signature sheet if there are more shareholders.)

NJ DIVISION OF REVENUE, PO BOX 308, TRENTON, NJ 08646

REV 9/05

OVERVIEW OF DISSOLUTION REQUEST PROCESS

USING FORM C-159D

A corporation may be dissolved by the written consent of all its shareholders entitled to vote on the action. To effect such a dissolution, all shareholders shall sign and file in the Office of the Treasurer, Division of Revenue, the articles of dissolution set forth in form C-159D. A "Tax Clearance Certificate" must also be issued for domestic profit corporations.

To begin the dissolution filing process, corporations should submit a completed dissolution package containing all of the following to the New Jersey Division of Revenue, PO Box 308, Trenton, N.J. 08625, Attn: Business Liquidation:

•This form (completed C159-D)

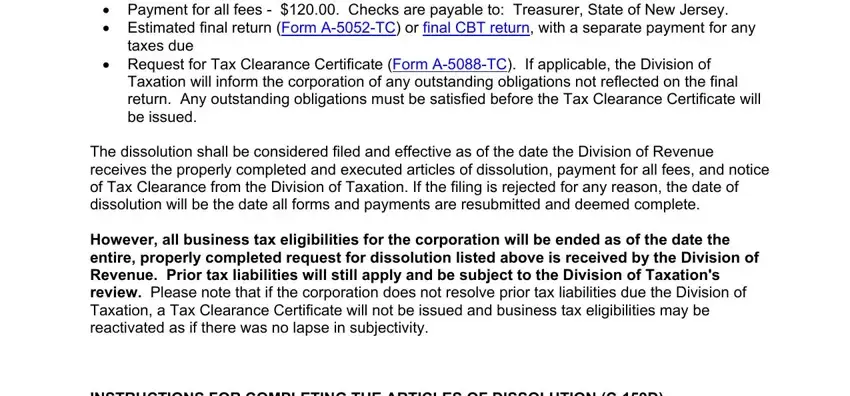

•Payment for all fees - $120.00. Checks are payable to: Treasurer, State of New Jersey.

•Estimated final return (Form A-5052-TC) or final CBT return, with a separate payment for any taxes due

•Request for Tax Clearance Certificate (Form A-5088-TC). If applicable, the Division of Taxation will inform the corporation of any outstanding obligations not reflected on the final return. Any outstanding obligations must be satisfied before the Tax Clearance Certificate will be issued.

The dissolution shall be considered filed and effective as of the date the Division of Revenue receives the properly completed and executed articles of dissolution, payment for all fees, and notice of Tax Clearance from the Division of Taxation. If the filing is rejected for any reason, the date of dissolution will be the date all forms and payments are resubmitted and deemed complete.

However, all business tax eligibilities for the corporation will be ended as of the date the entire, properly completed request for dissolution listed above is received by the Division of Revenue. Prior tax liabilities will still apply and be subject to the Division of Taxation's review. Please note that if the corporation does not resolve prior tax liabilities due the Division of Taxation, a Tax Clearance Certificate will not be issued and business tax eligibilities may be reactivated as if there was no lapse in subjectivity.

INSTRUCTIONS FOR COMPLETING THE ARTICLES OF DISSOLUTION (C-159D)

1.Name of Corporation -- Enter the corporation's name.

2.Corporation Number -- Enter the 10-digit number assigned by the State at the time the certificate of incorporation was filed.

3.Registered Agent -- List name of the corporation's current registered agent.

4.Registered Office -- List the corporation's current registered office address including street, city and zip code. (This must be a New Jersey address.)

5.Directors/Officers -- List the names and addresses of all current officers and directors. Attach a sheet with names and addresses if more space is required.

6.Legal attestation regarding N.J.S.A. 14A:12-3 -- DO NOT alter this field. This is the corporation's statement that it has taken all the necessary actions to dissolve in accordance with N.J.S.A. 14A:12-3.

7.Legal attestation relative to business status -- DO NOT alter this field. This is the corporation's statement that as of the date of adoption forth in Article 9, it has ceased doing business, does

C-159D Instructions

Page 2

not intend to recommence doing business, and any distribution of cash or property will be subject to taxation at the corporate level and/or individually to the shareholder.

**Note: State law (N.J.S.A. 14A:12-9) provides that a dissolved corporation may take such actions that are necessary for the purpose of winding up its affairs. This includes paying, satisfying and discharging the corporation's debts and other liabilities.

8.Statement of authorization -- DO NOT alter this field. This is the corporation's statement that this certificate has been signed in person or by proxy by all shareholders of the corporation entitled to vote thereon.

9.Date of Adoption -- List the date on which the corporation adopted the dissolution action. This field must carry a date only if the dissolution was adopted earlier than the signature. If not, leave this filed blank and the signature date will serve as the adoption date.

EXECUTION (Date/Signature)

Have all shareholders entitled to vote on the dissolution sign in person or by proxy. Provide the date of each signature.

**********

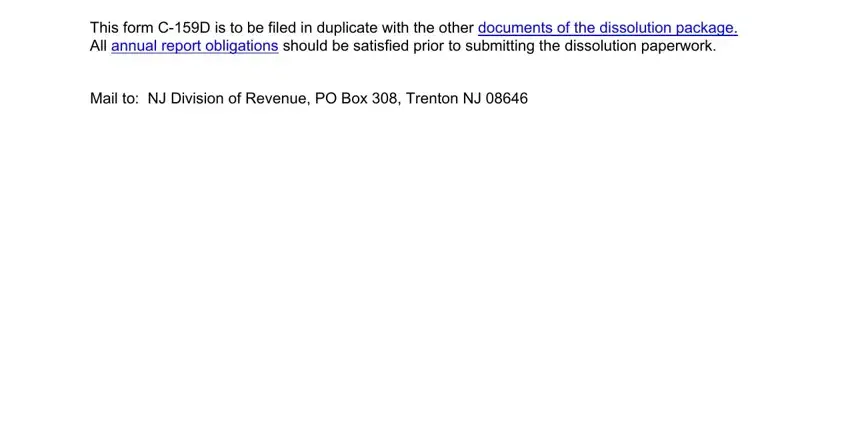

This form C-159D is to be filed in duplicate with the other documents of the dissolution package. All annual report obligations should be satisfied prior to submitting the dissolution paperwork.

Mail to: NJ Division of Revenue, PO Box 308, Trenton NJ 08646