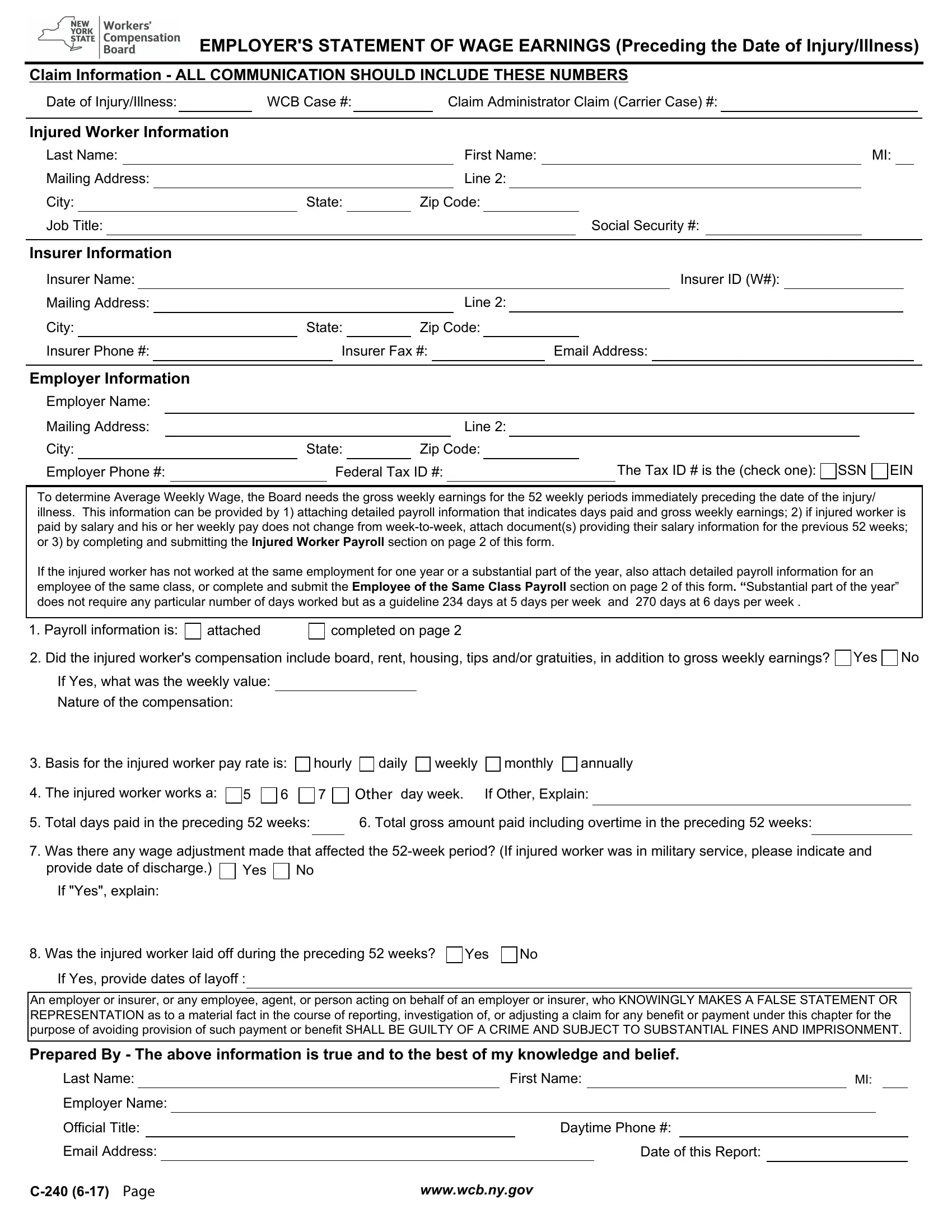

EMPLOYER'S STATEMENT OF WAGE EARNINGS (Preceding the Date of Injury/Illness)

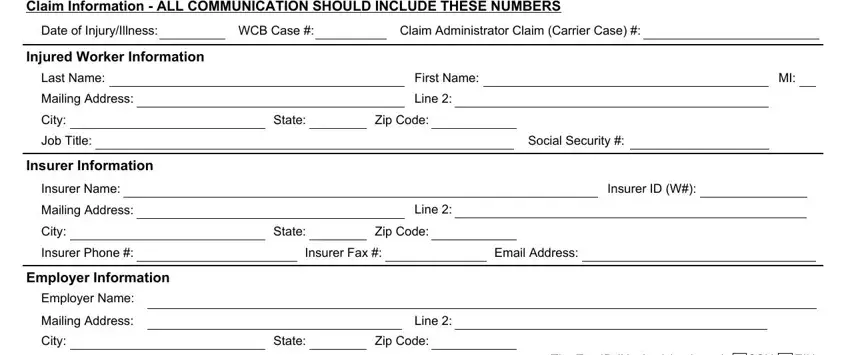

Claim Information - ALL COMMUNICATION SHOULD INCLUDE THESE NUMBERS

Date of Injury/Illness: WCB Case #:Claim Administrator Claim (Carrier Case) #:

Injured Worker Information

Last Name: |

|

|

|

|

|

First Name: |

|

|

|

|

MI: |

|

|

Mailing Address: |

|

|

|

|

Line 2: |

|

|

|

|

|

|

|

|

City: |

|

|

State: |

|

Zip Code: |

|

|

|

|

|

|

|

|

Job Title: |

|

|

|

|

|

|

|

|

|

Social Security #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurer Information

Insurer Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurer ID (W#): |

|

|

|

Mailing Address: |

|

|

|

|

|

|

Line 2: |

|

|

|

|

|

|

|

|

City: |

|

|

State: |

|

Zip Code: |

|

|

|

|

|

|

|

|

|

Insurer Phone #: |

|

|

Insurer Fax #: |

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Information

Employer Name:

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

Line 2: |

|

|

City: |

|

|

|

State: |

|

Zip Code: |

|

|

|

Employer Phone #: |

|

|

|

Federal Tax ID #: |

|

|

The Tax ID # is the (check one): |

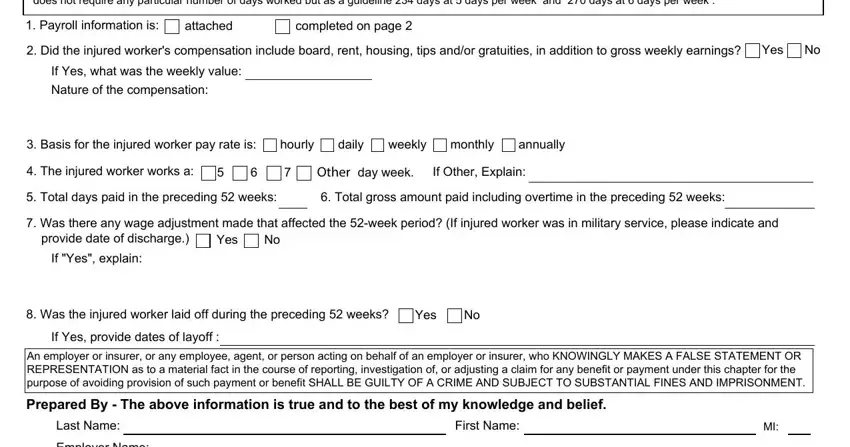

To determine Average Weekly Wage, the Board needs the gross weekly earnings for the 52 weekly periods immediately preceding the date of the injury/ illness. This information can be provided by 1) attaching detailed payroll information that indicates days paid and gross weekly earnings; 2) if injured worker is paid by salary and his or her weekly pay does not change from week-to-week, attach document(s) providing their salary information for the previous 52 weeks; or 3) by completing and submitting the Injured Worker Payroll section on page 2 of this form.

If the injured worker has not worked at the same employment for one year or a substantial part of the year, also attach detailed payroll information for an employee of the same class, or complete and submit the Employee of the Same Class Payroll section on page 2 of this form. “Substantial part of the year” does not require any particular number of days worked but as a guideline 234 days at 5 days per week and 270 days at 6 days per week .

1. Payroll information is: |

attached |

|

completed on page 2 |

|

|

|

2. Did the injured worker's compensation include board, rent, housing, tips and/or gratuities, in addition to gross weekly earnings? |

Yes |

|

If Yes, what was the weekly value: |

|

|

|

|

|

|

|

|

|

Nature of the compensation: |

|

|

|

|

|

|

|

|

|

3. |

Basis for the injured worker pay rate is: |

hourly |

daily |

weekly |

monthly |

annually |

|

4. |

The injured worker works a: |

5 |

6 |

7 |

|

Other day week. |

If Other, Explain: |

|

5. Total days paid in the preceding 52 weeks: |

|

|

6. Total gross amount paid including overtime in the preceding 52 weeks: |

|

|

|

|

|

|

|

|

|

|

|

|

|

7.Was there any wage adjustment made that affected the 52-week period? (If injured worker was in military service, please indicate and provide date of discharge.) Yes No

If "Yes", explain:

8.Was the injured worker laid off during the preceding 52 weeks? If Yes, provide dates of layoff :

An employer or insurer, or any employee, agent, or person acting on behalf of an employer or insurer, who KNOWINGLY MAKES A FALSE STATEMENT OR REPRESENTATION as to a material fact in the course of reporting, investigation of, or adjusting a claim for any benefit or payment under this chapter for the purpose of avoiding provision of such payment or benefit SHALL BE GUILTY OF A CRIME AND SUBJECT TO SUBSTANTIAL FINES AND IMPRISONMENT.

Prepared By - The above information is true and to the best of my knowledge and belief.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name: |

|

|

First Name: |

|

MI: |

|

Employer Name: |

|

|

|

|

|

|

|

|

|

|

Official Title: |

|

|

|

Daytime Phone #: |

|

|

|

|

Email Address: |

|

|

|

|

|

Date of this Report: |

|

|

|

|

C-240 (6-17) Page |

www.wcb.ny.gov |

|

|

|

Instructions for Completing Employer's Statement of Wage Earnings (Form C-240)

CLAIM INFORMATION

Date of Injury/Illness: Enter the date the injured worker was injured or noticed they were ill. Enter the date in month/day/year format. Include the four digit year.

WCB Case #: The Workers' Compensation Board Case number.

Insurer Case #: The Claim Administrator Claim (Carrier Case) number.

INJURED WORKER INFORMATION

Last Name, First Name, MI: Enter the injured worker's full legal name.

Mailing Address: Enter the injured worker's full address, including PO Box, if applicable, city or town, state, zip code.

Social Security #: Enter the injured worker's Social Security Number.

INSURER INFORMATION

Insurer Name: Enter the name of the Workers' Compensation Insurer or Self-Insured Group name.

Mailing Address: Enter the insurer or claims administrator address, including PO Box, if applicable, city or town, state, zip code.

Phone #: Enter the insurer phone number, including area code and extension, if applicable.

Fax #: Enter the insurer fax number, including area code, if applicable.

Email Address: Enter the insurer or claims administrator email address.

EMPLOYER INFORMATION

Employer Name: Enter the name of the injured worker's employer.

Mailing Address: Enter the employer's full address, including PO Box, if applicable, city or town, state, zip code.

Phone #: Enter the employer phone number, including area code and extension, if applicable.

Federal Tax ID #: Enter the employer Federal Tax ID number.

1.Payroll Information - Indicate if payroll information is attached to this form or if the information is entered on page 2.

2.Other Earnings: If the injured worker received board, rent, housing, tips and/or other gratuities, provide the weekly value and describe the

additional earnings. Note: Other earnings does not include accrued time such as vacation.

3.Wage Information: Enter the basis for injured worker's pay rate (hourly, daily, weekly, monthly or annually).

4. Days Worked Per Week: Check the number of days per week the injured worker's work schedule is based on. If it is other than a 5, 6 or 7 day week, explain.

5. Total Days Paid: Enter the total number of days for which the injured worker was paid in the 52 weeks immediately prior to the date of injury/ illness, including paid time off. If days paid (compensated) is zero, provide an explanation in question 7. Do not include accrued time such as vacation time.

6. Total Gross Amount Paid Including Overtime: Enter the injured worker's total gross pay (prior to taxes) for the 52 weeks immediately prior to the date of injury/illness, including overtime. Do not use the injured worker's take-home pay. "Wages" means the money rate at which the service rendered by the injured worker is compensated under the contract of hire in force at the time of the injury.

7.Wage Adjustments: If any wage adjustments (e.g., if the injured worker was demoted) were made during the 52 weeks prior to the injury/ illness, explain. Advise if the injured worker was in military service during the 52 week period, and give date of discharge.

8.Laid Off: Indicate if the injured worker was laid off during the 52 week period immediately prior to the date of injury/illness, and provide the dates of layoff.

PREPARED BY

Last Name, First Name, MI: Enter the preparer's full legal name.

Employer Name: Enter the name of the preparer's employer.

Official Title: Enter the preparer's official title.

Phone #: Enter the preparer's phone number, including area code and extension, if applicable.

Email Address: Enter the preparer's email address.

Date of this Report: Enter the date this report was prepared.

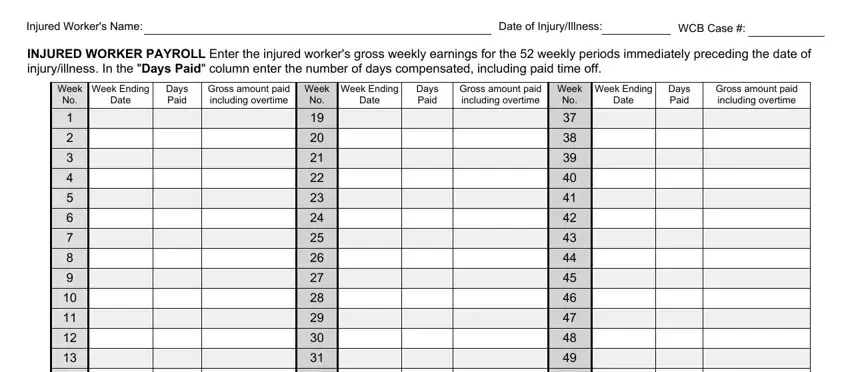

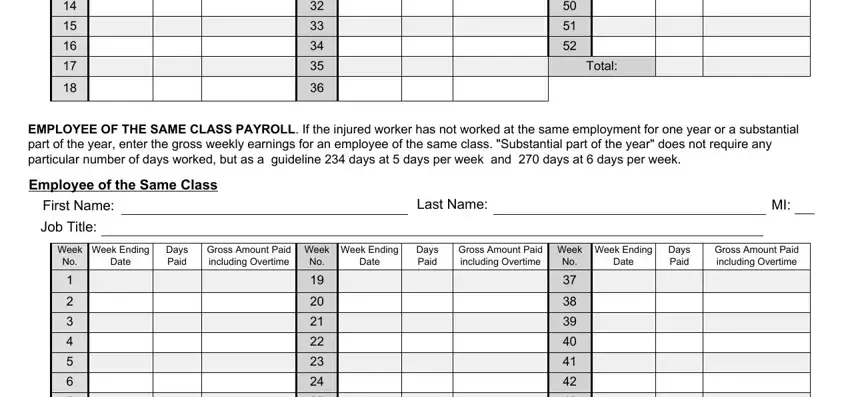

INSTRUCTIONS FOR COMPLETING INJURED WORKER PAYROLL AND EMPLOYEE OF SAME CLASS PAYROLL

Injured Worker Payroll

Week Ending Date: Enter the week ending dates for each of the 52 weeks immediately prior to the date of injury/illness.

Days Compensated (including paid time off): In the "Days Paid" column, give the number of days worked in the employment for which the worker was paid, including paid time off. If days paid (compensated) is zero, provide an explanation in question 7 on page 1. Do not include accrued time such as vacation time.

Gross Amount Paid including Overtime: Enter the injured worker's average weekly gross pay (prior to taxes), including overtime. Do not use the injured worker's take-home pay. "Wages" means the money rate at which the service rendered by the injured worker is compensated under the contract of hire in force at the time of the injury.

Employee of the Same Class Payroll: Give the gross weekly wages for an employee of the same class if the injured worker worked less than a substantial part of the year (234 days for a 5-day worker, or 270 days for a 6-day worker). In addition, provide name of employee in the same class and their job title. NOTE: "Number of days worked" is a guideline, and the Board may find that an injured worker has worked a substantial part of the year even if the injured worker did not work 234 days (5-day worker) or 270 days (6-day worker).

If attaching payroll information, do not submit page 2. All attachments should include the Injured Worker's full name, WCB Case # and Date of Injury/Illness.

Submit by mail or electronically directly to:

New York State Workers' Compensation Board |

Fax #: (877) 533-0337 |

PO Box 5205 |

WCB Address for Email Filing: wcbclaimsfiling@wcb.ny.gov |

Binghamton, NY 13902-5205 |

WCB Web Upload Link: https://wcbdoc.services.conduent.com/ |

C-240 (6-17) - INSTRUCTIONS (DO NOT SCAN) |

THE WORKERS' COMPENSATION BOARD EMPLOYS AND SERVES PEOPLE |

www.wcb.ny.gov |

|

WITH DISABILITIES WITHOUT DISCRIMINATION |

|

|