When you would like to fill out Form 1120 C, you don't have to download any programs - simply give a try to our online PDF editor. The editor is constantly upgraded by us, receiving new features and becoming greater. Starting is effortless! All you have to do is adhere to the next basic steps directly below:

Step 1: Just click the "Get Form Button" in the top section of this page to start up our pdf file editor. There you'll find all that is required to fill out your document.

Step 2: Once you open the online editor, you will get the document all set to be completed. Other than filling in various blanks, you may as well do various other actions with the PDF, namely adding any text, editing the initial text, adding illustrations or photos, putting your signature on the document, and much more.

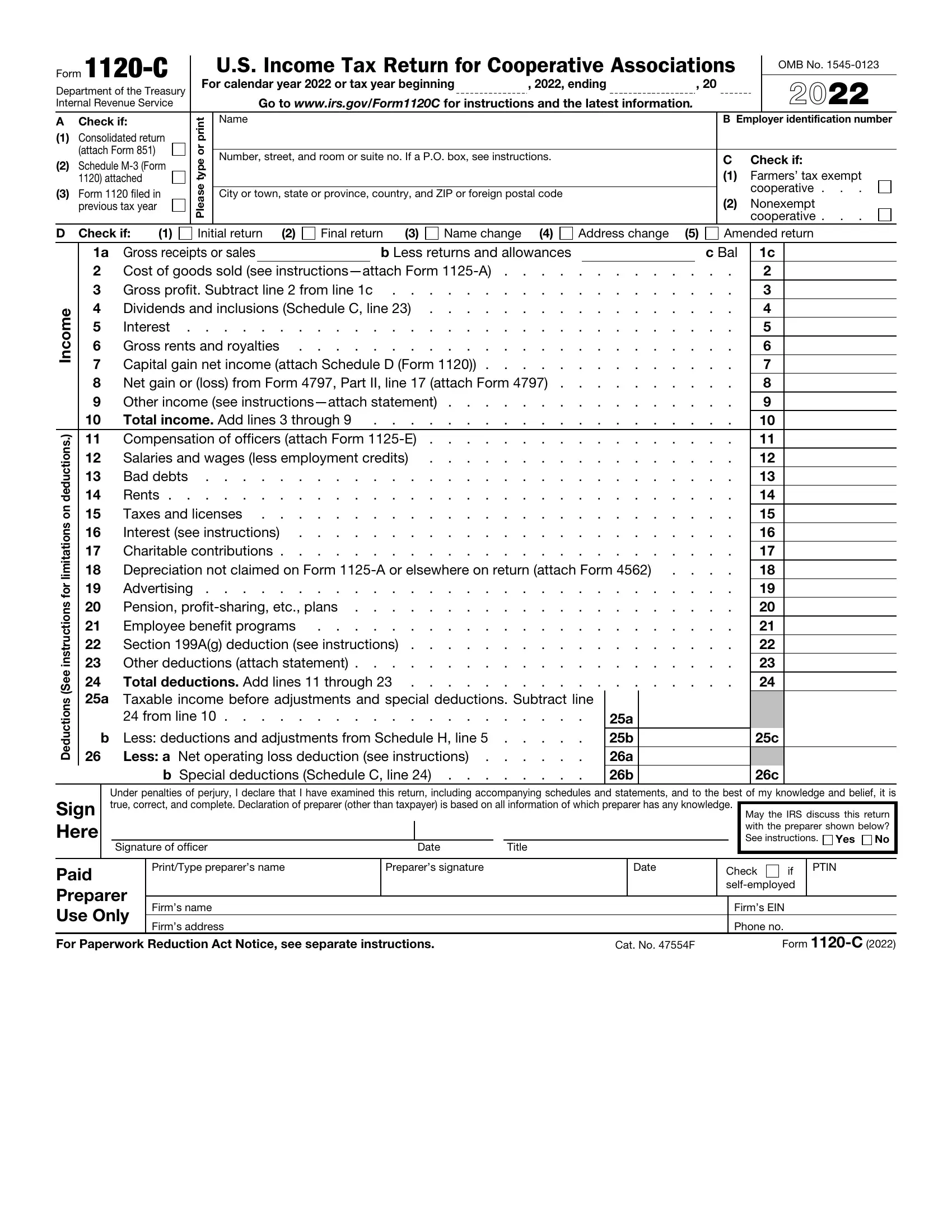

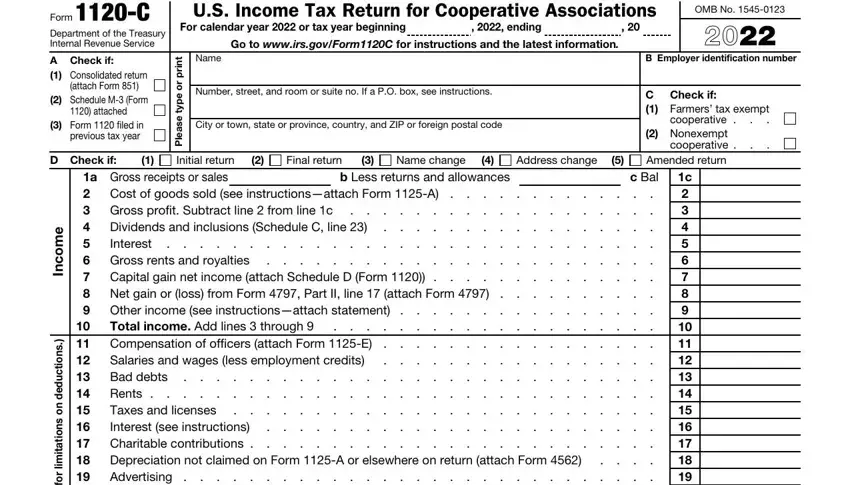

When it comes to fields of this specific form, here's what you need to know:

1. To start off, when filling in the Form 1120 C, start with the section that includes the subsequent blank fields:

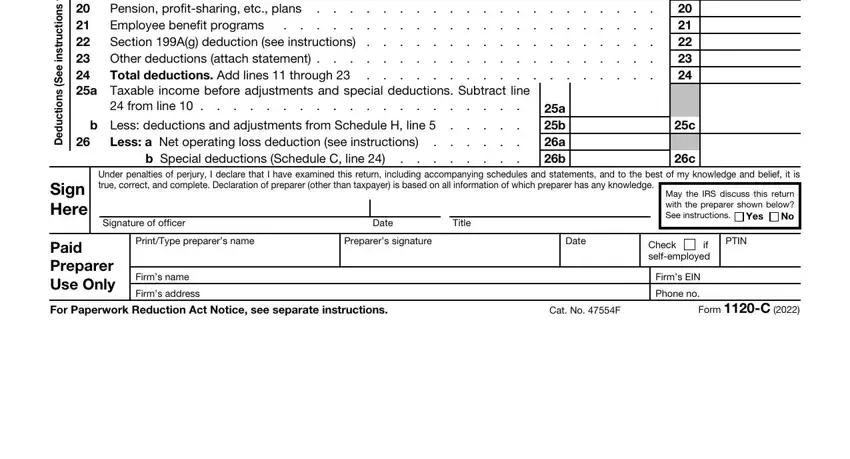

2. Right after completing this section, head on to the subsequent stage and enter the essential details in all these blank fields - Bad debts, Advertising Pension, from line, b Less deductions and adjustments, Less a Net operating loss, b Special deductions Schedule C, a b a b, i l r o f s n o i t c u r t s n, e e S, s n o i t c u d e D, c Bal, Under penalties of perjury I, Sign Here, Signature of officer, and Date.

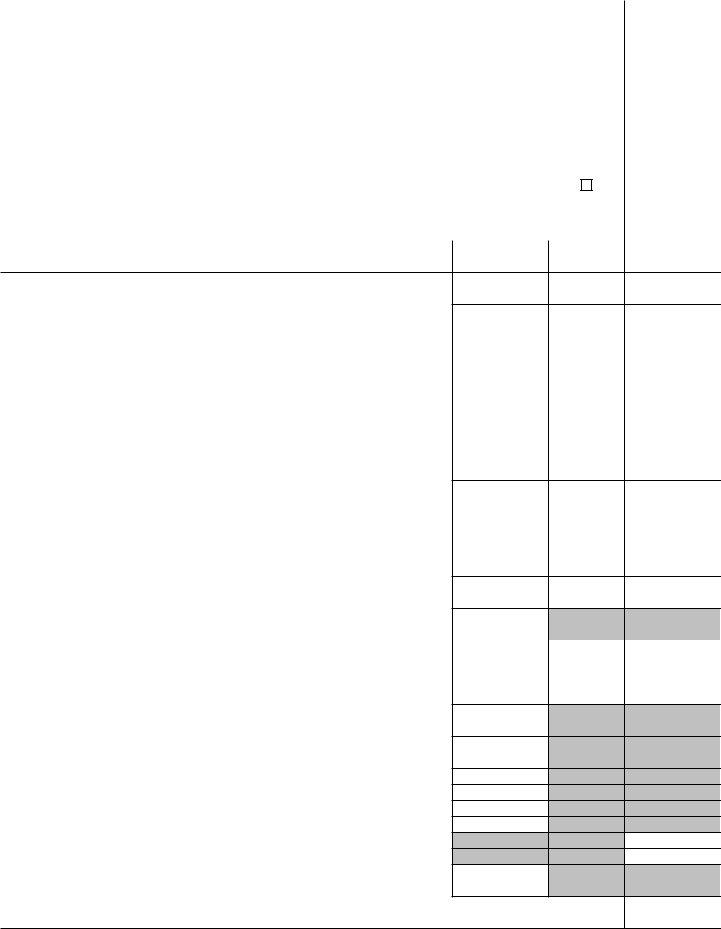

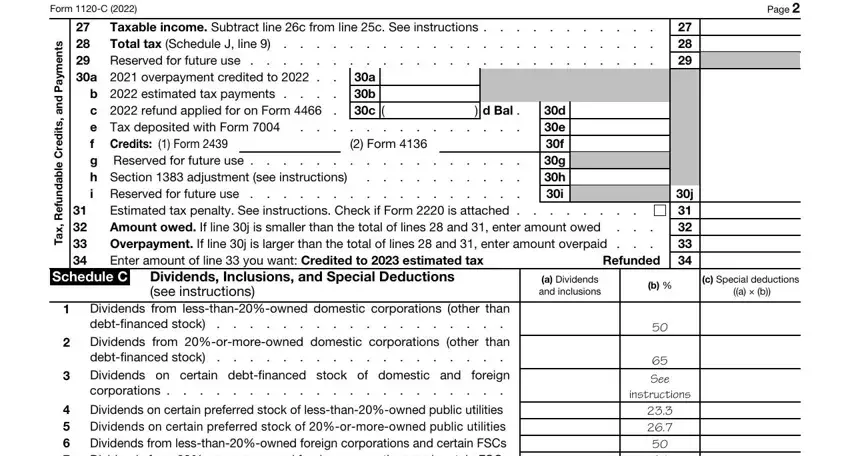

3. This next section is rather easy, Form C, Page, s t n e m y a P d n a, s t i d e r C e b a d n u f e R, x a T, Taxable income Subtract line c, Reserved for future use a, a b c d Bal, Reserved for future use, Estimated tax penalty See, d e f g h i, Refunded, Schedule C, Dividends Inclusions and Special, and a Dividends and inclusions - all these blanks has to be filled in here.

People generally make errors when completing Refunded in this part. Don't forget to reread whatever you type in here.

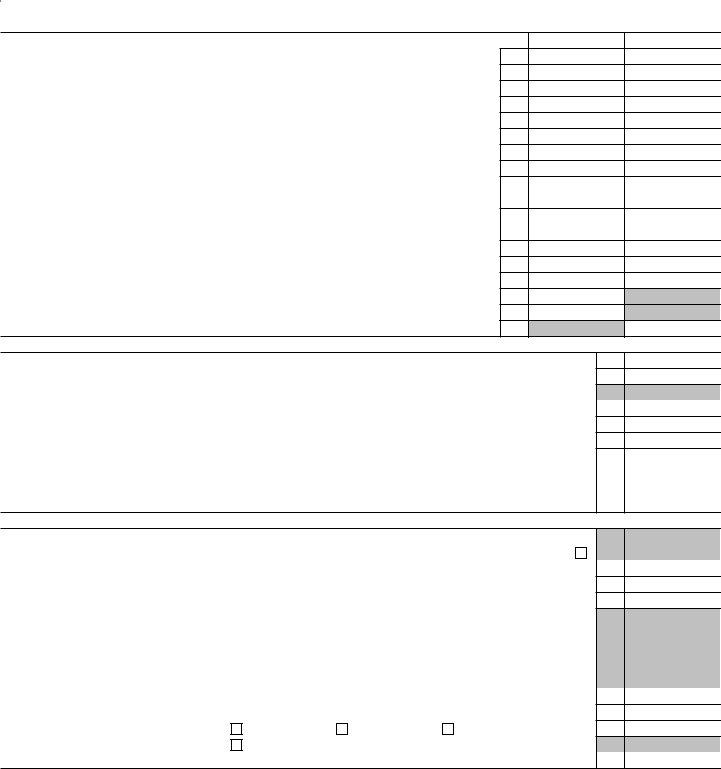

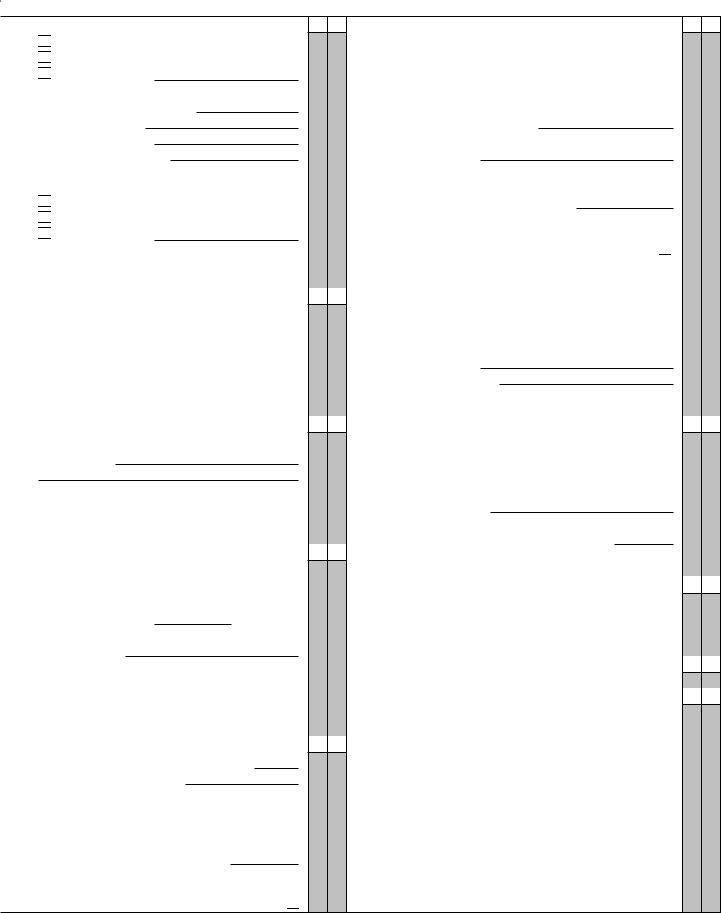

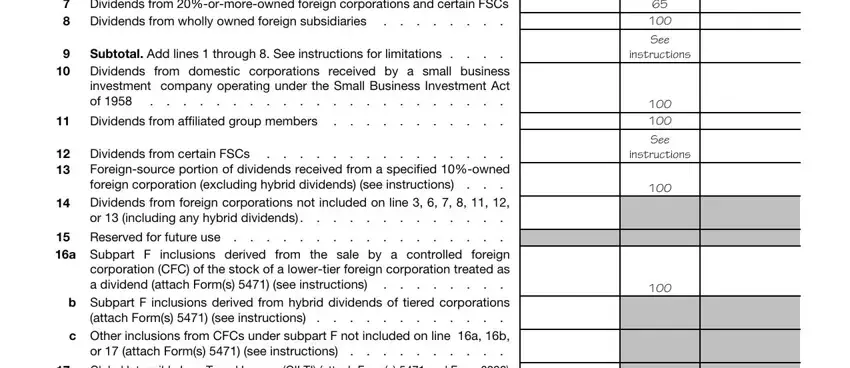

4. The next section requires your information in the subsequent areas: Dividends on certain preferred, Subtotal Add lines through See, Dividends from affiliated group, Dividends from certain FSCs, Reserved for future use, a Subpart F inclusions derived, See, instructions, See, instructions, b Subpart F inclusions derived, attach Forms see instructions, c Other inclusions from CFCs under, or attach Forms see instructions, and Global Intangible LowTaxed Income. Just remember to enter all of the requested info to go onward.

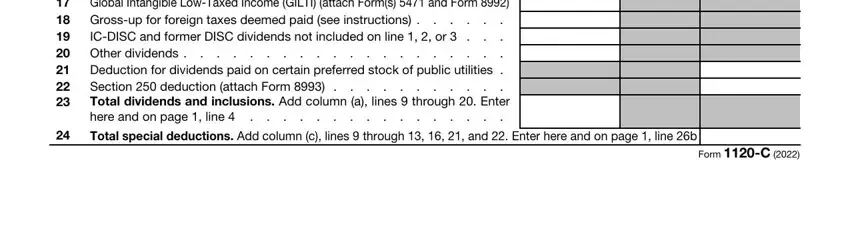

5. The pdf should be concluded by going through this segment. Here you have an extensive list of fields that must be completed with specific information for your form usage to be faultless: Global Intangible LowTaxed Income, Total special deductions Add, and Form C.

Step 3: Reread all the information you've inserted in the blank fields and then click on the "Done" button. Right after getting afree trial account here, you'll be able to download Form 1120 C or send it through email promptly. The PDF will also be accessible through your personal account menu with all of your modifications. FormsPal ensures your data privacy with a secure method that in no way saves or shares any private data provided. Be confident knowing your documents are kept protected each time you use our editor!