With the online editor for PDFs by FormsPal, you'll be able to fill in or edit form c2001 right here and now. To make our tool better and simpler to work with, we continuously develop new features, with our users' feedback in mind. This is what you would have to do to get started:

Step 1: First, open the pdf editor by clicking the "Get Form Button" in the top section of this site.

Step 2: Once you launch the PDF editor, you'll notice the document prepared to be filled in. Aside from filling out different fields, you may also perform other sorts of things with the Document, such as adding custom words, changing the original textual content, adding graphics, affixing your signature to the form, and much more.

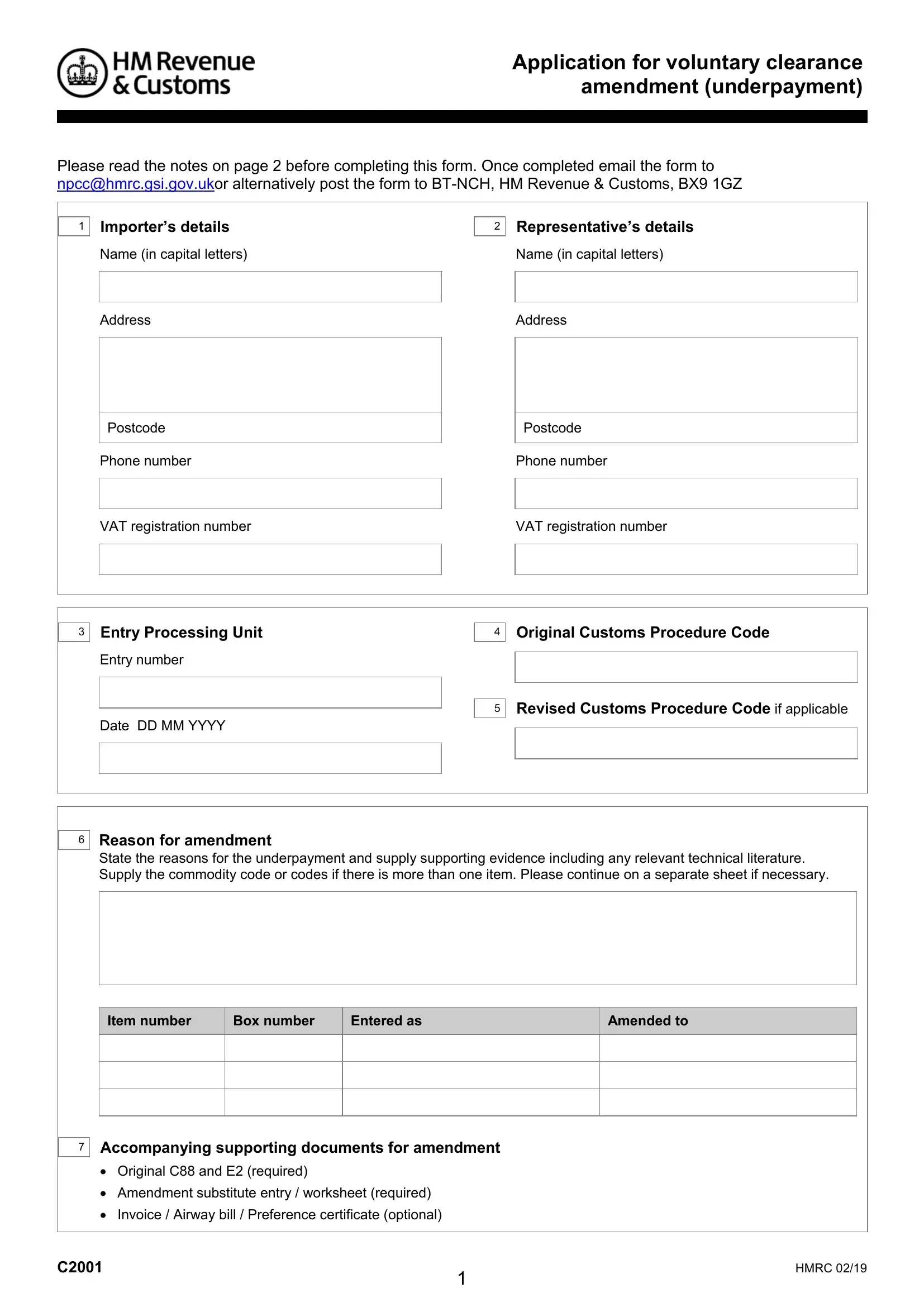

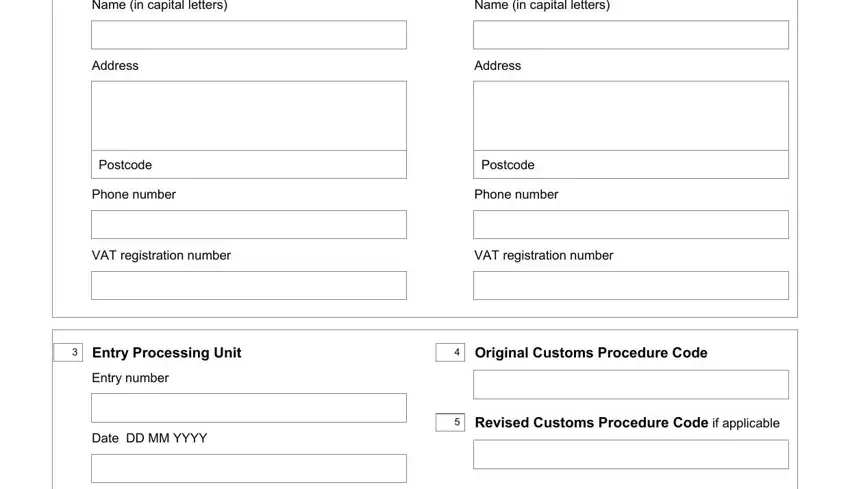

For you to fill out this PDF document, be sure you type in the information you need in every single blank:

1. Fill out your form c2001 with a selection of essential fields. Note all of the necessary information and ensure there is nothing overlooked!

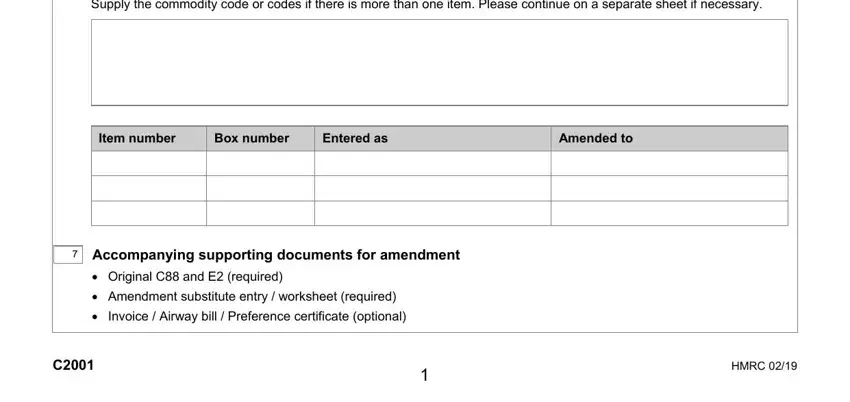

2. The subsequent part is to fill in the next few blanks: State the reasons for the, Item number, Box number, Entered as, Amended to, Accompanying supporting documents, Original C and E required , and HMRC .

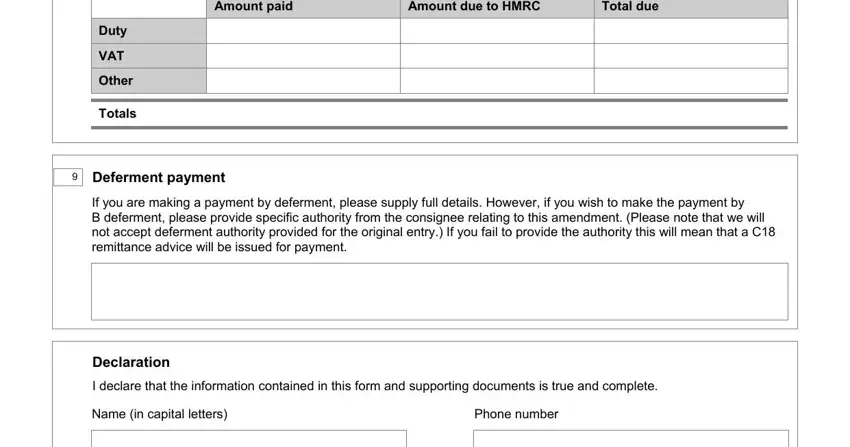

3. In this stage, examine Amount paid, Give the details of the amount of, Amount due to HMRC, Totals, Deferment payment If you are, Declaration I declare that the, Name in capital letters, and Phone number. Every one of these must be filled in with utmost precision.

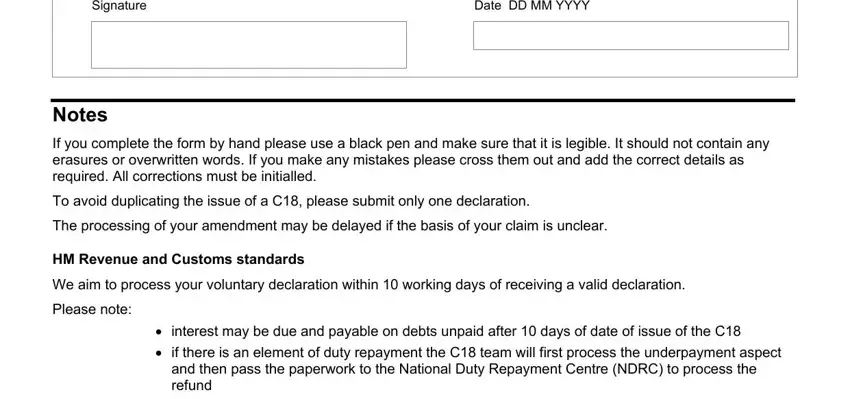

4. The following subsection will require your details in the following areas: Signature, Date DD MM YYYY, Notes If you complete the form by, HM Revenue and Customs standards, interest may be due and payable, and then pass the paperwork to the, and overpayment of VAT can be. Just be sure you provide all needed info to go onward.

A lot of people generally make some mistakes when filling in Signature in this area. You need to go over whatever you enter here.

Step 3: You should make sure the information is right and simply click "Done" to proceed further. Download the form c2001 when you register at FormsPal for a free trial. Readily gain access to the pdf document in your FormsPal cabinet, together with any modifications and adjustments being conveniently kept! Here at FormsPal, we strive to be certain that all of your details are maintained secure.