The PDF editor was designed with the intention of making it as simple and user-friendly as it can be. The next actions will help make creating the ca form 540nr easy and quick.

Step 1: Hit the orange "Get Form Now" button on the webpage.

Step 2: You can find each of the functions that you may use on your file once you've got accessed the ca form 540nr editing page.

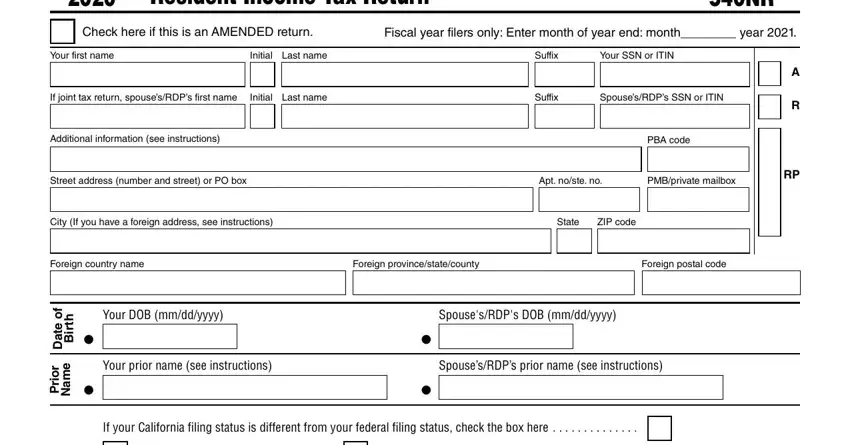

Type in the requested information in each section to fill in the PDF ca form 540nr

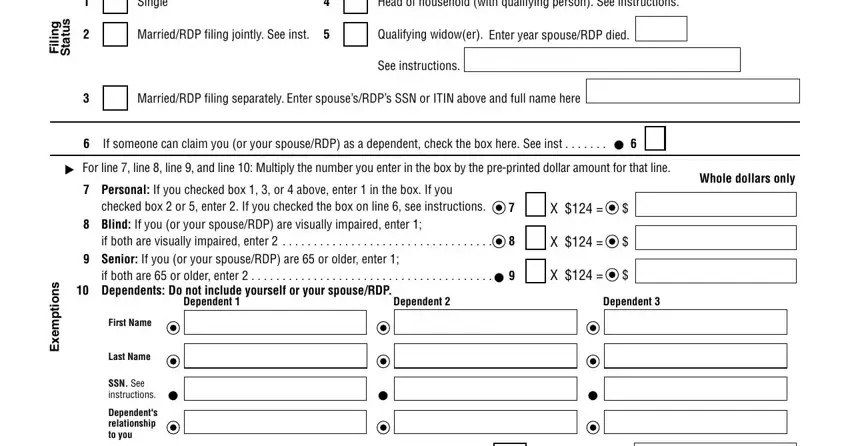

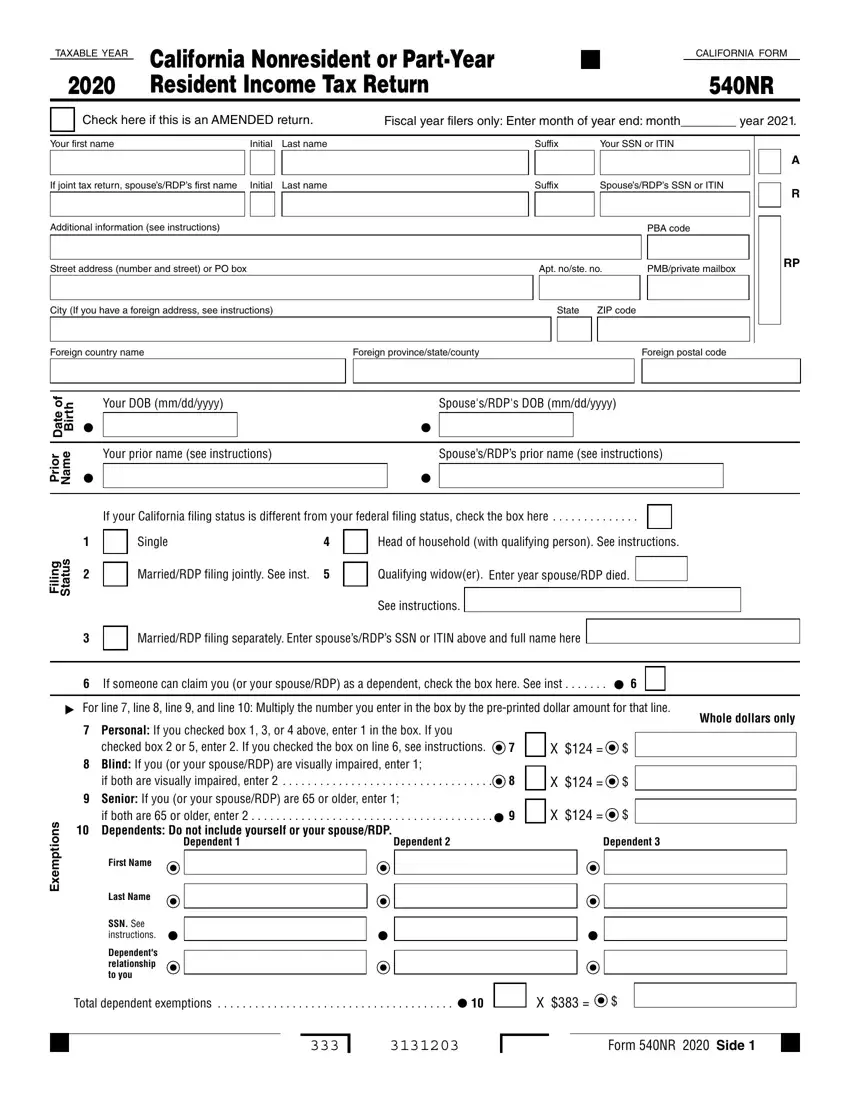

Type in the required data in the field g n, i l i, s u t a t S, Single, MarriedRDP filing jointly See inst, Head of household with qualifying, Qualifying widower, Enter year spouseRDP died, MarriedRDP filing separately, Enter spousesRDPs SSN or ITIN, See instructions, If someone can claim you or your, For line line line and line, Personal If you checked box or, and checked box or enter If you.

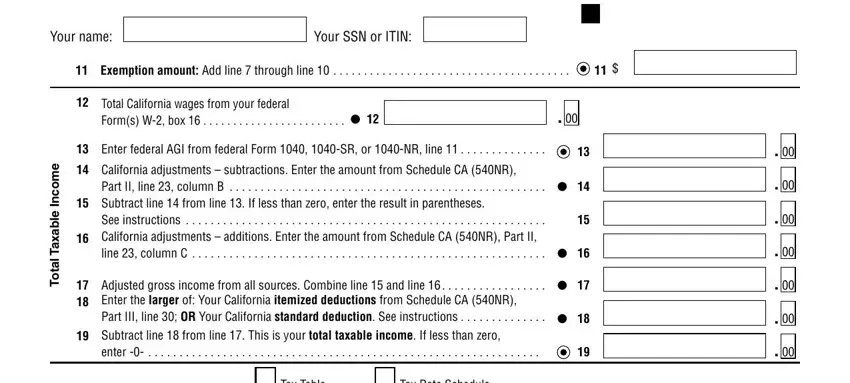

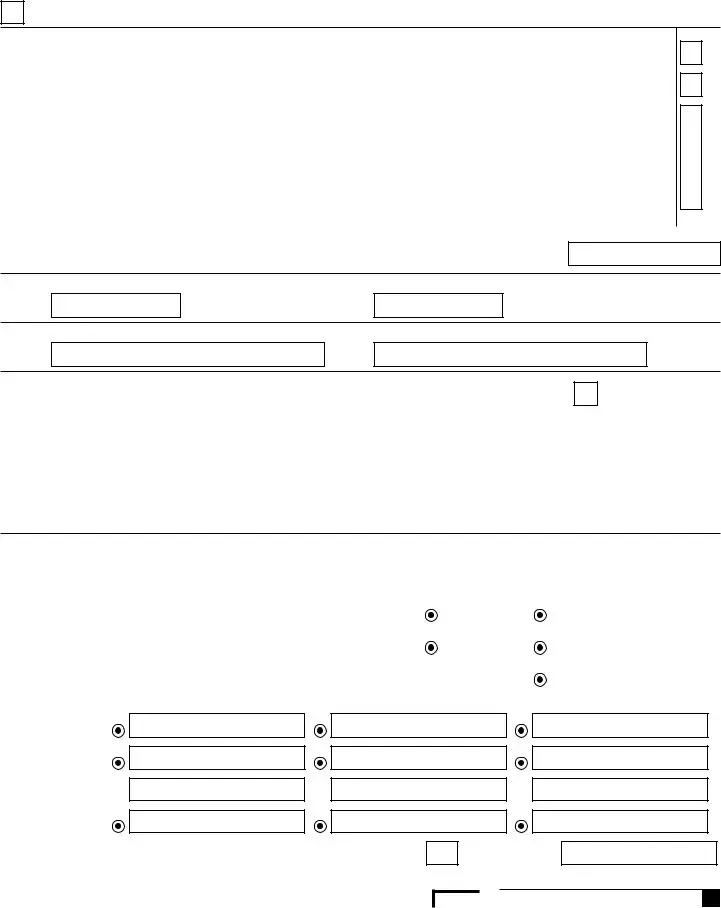

Put down any details you may need in the field Your name, Your SSN or ITIN, Exemption amount Add line through, e m o c n, e b a x a T, a t o T, Total California wages from your, Enter federal AGI from federal, California adjustments, Part II line column B, Subtract line from line If less, See instructions, Adjusted gross income from all, Subtract line from line This is, and Tax Table.

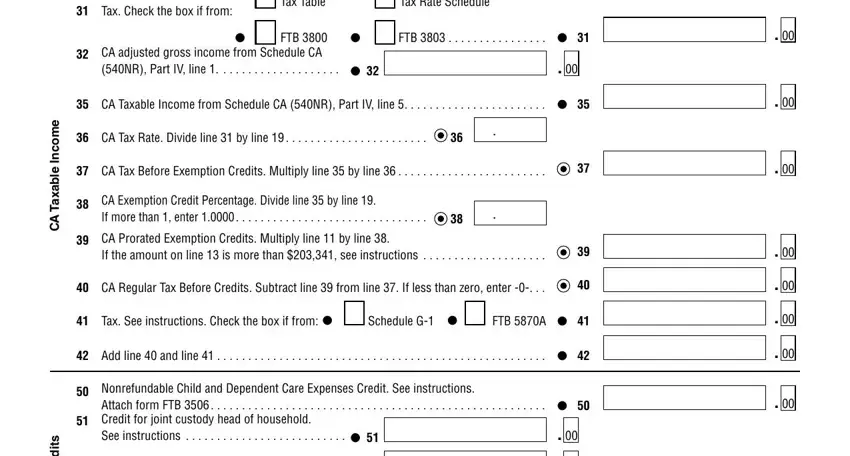

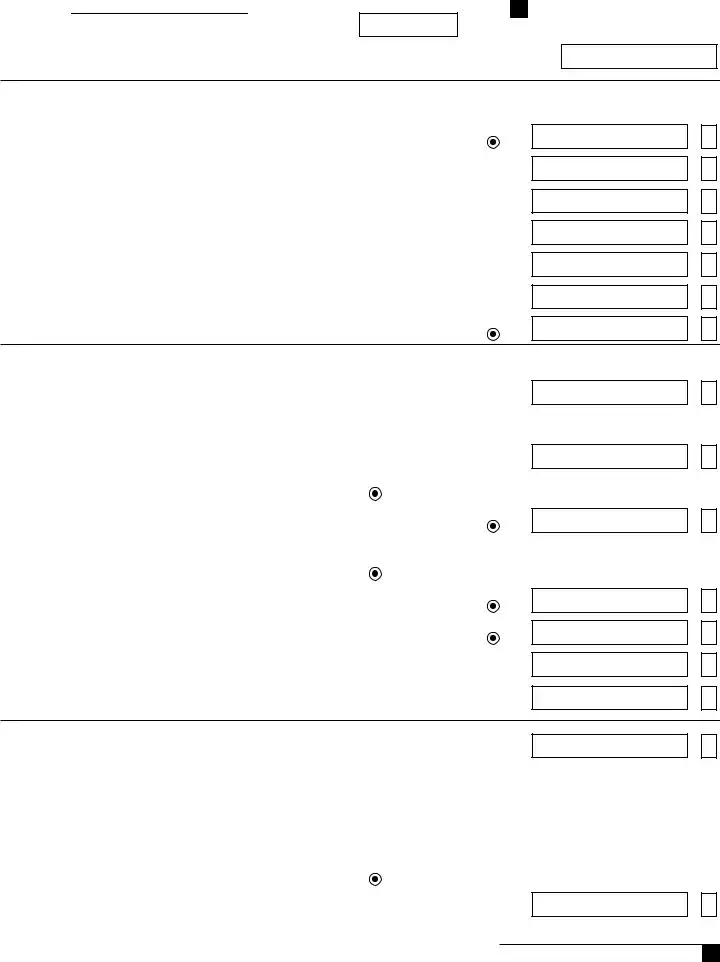

Please make sure to record the rights and obligations of the parties inside the e m o c n, e l b a x a T A C, s t i d e r C, Tax Check the box if from, Tax Table, Tax Rate Schedule, FTB CA adjusted gross income from, FTB, CA Taxable Income from Schedule CA, CA Tax Rate Divide line by line, CA Tax Before Exemption Credits, CA Exemption Credit Percentage, CA Prorated Exemption Credits, CA Regular Tax Before Credits, and Tax See instructions Check the box box.

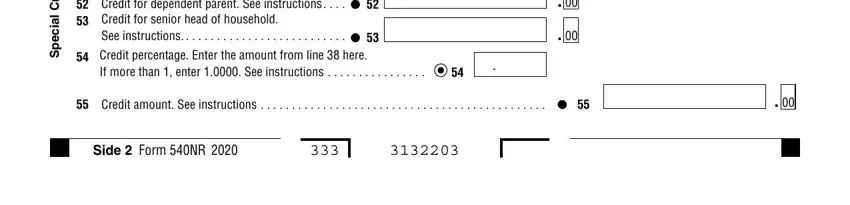

Look at the areas s t i d e r C, l a i c e p S, Credit for dependent parent See, If more than enter See, Credit amount See instructions, and Side Form NR and next fill them in.

Step 3: After you have selected the Done button, your file is going to be obtainable for export to any kind of electronic device or email you identify.

Step 4: Make sure you avoid potential difficulties by getting around a pair of duplicates of your file.

Your SSN or ITIN:

Your SSN or ITIN:

Your SSN or ITIN:

Your SSN or ITIN: