edd de3hw form print can be filled out online effortlessly. Just use FormsPal PDF editor to do the job promptly. We are committed to giving you the best possible experience with our tool by consistently introducing new functions and upgrades. Our editor is now even more useful with the newest updates! Currently, working with PDF documents is simpler and faster than ever before. Starting is easy! Everything you should do is follow these simple steps directly below:

Step 1: Press the "Get Form" button above on this webpage to open our PDF editor.

Step 2: When you start the editor, you will see the form ready to be filled out. Aside from filling in various blank fields, you can also perform some other things with the PDF, including putting on custom words, editing the original textual content, adding images, placing your signature to the form, and a lot more.

It is actually easy to finish the form adhering to our practical tutorial! This is what you should do:

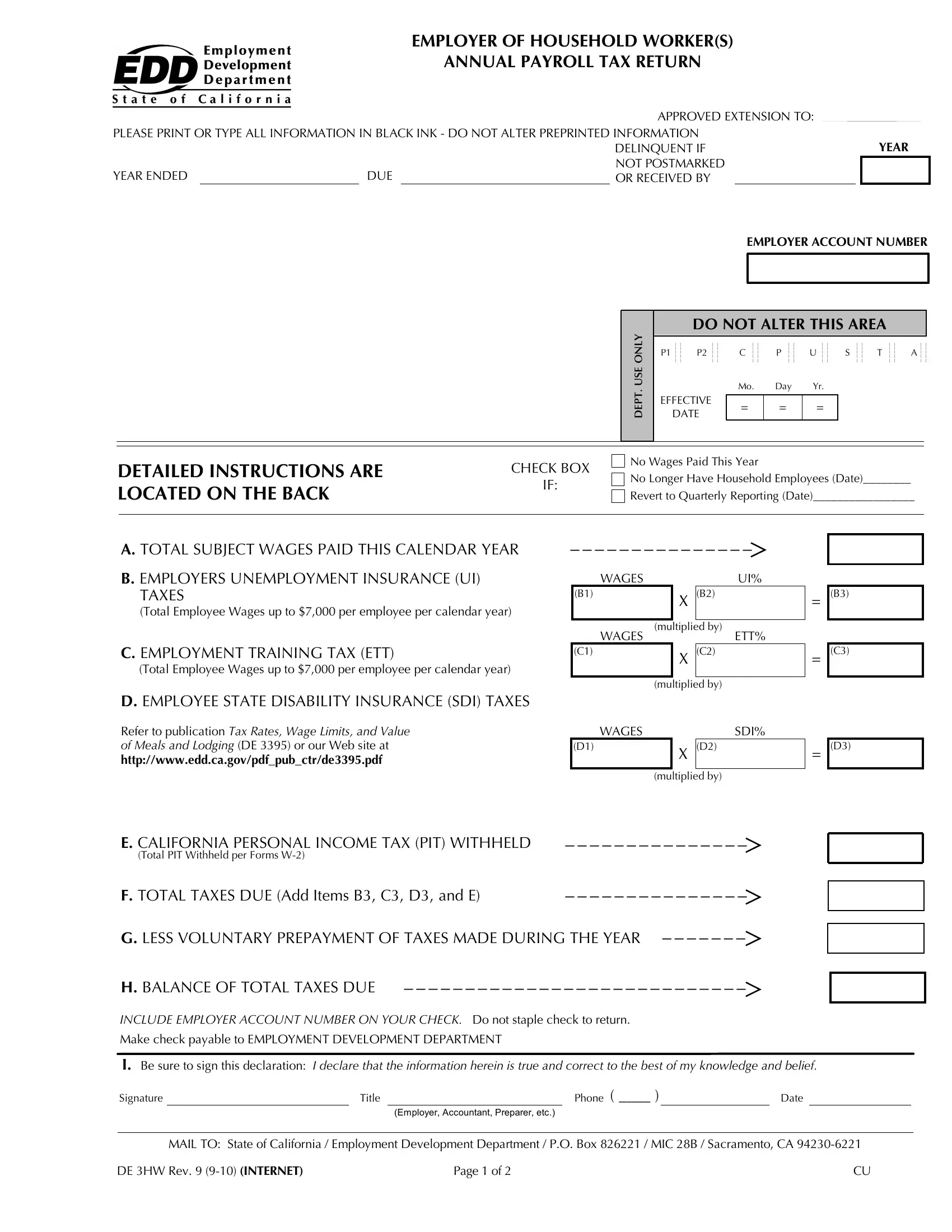

1. You'll want to complete the edd de3hw form print accurately, hence be careful while working with the areas containing these fields:

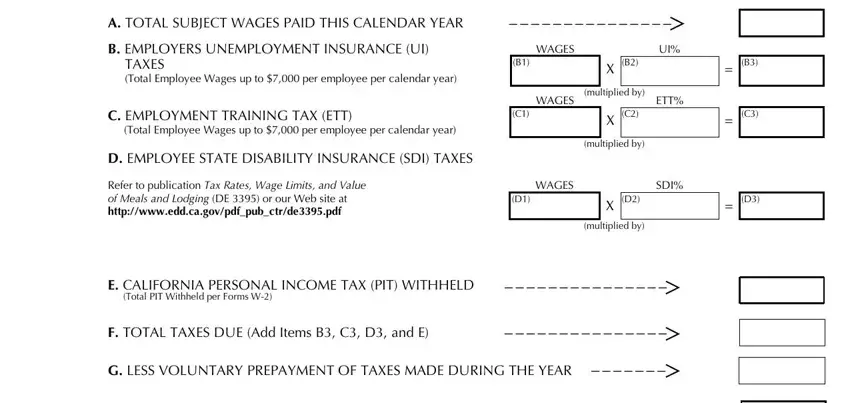

2. Your next stage would be to submit the next few fields: A TOTAL SUBJECT WAGES PAID THIS, B EMPLOYERS UNEMPLOYMENT INSURANCE, TAXES Total Employee Wages up to , C EMPLOYMENT TRAINING TAX ETT, Total Employee Wages up to per, D EMPLOYEE STATE DISABILITY, Refer to publication Tax Rates, WAGES, WAGES, multiplied by, ETT, multiplied by, WAGES, SDI, and multiplied by.

It is easy to make errors when filling in the C EMPLOYMENT TRAINING TAX ETT, so make sure to reread it before you'll finalize the form.

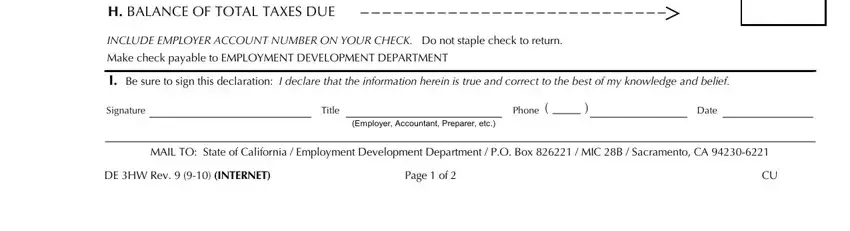

3. This next segment is related to H BALANCE OF TOTAL TAXES DUE, INCLUDE EMPLOYER ACCOUNT NUMBER ON, Make check payable to EMPLOYMENT, I Be sure to sign this declaration, Signature, Title, Phone , Date, Employer Accountant Preparer etc, MAIL TO State of California , and DE HW Rev INTERNETPageof - fill out every one of these blanks.

Step 3: Before finishing this form, make certain that all form fields are filled out the right way. The moment you establish that it is fine, click on “Done." After setting up a7-day free trial account at FormsPal, you'll be able to download edd de3hw form print or send it via email at once. The file will also be readily available via your personal account page with all of your edits. FormsPal ensures your information privacy with a secure system that never records or shares any sort of private information used. Feel safe knowing your docs are kept safe every time you work with our services!