Understanding the nuances of the CA1886 form is essential for individuals and organizations navigating the specifics of contracted-out employment terminations within the UK's National Insurance scheme. This form is a critical tool for communicating changes in employment status to the National Insurance Contributions Office, specifically designed for instances where contracted-out employment in a Contracted-out Salary Related (COSR) scheme, or the COSR part of a Contracted-out Mixed Benefit (COMB) scheme, comes to an end. Such terminations, especially for periods post-April 6, 1997, require careful handling to ensure accrued pension rights are preserved within the scheme. The form is detailed, requesting specific information such as Scheme Contracted-out Number (SCON) and ensuring it is not associated with a ceased scheme, a common oversight. Additionally, there are conditions under which the form is unnecessary—such as the person reaching state pension age or in specific tax year situations—which simplifies the process for some. Completing this form involves a step-by-step approach, guiding the individual through parts 4 to 6 with clarity and requiring information such as the member’s national insurance number, potential surname changes, and precise employment termination dates. The proper completion and submission of this form are supported by further guidance found in the Manual CA14, directly addressing the termination of contracted-out employment for salary related pension schemes. Furthermore, the declaration sections for both the employer and the scheme play crucial roles in certifying the accuracy of the information provided and the status of the pension rights—highlighting the form's function as a comprehensive communication tool between employers, schemes, and the National Insurance Contributions Office.

| Question | Answer |

|---|---|

| Form Name | Ca1886 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | ca1886 pdf, NE98, Revaluation, S148 |

NATIONAL INSURANCE CONTRIBUTIONS

Inland Revenue

National Insurance Contributions Office

Services to Pensions Industry

Benton Park View

Newcastle upon Tyne NE98 1ZZ

Notice of termination

You should complete this form when you need to notify us of:

•a termination of

•the active COSR part of a

- for periods of employment terminating on or after 6 April 1997

This form needs to be completed when accrued pension rights are to be preserved within the scheme. Further guidance can be found in Manual CA14 Termination of

for Salary Related Pension Schemes and Salary Related Parts of Mixed Benefit Schemes.

- we do not need you to send this form:

•if the person has reached state pension age, as our system automatically updates this information

•when a married woman has elected to pay reduced rate contributions

•if the person is in the Final Relevant Year (FRY) or last complete tax year before reaching pension age

•when a person is not already a member of a

1 What to do now

Please:

•read part 2

•fill in parts 4 to 6 clearly in black pen, using CAPITAL LETTERS

•check that you have used the correct Scheme

•check that the SCON you have used is not from a ceased scheme when a live scheme applies

•return it to us at the address shown above.

Help and guidance is available on our Internet site at www.inlandrevenue.gov.uk

From our homepage you need to:

•click on 'individuals and employees'

•go to 'Tell me about'

•click on 'drop down box'

•select 'National Insurance'

•click on 'Go'

Under the headings 'National Insurance' and 'You may also want'

•click on 'National Insurance Contribution Forms'

•click on form 'CA1586' and scroll down till you reach this form 'CA1886'

•click on 'View/Download an example of this item' for guidance on how to fill it in.

CA1886 March 2004 |

1 |

please turn over |

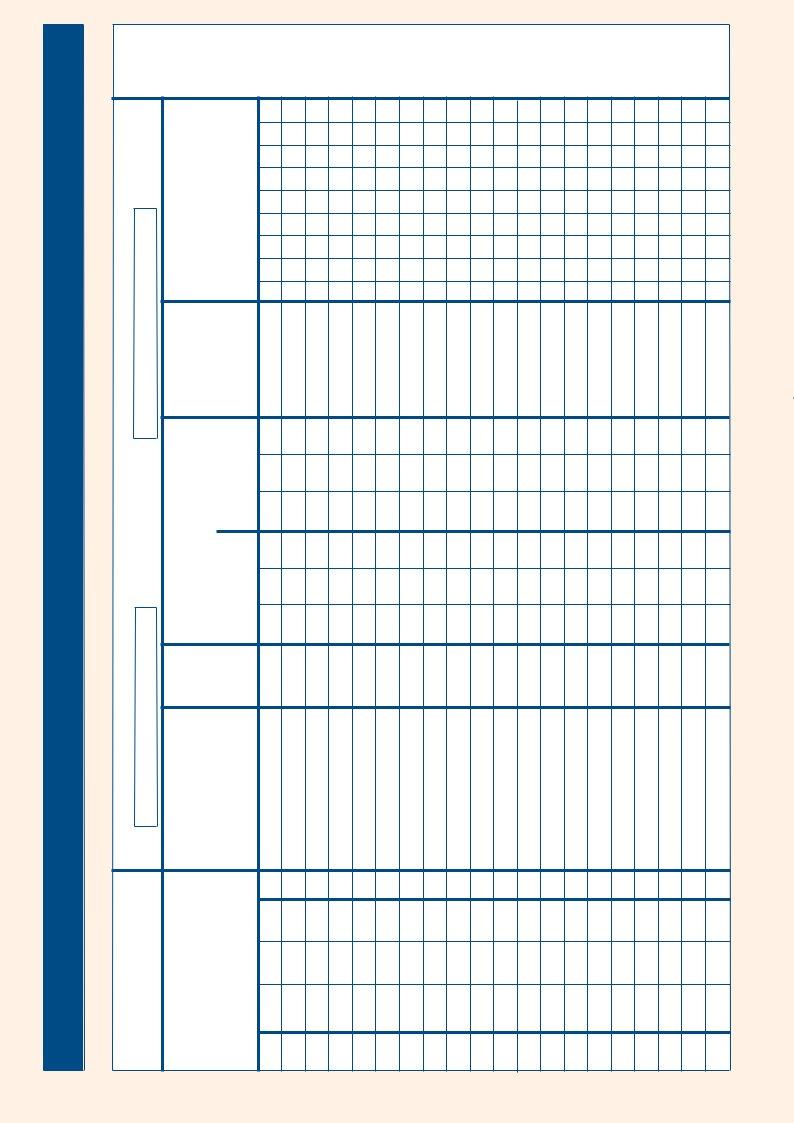

2 Guidance on completing part 6 of this form

Part 6 |

What to do |

|

|

|

|

Column 4 |

It is very important to enter the member’s National Insurance number. If you do not |

|

National Insurance |

know this please try and find out. If you are unable to find it use a separate form |

|

number |

CA1886 to record the person's surname, full forename(s) and date of birth, however, |

|

this may reject on our system. If a temporary number is held please ask the employer |

||

|

||

|

or individual to give you the correct number. |

|

|

|

|

Column 5 |

If the person's surname has changed in the last 12 months, it is important to also |

|

Surname |

enter the previous surname. If not this may reject on our system. |

|

|

|

|

Column 8 |

Only complete this box where the date |

|

Earnings box |

1997/98 tax year, shown in column 7. Enter the amount shown in column 1(d) of |

|

|

the End of Year Summary, form P14 or on the Deduction Working Sheet, form P11 |

|

|

or equivalent for the 1996/97 tax year. |

|

|

|

3 Improving our service to you

We are always pleased to receive your comments and suggestions about how we can improve our service. Please contact us at the address or telephone number shown if you have any comments or are unhappy with our service.

How to contact us

If you need to contact us please call the

please see opposite page

2

NATIONAL INSURANCE CONTRIBUTIONS

CA1886

Inland Revenue

National Insurance Contributions Office

Services to Pensions Industry

Benton Park View

Newcastle upon Tyne NE98 1ZZ

4 Declaration by the employer

I declare that the details shown in part 6 of this form refer to person(s) whose

Signature by, or on behalf of, the employer

Name

Date |

/ |

/ |

|

|

|

Position in company

5 Declaration by the scheme

I declare that the accrued Pension Rights of the person(s) shown in part 6 of this form are subject to:

Fixed/S148 Revaluation for pre 6 April 1997 rights, and Retail Price Indexation limited to 5% for post 6 April 1997 rights by the scheme with the Scheme

Note: Where the period of employment includes a period for which the Guaranteed Minimum Pension (GMP) rights were previously transferred in with Revaluation at Limited Rate/Fixed Rate, those rights will continue to be revalued at that rate unless they are changed to the full S148 rate.

Signature by, or on behalf of, the scheme

Name

Date |

/ |

/ |

|

|

|

Name of scheme

Position in scheme

Address for correspondence

Postcode

Daytime telephone and fax number |

Tel |

|

(including national dialling code) |

||

|

Fax

CA1886 |

3 |

please turn over |

Notificationoftermination |

|

6 |

|

For further guidance see Manual CA14 Termination of

(SCON) |

|

||

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

S |

||

3 |

|

|

|

|

|

|

|

(ECON) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

||

|

||

|

E |

|

2 |

|

|

EN |

1

|

referencenumber, |

ifany |

||

9 |

Employers |

|

|

|

Employeesearnings8 betweenLowerand |

UpperEarningsLimit duringthe96/97taxyear |

(onlywherethedatein |

column7endsinthe 97/98taxyear) |

|

7 |

(infiguresonly) |

StartedEnded |

Day Month Year Day Month Year |

|

6 |

Intls |

|

|

|

|

Surname |

CAPITALLETTERS) |

||

|

|

(use |

|

|

5 |

|

|

|

|

|

Insurancenumber |

|

|

|

|

National |

|

|

|

4 |

|

|

|

|

space this in write not do Please - only use official For

CA1886

4