Our top computer programmers worked hard to create the PDF editor we are pleased to deliver to you. This application permits you to quickly create carryover and can save valuable time. You simply need to adhere to this particular guide.

Step 1: On this website page, select the orange "Get form now" button.

Step 2: After you have entered the carryover editing page you'll be able to see every one of the options you may undertake about your document from the upper menu.

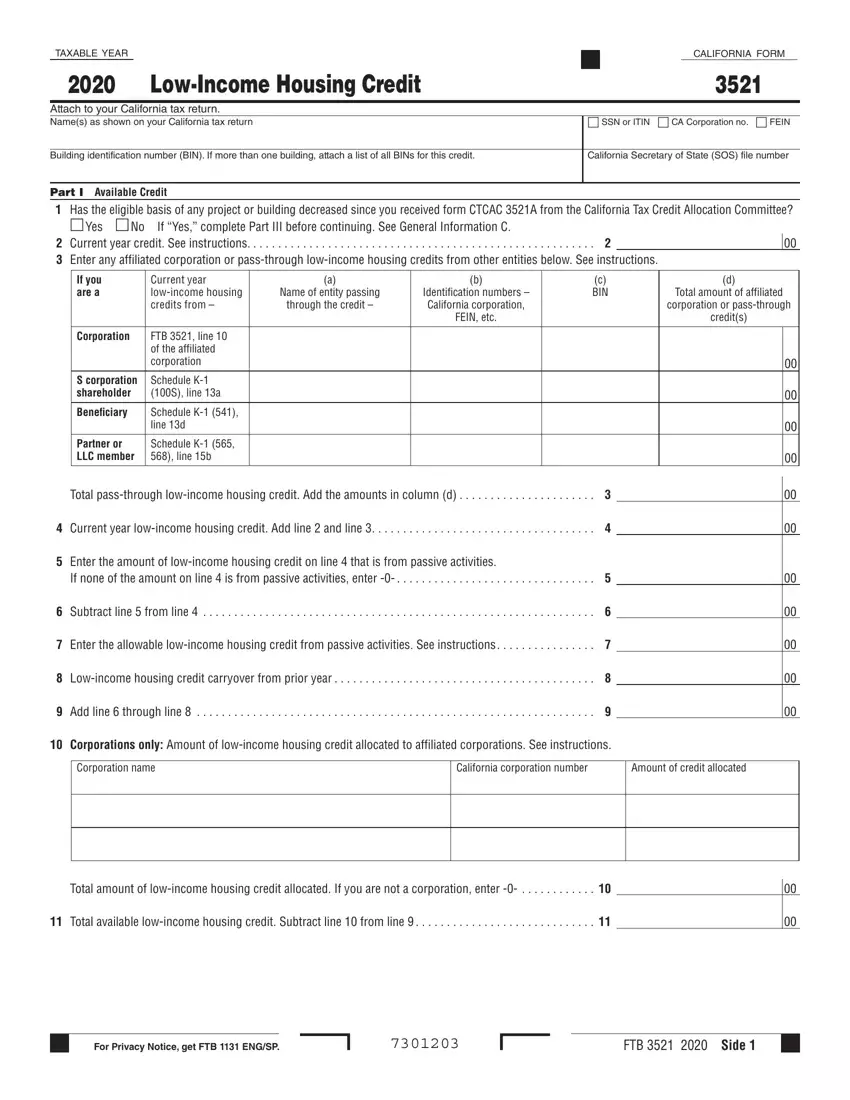

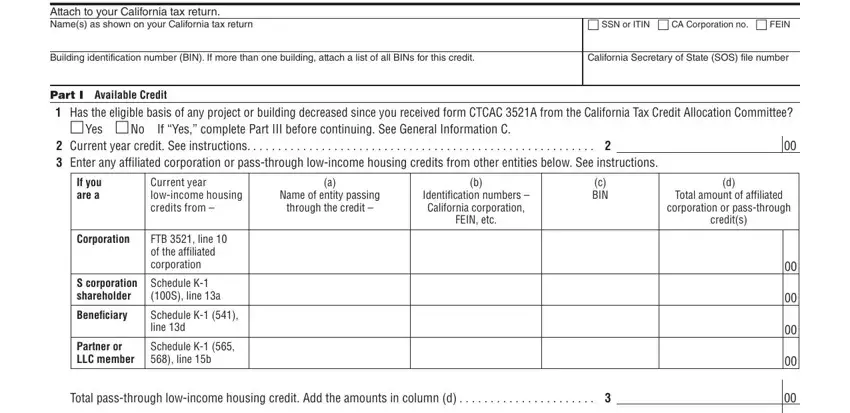

To prepare the template, enter the information the application will require you to for each of the following parts:

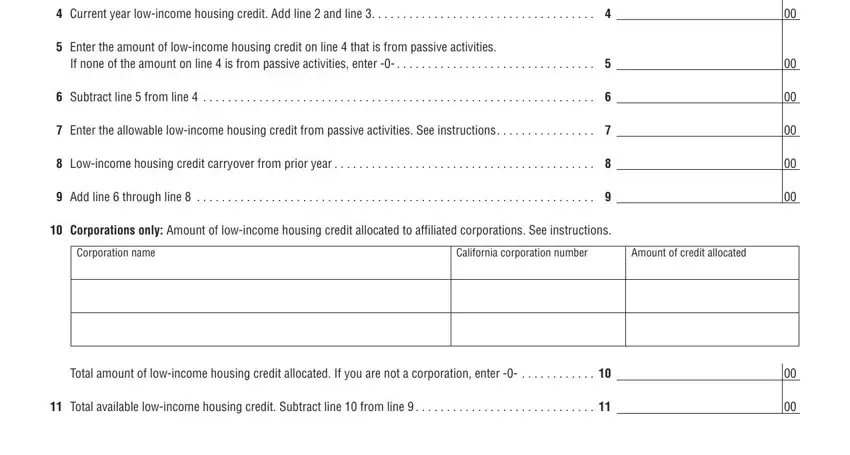

You have to fill in the Current year lowincome housing, Enter the amount of lowincome, If none of the amount on line is, Subtract line from line, Enter the allowable lowincome, Lowincome housing credit, Add line through line, Corporations only Amount of, Corporation name, California corporation number, Amount of credit allocated, Total amount of lowincome housing, and Total available lowincome housing space with the requested particulars.

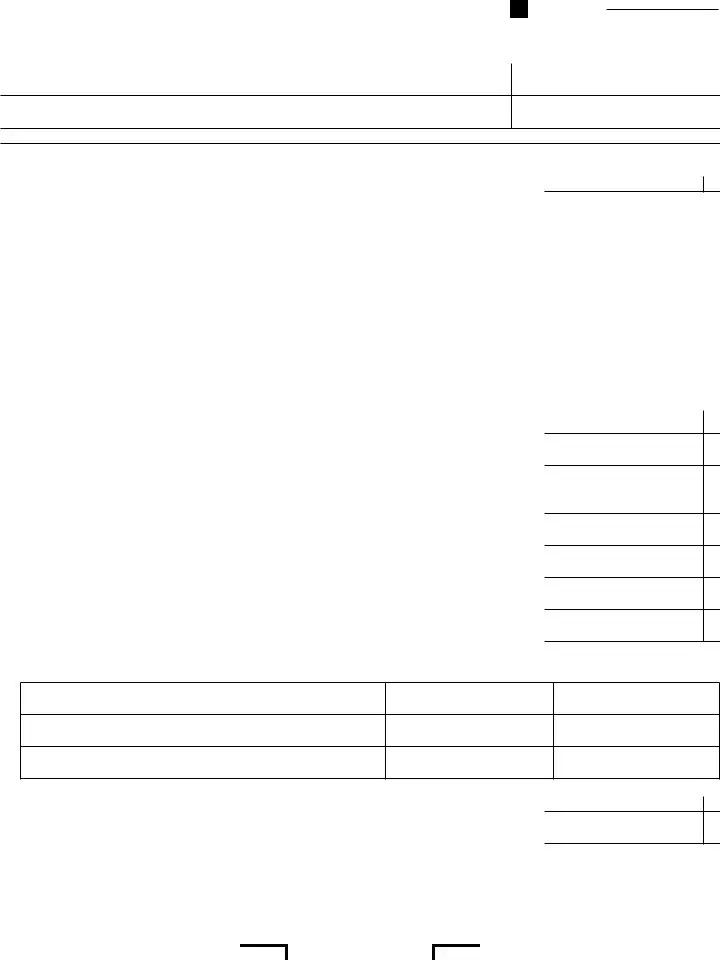

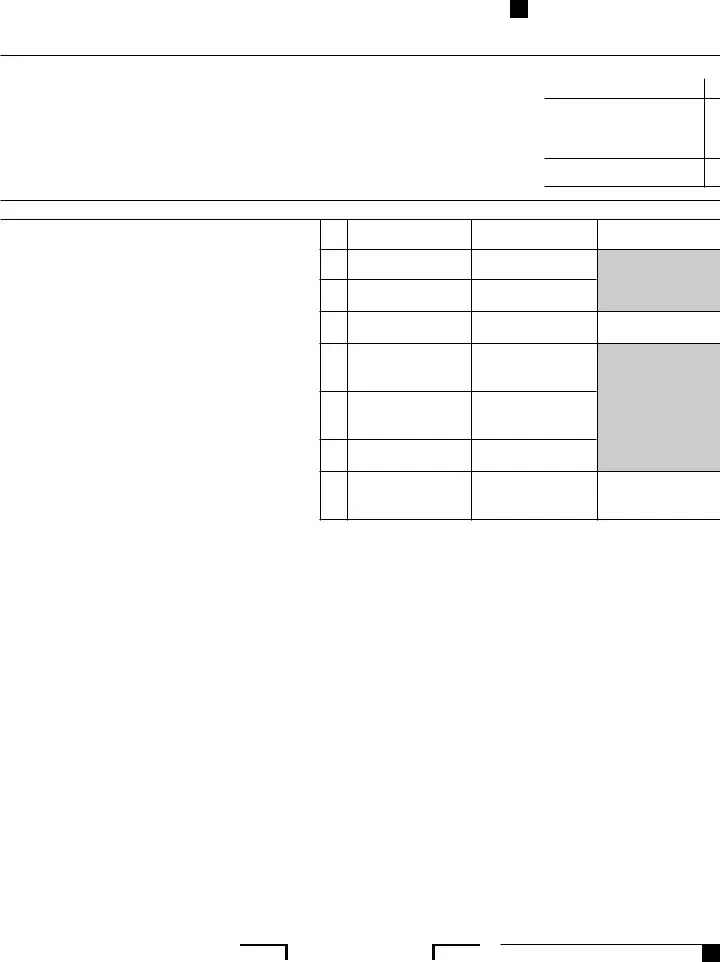

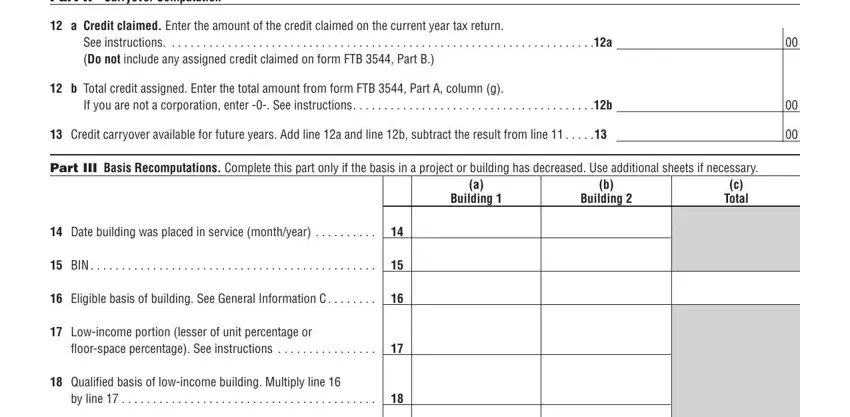

Inside the section talking about Part II Carryover Computation, a Credit claimed Enter the amount, See instructions, b Total credit assigned Enter the, If you are not a corporation enter, Credit carryover available for, Part III Basis Recomputations, a Building, b Building, c Total, Date building was placed in, BIN, Eligible basis of building See, Lowincome portion lesser of unit, and floorspace percentage See, one should jot down some required information.

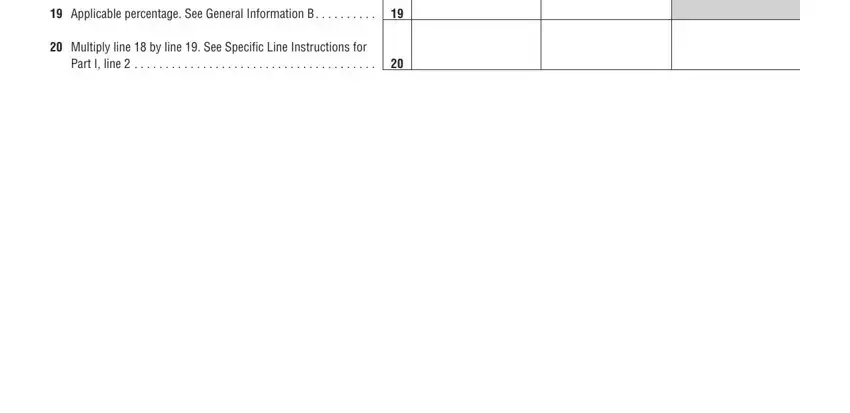

The Applicable percentage See General, Multiply line by line See, and Part I line segment should be applied to put down the rights or responsibilities of each party.

Step 3: Choose the "Done" button. Next, you can transfer the PDF file - save it to your device or deliver it through email.

Step 4: You can also make copies of the file torefrain from any upcoming issues. Don't worry, we don't display or track your information.