It is possible to prepare California Form 3805Z effortlessly using our online PDF tool. The editor is continually updated by our staff, acquiring cool functions and becoming greater. This is what you will have to do to begin:

Step 1: First, open the pdf editor by clicking the "Get Form Button" above on this webpage.

Step 2: The tool grants the capability to work with your PDF document in a range of ways. Change it by writing personalized text, adjust existing content, and put in a signature - all within several clicks!

It is straightforward to complete the document using this helpful guide! Here's what you want to do:

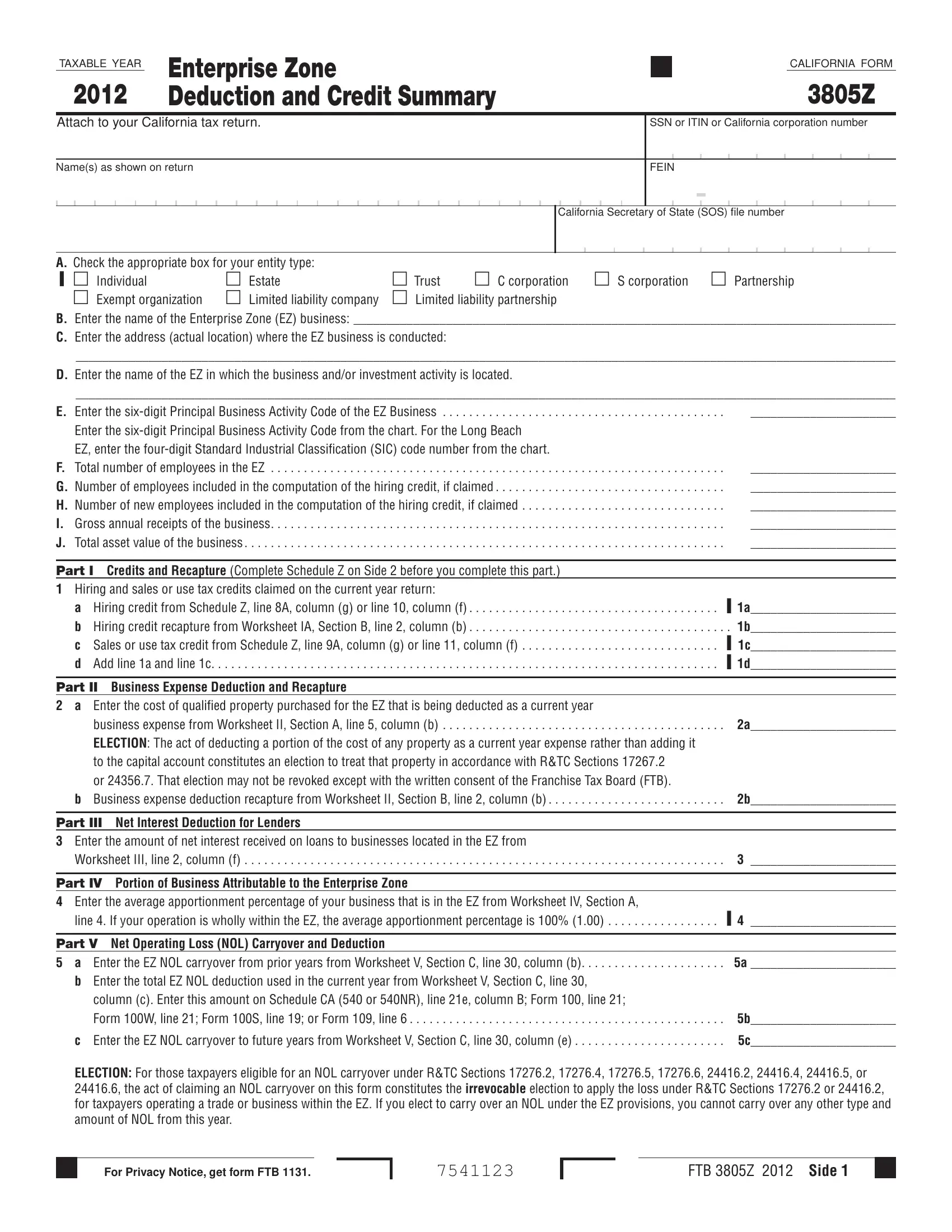

1. You'll want to fill out the California Form 3805Z accurately, hence pay close attention while filling out the segments comprising these blanks:

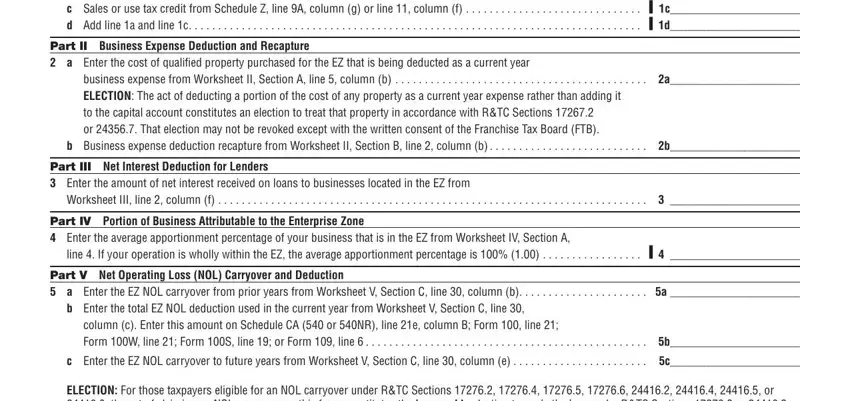

2. Your next stage is to complete the following blank fields: Part I Credits and Recapture, a Hiring credit from Schedule Z, Part II Business Expense Deduction, business expense from Worksheet II, b Business expense deduction, Part III Net Interest Deduction, Worksheet III line column f , Part IV Portion of Business, line If your operation is wholly, Part V Net Operating Loss NOL, b Enter the total EZ NOL deduction, column c Enter this amount on, c Enter the EZ NOL carryover to, and ELECTION For those taxpayers.

People who work with this document generally make errors while completing business expense from Worksheet II in this area. Be sure you re-examine what you enter right here.

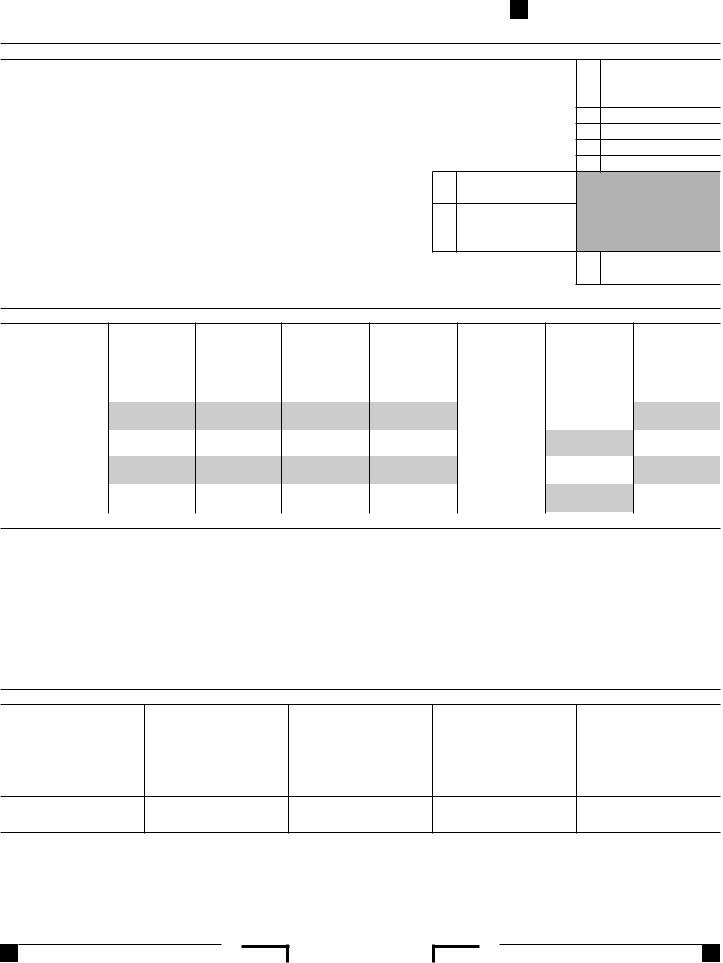

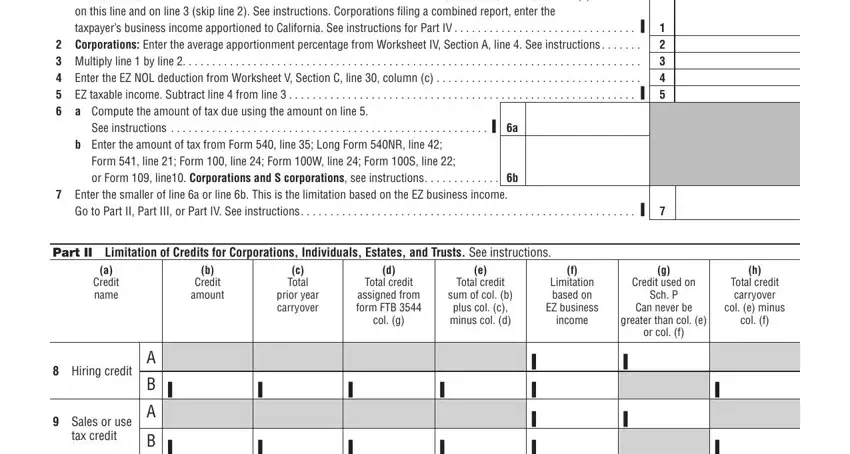

3. The next part is going to be straightforward - fill in all of the fields in Schedule Z Computation of Credit, on this line and on line skip, See instructions , b Enter the amount of tax from, Form line Form line Form W, Enter the smaller of line a or, Go to Part II Part III or Part IV, Part II Limitation of Credits for, Credit name, Credit amount, c Total, prior year carryover, Total credit, assigned from form FTB , and col g to conclude this process.

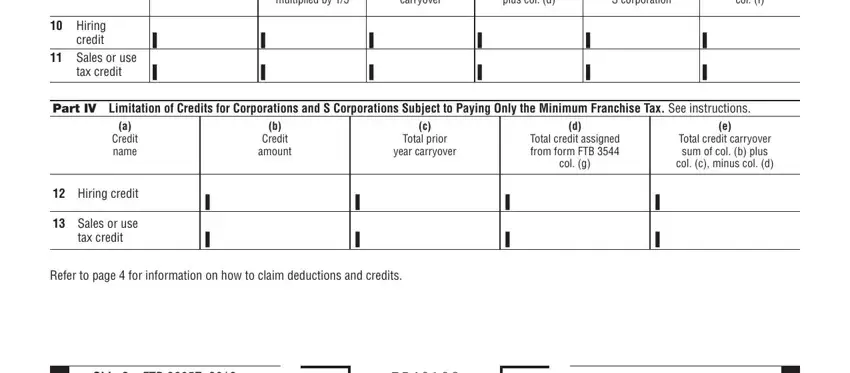

4. This particular paragraph comes with these particular form blanks to type in your specifics in: S corporation credit col b, prior year carryover, plus col d, Credit used this year by S, col f, Hiring credit Sales or use, tax credit, Part IV Limitation of Credits for, Credit name, Credit amount, Total prior, year carryover, Total credit assigned from form, col g, and Total credit carryover sum of col.

Step 3: Before moving forward, make certain that all form fields were filled in the correct way. When you believe it's all fine, click on “Done." Create a free trial account at FormsPal and acquire instant access to California Form 3805Z - download or modify from your FormsPal account page. FormsPal is focused on the privacy of all our users; we make sure that all personal data put into our editor is protected.