When working in the online tool for PDF editing by FormsPal, you are able to complete or change amazon right here. FormsPal expert team is constantly working to develop the editor and enable it to be much better for users with its multiple features. Take full advantage of today's progressive prospects, and find a myriad of unique experiences! Getting underway is effortless! All you need to do is take the next simple steps down below:

Step 1: First, access the editor by clicking the "Get Form Button" above on this webpage.

Step 2: Using this advanced PDF tool, you'll be able to do more than merely complete forms. Try all of the functions and make your docs seem perfect with custom textual content put in, or fine-tune the file's original input to perfection - all backed up by an ability to add stunning photos and sign the file off.

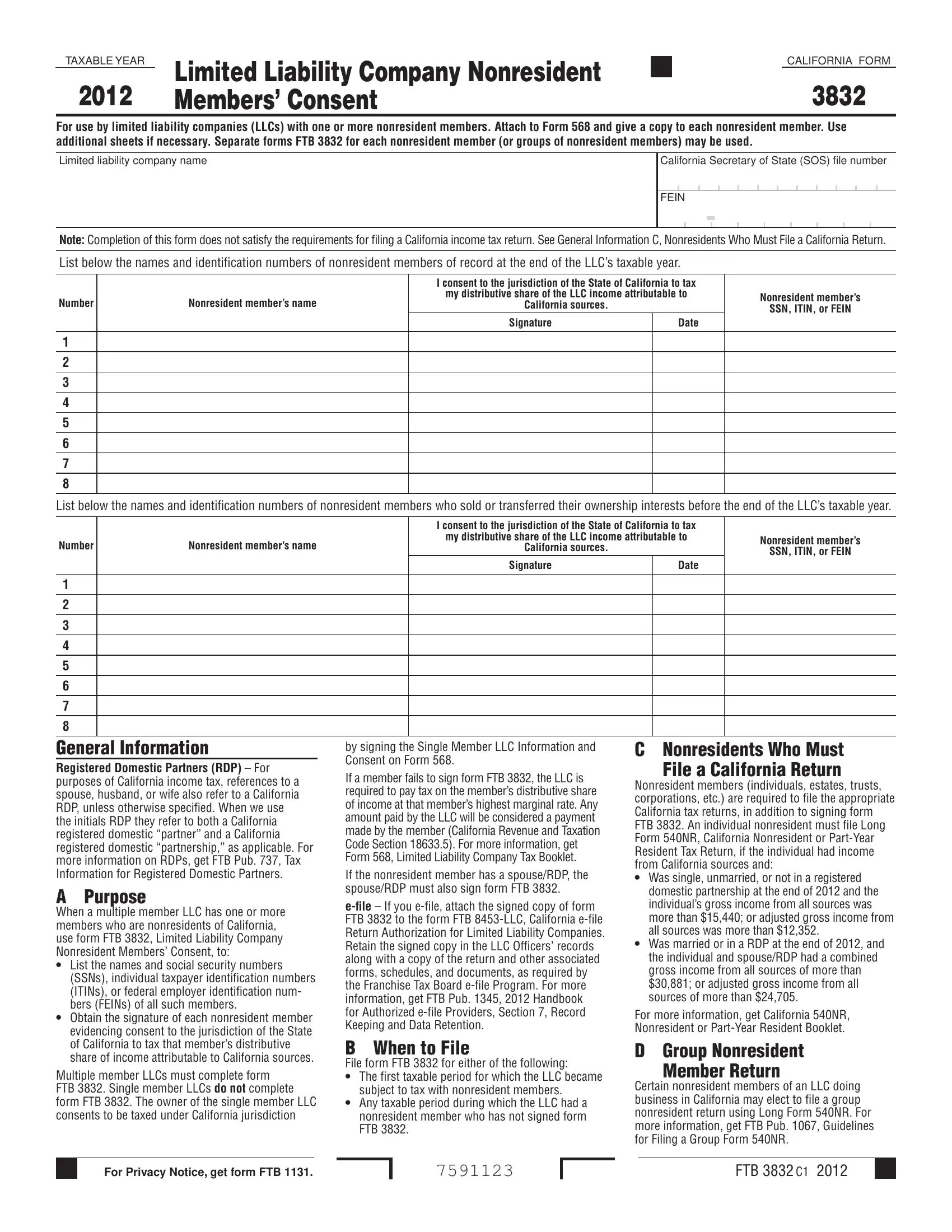

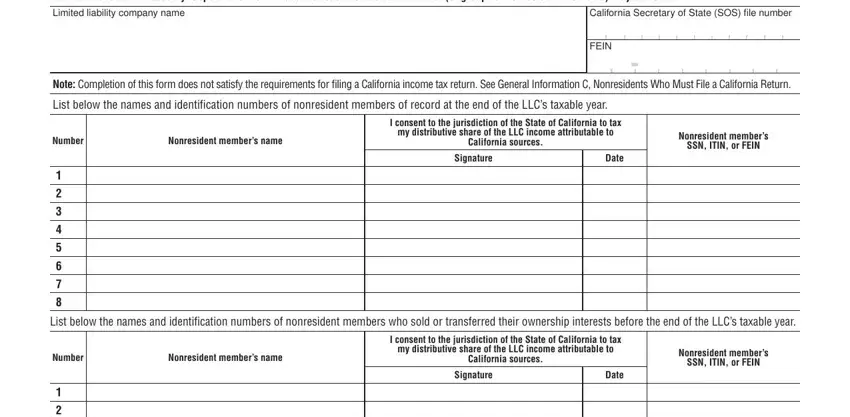

Pay close attention while filling out this form. Ensure all mandatory blank fields are completed correctly.

1. Complete your amazon with a group of necessary fields. Collect all the required information and be sure there is nothing forgotten!

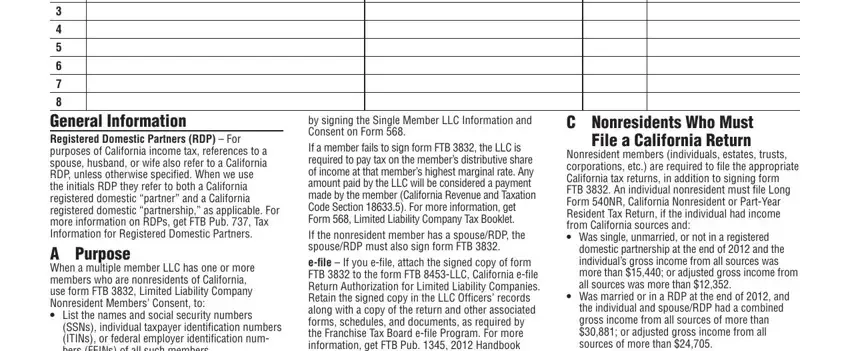

2. Given that the previous part is complete, you're ready insert the needed details in General Information Registered, SSNs individual taxpayer, by signing the Single Member LLC, C Nonresidents Who Must File a, Nonresident members individuals, domestic partnership at the end of, and Was married or in a RDP at the so that you can move on further.

It's easy to make a mistake when filling in your by signing the Single Member LLC, for that reason make sure that you reread it before you'll submit it.

Step 3: Prior to finishing your file, make certain that blank fields are filled in as intended. The moment you are satisfied with it, click on “Done." Grab your amazon when you sign up for a free trial. Readily view the form from your personal account page, with any edits and changes all preserved! FormsPal guarantees your data privacy via a secure method that in no way records or shares any sort of sensitive information used in the PDF. Be assured knowing your docs are kept confidential every time you use our service!