General Information

In general, for taxable years beginning on or after January 1, 2010, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2009. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. For more information, go to ftb.ca.gov and search for conformity. Additional information can be found

in FTB Pub. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA (540 or 540NR), and the Business Entity tax booklets.

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. We include information that is most useful to the greatest number of taxpayers in the limited space available. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the tax booklets. Taxpayers should not consider the tax booklets as authoritative law.

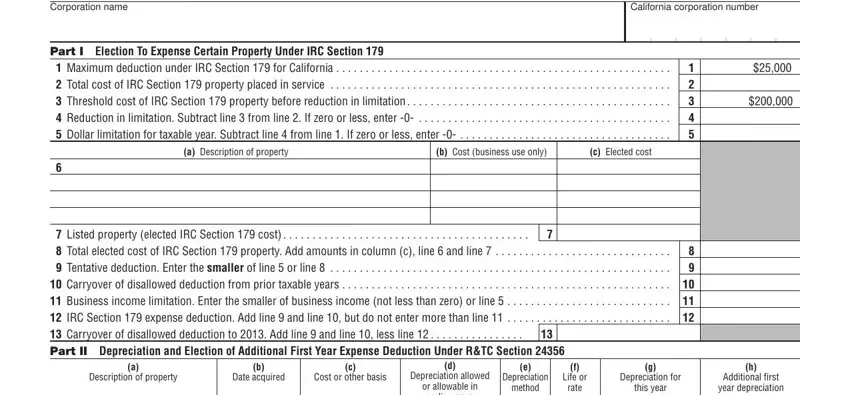

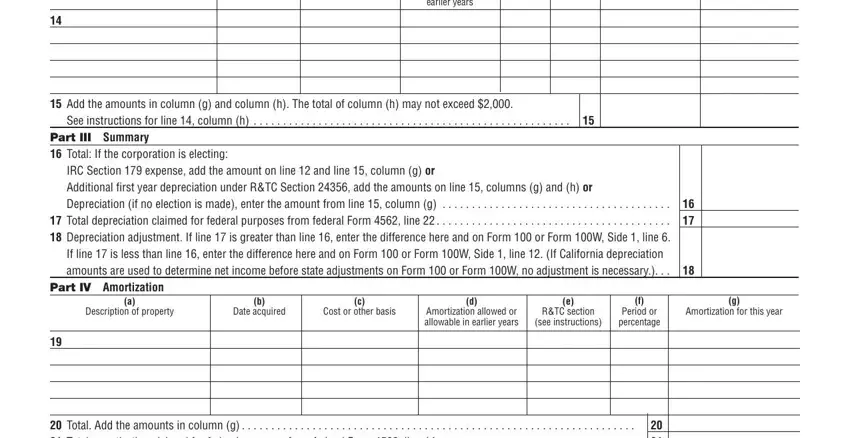

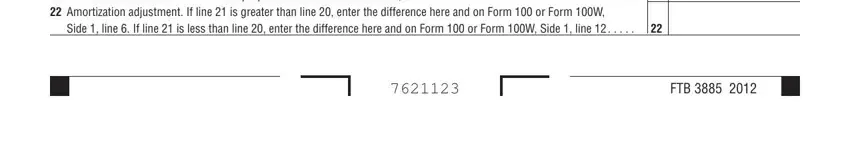

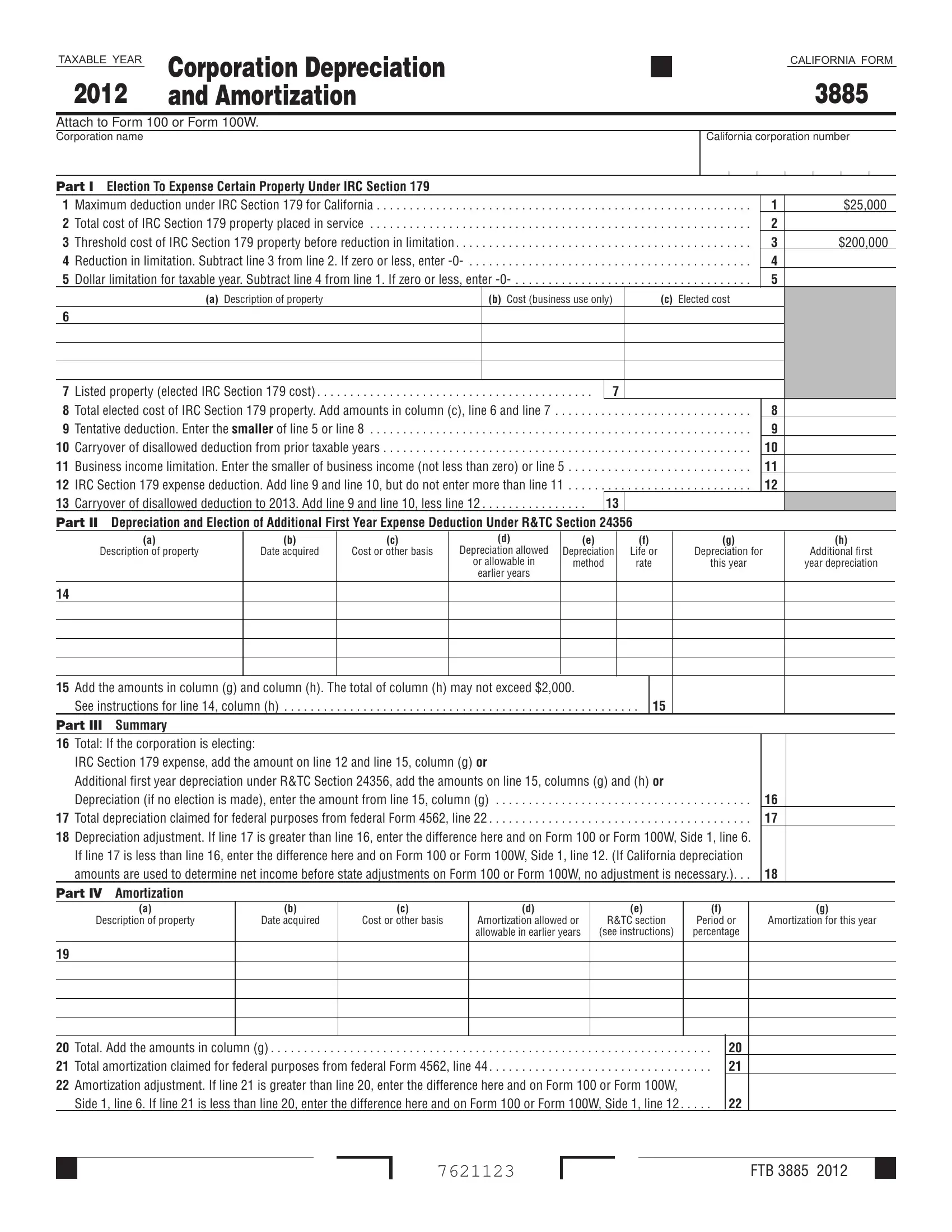

A Purpose

Use form FTB 3885, Corporation Depreciation and Amortization, to calculate California depreciation and amortization deduction for corporations, including partnerships and limited liability companies (LLCs) classified as corporations.

S corporations must use Schedule B (100S), S Corporation Depreciation and Amortization.

Depreciation is the annual deduction allowed to recover the cost or other basis of business or income producing property with a determinable useful life of more than one year. Generally, depreciation is used in connection with tangible property.

Amortization is an amount deducted to recover the cost of certain capital expenses over a fixed period. Generally amortization is used for intangible assets.

For amortizing the cost of certified pollution control facilities, use form FTB 3580, Application and Election to Amortize Certified Pollution Control Facility.

B Federal/State Differences

Differences between federal and California laws affect the calculation of depreciation and amortization. The following lists are not intended to be all-inclusive of the federal and state conformities and differences. For more information, refer to the R&TC.

California law conforms to federal law for the following:

•The sport utility vehicles (SUVs) and minivans built on a truck chassis are included in the definition of trucks and vans when applying the 6,000 pound gross weight limit. See federal Rev. Proc. 2003-75 for more information.

•The additional first-year depreciation, or the election to expense the cost of the property as provided in IRC Section 179, with modification.

•The federal Class Life Asset Depreciation Range (ADR) System provisions, which specifies a useful life for various types of property. However, California law does not allow the corporation to choose a depreciation period that varies from the specified asset guideline system.

California law does not conform to federal law for the following:

•The enhanced IRC Section 179 expensing election for assets placed in service in 2010 through 2012 taxable year.

•The first-year depreciation deduction allowed for new luxury autos or certain passenger automobiles acquired and placed in service in 2010 through 2012.

•The IRC Section 613A(d)(4) relating to the exclusion of certain refiners. See R&TC Section 24831.3 for more information.

•The IRC Section 168(k) relating to the 50% bonus depreciation deduction for assets acquired in tax years 2008 through 2012 and placed in service before 2013 (or before 2014 for certain qualifying property). For property acquired and placed in service after September 8, 2010, and before 2012 (before 2013 in the case of certain qualifying property), the bonus depreciation deduction is 100%.

•The additional first-year depreciation of certain qualified property placed in service after October 3, 2008, and the election to claim additional research and minimum tax credits in lieu of claiming the bonus depreciation.

•The accelerated recovery period for depreciation of smart meters and smart grid systems.

•The ten-year useful life for grapevines planted as replacements for vines subject to Phylloxera or Pierce’s disease. California law allows a useful life of five years.

•The federal special class life for gas station convenience stores and similar structures.

•The depreciation under Modified Accelerated Cost Recovery System (MACRS) for corporations, except to the extent such depreciation is passed through from a partnership or LLC classified as a partnership.

C Depreciation Calculation Methods

Depreciation methods are defined in R&TC Sections 24349 through 24354. Depreciation calculation methods, described in R&TC Section 24349, are as follows:

Straight-Line. The straight-line method divides the cost or other basis of property, less its estimated salvage value, into equal amounts over the estimated useful life of the property. An asset may not be depreciated below a reasonable salvage value.

Declining Balance. Under this method, depreciation is greatest in the first year and smaller in each succeeding year. The property must have a useful life of at least three years. Salvage value is not taken into account in determining the basis of the property, but the property may not be depreciated below a reasonable salvage value.

The amount of depreciation for each year is subtracted from the basis of the property and a uniform rate of up to 200% of the straight-line rate is applied to the remaining balance.

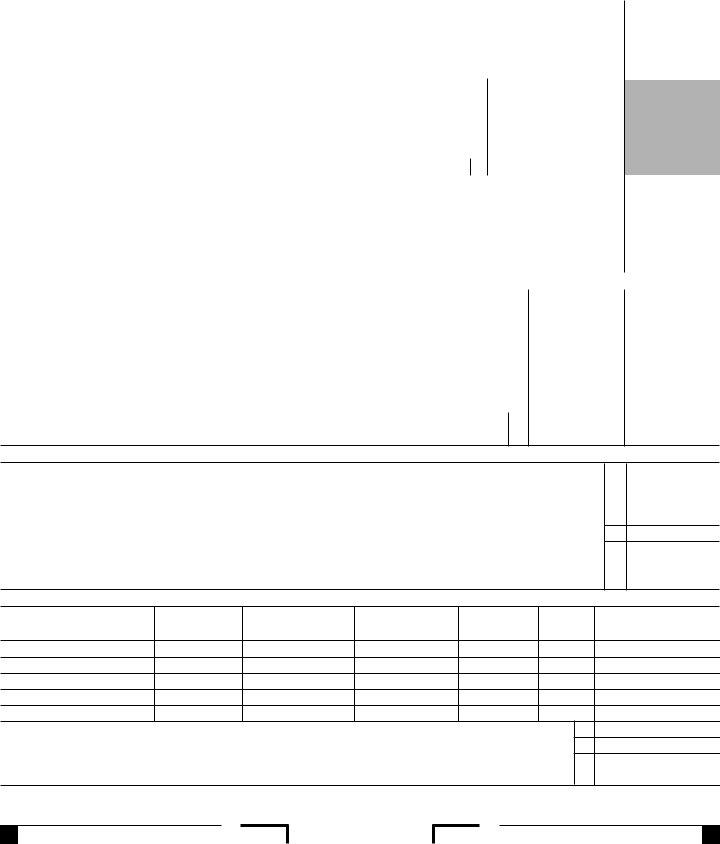

For example, the annual depreciation allowances for property with an original basis of $100,000 are:

|

|

Declining |

|

|

Remaining |

balance |

Depreciation |

Year |

basis |

rate |

allowance |

First. . . . . . $100,000 |

20% |

$20,000 |

Second . . . |

80,000 |

20% |

16,000 |

Third |

64,000 |

20% |

12,800 |

Fourth . . . . |

51,200 |

20% |

10,240 |

Sum-of-the-Years-Digits Method. This method may be used whenever the declining balance method is allowed. The depreciation deduction is figured by subtracting the salvage value from the cost of the property and multiplying the result by a fraction. The numerator of the fraction is the number of years

remaining in the useful life of the property. Therefore, the numerator changes each year as the life of the property decreases. The denominator of the fraction is the sum of the digits representing the years of useful life. The denominator remains constant every year.

Other Consistent Methods. Other depreciation methods may be used as long as the total accumulated depreciation at the end of any taxable year during the first 2/3 of the useful life of the property is not more than the amount that would have resulted from using the declining balance method.

D Period of Depreciation

Under Cal. Code Regs., tit. 18, section 24349(l), California conforms to the federal useful lives of property.

Use the following information as a guide to determine reasonable periods of useful life for purposes of calculating depreciation. Actual facts and circumstances will determine useful life. However, the figures listed below represent the normal periods of useful life for the types of property listed as shown in IRS Rev. Proc. 87-56.

•Office furniture, fixtures, machines,

and equipment . . . . . . . . . . . . . . . . . . . . . . 10 yrs.

This category includes furniture and fixtures (that are not structural components of a building) and machines and equipment used in the preparation of paper or data.

Examples include: desks; files; safes; typewriters, accounting, calculating, and data processing machines; communications equipment; and duplicating and copying equipment.

•Computers and peripheral

equipment (printers, etc.) . . . . . . . . . . . . . . . 6 yrs.

•Transportation equipment and

automobiles (including taxis) . . . . . . . . . . . . 3 yrs.

•General-purpose trucks:

Light (unloaded weight less than

13,000 lbs.) . . . . . . . . . . . . . . . . . . . . . . . . . 4 yrs. Heavy (unloaded weight 13,000 lbs.

or more) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 yrs.

•Buildings

This category includes the structural shell of a building and all of its integral parts that service normal heating, plumbing, air conditioning, fire prevention and power requirements, and equipment such as elevators and escalators.

Type of building:

Apartments . . . . . . . . . . . . . . . . . . . . . . . . . 40 yrs. Dwellings (including rental residences) . . . 45 yrs. Office buildings. . . . . . . . . . . . . . . . . . . . . . 45 yrs. Warehouses . . . . . . . . . . . . . . . . . . . . . . . . 60 yrs.

EDepreciation Methods to Use

Corporations may use the straight-line method for any depreciable property. Before using other methods, consider the kind of property, its useful life, whether it is new or used, and the date it was acquired. Use the following chart as a general guide to determine which method to use:

|

Maximum |

Property description |

depreciation method |

Real estate acquired 12/31/70 or earlier

New (useful life 3 yrs. or more) . . . . . 200% Declining balance Used (useful life 3 yrs. or more) . . . . . 150% Declining balance

Real estate acquired 1/1/71 or later Residential rental:

New. . . . . . . . . . . . . . . . . . . . . . . . . . 200% Declining balance Used (useful life 20 yrs. or more) . . . 125% Declining balance Used (useful life less than 20 yrs.) . . Straight-line