Whenever you need to fill out California Form 461, you won't need to download and install any applications - simply try using our PDF editor. Our development team is always endeavoring to develop the editor and ensure it is much better for clients with its handy features. Capitalize on the latest modern possibilities, and find a heap of new experiences! Getting underway is easy! All that you should do is adhere to the next basic steps down below:

Step 1: First of all, open the editor by pressing the "Get Form Button" at the top of this site.

Step 2: With our state-of-the-art PDF editor, you could accomplish more than merely fill out forms. Edit away and make your docs look high-quality with customized textual content added in, or modify the file's original content to excellence - all that comes with an ability to insert just about any graphics and sign the document off.

It is actually easy to complete the pdf using out helpful guide! Here's what you need to do:

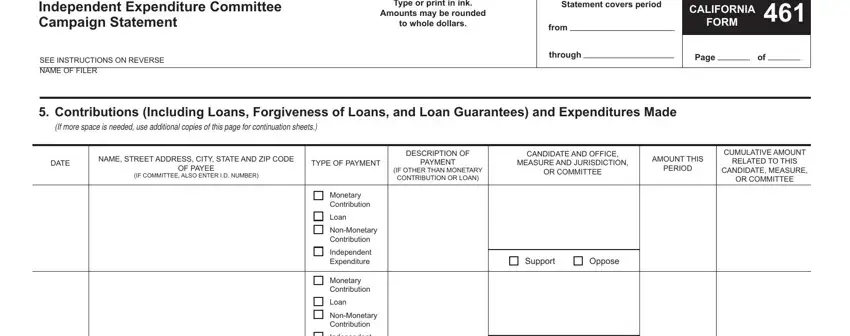

1. To get started, while filling out the California Form 461, start with the page that has the following blanks:

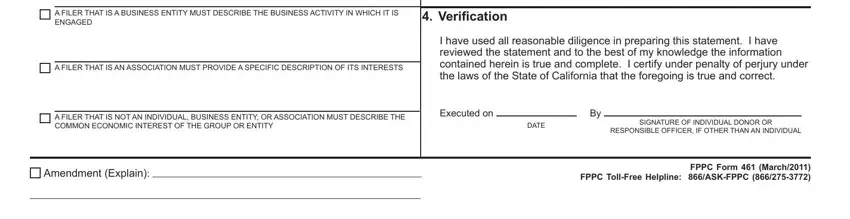

2. Once the last part is completed, proceed to type in the relevant information in all these - A FILER THAT IS A BUSINESS ENTITY, Verifi cation, A FILER THAT IS AN ASSOCIATION, I have used all reasonable, A FILER THAT IS NOT AN INDIVIDUAL, Executed on, DATE, SIGNATURE OF INDIVIDUAL DONOR OR, RESPONSIBLE OFFICER IF OTHER THAN, Amendment Explain, and FPPC Form March FPPC TollFree.

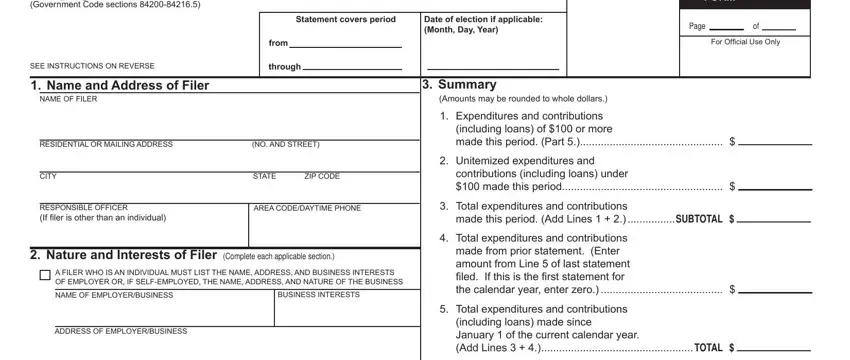

3. Within this part, check out Major Donor and Independent, Type or print in ink, Amounts may be rounded, to whole dollars, SEE INSTRUCTIONS ON REVERSE NAME, Statement covers period, from, through, CALIFORNIA, FORM, Page, Contributions Including Loans, If more space is needed use, DATE, and NAME STREET ADDRESS CITY STATE AND. Each one of these have to be completed with highest precision.

In terms of NAME STREET ADDRESS CITY STATE AND and If more space is needed use, ensure that you double-check them in this current part. Those two are surely the key ones in the PDF.

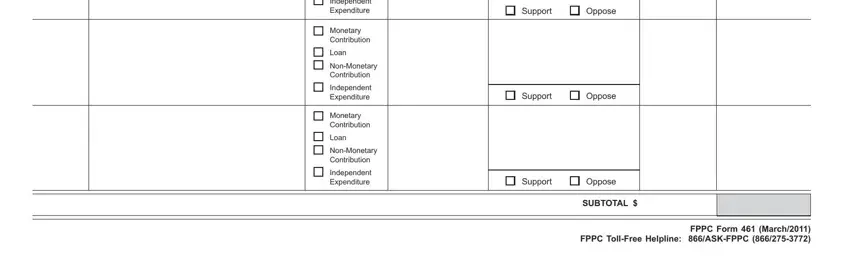

4. This next section requires some additional information. Ensure you complete all the necessary fields - Independent Expenditure, Monetary, Contribution, Loan, NonMonetary, Contribution, Independent Expenditure, Monetary, Contribution, Loan, NonMonetary, Contribution, Independent Expenditure, Support, and Oppose - to proceed further in your process!

Step 3: After you've looked over the information in the file's blank fields, click on "Done" to complete your document generation. Right after setting up afree trial account at FormsPal, you'll be able to download California Form 461 or email it right off. The PDF document will also be easily accessible in your personal account menu with your adjustments. FormsPal guarantees protected document editor devoid of personal data record-keeping or any type of sharing. Be assured that your information is in good hands with us!