You may fill out California without difficulty using our online PDF editor. Our professional team is relentlessly endeavoring to enhance the tool and make it much better for users with its extensive features. Enjoy an ever-evolving experience now! If you are looking to begin, here's what it takes:

Step 1: Click on the "Get Form" button above. It'll open our editor so that you can begin filling in your form.

Step 2: With the help of our advanced PDF editing tool, it is possible to accomplish more than just fill out blank form fields. Edit away and make your documents look faultless with custom text put in, or modify the file's original content to excellence - all accompanied by an ability to add your own pictures and sign it off.

This form needs specific details; to ensure consistency, remember to take into account the next suggestions:

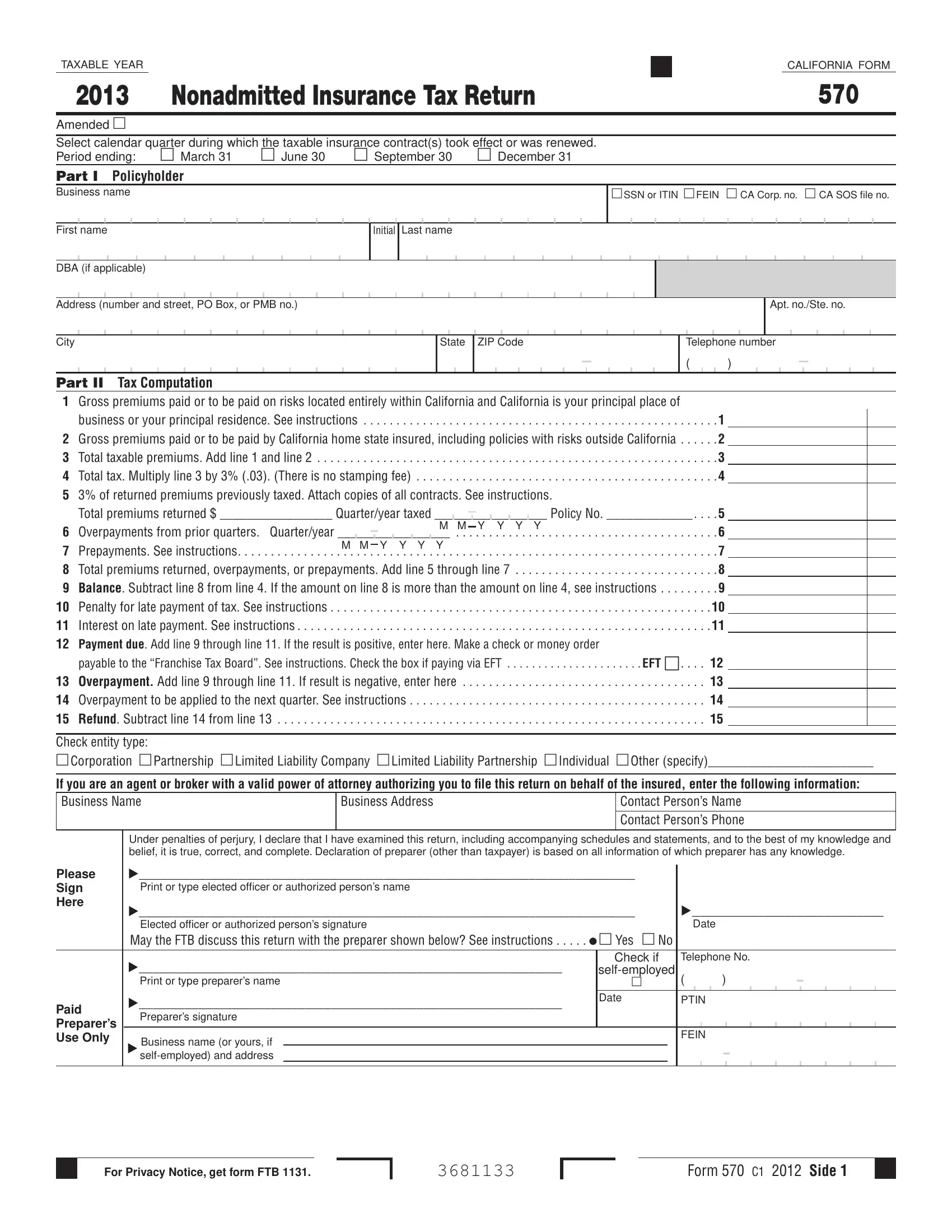

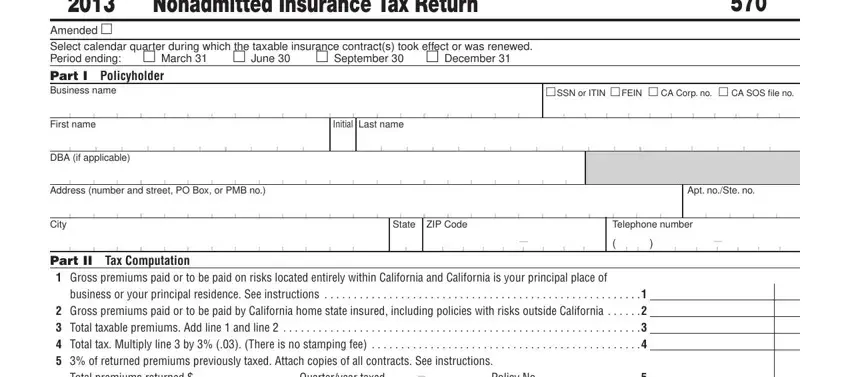

1. Complete your California with a group of major blank fields. Gather all the required information and be sure absolutely nothing is forgotten!

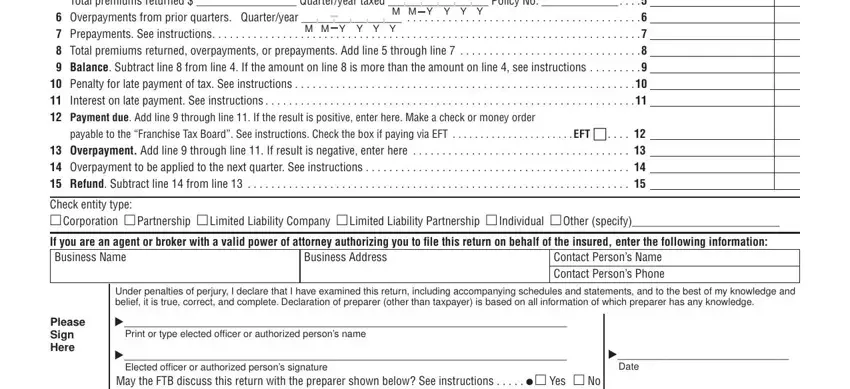

2. When the previous segment is finished, it's time to add the essential details in Part II Tax Computation Gross, M M Y Y Y Y, M M Y Y Y Y, payable to the Franchise Tax Board, Check entity type Corporation , If you are an agent or broker with, Business Address, Contact Persons Name Contact, Please Sign Here, Under penalties of perjury I, and Print or type elected officer or so you can move forward to the third part.

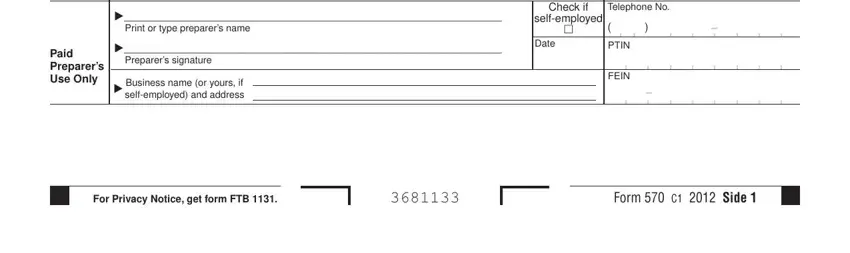

3. This next part is generally hassle-free - complete all of the fields in Please Sign Here, Paid Preparers Use Only, Elected officer or authorized, Date, Print or type preparers name, Check if, Telephone No, selfemployed, Preparers signature, Date, Business name or yours if, PTIN, FEIN, For Privacy Notice get form FTB , and Form C Side in order to finish the current step.

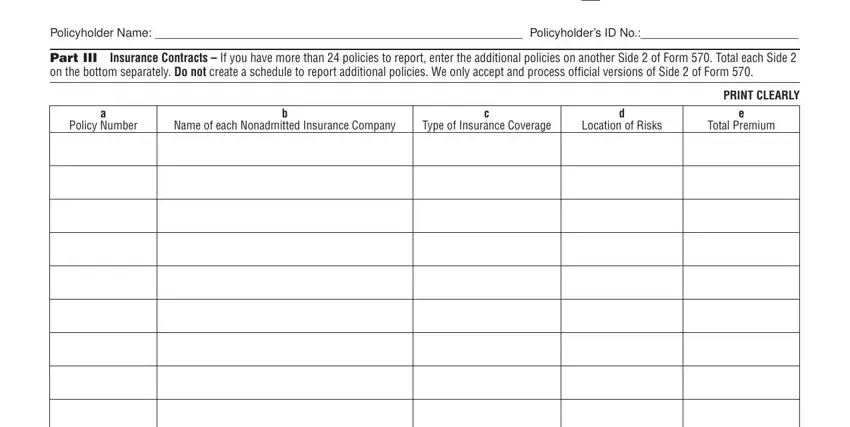

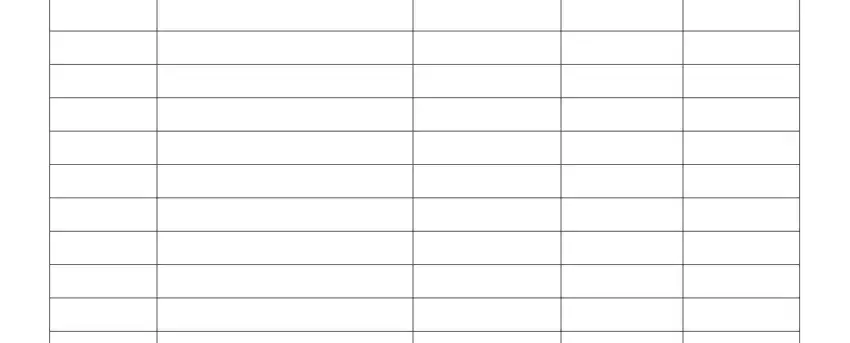

4. The subsequent paragraph comes next with these blank fields to fill out: Policyholder Name Policyholders, Part III on the bottom separately, Insurance Contracts If you have, PRINT CLEARLY, Policy Number, Name of each Nonadmitted Insurance, Type of Insurance Coverage, Location of Risks, and Total Premium.

In terms of Name of each Nonadmitted Insurance and Policy Number, make certain you review things in this current part. The two of these could be the most significant ones in the file.

5. To conclude your form, the last section requires a few additional blanks. Typing in will certainly finalize everything and you're going to be done in no time at all!

Step 3: Always make sure that the information is correct and then click "Done" to progress further. Try a free trial option with us and obtain instant access to California - download or edit from your personal account page. Here at FormsPal.com, we do everything we can to ensure that all your details are maintained protected.