When working in the online PDF editor by FormsPal, it is easy to fill in or change California Form 540X here and now. The tool is constantly improved by our staff, acquiring new awesome features and becoming greater. Getting underway is easy! All that you should do is follow these easy steps directly below:

Step 1: Hit the "Get Form" button in the top part of this webpage to access our PDF tool.

Step 2: With our handy PDF tool, it is easy to accomplish more than just fill in blanks. Try all the features and make your forms look faultless with custom textual content incorporated, or fine-tune the original content to excellence - all that comes along with the capability to insert stunning graphics and sign the PDF off.

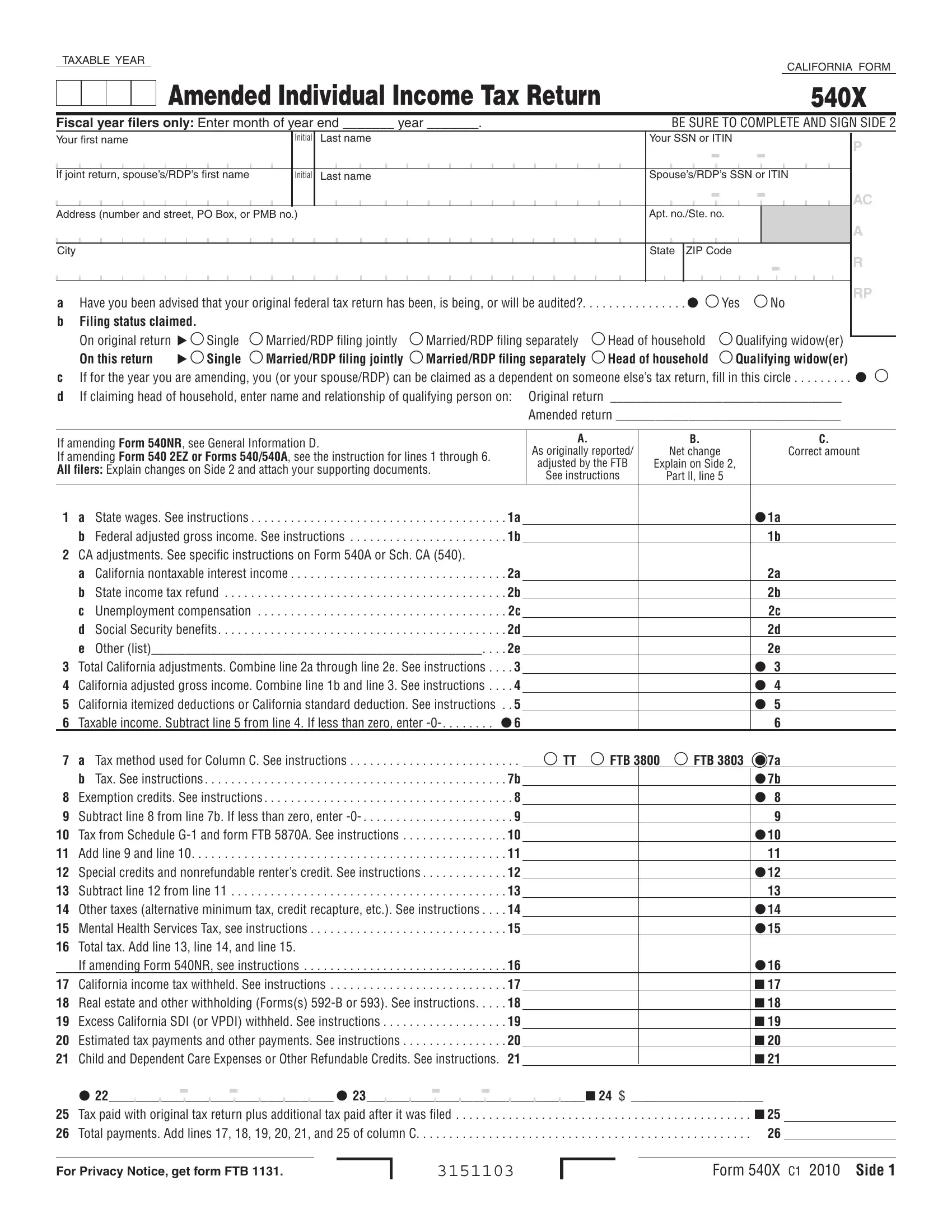

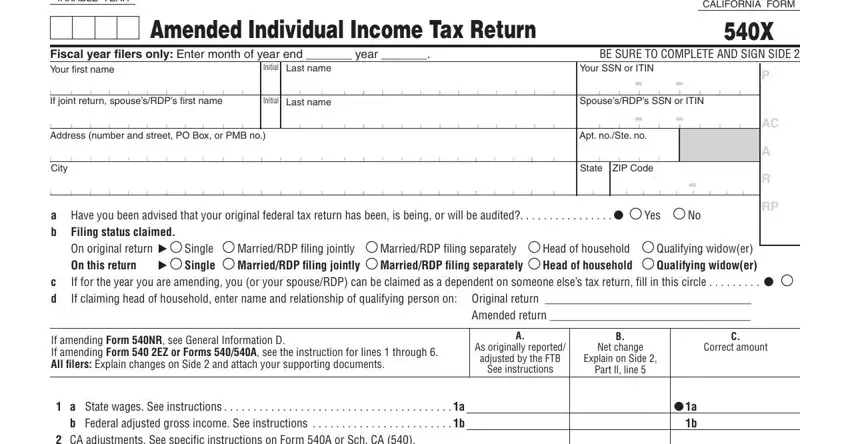

For you to finalize this document, make certain you provide the right details in every field:

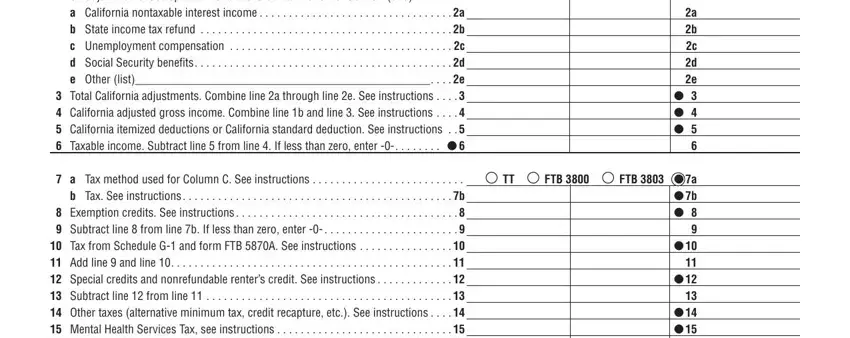

1. While filling in the California Form 540X, be sure to incorporate all necessary blank fields in its corresponding part. It will help to facilitate the work, which allows your information to be handled efficiently and accurately.

2. After the last segment is finished, it is time to put in the required particulars in a b c d e, a State wages See instructions , Taxable income Subtract line , and b Tax See instructions allowing you to progress further.

People often get some points incorrect when filling in b Tax See instructions in this part. Be sure you reread what you type in here.

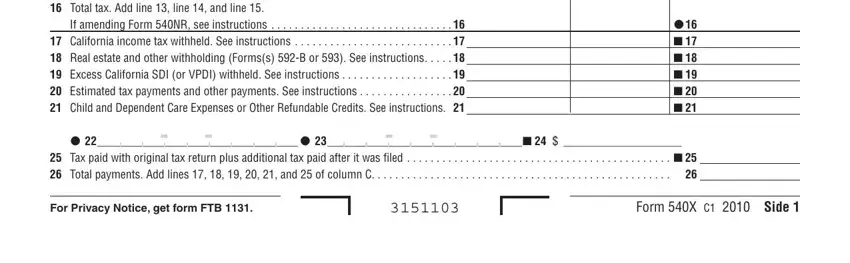

3. This third stage is normally simple - complete every one of the form fields in Taxable income Subtract line , b Tax See instructions , Tax paid with original tax, For Privacy Notice get form FTB , and Form X C Side to complete this segment.

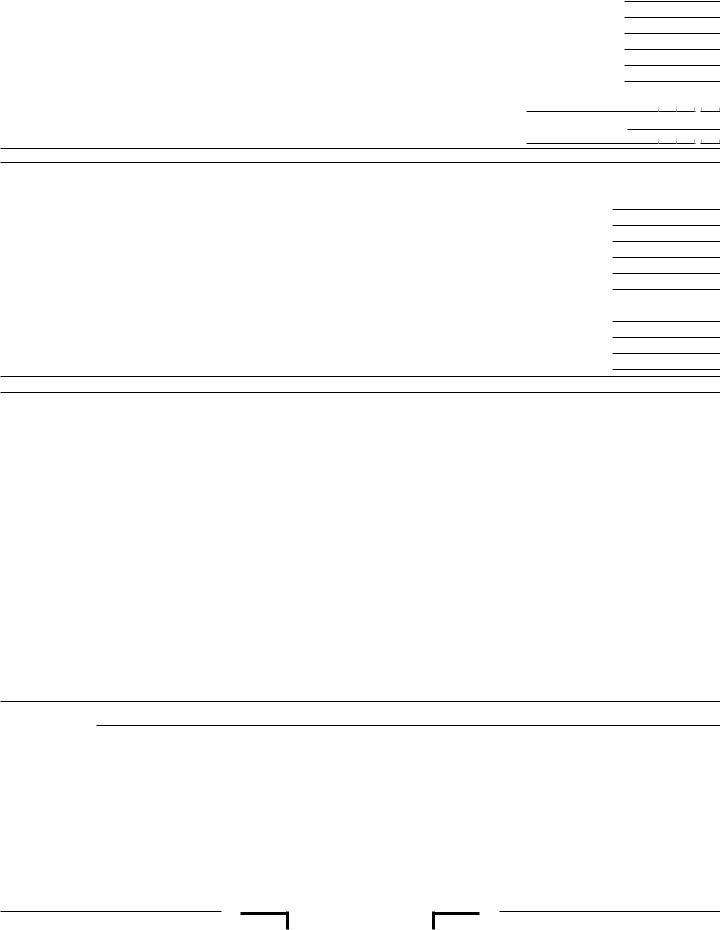

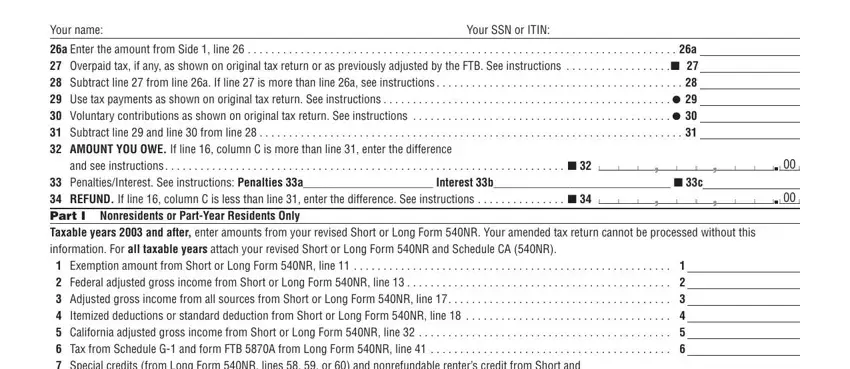

4. The subsequent paragraph needs your input in the following areas: Your name, Your SSN or ITIN, and see instructions , and a Enter the amount from Side line. Be sure you provide all of the requested info to move onward.

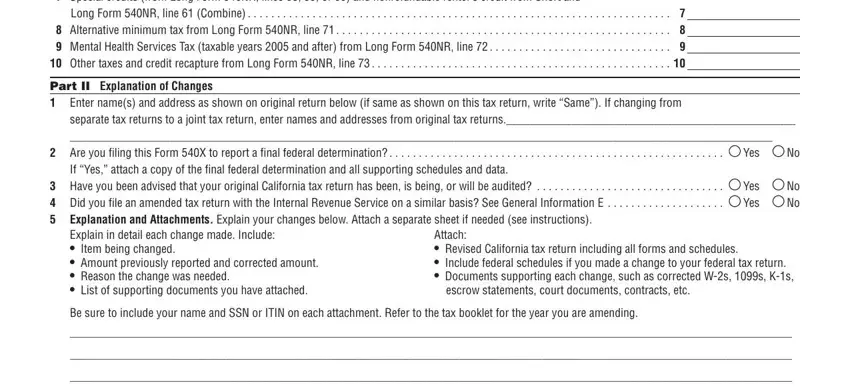

5. Last of all, the following final segment is precisely what you will need to finish before using the document. The blank fields at this point are the next: a Enter the amount from Side line, Long Form NR line Combine , separate tax returns to a joint, Part II Explanation of Changes , If Yes attach a copy of the final, Explain in detail each change made, Attach Revised California tax, and Be sure to include your name and.

Step 3: Once you have reread the details provided, just click "Done" to finalize your document creation. Make a free trial account with us and get immediate access to California Form 540X - available from your personal account page. At FormsPal.com, we do everything we can to guarantee that all your information is maintained private.