Handling PDF files online can be super easy with our PDF editor. Anyone can fill out franchise tax board form 541 here and try out many other functions we provide. The tool is constantly maintained by our team, acquiring powerful features and becoming better. Getting underway is easy! Everything you should do is follow the following simple steps below:

Step 1: Access the PDF form in our tool by pressing the "Get Form Button" in the top part of this webpage.

Step 2: The editor enables you to customize your PDF file in many different ways. Enhance it by including any text, adjust existing content, and add a signature - all close at hand!

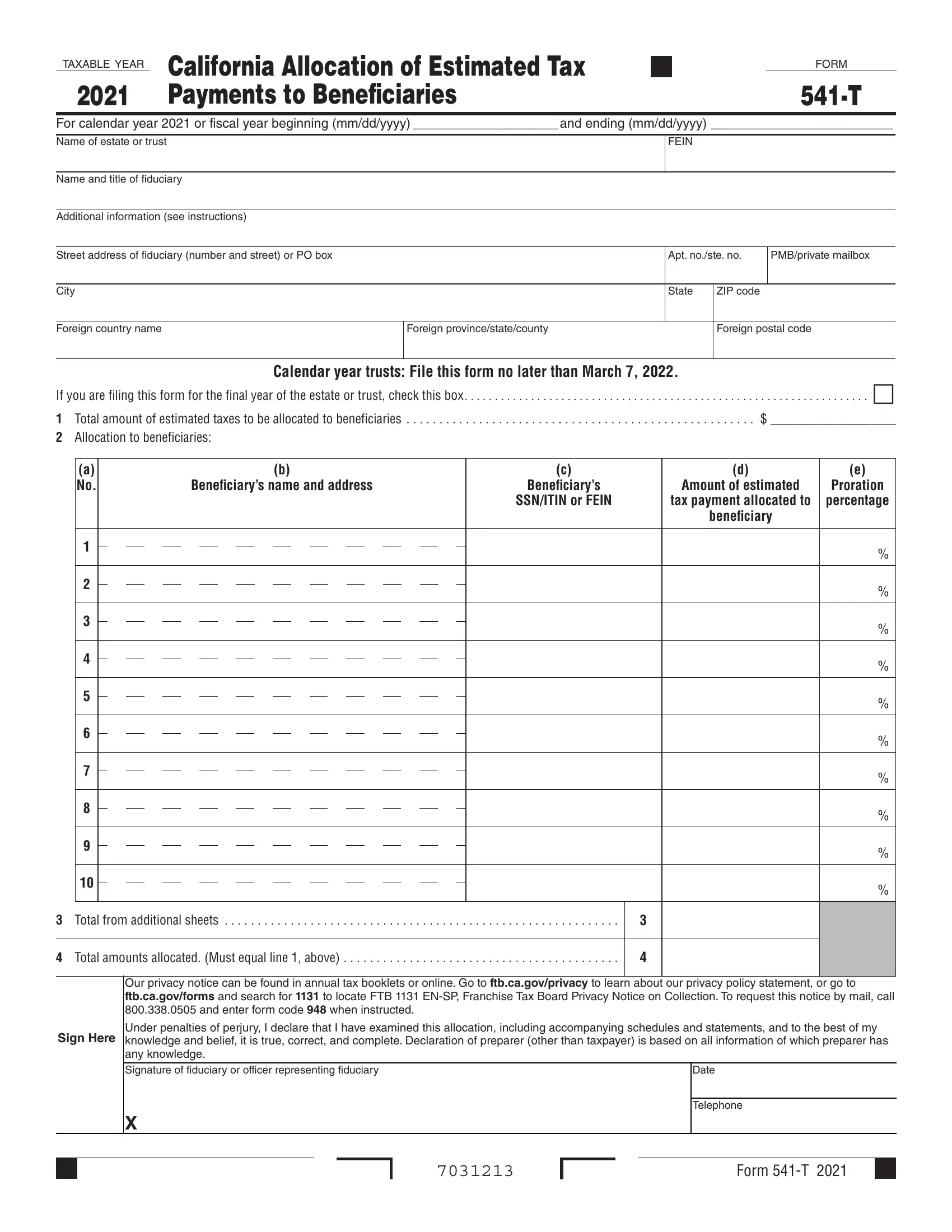

As for the blank fields of this specific document, this is what you need to do:

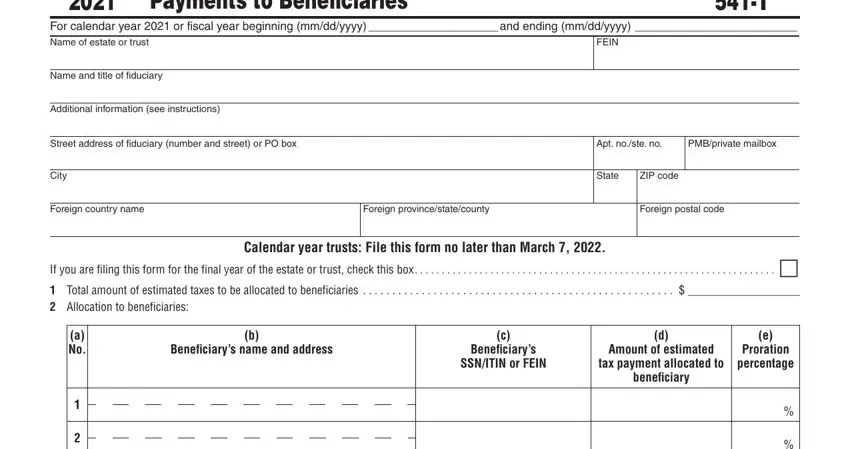

1. Start completing the franchise tax board form 541 with a selection of necessary blanks. Consider all of the necessary information and make certain there's nothing left out!

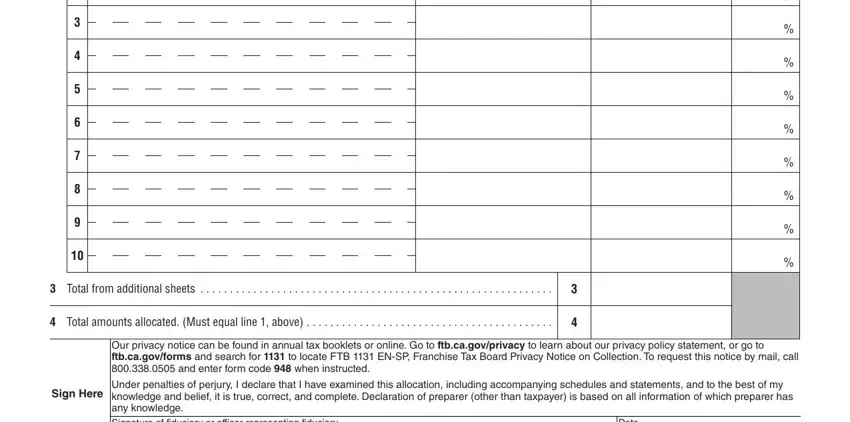

2. Your next stage is to fill in the following blank fields: Total from additional sheets , Total amounts allocated Must, Our privacy notice can be found in, Sign Here, Under penalties of perjury I, and Date.

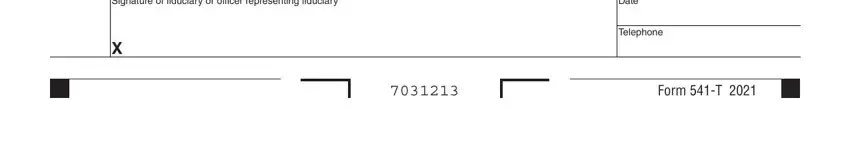

3. Completing Under penalties of perjury I, Date, Telephone, and Form T is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be extremely attentive while completing Form T and Under penalties of perjury I, since this is the section where a lot of people make errors.

Step 3: Prior to finishing this file, double-check that form fields were filled out the right way. When you think it's all fine, click “Done." Join FormsPal today and instantly obtain franchise tax board form 541, prepared for download. Every single change made is handily saved , helping you to modify the file at a later stage as needed. FormsPal guarantees your data privacy via a secure system that in no way records or distributes any sensitive information used in the form. Be assured knowing your files are kept safe any time you use our services!