You are able to fill out Transportationandlodging effortlessly using our PDFinity® online PDF tool. FormsPal expert team is relentlessly working to improve the editor and ensure it is much easier for clients with its extensive functions. Make use of the current revolutionary opportunities, and find a heap of new experiences! Here is what you will need to do to get going:

Step 1: First, open the pdf editor by clicking the "Get Form Button" in the top section of this page.

Step 2: With the help of this state-of-the-art PDF file editor, you can actually accomplish more than simply fill out blank form fields. Edit away and make your docs look sublime with customized textual content put in, or optimize the file's original content to perfection - all accompanied by the capability to add any kind of images and sign the document off.

It's simple to finish the pdf using out helpful guide! Here is what you need to do:

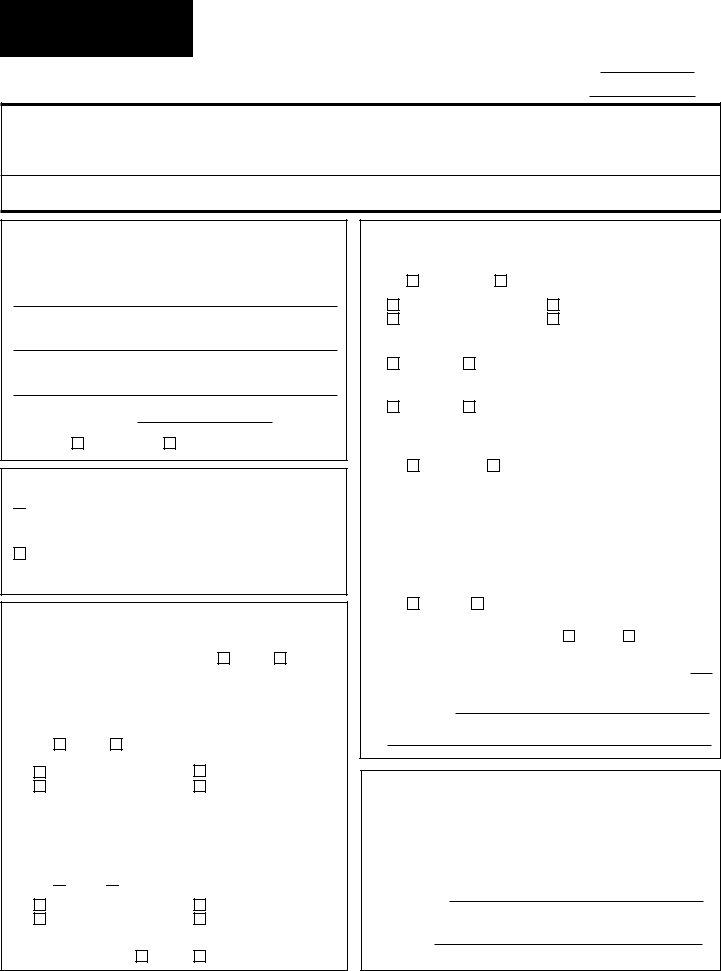

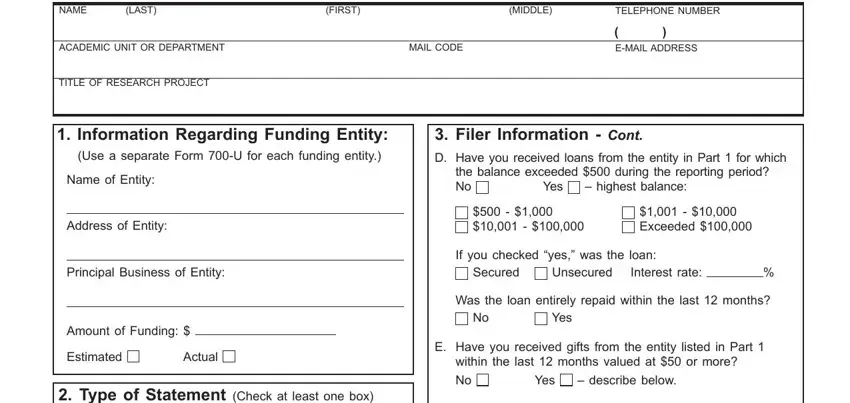

1. It is important to complete the Transportationandlodging properly, so be attentive when working with the segments containing these specific fields:

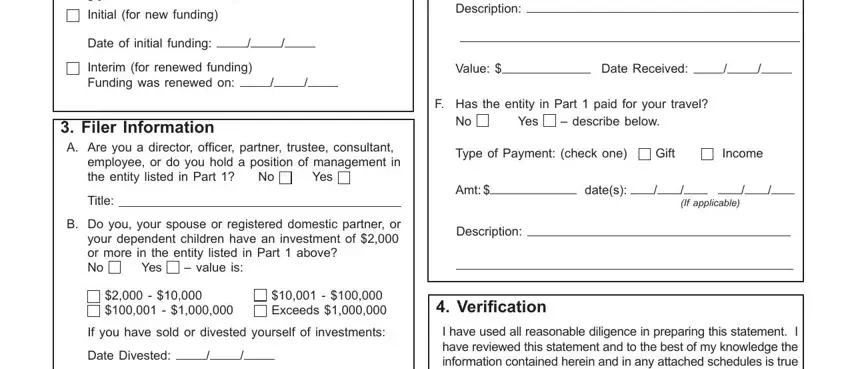

2. Once your current task is complete, take the next step – fill out all of these fields - Type of Statement Check at least, Initial for new funding, Date of initial funding, Interim for renewed funding, Funding was renewed on, Filer Information A Are you a, Yes, Title, B Do you your spouse or registered, value is, Yes, Exceeds , If you have sold or divested, Date Divested, and Description with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

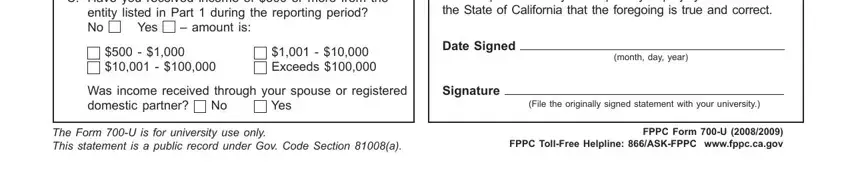

3. This next part is going to be straightforward - complete every one of the form fields in C Have you received income of or, entity listed in Part during the, Yes, amount is, Exceeds , Was income received through your, Yes, Veriication I have used all, Date Signed, Signature, month day year, File the originally signed, The Form U is for university use, and FPPC Form U FPPC TollFree in order to complete this process.

When it comes to Was income received through your and Veriication I have used all, ensure that you don't make any mistakes in this section. Both of these are the most significant fields in this document.

Step 3: Right after you've reviewed the details you filled in, click on "Done" to complete your document creation. Right after registering afree trial account with us, you will be able to download Transportationandlodging or send it via email directly. The PDF will also be available via your personal cabinet with your every single modification. FormsPal guarantees secure form editing with no personal data recording or any sort of sharing. Rest assured that your data is secure with us!