By using the online PDF tool by FormsPal, you can complete or change California Form 8454 right here. In order to make our tool better and easier to work with, we consistently work on new features, considering suggestions from our users. To get the process started, go through these simple steps:

Step 1: Click on the orange "Get Form" button above. It'll open up our pdf tool so you can start completing your form.

Step 2: Using this state-of-the-art PDF editor, it is possible to accomplish more than merely complete blanks. Try each of the features and make your docs look perfect with custom textual content added in, or fine-tune the file's original content to excellence - all backed up by an ability to insert almost any graphics and sign the PDF off.

As a way to finalize this form, be certain to enter the information you need in each and every field:

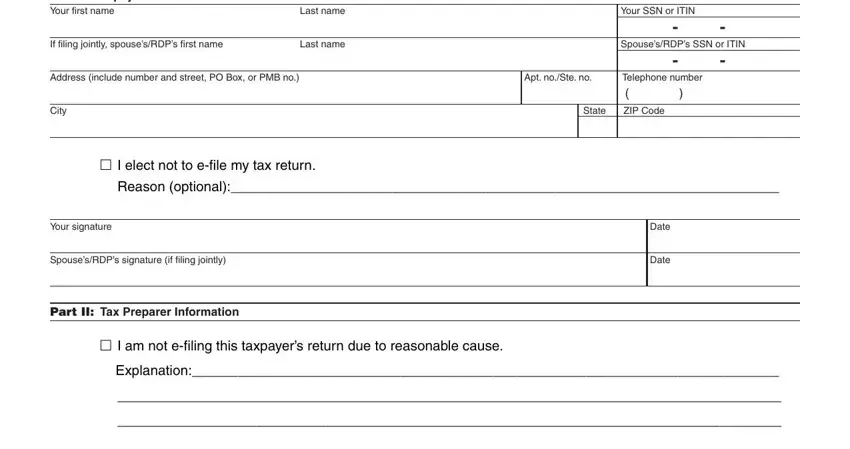

1. To get started, once filling out the California Form 8454, start with the page that includes the following fields:

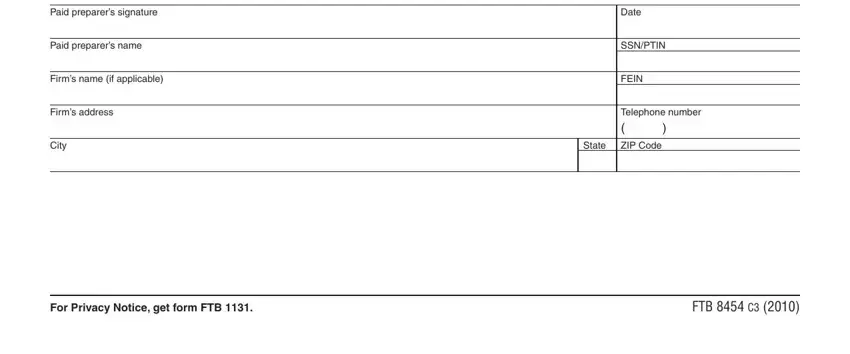

2. Right after this section is done, go to type in the suitable details in all these - Paid preparers signature, Paid preparers name, Firms name if applicable, Firms address, City, Date, SSNPTIN, FEIN, Telephone number , State, ZIP Code, For Privacy Notice get form FTB , and FTB C .

People often make some mistakes while filling out City in this area. You need to read again whatever you enter here.

Step 3: Confirm that your information is accurate and just click "Done" to progress further. Sign up with FormsPal now and immediately get access to California Form 8454, set for downloading. Every single edit you make is handily preserved , so that you can change the document further when required. Here at FormsPal.com, we do our utmost to make sure that all of your details are kept private.