General Information

A Purpose of Form FTB 8879

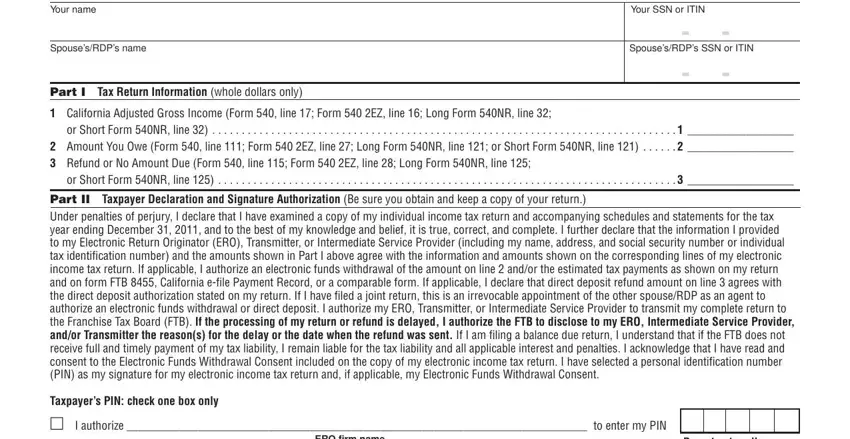

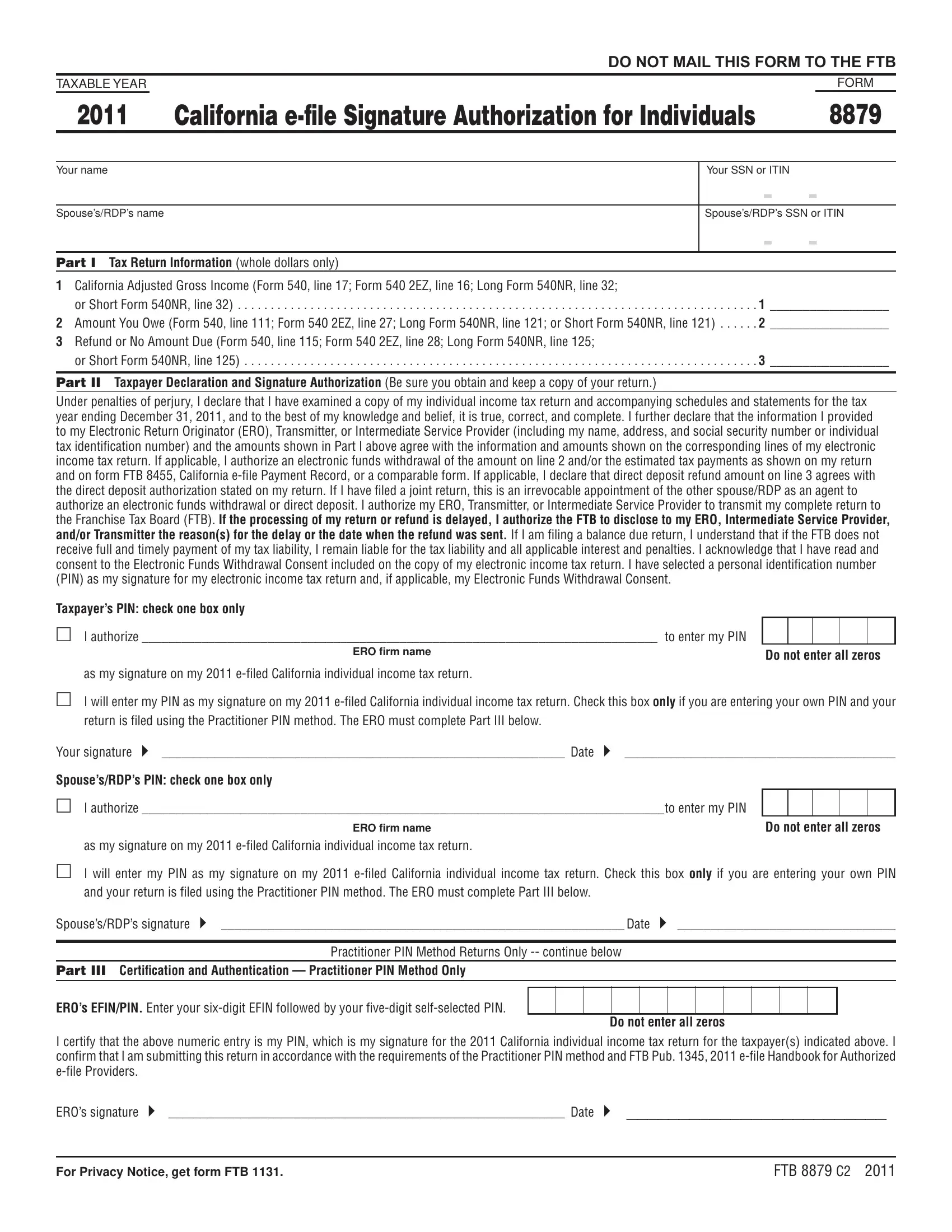

Form FTB 8879, California e-file Signature Authorization for Individuals, must be completed when an individual e-file tax return is being signed using the Practitioner PIN method. By signing this form, the taxpayer authorizes the Electronic Return Originator (ERO) to enter the taxpayer’s personal identification number (PIN) on his or her 2011 e-filed California individual income tax return. This is a one-time authorization tied to this specific tax return.

Form FTB 8879 does not serve as proof of filing – the acknowledgement containing the date of acceptance for the accepted tax return is that proof.

Do not use form FTB 8879 if the taxpayer(s) will sign form FTB 8453, California e-file Return Authorization for Individuals, or will enter their own PIN and shared secret.

B Practitioner PIN Method

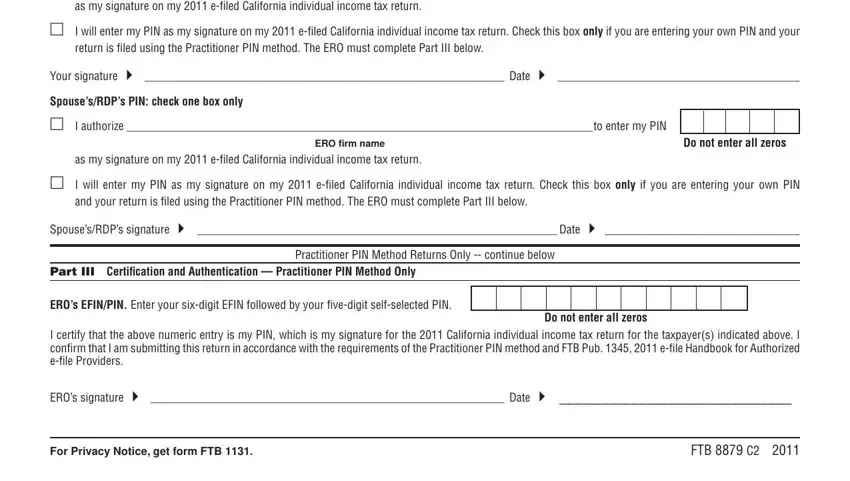

The Practitioner PIN method is an electronic signature option for taxpayers e-filing their individual income tax return through an ERO. To select this method, both the taxpayer(s) and ERO must sign form FTB 8879. When using this method, the taxpayer generally does not need to supply a shared secret with their PIN. The Practitioner PIN method can be used when the taxpayer’s shared secret is not known or the taxpayer cannot physically enter their PIN on their ERO’s computer.

For taxpayers who are married or RDPs filing jointly, it is acceptable for one spouse/RDP to authorize the ERO to enter his or her PIN and the other to choose to enter his or her own PIN. In this scenario, the spouse/ RDP entering his or her own PIN must also provide the correct shared secret. It is not acceptable for one spouse/RDP to enter both PINs.

C Taxpayer Responsibilities

Before you can e-file your individual tax return, you must:

•Inspect a copy of your individual income tax return and ensure the information is correct. Reconfirm your routing and account numbers entered into the tax preparation software.

•Review and approve the sworn statements and disclosure statements.

•Indicate or verify the five-digit PIN that will be used as your signature.

•Receive and review the information on form FTB 8455, California e-file Payment Record for Individuals, or a comparable form.

•Sign and date form FTB 8879 and submit it to your ERO (fax is acceptable).

Your tax return will not be transmitted to the Franchise Tax Board (FTB) until the ERO receives your signed form FTB 8879.

After your tax return is e-filed, you must retain the following documents (in electronic or paper format) for the California statute of limitations period:

•Original Forms W-2, W-2G, and 1099-R.

•A copy of Form 540, Form 540 2EZ, Long, or Short Form 540NR.

•A copy of form FTB 8455, California e-file Payment Record for Individuals, or a comparable form.

•A copy of your federal tax return.

•A copy of your other state income tax return if you claimed the California Other State Tax Credit. Refer to California Schedule S.

The California statute of limitations is the later of four years from the due date of the tax return or four years from the date the tax return is filed. (Exception: An extended statute of limitations period may apply for California or federal tax returns that are related to or subject to a federal audit.)

D ERO Responsibilities

Before you can e-file your client’s individual tax return, you must:

•Confirm the identity of the taxpayer(s) per FTB Pub. 1345, Section 6.

•Complete form FTB 8879 through Part I with information from the taxpayer’s tax return.

•Complete form FTB 8455, California e-file Payment Record for Individuals, or a comparable form.

•Enter the ERO firm name (not the name of the individual preparing the tax return) in Part II.

•Review the taxpayer’s tax return, plus banking information.

•Provide the taxpayer (in electronic or paper format):

oForm FTB 8879.

oA complete copy of their tax return.

oForm FTB 8455, California e-file Payment Record for Individuals, or a comparable form.

•Obtain each taxpayer’s signature after the tax return is prepared but before you transmit it.

•Record the eleven-digit PIN that will be used as your signature.

•Sign and date form FTB 8879.

After the tax return is e-filed, you must:

•Retain form FTB 8879 for four years from the due date of the tax return or four years from the date the tax return is filed, whichever is later.*

•Retain all required e-file return information per FTB Pub. 1345, Section 8.*

•Upon request, provide a copy of form FTB 8879 to the taxpayer or the FTB.

*Exception: For VITA/TCE/Not for Profit Sites, the taxpayer must retain these documents.

E Banking Information

Using direct deposit or electronic funds withdrawal is voluntary and ap- plies only to the tax return you are filing at this time. Be sure the account information entered in the tax preparation software as shown on your tax return is correct. If the bank or financial institution rejects the electronic funds withdrawal due to an error in the routing number or account number, we will send you a notice that may include penalties and interest.

To cancel an electronic funds withdrawal or a scheduled estimated tax payment, you must call the FTB at 916.845.0353 at least two working days before the date of the withdrawal.

Caution: Check with your financial institution to make sure your deposit will be accepted and to get the correct routing and account numbers. The FTB is not responsible for a lost refund due to incorrect account information entered by you or your representative.

Do not mail form FTB 8879 to the FTB.