By using the online tool for PDF editing by FormsPal, you're able to complete or edit nullity here and now. The tool is constantly maintained by our team, receiving powerful functions and growing to be greater. Here is what you will need to do to get started:

Step 1: Just click the "Get Form Button" in the top section of this webpage to start up our form editing tool. There you will find all that is needed to fill out your document.

Step 2: With this handy PDF editor, it's possible to accomplish more than merely fill in blanks. Express yourself and make your documents seem high-quality with custom text incorporated, or fine-tune the file's original input to perfection - all that backed up by the capability to add almost any pictures and sign the PDF off.

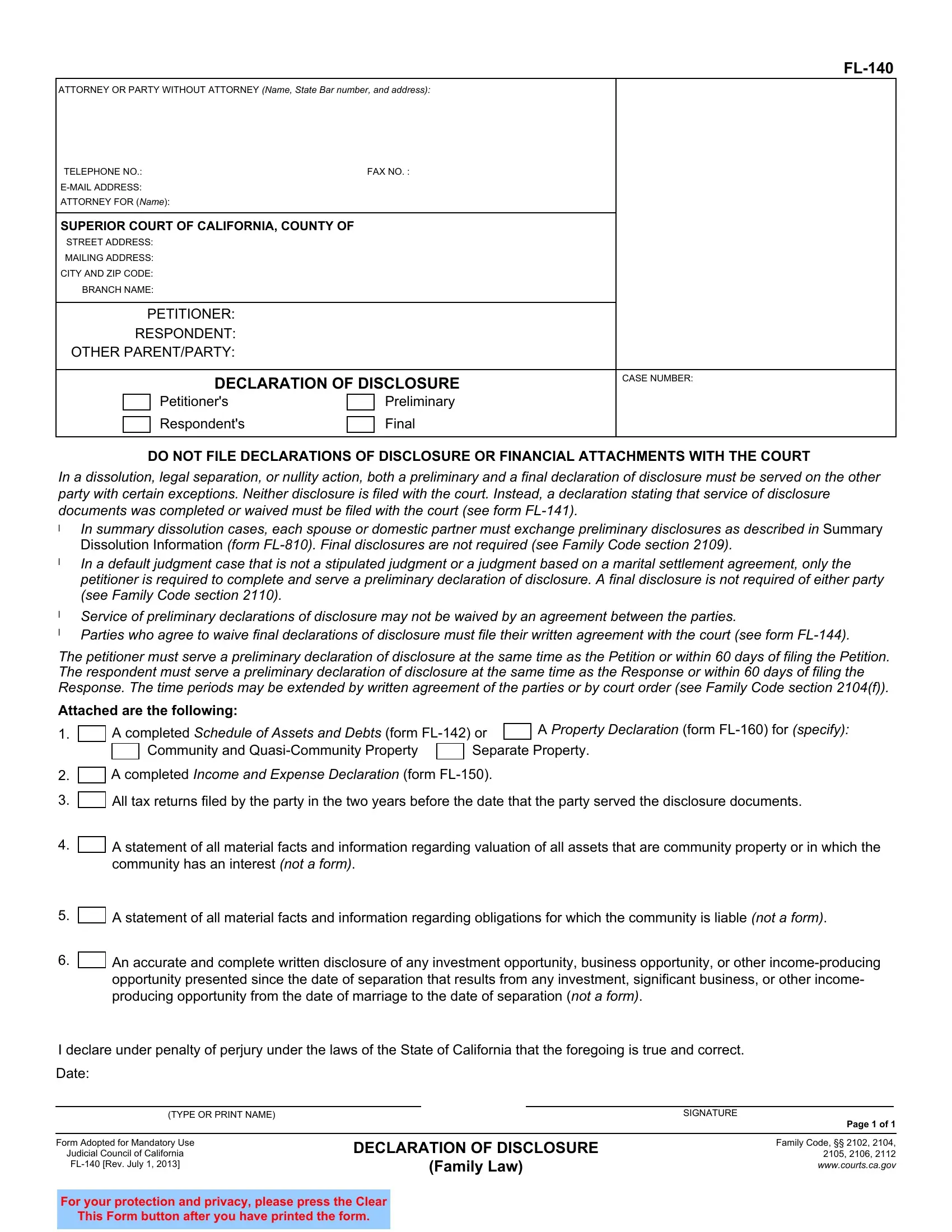

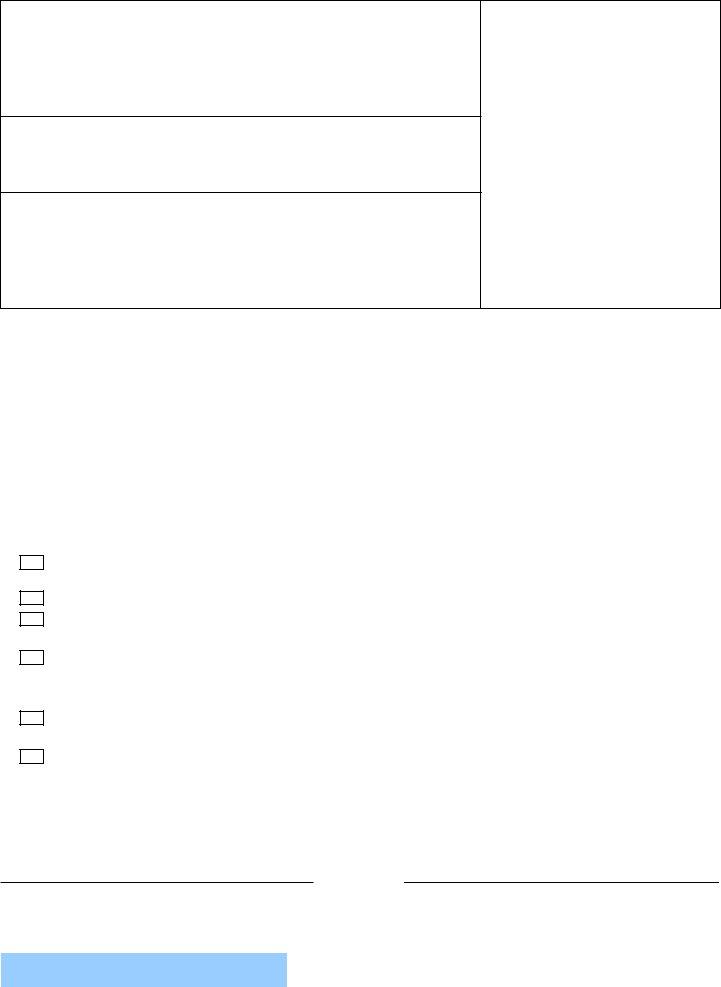

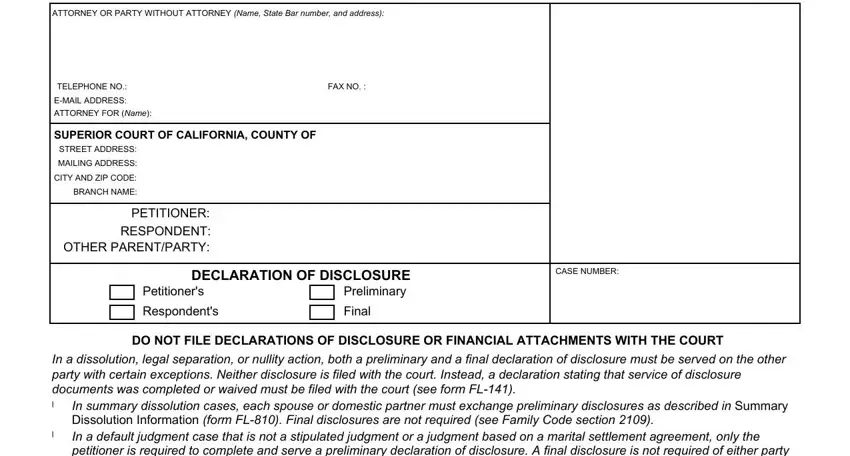

As for the blank fields of this specific document, here is what you want to do:

1. Firstly, while filling in the nullity, begin with the part that includes the following fields:

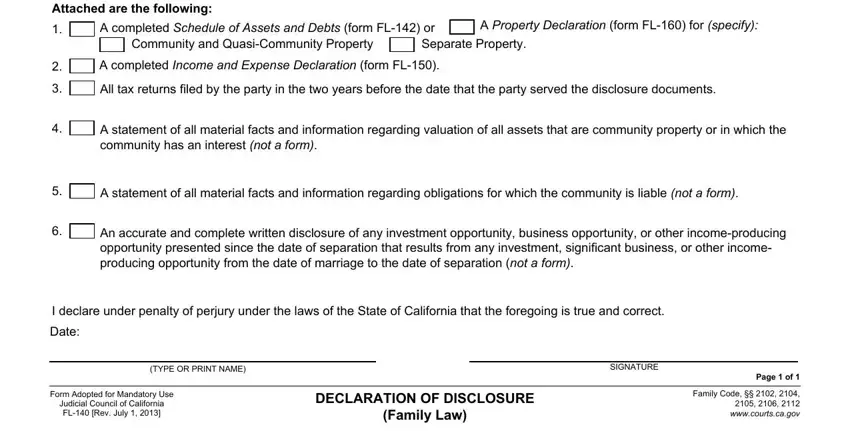

2. Once the last array of fields is completed, proceed to enter the suitable information in all these: Attached are the following, A completed Schedule of Assets and, A Property Declaration form FL for, Community and QuasiCommunity, Separate Property, A completed Income and Expense, All tax returns filed by the party, A statement of all material facts, A statement of all material facts, An accurate and complete written, I declare under penalty of perjury, Date, TYPE OR PRINT NAME, SIGNATURE, and Form Adopted for Mandatory Use.

It is possible to make an error when filling out your Date, therefore make sure you reread it before you finalize the form.

Step 3: Before finalizing this document, check that all blanks have been filled out the proper way. Once you establish that it is fine, press “Done." Sign up with us right now and easily get access to nullity, prepared for download. All modifications made by you are kept , so that you can customize the document at a later point if necessary. FormsPal ensures your information confidentiality by having a secure method that in no way saves or shares any kind of private information involved in the process. Feel safe knowing your docs are kept protected whenever you use our tools!