INDEMNITY AGREEMENT — READ CAREFULLY

Principal and each of the other undersigned (collectively “Indemnitors”) affirm that the statements in the foregoing application are true and are made to induce Developers Surety and Indemnity Company and/or Indemnity Company of California (hereinafter “Surety”) to issue the bond or bonds described therein (collectively “Bond”), including any extensions, renewals, modifications or substitutions of or additions to the Bond. Each Indemnitor further affirms that he, she or it understands that a Bond is a credit relationship, and authorizes Surety or its authorized agent, Insco Insurance Services, Inc., to gather the information it considers necessary and appropriate to evaluate creditworthiness.

AS CONSIDERATION for issuing the Bond, Indemnitors hereby jointly and severally agree, for themselves, their personal representatives, successors and assigns:

1.To fully reimburse Surety and indemnify it against all liability, loss, claims, demands, attorney’s fees, costs and expenses of every kind and nature which Surety incurs or for which it may become liable as a consequence of issuing the Bond (collectively “Loss”), regardless of whether the Surety has actually received a claim or paid any amount.

2.To pay Surety the initial, fully earned, premium and all subsequent renewals, extensions, or modifications until there is no further liability under the Bond.

3.Surety may, at its sole discretion, deny, pay, compromise, defend or appeal any claim or suit against the Bond. An itemized statement of or sworn voucher from the Surety attesting to the Loss shall be prima facie evidence of the Loss.

4.If Surety establishes a reserve account, the Indemnitors shall immediately upon demand provide Surety with acceptable collateral equal to the reserve set and any future reserve increases, whether or not Surety has yet made a payment or incurred a Loss. Surety may retain the collateral until all actual and potential claims against the bond are exonerated and all loss is fully reimbursed.

5.All money and other proceeds of the obligations covered by the Bond (“Obligation”) are received by Principal in trust for the benefit of Surety for the sole purpose of performing the Obligation until the Surety’s liability is completely exonerated.

6.To secure Indemnitors’ duties and obligations to Surety, Indemnitors, upon Surety’s declaration of principals default, assign to Surety all rights and title to and interest in all amounts due under the Obligation and under all other bonded and unbonded contracts; all agreements, notes, accounts or accounts receivable in which Indemnitors have any interest; and all subcontracts under the Obligation.

7.Each Indemnitor irrevocably appoints Surety or its designee as his, her or its attorney-in-fact with the right and power, but not the obligation, to exercise all of the rights assigned to Surety under this Agreement and to make, execute and deliver any and all additional contracts, instruments, assignments, documents or papers (including, but not limited to, the endorsement of checks or other instruments payable to Principal or any Indemnitor representing payment of Obligation monies) deemed necessary and proper by Surety in order to give full effect to the intent and meaning of the assignments or rights contained herein. It is expressly agreed that this power-of-attorney is coupled with the interest of Surety in receiving the indemnification from Indemnitors. Indemnitors hereby ratify all acts by Surety or its designee as attorney-in-fact.

8.Until full satisfactory performance of the Obligation and exoneration of the Bond, Surety may freely access, examine and copy Indemnitors’ books, records, credit reports and accounts (“Records”). Indemnitors authorize third parties in possession of these Records to furnish to Surety any information requested in connection with any transaction.

9.Indemnitors agree that the place of performance of the obligations created by this Agreement or issuance of the Bond is Orange County, California.

10.Each Indemnitor agrees he, she or it is bound to every obligation in this Agreement regardless of (a) whether the principal fails to sign a Bond; (b) the existence, release, return, exchange or viability of or failure to obtain collateral or security securing Indemnitors’ duties and obligations under this Agreement; (c) the identity of any other Indemnitor; (d) whether or not any other Indemnitor is bound; or (e) the failure of any other person or entity to sign this Agreement.

11.Indemnitors expressly waive notice of any claim or demand against the Bond or information provided to the Surety. Surety shall have the right to decline issuance of any or all bonds and may cancel, withdraw or procure its release from the Bond or any bond at any time, without incurring liability to Indemnitors.

12.As used in this Agreement, the plural and singular shall include each other as circumstances require. If any portion of this Agreement is unenforceable that portion shall be considered deleted with the remainder continuing in full force and effect.

13.A facsimile, photocopy, electronic or optical reproduction shall be admissible in a court of law with the same force and effect as the original.

14.This Agreement is a continuing obligation of the Principal and Indemnitors and may not be terminated.

15.As consideration for Surety’s execution of the Bond applied for, each Indemnitor jointly and severally agrees to be bound by all of the terms of this Agreement as though each were the sole applicant and each admits to being financially interested in the performance of the Obligation.

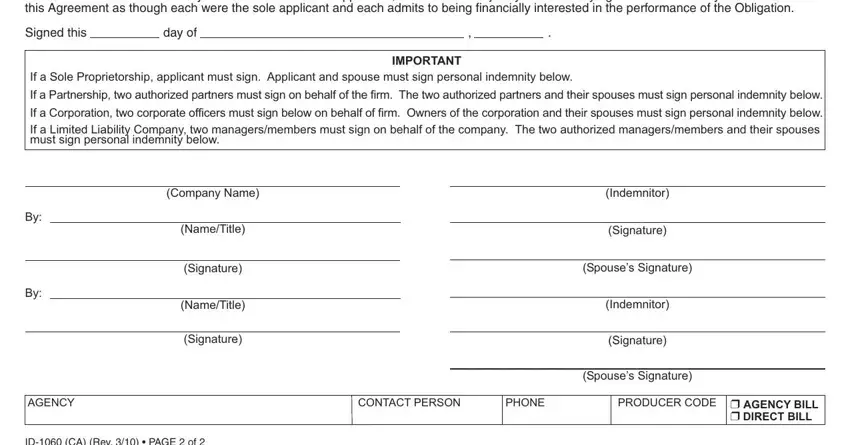

IMPORTANT

If a Sole Proprietorship, applicant must sign. Applicant and spouse must sign personal indemnity below.

If a Partnership, two authorized partners must sign on behalf of the firm. The two authorized partners and their spouses must sign personal indemnity below. If a Corporation, two corporate officers must sign below on behalf of firm. Owners of the corporation and their spouses must sign personal indemnity below.

If a Limited Liability Company, two managers/members must sign on behalf of the company. The two authorized managers/members and their spouses must sign personal indemnity below.

|

(Company Name) |

|

(Indemnitor) |

By: |

|

|

|

(Name/Title) |

|

(Signature) |

|

|

|

|

|

(Signature) |

|

(Spouse’s Signature) |

By: |

|

|

|

|

|

(Indemnitor) |

|

(Name/Title) |

|

|

|

|

|

|

(Signature) |

|

(Signature) |

|

|

|

|

|

|

|

(Spouse’s Signature) |