|

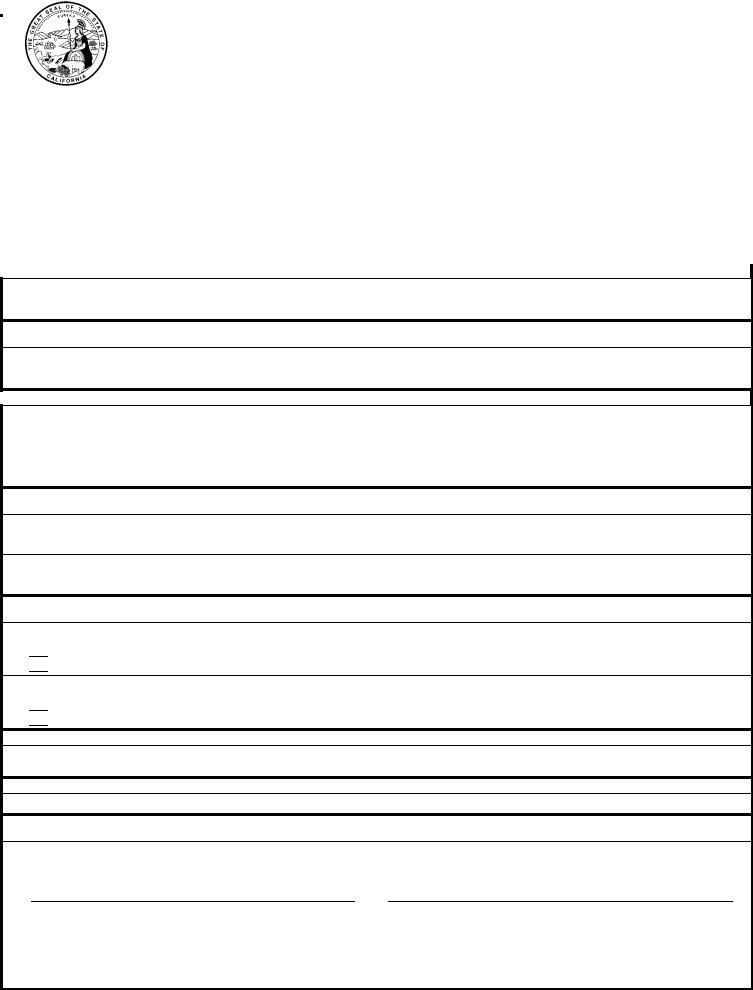

LP-7 |

|

|

|

|

|

|

|

State of California |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secretary of State |

|

|

|

|

|

|

|

Limited Partnership |

|

|

|

|

|

|

|

Certificate of Revival |

|

|

|

|

|

|

|

A $30.00 filing fee AND written confirmation from the California Franchise Tax Board |

|

|

|

|

|

|

|

(FTB) that confirms all taxes, fees, penalties and interest have been paid to the FTB |

|

|

|

|

|

|

|

and all required tax returns have been filed must accompany this form. |

|

|

|

|

|

|

|

|

This Space For Filing Use Only |

|

|

|

IMPORTANT – Read instructions before completing this form. |

|

|

|

|

|

|

|

|

|

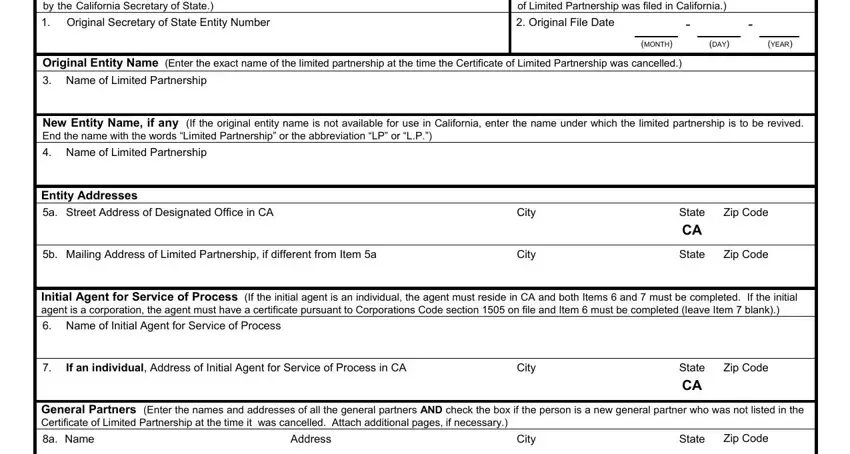

Original File Number (Enter the original file number issued to the limited partnership by the |

Original File Date (Enter the date the original Certificate |

California Secretary of State.) |

of Limited Partnership was filed in California.) |

|

|

|

1. Original Secretary of State File Number |

2. Original File Date |

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MONTH) |

|

(DAY) |

|

(YEAR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Original Entity Name (Enter the exact name of the limited partnership at the time the Certificate of Limited Partnership was cancelled.)

3.Name of Limited Partnership

New Entity Name, if any (If the original entity name is not available for use in California, enter the name under which the limited partnership is to be revived. End the name with the words “Limited Partnership” or the abbreviation “LP” or “L.P.”)

4.Name of Limited Partnership

Entity Addresses

5a. |

Street Address of Designated Office in CA |

City |

State |

Zip Code |

|

|

|

CA |

|

|

|

|

|

|

5b. |

Mailing Address of Limited Partnership, if different from Item 5a |

City |

State |

Zip Code |

Initial Agent for Service of Process (If the initial agent is an individual, the agent must reside in CA and both Items 6 and 7 must be completed. If the initial agent is a corporation, the agent must have a certificate pursuant to Corporations Code section 1505 on file and Item 6 must be completed (leave Item 7 blank).)

6.Name of Initial Agent for Service of Process

7. If an individual, Address of Initial Agent for Service of Process in CA |

City |

State Zip Code |

|

|

CA |

General Partners (Enter the names and addresses of all the general partners AND check the box if the person is a new general partner who was not listed in the Certificate of Limited Partnership at the time it was cancelled. Attach additional pages, if necessary.)

8a. Name |

Address |

City |

State Zip Code |

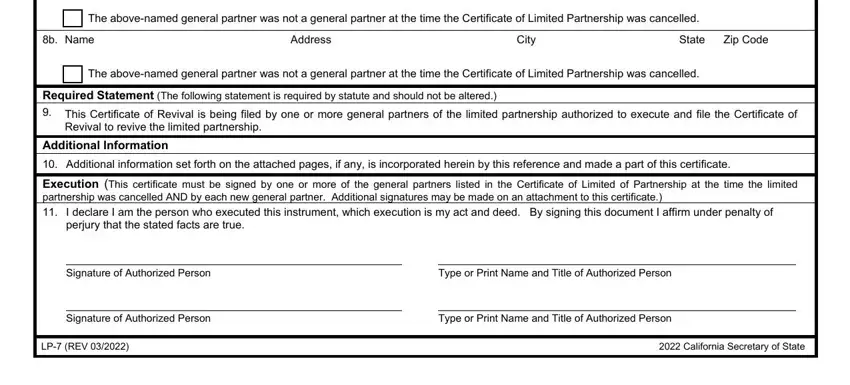

The above-named general partner was not a general partner at the time the Certificate of Limited Partnership was cancelled.

8b. Name |

Address |

City |

State Zip Code |

The above-named general partner was not a general partner at the time the Certificate of Limited Partnership was cancelled.

Required Statement (The following statement is required by statute and should not be altered.)

9.This Certificate of Revival is being filed by one or more general partners of the limited partnership authorized to execute and file the Certificate of Revival to revive the limited partnership.

Additional Information

10. Additional information set forth on the attached pages, if any, is incorporated herein by this reference and made a part of this certificate.

Execution (This certificate must be signed by one or more of the general partners listed in the Certificate of Limited of Partnership at the time the limited partnership was cancelled AND by each new general partner. Additional signatures may be made on an attachment to this certificate.)

11.I declare I am the person who executed this instrument, which execution is my act and deed. By signing this document I affirm under penalty of perjury that the stated facts are true.

|

Signature of Authorized Person |

|

Type or Print Name and Title of Authorized Person |

|

|

|

|

|

|

Signature of Authorized Person |

|

Type or Print Name and Title of Authorized Person |

|

|

|

LP-7 (REV 01/2013) |

|

APPROVED BY SECRETARY OF STATE |

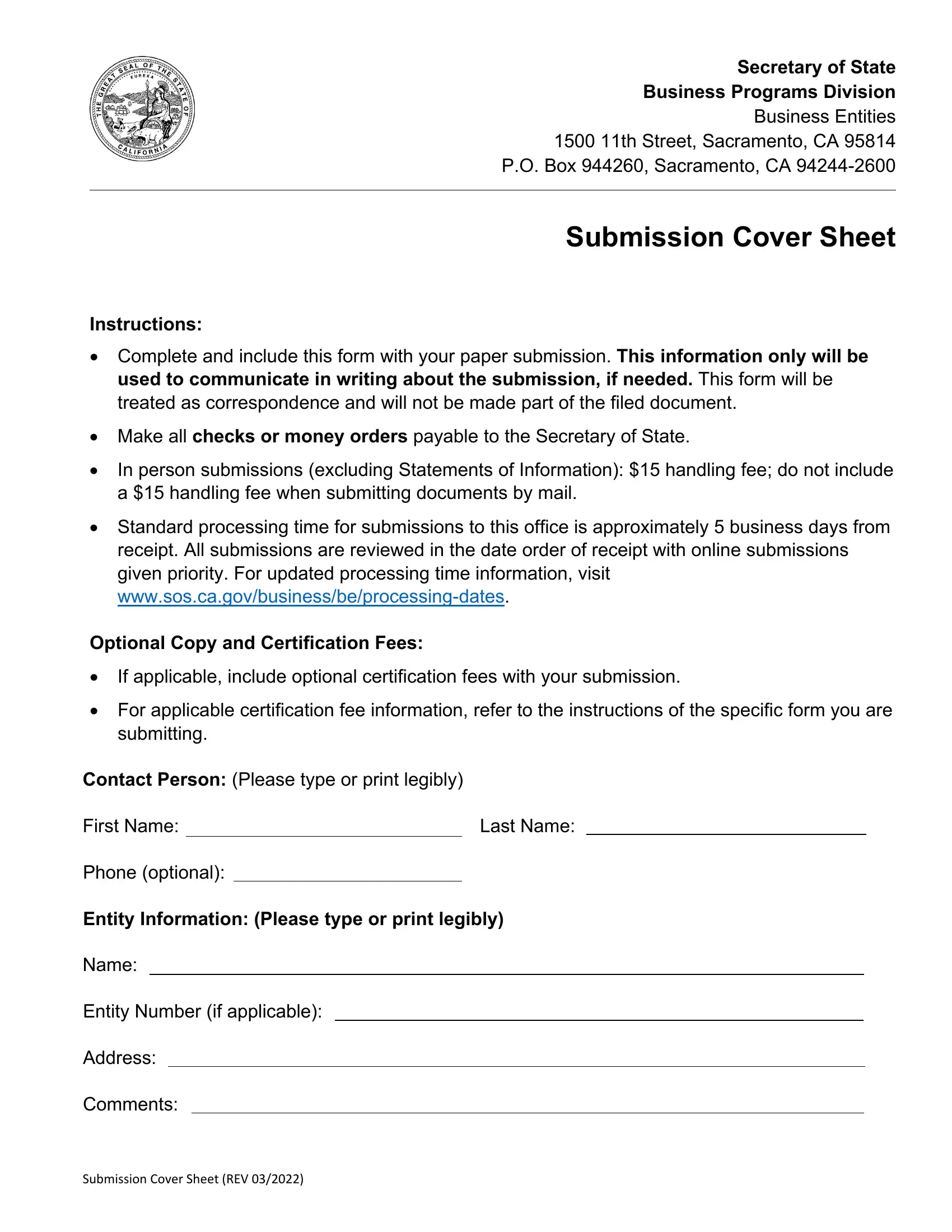

Instructions for Completing the

Certificate of Revival (Form LP-7)

Where to File: For easier completion, this form is available on the California Secretary of State's website at www.sos.ca.gov/business/be/forms.htm and can be completed online and printed to mail. The completed form can be mailed to Secretary of State, Document Filing Support Unit, P.O. Box 944225, Sacramento, CA 94244-2250 or delivered in person (drop off) to the Sacramento office. If you are not completing this form online, please type or legibly print in black or blue ink. This form is filed only in the Sacramento office.

Legal Authority: Statutory filing requirements are found in California Corporations Code section 15902.09. All

statutory references are to the California Corporations Code, unless otherwise stated. Note: Signing Form LP-7 constitutes an affirmation under penalty of perjury that the facts stated in the certificate are true. (Section 15902.08(b).)

Form LP-7 may be used to revive a domestic (California) limited partnership if: (1) the California limited partnership was cancelled on or after January 1, 2008 pursuant to Section 15902.03 of the Uniform Limited Partnership Act of 2008 (2008 LP Act); and (2) at least one of the general partners listed in the Certificate of Limited Partnership at the time it was cancelled is still a general partner.

Upon the filing of Form LP-7 with the California Secretary of State, the California limited partnership will be revived with the same force and effect as if the certificate of limited partnership had not been cancelled pursuant to Section 15902.03.

It is recommended that legal counsel be consulted prior to submitting Form LP-7 to ensure that all issues are appropriately addressed.

2008 LP Act: A cancelled California limited partnership was subject to the 2008 LP Act (1) if the limited partnership was formed on or after January 1, 2008; or (2) if the limited partnership was formed prior to January 1, 2008, and elected to be governed by the 2008 LP Act prior to or at the time of cancellation pursuant to Section 15902.03.

Fees: The fee for filing Form LP-7 is $30.00. A non-refundable $15.00 special handling fee is applicable for processing documents delivered in person (drop off) at the Sacramento office. The preclearance and/or expedited filing of a document within a guaranteed time frame can be requested for an additional non-refundable fee in lieu of the special handling fee. For detailed information about preclearance and expedited filing services, go to www.sos.ca.gov/business/be/service-options.htm. The special handling fee or preclearance and expedited filing services are not applicable to documents submitted by mail. Check(s) should be made payable to the Secretary of State.

Copies: Upon filing, we will return one (1) uncertified copy of your filed document for free. To get additional copies, include a separate request and payment for copy fees when the document is submitted. Copy fees are $1.00 for the first page and $.50 for each additional page. For certified copies, there is an additional $5.00 certification fee, per copy.

Additional Requirement: Form LP-7 must be accompanied by written confirmation from the California Franchise

Tax Board (FTB) that confirms: (1) that all taxes, fees, penalties and interest have been paid to the FTB; and (2) that all required tax returns have been filed by the LP, including returns for each year between the cancellation and the revival of the LP. (Section 15902.09(a).) For information about the required letter, go to https://www.ftb.ca.gov or call FTB at (916) 845-7165.

Complete the Certificate of Revival (Form LP-7) as follows:

Item 1. Enter the original file number issued to the limited partnership by the California Secretary of State.

Item 2. Enter the date the initial Certificate of Limited Partnership was filed with the California Secretary of State. Enter the date as mm/dd/yyyy.

Item 3. Enter the name of the limited partnership exactly as it was of record with the California Secretary of State at the time the Certificate of Limited Partnership was cancelled.

LP-7 INSTRUCTIONS (REV 01/2013) |

PAGE 1 OF 2 |

LP-7 Instructions

Page 2 of 2

Item 4. If the name in Item 3 is not available for use in California, enter the name under which the limited partnership is to be revived. The name must end with the words “Limited Partnership,” or the abbreviation “LP” or “L.P.” and may not contain the words “bank,” “insurance,” “trust,” “trustee,” “incorporated,” “inc.,” “corporation,” or “corp.” (Section 15901.08.)

Items Item 5a: Enter the street address of the designated office address in California. The “designated office” 5a & 5b. may, but need not, be the place of the limited partnership’s activity in California. (Sections 15902.01,

15901.02(e) and 15901.14.) Please do not use a P.O. Box address or abbreviate the name of the city.

Item 5b: If different from the address in Item 5a, enter the mailing address of the limited partnership. (Section 15902.01.) Please do not abbreviate the name of the city. Do not complete item 5b if the mailing address is the same as the street address in Item 5a.

Items If designating an individual as the agent for service of process, complete Items 6 and 7. If designating a 6 & 7 corporation as the agent for service of process, complete Item 6 and proceed to Item 8 (do not complete Item 7). If a corporation is designated as agent, that corporation must have previously filed with the California Secretary of State a certificate pursuant to Corporations Code section 1505. The agent should agree to accept service of process on behalf of the limited partnership prior to designation.

Note: A limited partnership cannot act as its own agent and no domestic or foreign corporation may file pursuant to Section 1505 unless the corporation is currently authorized to engage in business in California and is in good standing on the records of the California Secretary of State.

Items Enter the name and address of each general partner AND check the box if the person is a new general 8a - 8b. partner who was not listed in the Certificate of Limited Partnership at the time it was cancelled. If there are more than two general partners, attach additional pages. Please do not abbreviate the name of the city. The limited partnership must have one or more general partners. (Section 15901.02(q).) Note: If a general partner is a trust, both the name of the trust (including the date of the trust, if applicable) and the

trustee should be listed. Example: Mary Todd, trustee of the Lincoln Family Trust U/T/A 5-1-94.

Note: At least one of the general partners named in Items 8a - 8b (or attachment, if any) must have been listed in the Certificate of Limited Partnership at the time it was cancelled.

Item 9. This statement is required by statute and should not be altered.

Item 10. Attach any other information to be included in Form LP-7, provided that the information is not inconsistent with law.

Item 11. Form LP-7 must be signed: (1) by at least one of the general partners who was listed in the Certificate of Limited Partnership at the time it was cancelled; and (2) by each person designated in Form LP-7 as a new general partner. (Section 15902.04.)

If Form LP-7 is filed by any person other than the general partner(s), the signature must be followed

by the words “signature pursuant to Section_____________” identifying the appropriate statutory

authority. (Section 15902.05.)

If Form LP-7 is signed by an attorney-in-fact, the signature should be followed by the words “Attorney-in-fact for (name of the partner).” (Section 15902.04.)

If Form LP-7 is signed by a general partner who is an association, the person who signs for the association should state the exact name of the association, his/her name and position/title.

If Form LP-7 is signed by a general partner who is a trust, Form LP-7 should be signed by a trustee as follows: _______________ trustee for _____________ trust (including the date of the trust, if applicable). Example: Mary Todd, trustee of the Lincoln Family Trust (U/T/A 5-1-94).

If additional signature space is necessary, the signatures may be made on an attachment to Form LP-7.

Any attachments to Form LP-7 are incorporated by reference and made part of Form LP-7. All attachments should be 8 ½” x 11”, one-sided and legible.

LP-7 INSTRUCTIONS (REV 01/2013) |

PAGE 2 OF 2 |