Should you want to fill out California Form Sr 10, it's not necessary to install any software - just try our online tool. To have our editor on the leading edge of practicality, we work to integrate user-driven capabilities and enhancements on a regular basis. We're at all times looking for feedback - join us in revampimg how you work with PDF forms. For anyone who is looking to begin, this is what it will require:

Step 1: First, open the tool by clicking the "Get Form Button" in the top section of this page.

Step 2: The editor offers the capability to modify almost all PDF documents in various ways. Improve it by adding personalized text, correct existing content, and put in a signature - all close at hand!

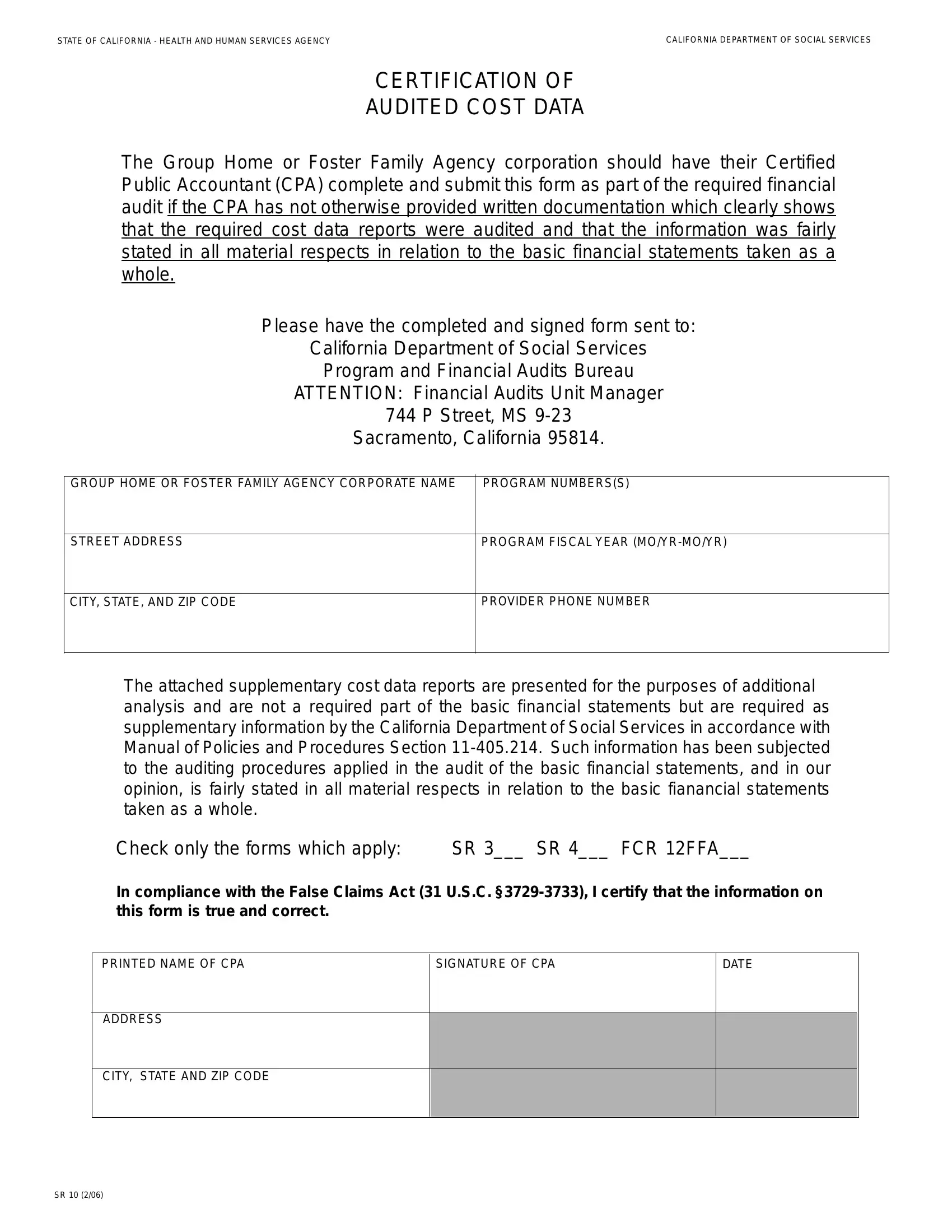

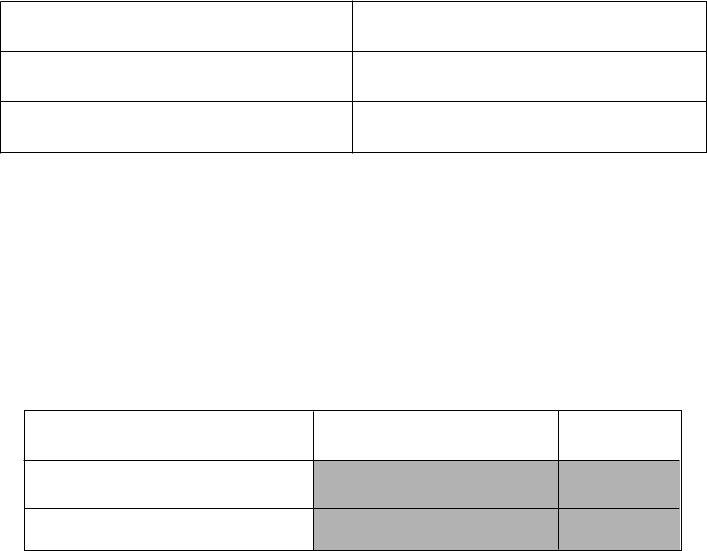

This PDF requires particular information to be filled in, therefore you should take some time to type in precisely what is requested:

1. Fill out the California Form Sr 10 with a number of essential fields. Collect all of the information you need and make sure there is nothing neglected!

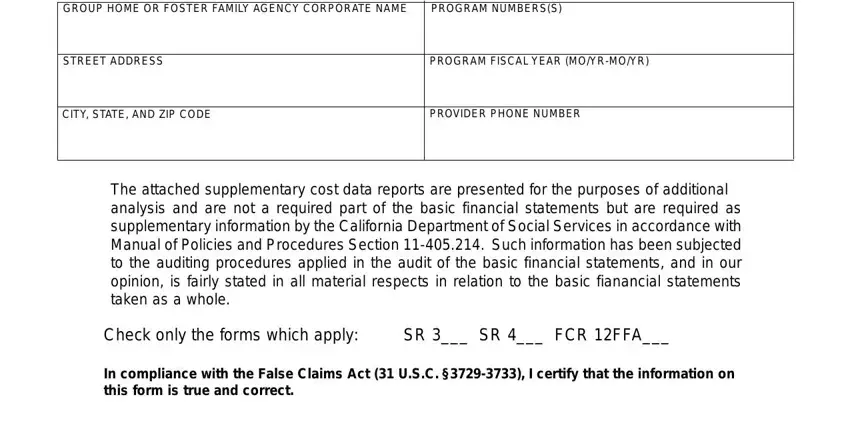

2. Once your current task is complete, take the next step – fill out all of these fields - PRINTED NAME OF CPA, SIGNATURE OF CPA, DATE, ADDRESS, CITY STATE AND ZIP CODE, and SR with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

A lot of people frequently make some errors while filling out SR in this area. Make sure you double-check what you enter here.

Step 3: After you have looked over the details in the file's blank fields, just click "Done" to finalize your form at FormsPal. Obtain your California Form Sr 10 when you sign up for a 7-day free trial. Conveniently access the pdf file inside your FormsPal cabinet, along with any edits and changes conveniently saved! We do not sell or share the information you type in while filling out forms at FormsPal.