C |

TO: CalPERS/ Benefit Services Division |

P.O. Box 942711 |

Sacramento, CA 94229-2711 |

Fax:(916) 795-3933 |

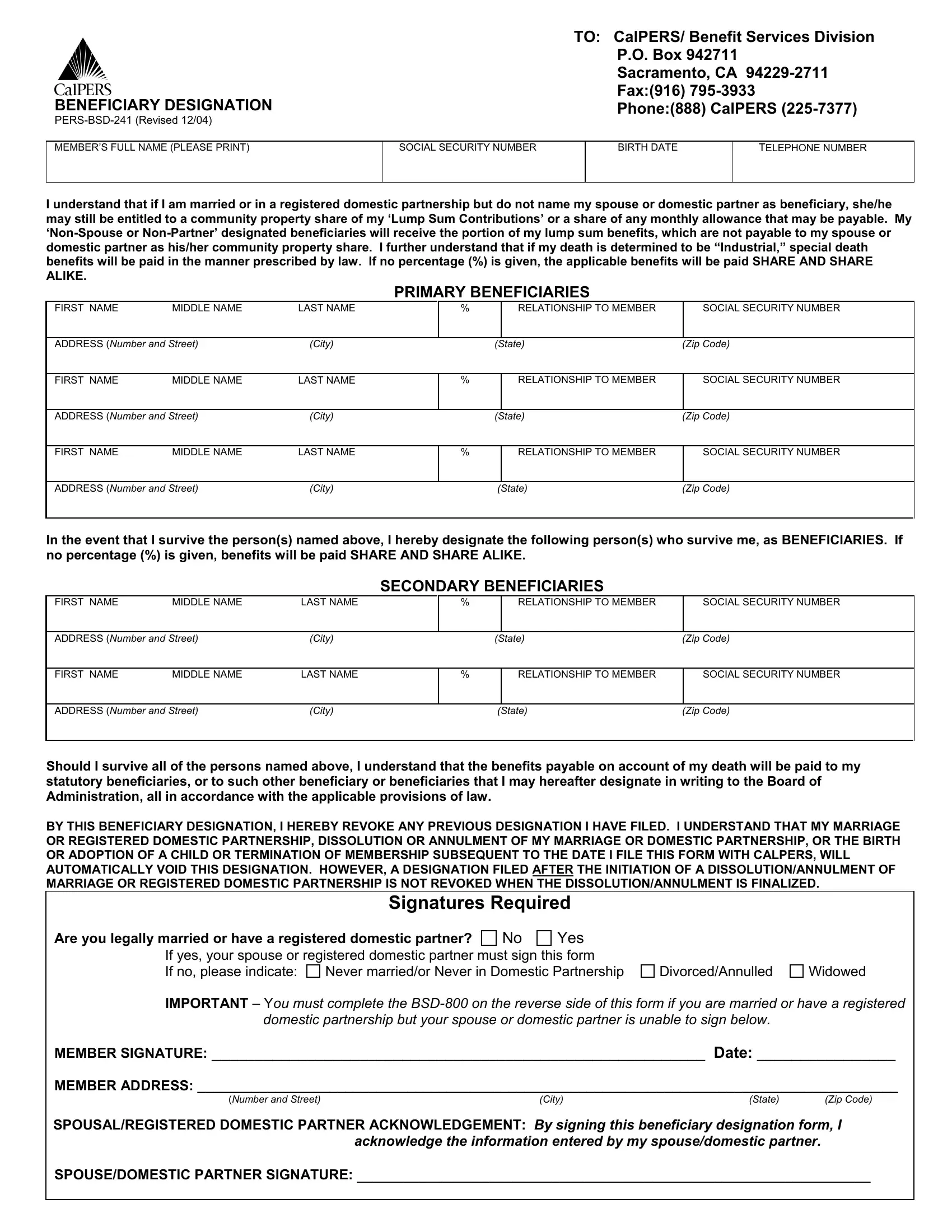

BENEFICIARY DESIGNATION |

Phone:(888) CalPERS (225-7377) |

PERS-BSD-241 (Revised 12/04) |

|

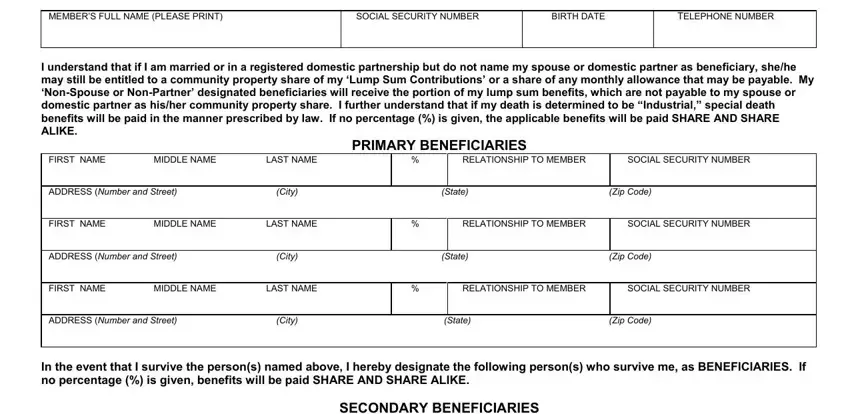

MEMBER’S FULL NAME (PLEASE PRINT)

I understand that if I am married or in a registered domestic partnership but do not name my spouse or domestic partner as beneficiary, she/he may still be entitled to a community property share of my ‘Lump Sum Contributions’ or a share of any monthly allowance that may be payable. My ‘Non-Spouse or Non-Partner’ designated beneficiaries will receive the portion of my lump sum benefits, which are not payable to my spouse or domestic partner as his/her community property share. I further understand that if my death is determined to be “Industrial,” special death benefits will be paid in the manner prescribed by law. If no percentage (%) is given, the applicable benefits will be paid SHARE AND SHARE ALIKE.

PRIMARY BENEFICIARIES

FIRST NAME |

MIDDLE NAME |

LAST NAME |

% |

|

RELATIONSHIP TO MEMBER |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

ADDRESS (Number and Street) |

(City) |

|

(State) |

(Zip Code) |

|

|

|

|

|

|

|

FIRST NAME |

MIDDLE NAME |

LAST NAME |

% |

|

RELATIONSHIP TO MEMBER |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

ADDRESS (Number and Street) |

(City) |

|

(State) |

(Zip Code) |

|

|

|

|

|

|

|

FIRST NAME |

MIDDLE NAME |

LAST NAME |

% |

|

RELATIONSHIP TO MEMBER |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

ADDRESS (Number and Street) |

(City) |

|

(State) |

(Zip Code) |

|

|

|

|

|

|

|

In the event that I survive the person(s) named above, I hereby designate the following person(s) who survive me, as BENEFICIARIES. If no percentage (%) is given, benefits will be paid SHARE AND SHARE ALIKE.

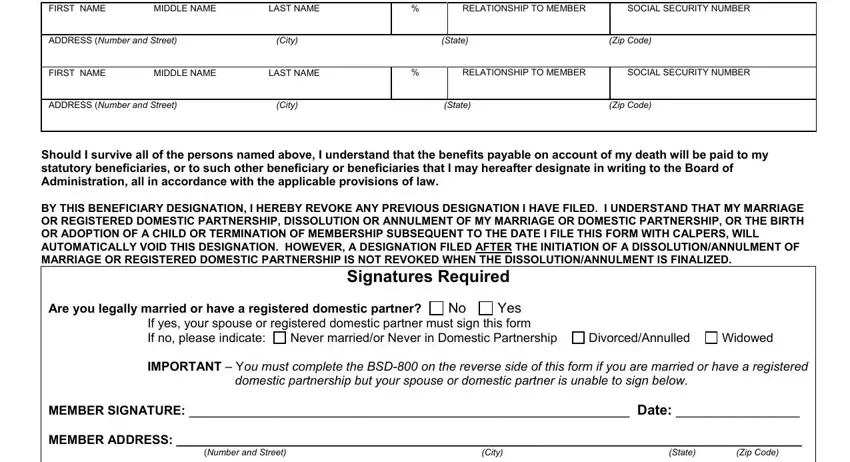

SECONDARY BENEFICIARIES

FIRST NAME |

MIDDLE NAME |

LAST NAME |

% |

|

RELATIONSHIP TO MEMBER |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

ADDRESS (Number and Street) |

(City) |

|

(State) |

(Zip Code) |

|

|

|

|

|

|

|

FIRST NAME |

MIDDLE NAME |

LAST NAME |

% |

|

RELATIONSHIP TO MEMBER |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

ADDRESS (Number and Street) |

(City) |

|

(State) |

(Zip Code) |

|

|

|

|

|

|

|

Should I survive all of the persons named above, I understand that the benefits payable on account of my death will be paid to my statutory beneficiaries, or to such other beneficiary or beneficiaries that I may hereafter designate in writing to the Board of Administration, all in accordance with the applicable provisions of law.

BY THIS BENEFICIARY DESIGNATION, I HEREBY REVOKE ANY PREVIOUS DESIGNATION I HAVE FILED. I UNDERSTAND THAT MY MARRIAGE OR REGISTERED DOMESTIC PARTNERSHIP, DISSOLUTION OR ANNULMENT OF MY MARRIAGE OR DOMESTIC PARTNERSHIP, OR THE BIRTH OR ADOPTION OF A CHILD OR TERMINATION OF MEMBERSHIP SUBSEQUENT TO THE DATE I FILE THIS FORM WITH CALPERS, WILL AUTOMATICALLY VOID THIS DESIGNATION. HOWEVER, A DESIGNATION FILED AFTER THE INITIATION OF A DISSOLUTION/ANNULMENT OF MARRIAGE OR REGISTERED DOMESTIC PARTNERSHIP IS NOT REVOKED WHEN THE DISSOLUTION/ANNULMENT IS FINALIZED.

Signatures Required

Are you legally married or have a registered domestic partner? |

No |

Yes |

If yes, your spouse or registered domestic partner must sign this form

If no, please indicate: Never married/or Never in Domestic Partnership

IMPORTANT – You must complete the BSD-800 on the reverse side of this form if you are married or have a registered domestic partnership but your spouse or domestic partner is unable to sign below.

MEMBER SIGNATURE: _________________________________________________________ Date: ________________

MEMBER ADDRESS: __________________________________________________________________________________________

(Number and Street) |

(City) |

(State) |

(Zip Code) |

SPOUSAL/REGISTERED DOMESTIC PARTNER ACKNOWLEDGEMENT: By signing this beneficiary designation form, I acknowledge the information entered by my spouse/domestic partner.

SPOUSE/DOMESTIC PARTNER SIGNATURE: __________________________________________________________________

INFORMATION AND INSTRUCTIONS FOR CalPERS

BENEFICIARY DESIGNATION FORM

If you die before you retire, the Public Employees’ Retirement Law provides for payment of specific Death Benefits to your surviving beneficiaries. Please see your personnel officer for a description of the benefits. The benefits are payable to the following beneficiaries:

A. If you are a safety member and your death is job-related, or if you are not a safety member but you are fatally attacked while performing your official job duties, the Special Death Benefit may be payable. This benefit is payable by law to your surviving spouse/registered domestic partner (whether or not you were still living together at the time of your death) or, if none, to your unmarried children/step-children under age 22, whether or not you have filed a beneficiary designation.

B. If you are eligible for retirement or you are a State member with at least 20 years of State service credit, a monthly death benefit allowance may be payable. If you do not have a valid beneficiary designation on file, the benefits will be payable to your surviving spouse/registered domestic partner to whom you have been married to or in a partnership with for either one year or prior to the onset of the injury or illness that resulted in death. Or, if there is no eligible surviving spouse/registered domestic partner, the allowance will be payable to your unmarried minor children, if any.

If you do have a valid beneficiary designation on file your spouse/registered domestic partner may still be entitled to a community property share of your lump sum contributions or monthly death benefit allowance. However, your non- spouse/non-domestic partner designated beneficiaries will receive the portion of your lump sum benefits which are not payable to your spouse/registered domestic partner as his/her community property share.

C. If A and B do not apply and there is no valid Beneficiary Designation on file at the time of death, the benefits will be payable to your survivors in the following order:

1.Your surviving spouse/registered domestic partner (whether or not you were still living together at the time of your death); or, if none

2.Natural and adopted children, including (in limited situations) a natural child adopted by another, share and share alike; or, if none,

3.Parents, share and share alike; or if none,

4.Brothers and sisters, share and share alike, or if none,

5.Your estate (if probated, or subject to probate), or if not,

6.Your trust (if one exists), or if not,

7.Stepchildren, share and share alike, or, if none,

8.Grandchildren, including step-grandchildren, share and share alike, or, if none,

9.Nieces and nephews, share and share alike, or, if none,

10.Great-grandchildren, share and share alike, or, if none,

11.Cousins, share and share alike.

If A and B do not apply and there is a valid Beneficiary Designation on file at the time of death, the benefits will be payable to the beneficiary(ies) you designate on the form. However, if you are married or have a registered domestic partner at the time of death, your spouse/domestic partner may still be entitled to a community property share of your lump sum contributions.

D. You may designate or change your beneficiaries at any time by completing another Beneficiary Designation form. You may name as beneficiary any person or persons, a corporation or your estate. Payment will be made to your estate only if probated. You may designate a trust as your beneficiary; however, you must provide the name of the trust, the date of the trust, and the name and address where the trust is filed. It is not necessary to provide the name of the trustee. Reminder:

If you are married or in a domestic partnership at the time of your death and you do not name your spouse/domestic partner as beneficiary, he/she may still be entitled to a community property share of your lump sum contributions or a share of any monthly allowance that may be payable.

E. Your Beneficiary Designation will be revoked automatically, and benefits will be payable to the closest survivor listed in section C, if any of the following events occur after your designation form is received by CalPERS:

1.Marriage/Registration of Domestic Partnership; or

2.Dissolution or annulment of your marriage/domestic partnership. However, a designation filed after the initiation of a dissolution/annulment of marriage or domestic partnership is NOT revoked when the dissolution/annulment is finalized; or

3.Birth or adoption of a child; or

4.Termination of membership that results in a refund of your contributions.

INSTRUCTIONS (See Reverse Side of This Page)

INSTRUCTIONS

1.Print clearly with ball point pen or type all information requested. If you make an error, make the necessary correction by lining through the error and initialing the change. No erasures or correction fluid will be accepted.

2.Enter on the form the full name of your beneficiaries, relationship, social security number (if known), and the complete address for each. (If the form does not provide enough space, you may attach additional sheets provided you indicate whether you are designating “primary” or “secondary” beneficiaries. You must sign, date, and write your social security number at the top of each additional sheet.)

3.If a (%) is entered make sure the total equals 100%.

4.Your spouse/registered domestic partner must sign the form to acknowledge the names of the beneficiaries you are designating. IMPORTANT: If you are unable to obtain your spouse’s/domestic partner’s signature, you MUST complete the BSD-800, “Justification for Absence of Spouse or Domestic Partner’s Signature” form, on the reverse side of the designation form or your designation form may be rejected.

5.Enter the date you signed the form and your current mailing address.

6.Mail the completed form to the Public Employees’ Retirement System at the address shown, or you may fax it to (916)

795-3933.

7.After CalPERS receives and reviews the form a confirmation letter will be mailed to you within 6 weeks. If the form is not acceptable a new form will be mailed to you to complete.

IMPORTANT INFORMATION

The Information Practices Act of 1977 and the Federal Privacy Act require the California Public Employees’ Retirement System to provide the following information to individuals who are asked to supply information. The information requested is collected pursuant to the Government Code Sections (20000, et seq.) and will be used for administration of the Board’s duties under the Retirement Law, the Social Security Act, and the Public Employees’ Medical and Hospital Care Act, as the case may be. Failure to supply all of the requested information may result in the System being unable to perform its functions regarding your status. Portions of this information may be transferred to: state and public agency employers, California State Attorney General, Office of the State Controller, Teale Data Center, Franchise Tax Board, Internal Revenue Service, Workers’ Compensation Appeals Board, State Compensation Insurance Fund, County District Attorneys, Social Security Administration, beneficiaries of deceased members, physicians, insurance carriers, and various vendors who prepare microfiche/microfilm for CalPERS. Disclosure to these parties is done in strict accordance with current statutes regarding confidentiality.

You have the right to review your membership files maintained by the California Public Employees’ Retirement System. For questions concerning your rights under the Information Practices Act of 1977, please contact the Information Practices Act Coordinator, CalPERS, P.O. Box 942702, Sacramento, CA 94229

Benefit Services Division |

|

P.O. Box 942711 |

|

Sacramento, CA 94229- |

2711 |

(888) Cal-PERS (225-7377) |

|

C TDD - (916) 795-3240; FAX |

(916) 795-3933 |

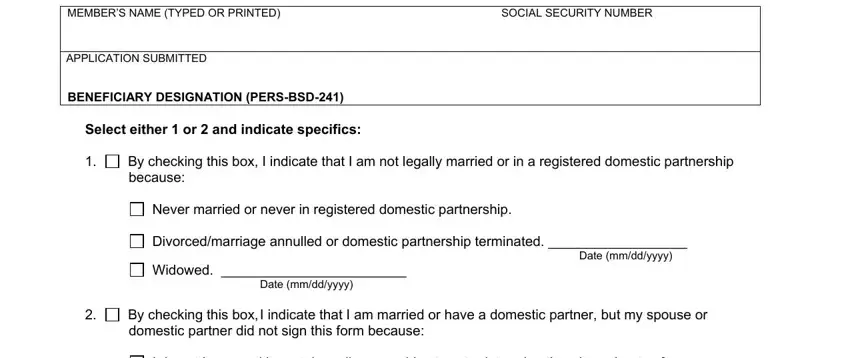

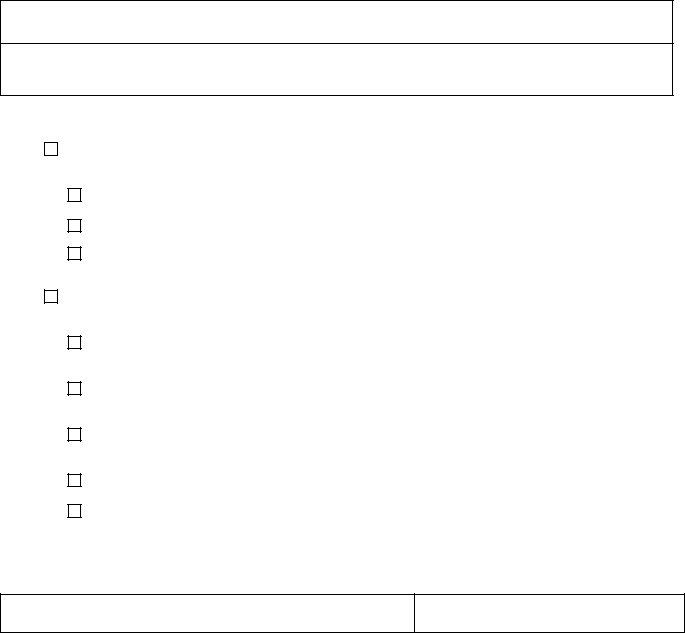

JUSTIFICATION FOR ABSENCE OF SPOUSE OR REGISTERED DOMESTIC PARTNER’S SIGNATURE

Pursuant to Government Code Section 21261, the member’s current spouse or registered domestic partner must be made aware of the selection of benefits or change in beneficiary made by the member. The spouse or domestic partner of a CalPERS member must acknowledge the submission of a request for refund of contributions; election of retirement optional settlement; and designation of beneficiary for Pre-retirement Death Benefits.

If a spouse or domestic partner’s signature does not appear on one of the above-mentioned documents, the following information MUST be completed by the member and submitted with the application/form.

MEMBER’S NAME (TYPED OR PRINTED) |

SOCIAL SECURITY NUMBER |

APPLICATION SUBMITTED

BENEFICIARY DESIGNATION (PERS-BSD-241)

Select either 1 or 2 and indicate specifics:

By checking this box, I indicate that I am not legally married or in a registered domestic partnership because:

Never married or never in registered domestic partnership.

Divorced/marriage annulled or domestic partnership terminated. __________________

Date (mm/dd/yyyy)

Widowed. ________________________

Date (mm/dd/yyyy)

By checking this box,I indicate that I am married or have a domestic partner, but my spouse or domestic partner did not sign this form because:

I do not know and have taken all reasonable steps to determine the whereabouts of my spouse or domestic partner, OR,

My spouse or domestic partner has been advised of the application and has refused to sign the written acknowledgement; OR

My spouse or domestic partner is incapable of executing the acknowledgement because of an incapacitating mental or physical condition; OR,

My spouse or domestic partner has no identifiable community property interest in the benefit, OR,

My spouse or domestic partner and I have executed a marriage settlement or partnership agreement that makes the community property law inapplicable to the marriage or partnership.

I certify under penalty of perjury that the foregoing information is true and correct.

PERS-BSD-800 (Revised 12/04)