You'll be able to fill in t2200s form effectively by using our online PDF tool. Our team is continuously endeavoring to enhance the tool and insure that it is much faster for users with its extensive features. Unlock an constantly innovative experience now - explore and uncover new possibilities as you go! With a few simple steps, you'll be able to begin your PDF journey:

Step 1: Press the "Get Form" button at the top of this page to get into our editor.

Step 2: With the help of this advanced PDF editor, you can actually accomplish more than just complete forms. Express yourself and make your documents look faultless with custom textual content added in, or modify the original content to perfection - all comes along with the capability to incorporate almost any pictures and sign the file off.

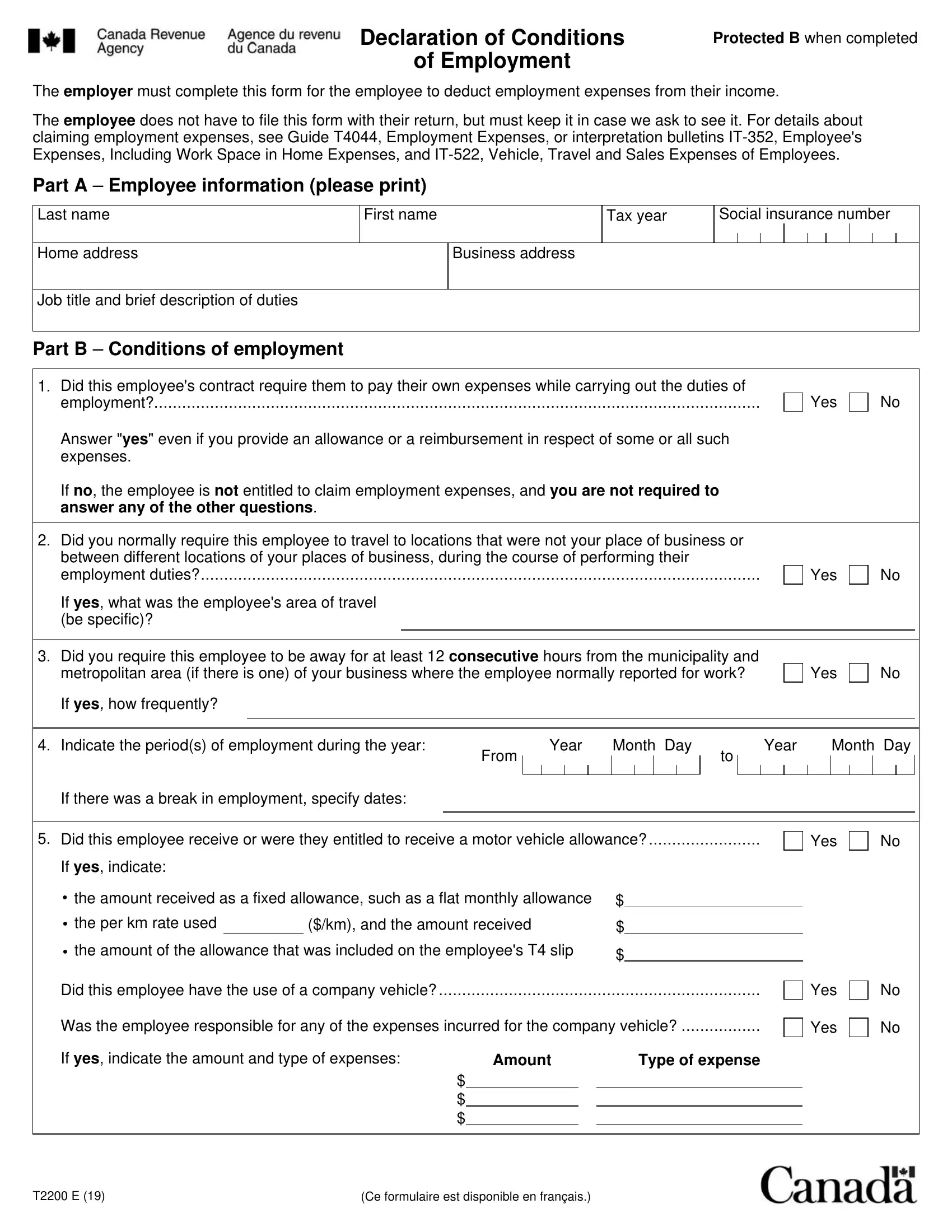

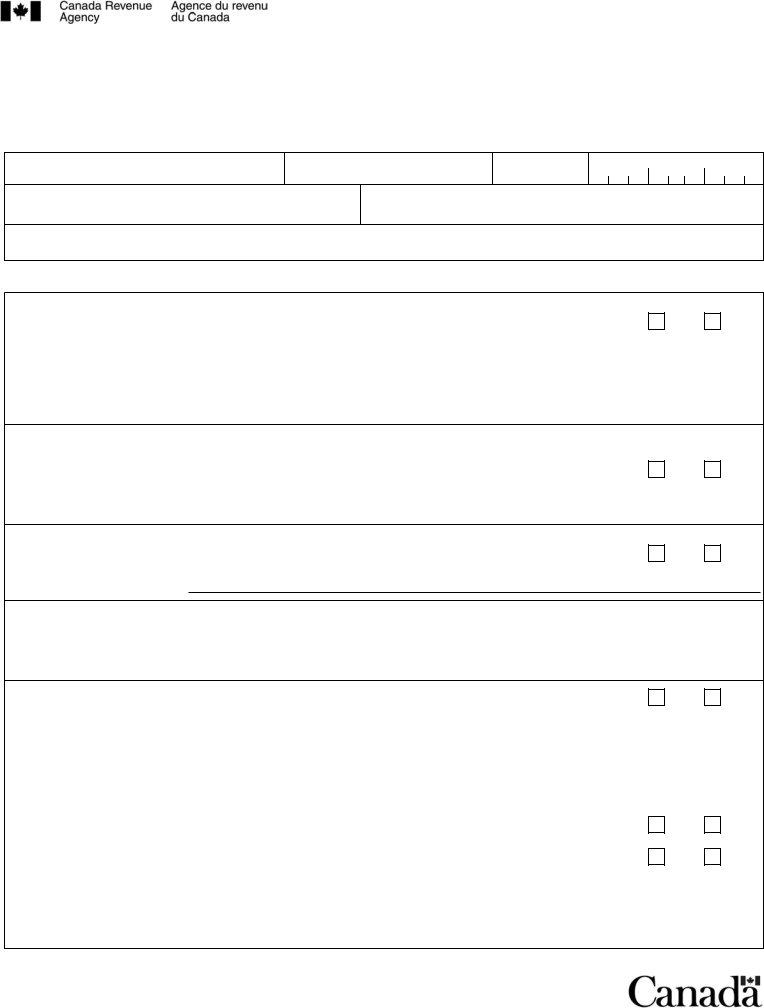

When it comes to blanks of this specific document, here is what you should do:

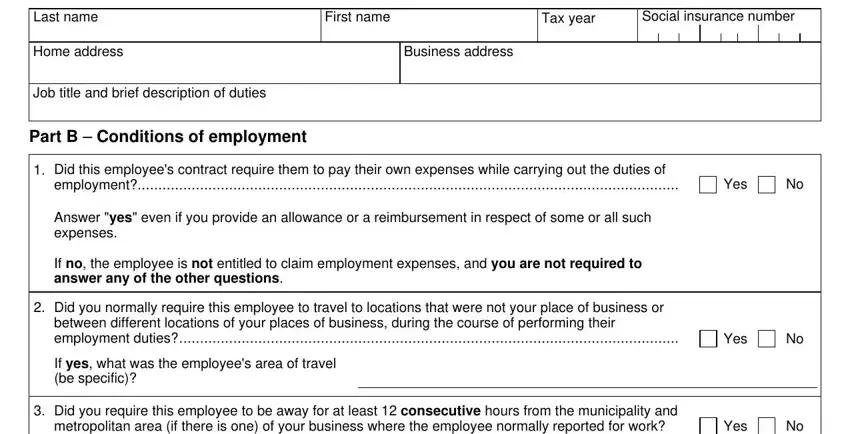

1. Start filling out your t2200s form with a group of necessary fields. Gather all of the required information and make certain absolutely nothing is neglected!

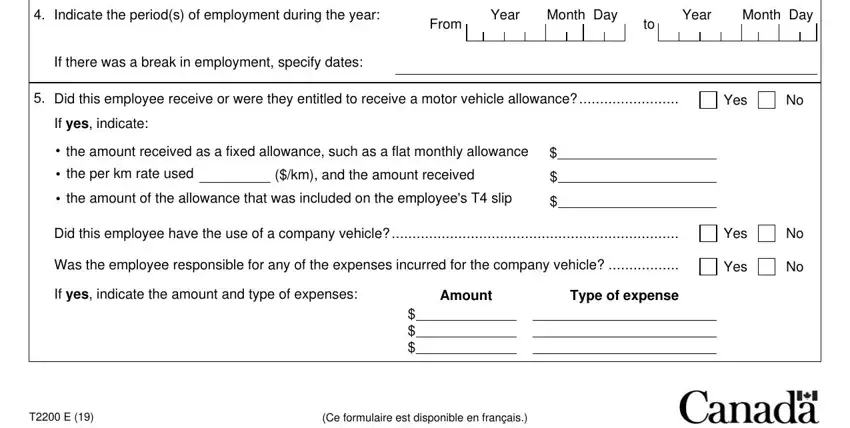

2. The next part is usually to fill in all of the following blank fields: Indicate the periods of employment, Year Month Day, From, Year Month Day, If there was a break in employment, Did this employee receive or were, Yes, If yes indicate, cid the amount received as a fixed, cid the per km rate used, km and the amount received, cid the amount of the allowance, Did this employee have the use of, Was the employee responsible for, and If yes indicate the amount and.

It's easy to make errors when filling in the cid the per km rate used, so make sure to go through it again before you send it in.

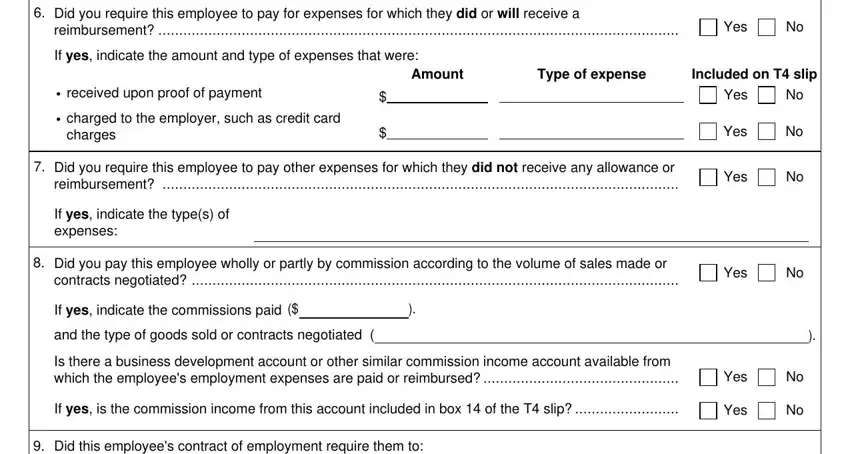

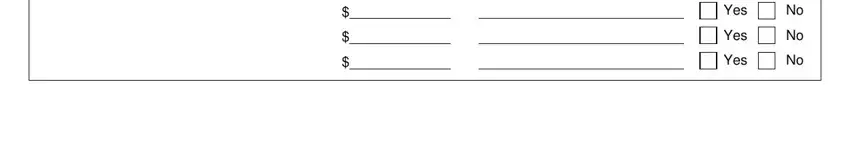

3. The next step is going to be straightforward - fill in every one of the fields in Did you require this employee to, reimbursement , Yes, If yes indicate the amount and, Amount, Type of expense, Included on T slip, cid received upon proof of payment, cid charged to the employer such, charges, Did you require this employee to, If yes indicate the types of, Yes, Yes, and Yes in order to complete this process.

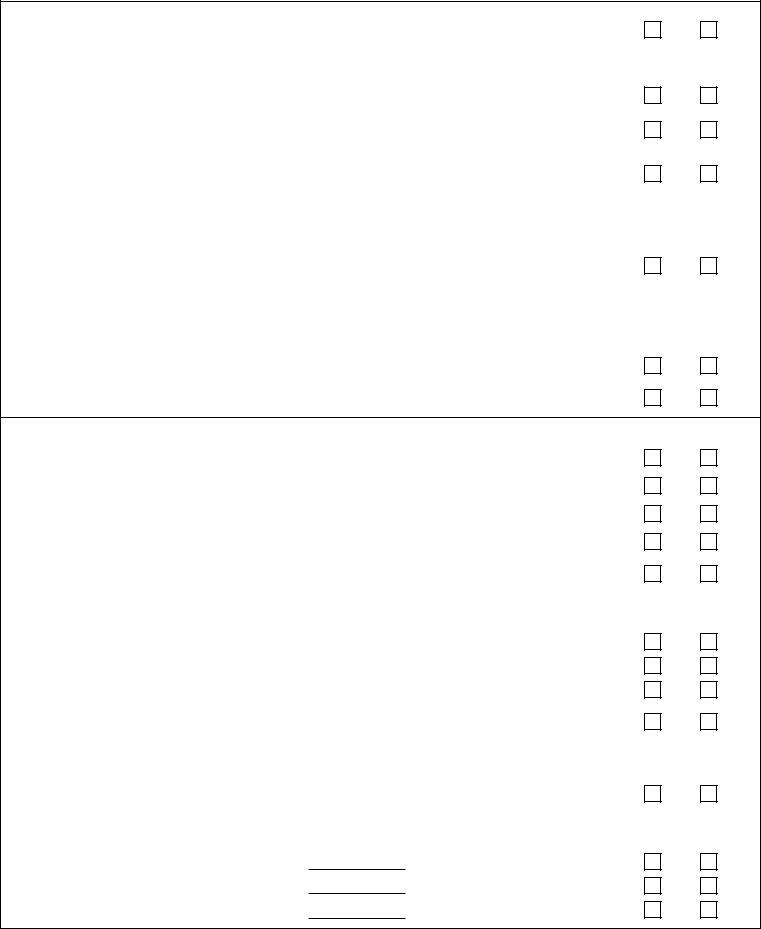

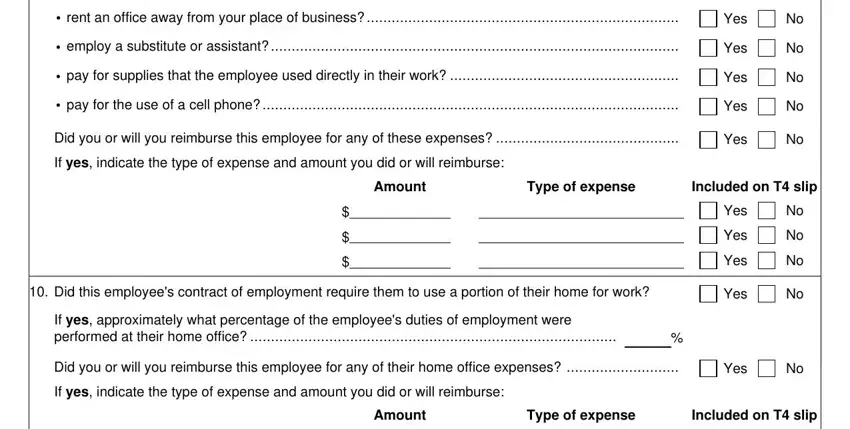

4. To go onward, the following stage involves typing in a few blanks. These comprise of Did this employees contract of, cid rent an office away from your, cid employ a substitute or, cid pay for supplies that the, cid pay for the use of a cell, Did you or will you reimburse this, If yes indicate the type of, Yes, Yes, Yes, Yes, Yes, Amount, Type of expense, and Included on T slip, which are fundamental to moving forward with this particular process.

5. Lastly, this final part is precisely what you will need to complete prior to submitting the document. The blank fields at issue include the following: Yes, Yes, and Yes.

Step 3: Before finalizing this document, you should make sure that blank fields have been filled out as intended. Once you determine that it is good, press “Done." Make a free trial subscription with us and gain direct access to t2200s form - with all transformations kept and accessible in your personal account page. At FormsPal, we strive to be sure that all of your information is stored protected.