t3010 charity return can be filled in online with ease. Simply use FormsPal PDF editing tool to get it done in a timely fashion. The editor is constantly upgraded by us, receiving awesome functions and turning out to be better. It just takes just a few easy steps:

Step 1: Hit the "Get Form" button in the top area of this webpage to access our tool.

Step 2: Using our state-of-the-art PDF tool, you could do more than merely complete blank form fields. Express yourself and make your forms appear faultless with custom textual content put in, or adjust the original input to excellence - all comes with the capability to incorporate your own graphics and sign the PDF off.

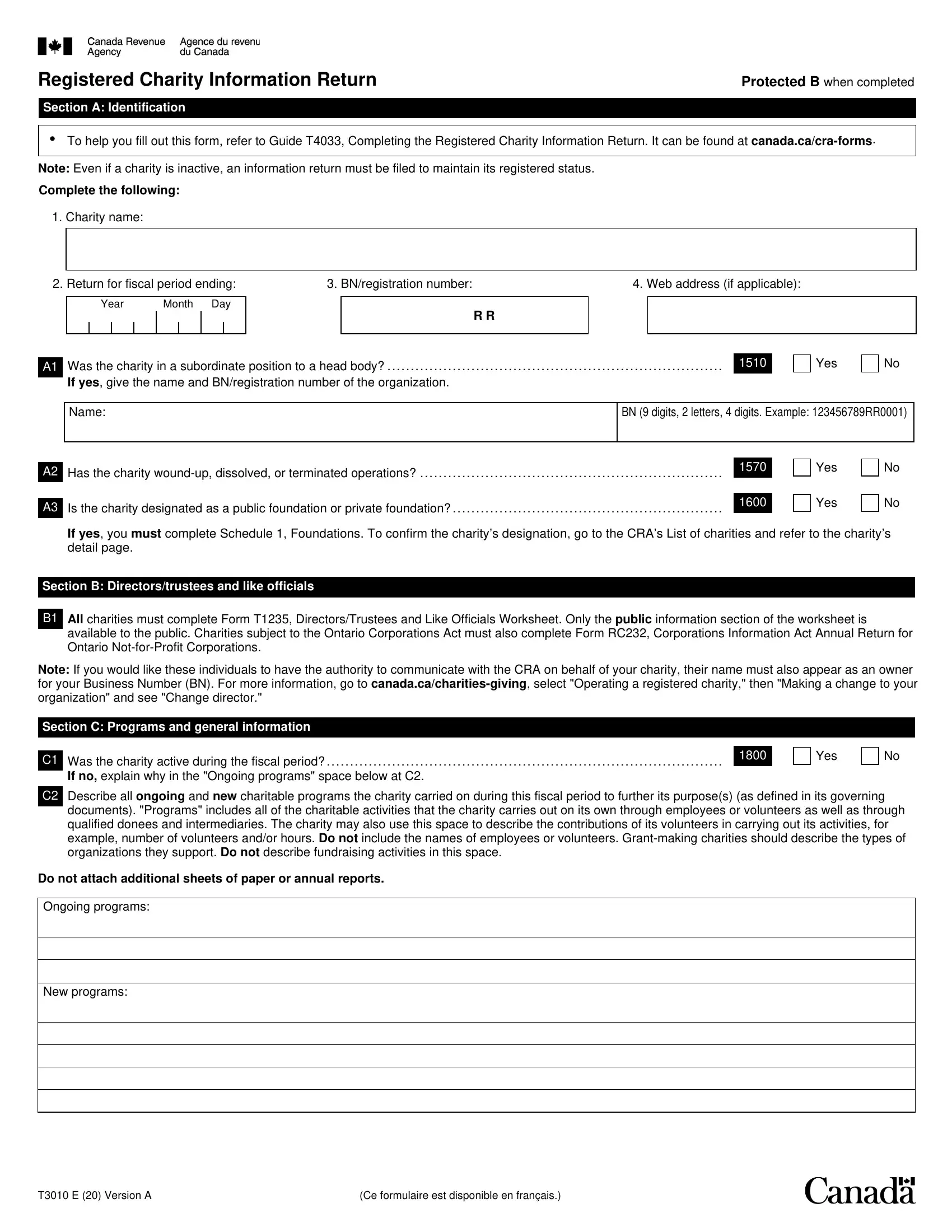

In an effort to fill out this PDF document, ensure you enter the right details in every area:

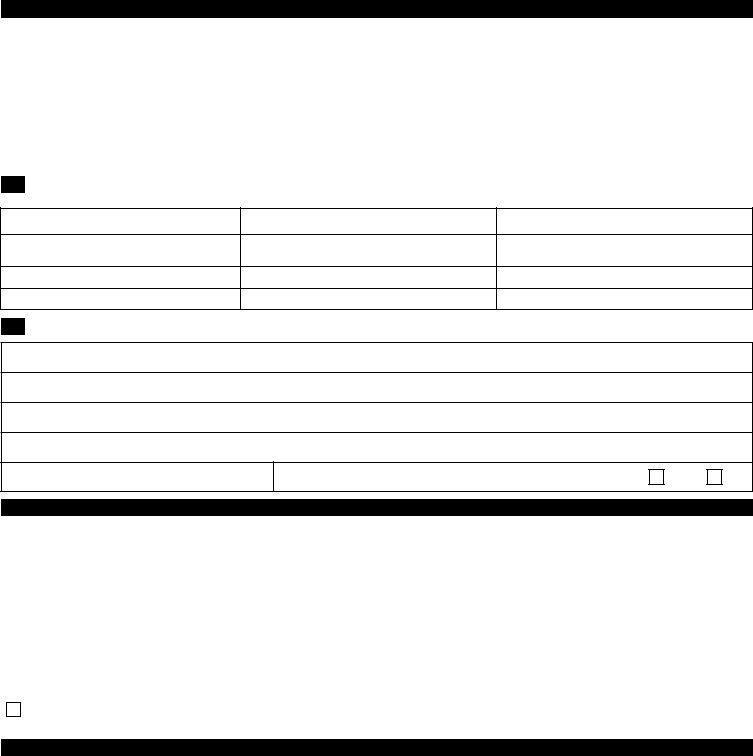

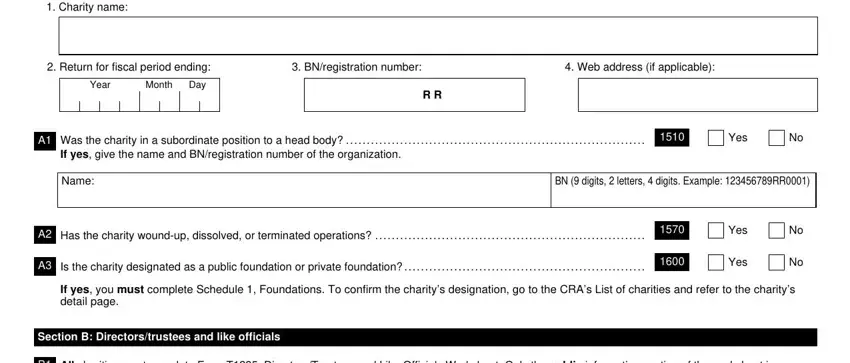

1. To begin with, while filling out the t3010 charity return, start out with the part that has the next blank fields:

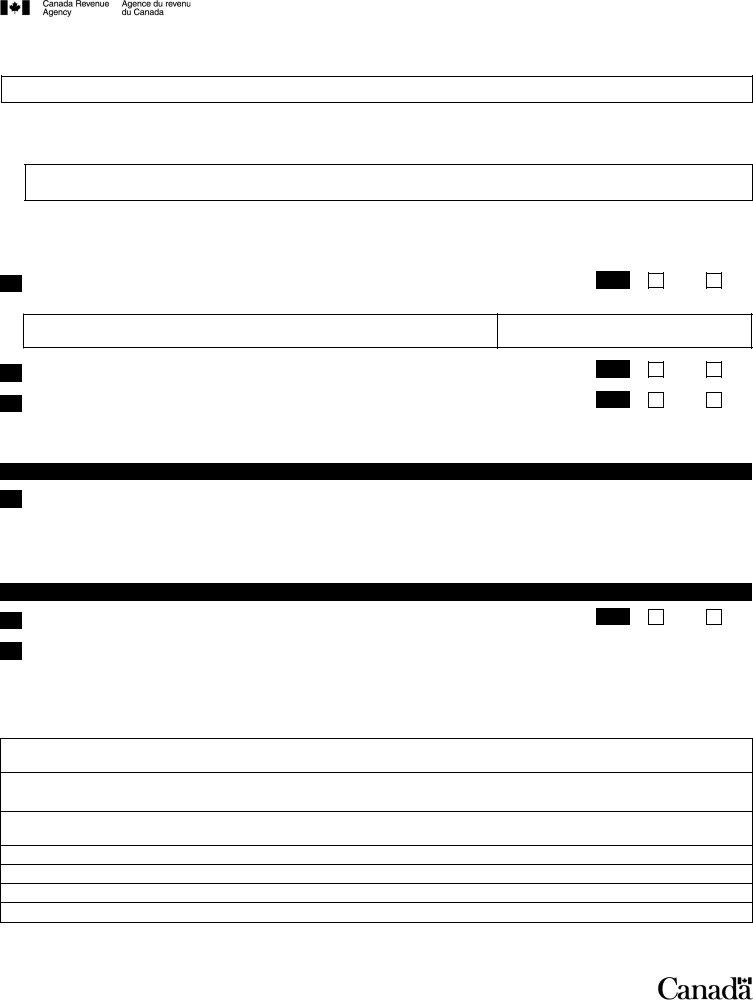

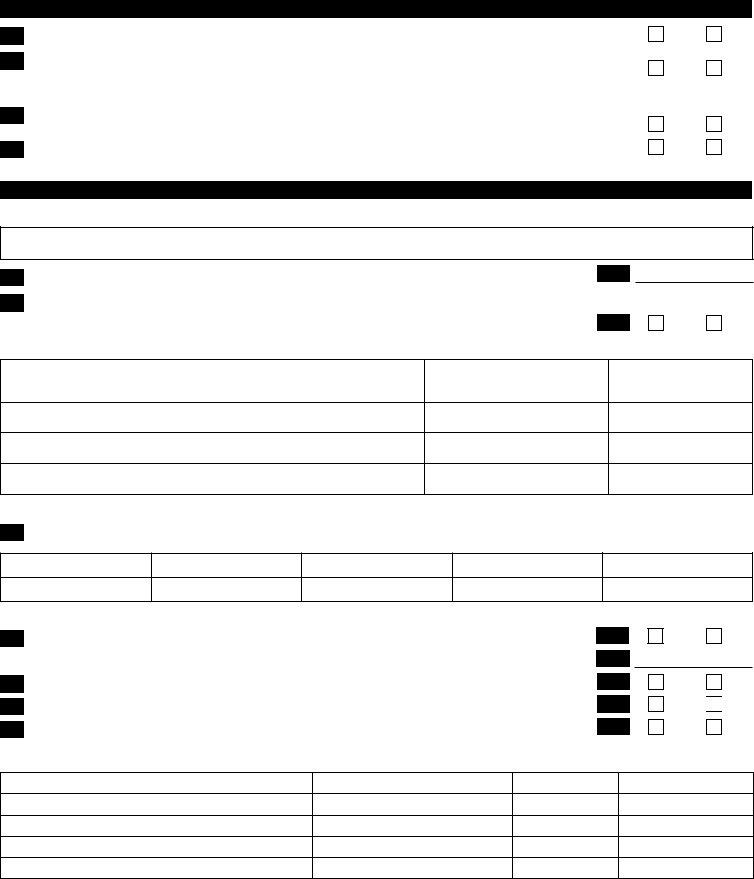

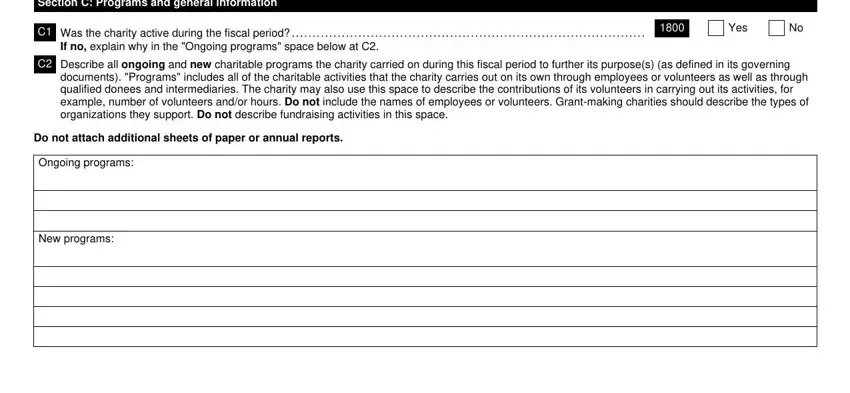

2. Right after completing this step, go to the next part and enter the essential particulars in these fields - Section C Programs and general, Was the charity active during the, Yes, C Describe all ongoing and new, documents Programs includes all of, Do not attach additional sheets of, Ongoing programs, and New programs.

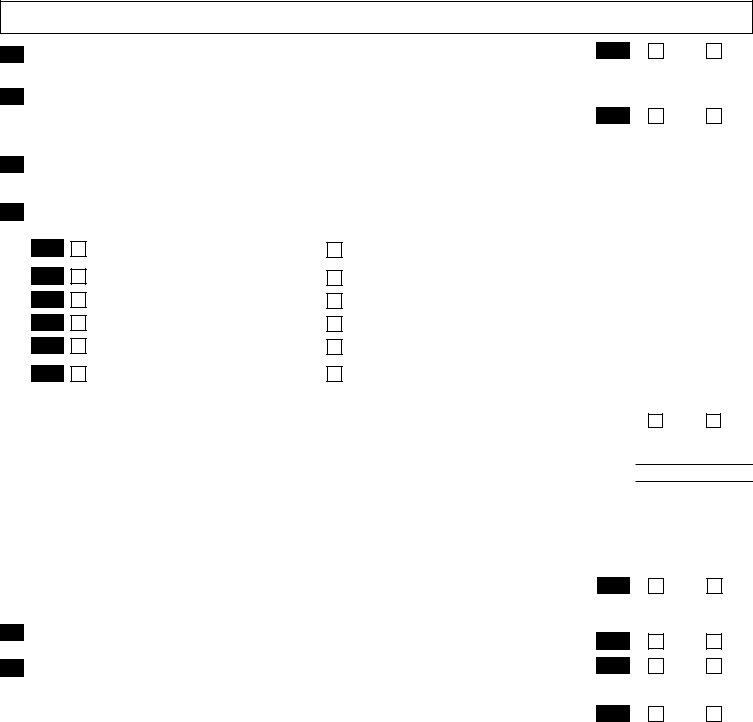

3. The third part is normally simple - complete all of the fields in Registered charities may make, Did the charity make gifts or, Yes, Important If yes you must complete, Did the charity carry on fund or, Yes, Important If yes you must complete, C Public policy dialogue and, This question has been removed, C If the charity carried on, used during the fiscal period, Advertisementsprintradio TV, Auctions, Collection plateboxes, and Doortodoor solicitation to complete the current step.

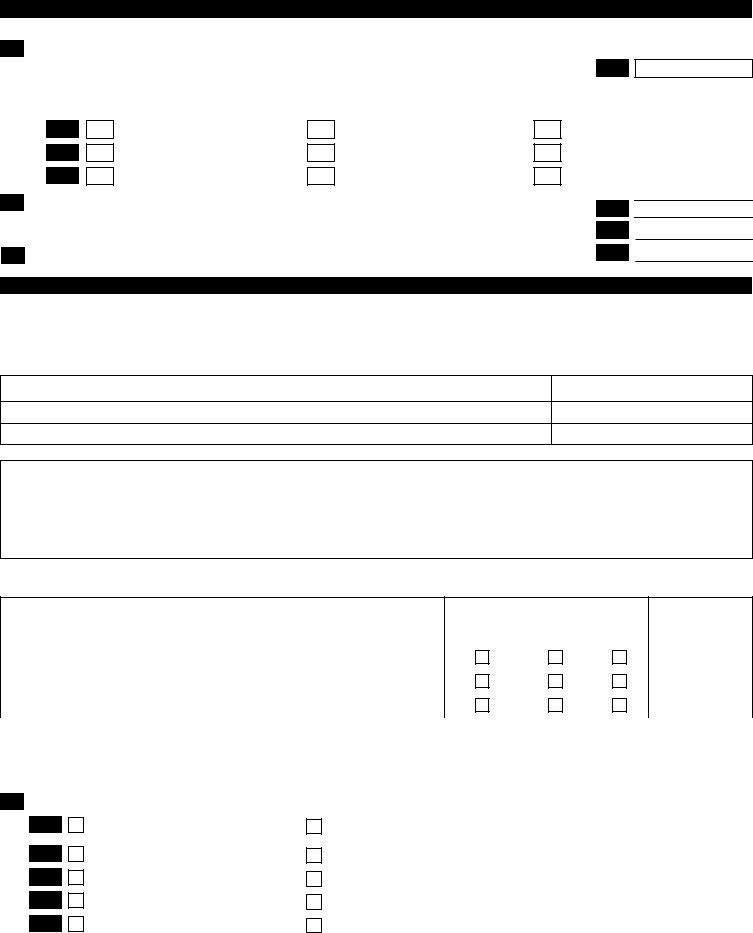

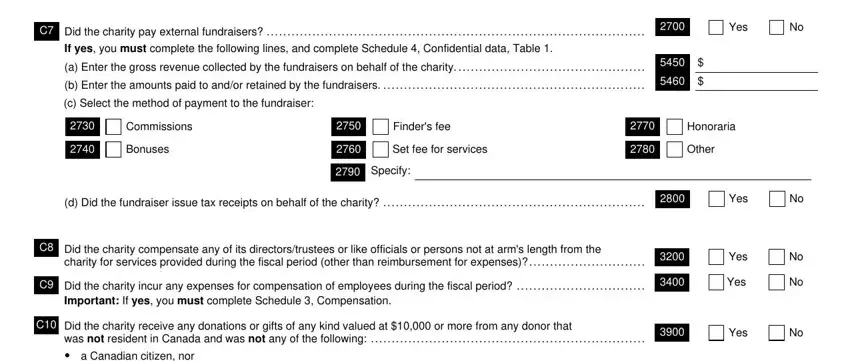

4. To go forward, this next section requires filling out a handful of form blanks. Examples include Did the charity pay external, Yes, If yes you must complete the, a Enter the gross revenue, b Enter the amounts paid to andor, c Select the method of payment to, Commissions, Bonuses, Finders fee, Set fee for services, Specify, Honoraria, Other, d Did the fundraiser issue tax, and Yes, which you'll find essential to going forward with this particular process.

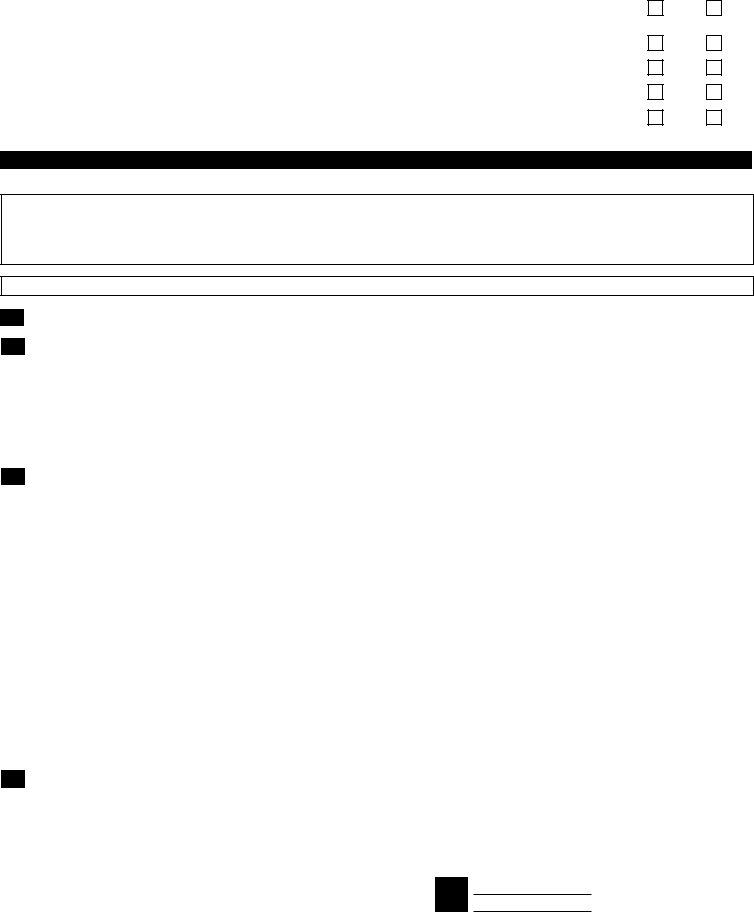

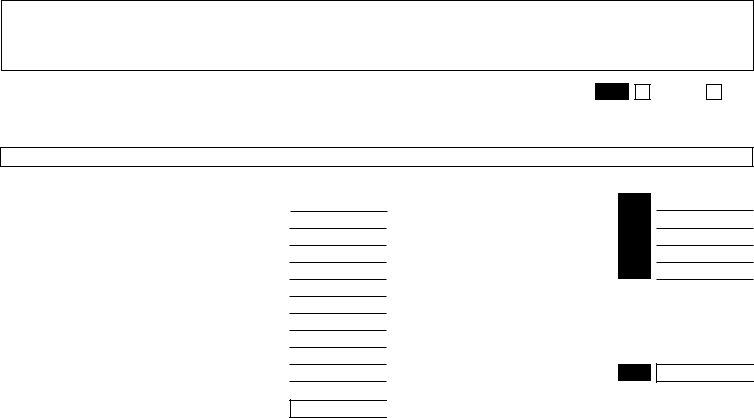

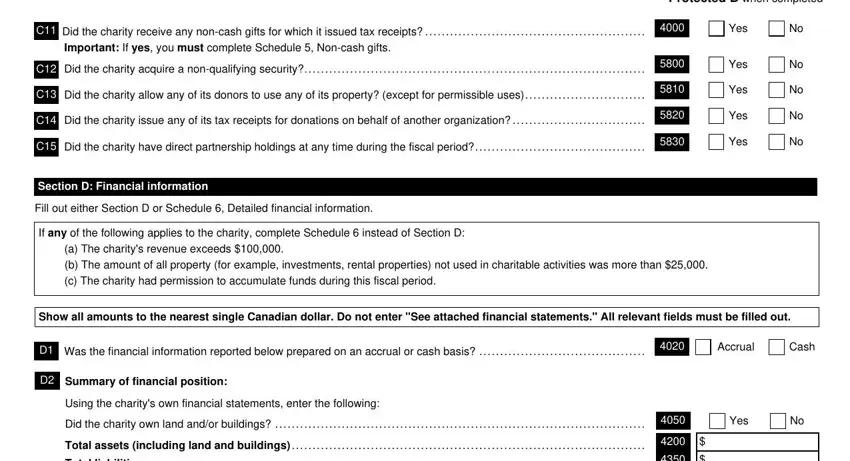

5. Last of all, this last segment is precisely what you need to complete prior to using the PDF. The blank fields under consideration are the next: Did the charity receive any, Did the charity acquire a, Did the charity allow any of its, Did the charity issue any of its, Did the charity have direct, Protected B when completed, Yes, Yes, Yes, Yes, Yes, Section D Financial information, Fill out either Section D or, If any of the following applies to, and a The charitys revenue exceeds b.

It is possible to make errors when completing your Did the charity issue any of its, hence make sure that you go through it again prior to deciding to finalize the form.

Step 3: Prior to addressing the next stage, you should make sure that all form fields have been filled in right. Once you believe it's all good, press “Done." After starting afree trial account at FormsPal, it will be possible to download t3010 charity return or email it right away. The PDF document will also be available in your personal account menu with all your adjustments. We don't share the information you provide while working with documents at our website.