Carrier Certification Requirements Sheet

KLLM Logistics Services welcomes your interest in becoming an approved carrier. We are confident that you will find KLLM Logistics Services a company that is dedicated to our contract carriers and we’ll make it easy to do business with us. The attached Packet includes information about our company along with various forms that you will need to fill out in order to become an approved contract carrier for KLLM Logistics Services.

This packet should contain:

1.This Document-Cover Sheet

2.Carrier Profile Sheet

3.Broker Carrier Agreement

4.KLLM Logistics Services profile with credit references

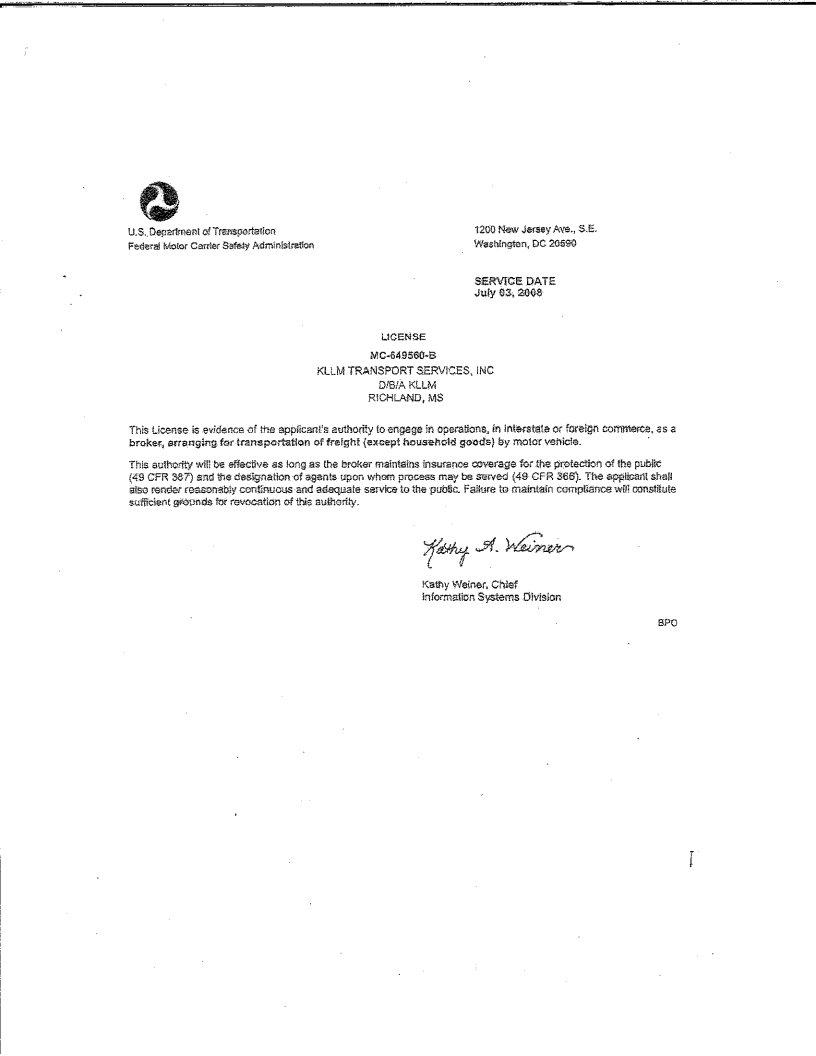

5.KLLM Logistics Services Authority

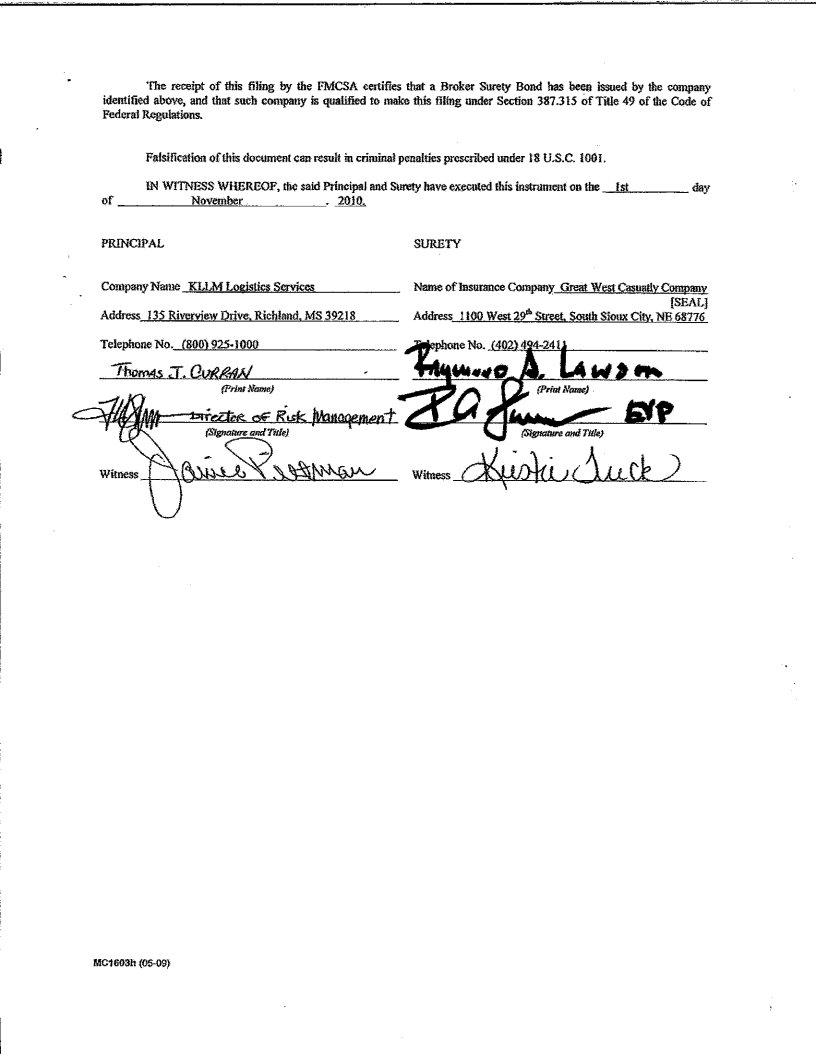

6.KLLM Logistics Services Surety Bond

7.Request for Insurance Certificate Form to fax to your Insurance Company

8.Blank W-9

After you have filled out the Carrier Profile and signed the Broker Carrier Agreement, without exceptions, the following must be faxed to KLLM Logistics Services. We cannot dispatch a driver until this information is received and entered into our computer system:

1.The completed Carrier Profile Sheet

2.The completed & signed Broker Carrier Agreement

3.A filled out W-9

4.A copy of your operating authority

5.A valid Insurance Certificate showing the current coverage with minimum amounts of:

a.$100,000 cargo coverage showing deductibles & reefer breakdown coverage if you are hauling reefer loads and listing any exclusions

b.$1,000,000 auto liability.

c.$1,000,000 commercial general liability with a $2,000,000 aggregate

6.Receipt of a fax, sent from your Insurance Company showing KLLM Logistics Services as a Certificate Holder and Additional Insured on your Insurance Coverage.

If you should have any questions regarding these procedures please call us at 866-682-3010.

Please email or fax your complete packet to the office that you are doing business with:

Jackson, MS |

ph. 866-682-3010 |

fax: 601-936-5449 |

email: kllmjn@kllm.com |

New Orleans, LA |

ph. 866-328-9189 |

fax: 504-210-0182 |

email: kllmnola@kllm.com |

Chattanooga, TN |

ph. 423-892-1735 |

fax: 423-899-2237 |

email: cestes@kllm.com |

Boston, MA |

ph. 508-762-0064 |

|

email: bkicher@kllm.com |

Fernandina Beach, FL |

ph. 888-724-8789 |

fax: 800-474-3979 |

email: dprax@kllm.com |

Thank you for doing business with KLLM Logistics Services.

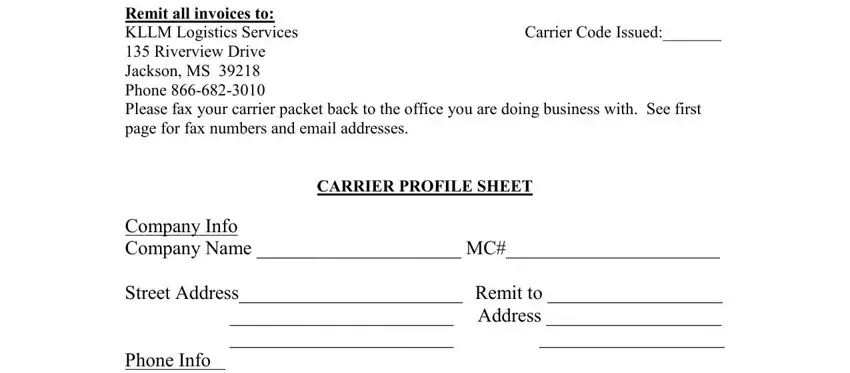

Remit all invoices to: |

|

KLLM Logistics Services |

Carrier Code Issued:_______ |

135 Riverview Drive |

|

Jackson, MS 39218 |

|

Phone 866-682-3010 |

|

Please fax your carrier packet back to the office you are doing business with. See first page for fax numbers and email addresses.

CARRIER PROFILE SHEET

Company Info

Company Name _____________________ MC#______________________

Street Address_______________________ |

Remit to __________________ |

|

_______________________ |

Address __________________ |

|

_______________________ |

___________________ |

Phone Info |

|

|

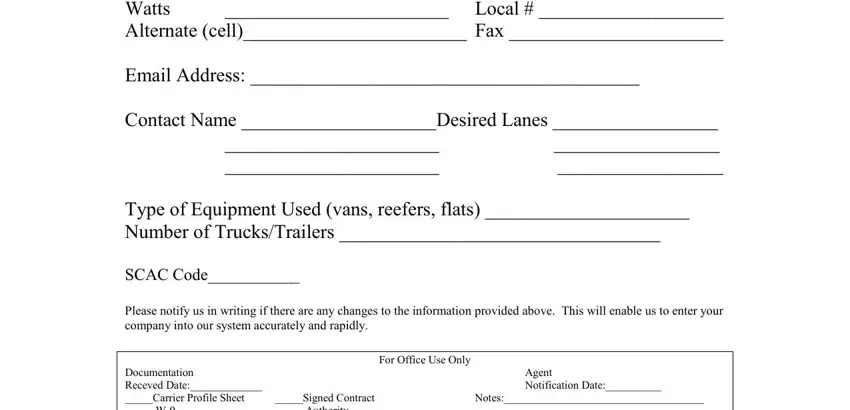

Watts |

_______________________ |

Local # ___________________ |

Alternate (cell)_______________________ Fax ______________________

Email Address: ________________________________________

Contact Name ____________________Desired Lanes _________________

______________________ _________________

______________________ _________________

Type of Equipment Used (vans, reefers, flats) _____________________

Number of Trucks/Trailers _________________________________

SCAC Code___________

Please notify us in writing if there are any changes to the information provided above. This will enable us to enter your company into our system accurately and rapidly.

|

|

For Office Use Only |

Documentation |

|

Agent |

Receved Date:_____________ |

|

Notification Date:__________ |

_____Carrier Profile Sheet |

_____Signed Contract |

Notes:____________________________________ |

_____ W-9 |

_____ Authority |

__________________________________________ |

_____ Cargo Ins |

_____ Liability Ins |

__________________________________________ |

|

|

|

KLLM Logistics Services

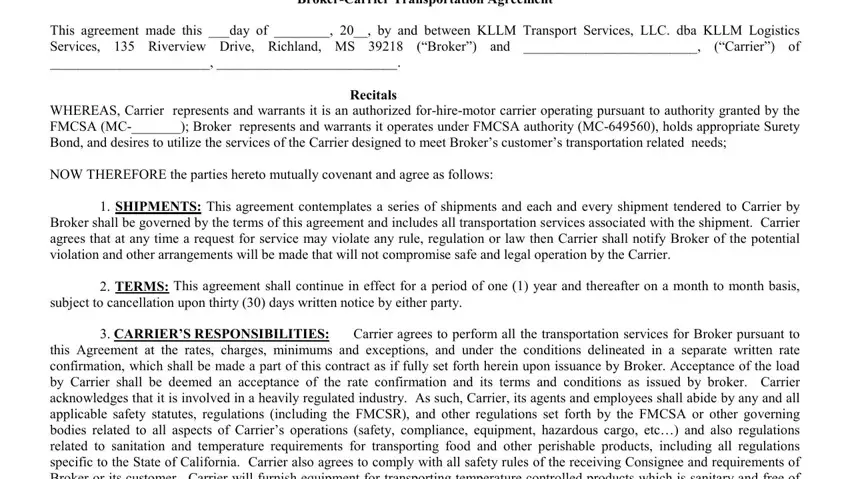

Broker-Carrier Transportation Agreement

This agreement made this ___day of ________, 20__, by and between KLLM Transport Services, LLC. dba KLLM Logistics

Services, 135 Riverview Drive, Richland, MS 39218 (“Broker”) and _________________________, (“Carrier”) of

_______________________, __________________________.

Recitals

WHEREAS, Carrier represents and warrants it is an authorized for-hire-motor carrier operating pursuant to authority granted by the FMCSA (MC-_______); Broker represents and warrants it operates under FMCSA authority (MC-649560), holds appropriate Surety

Bond, and desires to utilize the services of the Carrier designed to meet Broker’s customer’s transportation related needs;

NOW THEREFORE the parties hereto mutually covenant and agree as follows:

1.SHIPMENTS: This agreement contemplates a series of shipments and each and every shipment tendered to Carrier by Broker shall be governed by the terms of this agreement and includes all transportation services associated with the shipment. Carrier agrees that at any time a request for service may violate any rule, regulation or law then Carrier shall notify Broker of the potential violation and other arrangements will be made that will not compromise safe and legal operation by the Carrier.

2.TERMS: This agreement shall continue in effect for a period of one (1) year and thereafter on a month to month basis, subject to cancellation upon thirty (30) days written notice by either party.

3.CARRIER’S RESPONSIBILITIES: Carrier agrees to perform all the transportation services for Broker pursuant to this Agreement at the rates, charges, minimums and exceptions, and under the conditions delineated in a separate written rate confirmation, which shall be made a part of this contract as if fully set forth herein upon issuance by Broker. Acceptance of the load by Carrier shall be deemed an acceptance of the rate confirmation and its terms and conditions as issued by broker. Carrier acknowledges that it is involved in a heavily regulated industry. As such, Carrier, its agents and employees shall abide by any and all applicable safety statutes, regulations (including the FMCSR), and other regulations set forth by the FMCSA or other governing bodies related to all aspects of Carrier’s operations (safety, compliance, equipment, hazardous cargo, etc…) and also regulations related to sanitation and temperature requirements for transporting food and other perishable products, including all regulations specific to the State of California. Carrier also agrees to comply with all safety rules of the receiving Consignee and requirements of Broker or its customer. Carrier will furnish equipment for transporting temperature controlled products which is sanitary and free of any contaminations, suitable for the particular commodity being transported and which will not cause in whole or in part adulteration of the commodity as defined in 21 USCA 342. Carrier shall be responsible to Broker for any and all penalties assessed or other liability imposed upon Broker or any other party on the bill of lading (including its customer) due to failure of Carrier to comply with any statute, rule, regulation or other provision of law.

4.RECEIPT AND BILLS OF LADING: Carrier shall issue and sign a receipt or Bill of Lading issued under 49 U.S.C. § 80101 et. seq., and 49 C.F.R. §373.101 (and any amendments thereto), for each shipment in the form required by Broker which may be a Bill of Lading issued by consignor. Insertion by consignor or shipper of Broker’s name as the carrier on a bill of lading shall not change Broker’s status as a property broker or Carrier’s status as a motor carrier. Broker hereby consents to the execution of the receipt or Bill of Lading by Carrier and further consents to the use by Carrier of Broker or consignor’s Bill of Lading or receipt pursuant to 49 U.S.C. 14706(2). Carrier may not issue its own Bill of Lading or receipt containing terms that reference or attempt to incorporate a tariff or rules circular or similar document and any attempt to incorporate such into the Bill of Lading or receipt shall be ineffective and void. It is the express intent of the parties that this agreement shall govern all shipments and to the extent this agreement conflicts with any previously published rates or tariffs or other published terms and conditions of service, this agreement shall control. Upon delivery of each shipment, Carrier shall obtain a receipt signed by the Consignee, in a form required by Broker, showing the goods delivered, the condition of the goods, confirmed count of the goods and the date and time of delivery.

5.EQUIPMENT and COSTS: Carrier agrees to furnish suitable equipment at its own expense. Carrier shall assume and pay all costs and expenses, including but not limited to fuel, oil, tires, and other parts, supplies and equipment necessary or required for the safe operation and maintenance of the equipment required for shipments tendered under this contract. Rates or charges, including but not limited to stop-offs, detention, loading or unloading, fuel surcharges, or other accessorial charges shall only be valid when expressly agreed to in writing via the rate confirmation or other signed writing.

6.FREIGHT PAYMENTS: Invoices should be submitted with a clear and concise copy of the proof of delivery. Carrier hereby appoints Broker as its agent for receipt of all transportation charges incurred. Broker reserves the right to request an original proof of delivery from the Carrier if needed. If invoices are complete and correct and are accompanied by proofs of delivery, and other required documentation, Broker agrees to make payment thereof to Carrier within a reasonable time not to exceed thirty (30) days following receipt of such invoices. However, no interest, penalty or other charges shall be applied for any late payment. All freight payments due are subject to set-off by Broker for any and all unpaid claims for loss or damage to cargo, or other unpaid indemnity obligations, whether the freight payment is due for transportation of the damaged cargo or transportation of other unrelated

cargo. Broker will forward payments for net amounts due Carrier after all discounts, deductions and set-offs permitted by this Agreement. Carrier hereby assigns to Broker all its rights to collect freight charges from Shipper or any other responsible third party immediately upon receipt of payment of its freight charges by Broker. Carrier may not seek payment from any party other than the Broker if the third party has made payment to the Broker. Carrier hereby waives recourse against all parties to the bill of lading once the responsible party has paid Broker.

7.FREIGHT LOSS OR DAMAGE: Carrier’s liability for cargo loss, damage, delay or theft from any cause shall be as described in the provisions of 49 U.S.C. 14706 (Carmack Amendment). The parties do not agree to released value rates, or other limitations on cargo liability, and any provision on any Bill of Lading, tariff, rules circular, receipt or other shipping document purporting to set a released value rate or limitation shall be invalid. Carrier by accepting shipment, whether or not by signing an original Bill of Lading or accepting an electronic shipping document in lieu of an original Bill of Lading, acknowledges that the cargo is in good condition. Claims will be filed and resolved in accordance with federal regulations found at 49 C.F.R.370 et seq., which shall govern all claims process and salvage. Notwithstanding the terms of 49 C.F.R. 370 et. seq., as amended, Carrier agrees to provide written disposition; pay, decline or make settlement offer in writing on all cargo loss and damage claims within sixty (60) days of its receipt thereof. In the event of failure by the Carrier to pay, decline or offer settlement within this 60 day period Broker may deduct the full amount of such claim from the outstanding invoices of the Carrier after providing Carrier with written notice and giving Carrier ten (10) days to process the claim and cure the breach. Neither party shall be liable to the other for consequential damages without prior written notification of the risk of loss and its approximate financial amount, and agreement to assume such responsibility in writing. All claims for cargo loss or damages shall be submitted to Carrier in writing within 270 days after delivery or, if lost, the date of the scheduled delivery. Any civil action or arbitration for loss or damage to cargo must be brought within two

(2)years. The period for bringing a civil action or arbitration is computed from the date the Carrier gives Broker written notice that the carrier has disallowed any part of the claim specified in the notice.

8.BACK SOLICTATION: Carrier agrees that it shall not, during the term hereof, and for a period of two (2) years from the date of the termination of this agreement, directly or indirectly solicit or otherwise contact any person or customer of Broker with whom Carrier had substantial contact for the purpose of transporting shipments directly for or on behalf of such person or customer, as the violations by Carrier of the provisions of the paragraph would cause irreparable injury to Broker, and there is no adequate remedy at law or in equity, to enjoin Carrier in a court of equity from violating such provision.

9.INDEMNIFICATION: Carrier shall be liable to Broker and the parties identified on bills of lading for any and all loss, damage, or delay to shipments. The value of the shipment shall be sales price at destination. Carrier shall indemnify, defend and save harmless Broker, Broker’s customer, and the parties identified on the bills of lading, and its subsidiaries and their respective officers, directors, and employees from and against all liabilities, obligations, losses, damages, penalties, claims, actions, suits, costs, charges, and expenses, including without limitation, fees and expenses of legal counsel and expert witnesses as they accrue, which are the result of or arising out of any or all or the work or services performed under this contract by Carrier or its contractors.

10.INSURANCE: Carrier will provide to Broker insurance certificates naming Broker as certificate holder, and to include additional insured endorsement required herein and providing 30 day notice of material change or cancellation of policies. Carrier will procure and maintain in force continuously throughout the term of this agreement the following types of insurance: 1) Comprehensive Automobile and Truck Liability Insurance (must include hired or non-owned vehicles and MCS-90) with limits of liability of not less than $1,000,000.00 combined single limit per occurrence ($5,000,000.00 for Hazardous Cargo) for bodily injury and property damage, insuring all motor vehicles used by Carrier in the performance of its obligations hereunder, whether such vehicles are owned, non- owned, leased, or hired; 2) Commercial general liability, including contractual liability, with a policy limit of not less than $1,000,000 per occurrence and $2,000,000 aggregate; 3) Motor Truck Cargo Insurance with a minimum limit of $100,000.00 per occurrence, or in excess of $100,000.00 as required by Broker. The per occurrence Cargo limit shall at all times be equal to or greater than Carrier’s legal liability under the Bill of Lading, contract of carriage, shipping receipt or similar and Carrier shall not accept loads in excess of its current coverage unless Carrier has secured additional insurance and provided Broker with proof of such prior to accepting the load tender. Coverage is to provide physical loss and/or damage to the transported commodities while in the course of transit including loss and/or damage sustained during loading and unloading, at rest stops (regardless of whether the truck is unattended), and dishonesty (including theft and/or pilferage) by drivers of transported commodities in the care, custody and control of the Carrier ; 4) Statutory Worker’s compensation; 5) Employer’s liability insurance with a policy limit of not less than $500,000. Broker shall be named via an Additional Insured Endorsement on the Carriers’ General Liability and Auto and Truck Liability Insurances and as a Loss Payee on the Motor Truck Cargo Insurance. Regardless of the insurance required above, the Carrier will at all times comply with the above limits or the minimum required by law, whichever is greater.

11.OVERCHARGES and UNDERCHARGES: Carrier specifically disclaims application of published or non-published tariffs, and acknowledges that any rate of Carrier in excess of rate named herein an unreasonable and inapplicable rate. The processing, investigation, and disposition of overcharge, undercharge, duplicate payment, unidentified payment or over collection claims shall be governed by 49 C.F.R. 378.

2

12.AMENDMENT/ASSIGNMENT/BROKERING: This Agreement may not be modified or amended except by an instrument in writing, signed by both parties hereto. Carrier shall not assign, lease, sub-lease, subcontract, delegate, interline or broker to any other Carrier or person, its responsibilities for the performance of transportation services pursuant to this Agreement. This prohibition does not apply to equipment under lease pursuant to 49 C.F.R. Part 376. Carrier accepts primary responsibility as the originating and delivering motor carrier for all loses if the terms of this paragraph are violated without regard to fault by Carrier or other third parties.

13.STATUS of CARRIER: In the performance of the transportation services hereunder, Carrier shall be an independent for-hire motor carrier and shall not be or act as an agent or employee of Broker, shipper, consignor or consignee. As between the parties, Carrier shall have the sole and exclusive responsibility for the costs and over the manner in which its employees and/or independent contractors perform the transportation service, including the equipment provided. No employee, agent or other representative of either party shall at any time be deemed to be under the control or authority of the other party, or the joint control of both parties. Each party shall be fully liable for all worker's compensation premiums and liability, Federal, State and local withholding taxes or charges related to its respective employees, and each agrees to hold the other harmless from any claims brought against the other in relation thereto. No provision of this Agreement or any act of the parties pursuant to this Agreement shall be construed to express or imply a joint venture, partnership, principal-agent relationship, or employer-employee relationship exists. Neither party intends to give the other party exclusive rights or privileges under this Agreement or prohibit the provision of transportation services to other third parties.

14.ARBITRATION: Any and all disputes arising under this agreement shall be resolved in binding arbitration through services of Transportation ADR Council, Inc. or the American Arbitration Association and shall be final and binding. The party filing arbitration shall select the arbitration rules under which to file and such selection shall be final. The “Arbitration Agreement and Jury Trial Waiver” are appended to this agreement and incorporated as set forth fully herein. Any award or judgment shall identify the losing party against whom all expenses of arbitration, including attorney fees, shall be cast.

15.APPLICABLE LAW: The terms of this contract shall be governed by the laws of the State of Mississippi, subject to applicable federal law, rules and regulations and disregarding any choice-of-law principle under which Mississippi would look to the laws of another jurisdiction.

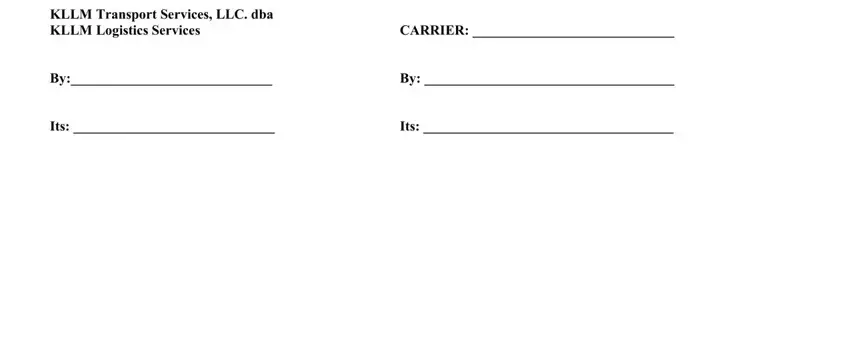

IN WITNESS WHEREOF, the parties have executed this Transportation Agreement by their duly authorized representatives on the date first above written in duplicate.

BROKER: |

|

KLLM Transport Services, LLC. dba |

|

KLLM Logistics Services |

CARRIER: _____________________________ |

By:_____________________________ |

By: ____________________________________ |

Its: _____________________________ |

Its: ____________________________________ |

3

DBA KLLM Logistics Services

Profile with Credit References

Physical Address

Remit all invoices to:

KLLM Logistics Services

135 Riverview Drive

Jackson, MS 39218

Phone 866-682-3010

Fax 601-936-5669

Federal ID# 26-3628823

MC# |

649560 |

Duns |

# 045-321-841 |

SCAC Code KLLT

Carrier References:

Bopari Transport Inc.

Sunny Bopari

PO Box 9367

Fresno, CA 93792-9367

559-275-1960

T.S. Expediting Services Inc

Kelly Scherer

PO Box 307

Perrysburg, OH 43552

800-821-6395

Stewart Transportation

Jon Martin

PO Box 16447

Hattiesburg, MS 39404

601-582-0246

|

Trade References: |

Empire Trucks |

PO Box 54325; Jackson, MS 39208 601-939-5000 |

Utility Trailers 550 Hwy 49 South; Richland, MS 39218 601-939-9000 Travel Centers 24601 Centerridge; Westlake, OH 44145 440-808-9100

From: KLLM Logistics Services

Attention: ______________________________________________

Fax #: ______________________________________________

REQUEST FOR CERTIFICATE

Request for Certificate of Insurance for:

______________________________________________________

With Cargo, Auto Liability, and General Liability naming KLLM Logistics Services as the certificate holder and as Additional Insured. Please list the Deductible, Limits, Sub-Limits, and Exclusions. If you are hauling a frozen or refrigerated load, please include reefer breakdown.

Certificate Holder:

KLLM Logistics Services

135 Riverview Drive

Jackson, MS 39218

Please email to: awarner@kllm.com

Please fax to:

Attn: Logistics Department

Phone: 508-762-0064

****Payments are not released until all paperwork is on file.

Thank you.

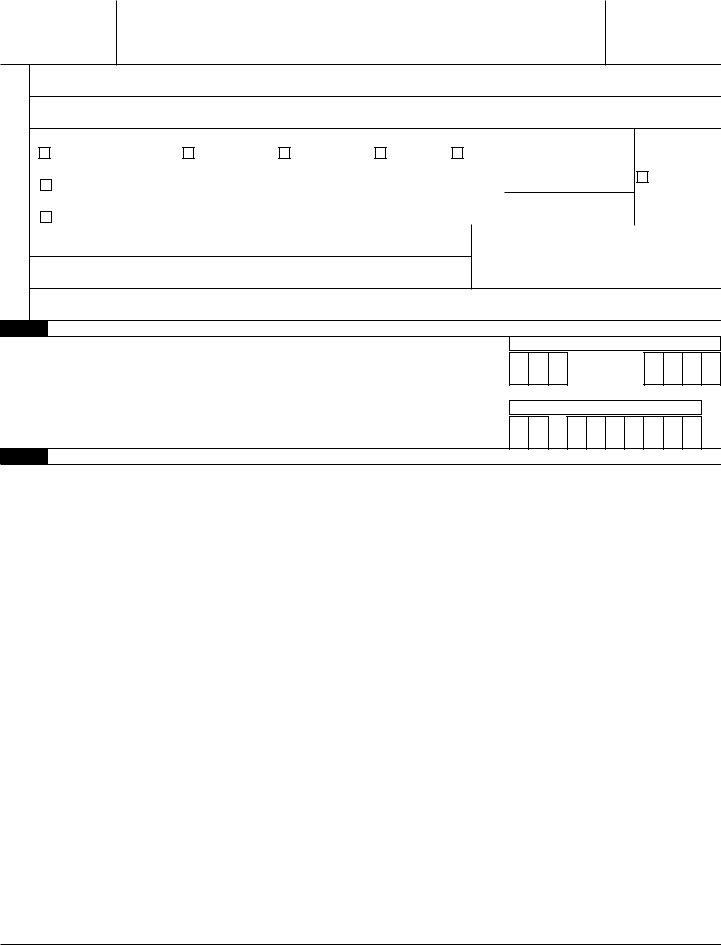

Form W-9

(Rev. December 2011)

Department of the Treasury

Internal Revenue Service

Request for Taxpayer

Identification Number and Certification

Give Form to the requester. Do not send to the IRS.

Print or type See Specific Instructions on page 2.

Name (as shown on your income tax return)

Business name/disregarded entity name, if different from above

Check appropriate box for federal tax classification:

Individual/sole proprietor |

C Corporation |

S Corporation |

Partnership |

Trust/estate |

|

Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=partnership) ▶ |

Exempt payee |

|

Other (see instructions) ▶ |

|

|

|

|

|

Address (number, street, and apt. or suite no.) |

|

|

Requester’s name and address (optional) |

|

City, state, and ZIP code

List account number(s) here (optional)

Part I Taxpayer Identification Number (TIN)

Enter your TIN in the appropriate box. The TIN provided must match the name given on the “Name” line to avoid backup withholding. For individuals, this is your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the Part I instructions on page 3. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN on page 3.

Note. If the account is in more than one name, see the chart on page 4 for guidelines on whose number to enter.

Employer identification number

–

Part II Certification

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3.I am a U.S. citizen or other U.S. person (defined below).

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions on page 4.

|

Sign |

Signature of |

|

|

Here |

U.S. person ▶ |

Date ▶ |

|

General Instructions |

Note. If a requester gives you a form other than Form W-9 to request |

|

Section references are to the Internal Revenue Code unless otherwise |

your TIN, you must use the requester’s form if it is substantially similar |

|

to this Form W-9. |

|

noted. |

|

|

|

Definition of a U.S. person. For federal tax purposes, you are |

|

|

|

|

Purpose of Form |

considered a U.S. person if you are: |

|

A person who is required to file an information return with the IRS must |

• An individual who is a U.S. citizen or U.S. resident alien, |

|

|

|

obtain your correct taxpayer identification number (TIN) to report, for |

• A partnership, corporation, company, or association created or |

|

example, income paid to you, real estate transactions, mortgage interest |

organized in the United States or under the laws of the United States, |

|

you paid, acquisition or abandonment of secured property, cancellation |

• An estate (other than a foreign estate), or |

|

of debt, or contributions you made to an IRA. |

|

• A domestic trust (as defined in Regulations section 301.7701-7). |

|

Use Form W-9 only if you are a U.S. person (including a resident |

|

Special rules for partnerships. Partnerships that conduct a trade or |

|

alien), to provide your correct TIN to the person requesting it (the |

|

business in the United States are generally required to pay a withholding |

|

requester) and, when applicable, to: |

|

tax on any foreign partners’ share of income from such business. |

|

1. Certify that the TIN you are giving is correct (or you are waiting for a |

|

Further, in certain cases where a Form W-9 has not been received, a |

|

number to be issued), |

|

partnership is required to presume that a partner is a foreign person, |

|

|

|

|

2. Certify that you are not subject to backup withholding, or |

and pay the withholding tax. Therefore, if you are a U.S. person that is a |

|

3. Claim exemption from backup withholding if you are a U.S. exempt |

partner in a partnership conducting a trade or business in the United |

|

|

|

payee. If applicable, you are also certifying that as a U.S. person, your |

States, provide Form W-9 to the partnership to establish your U.S. |

|

status and avoid withholding on your share of partnership income. |

|

allocable share of any partnership income from a U.S. trade or business |

|

|

|

is not subject to the withholding tax on foreign partners’ share of |

|

|

effectively connected income. |

|

Cat. No. 10231X |

Form W-9 (Rev. 12-2011) |