Understanding the complexities of maritime and shipping regulations is crucial for companies and individuals involved in these activities, particularly when it comes to financial obligations. Among these responsibilities is the Harbor Maintenance Fee (HMF), a charge levied by the U.S. Customs and Border Protection (CBP) to fund the maintenance of ports and harbors. The CBP Form 349 plays a critical role in this process, serving as a Quarterly Summary Report for these fees. Specifically designed to comply with regulations set forth in 19 CFR 24.24, this form requires the detailed reporting of shipment types, their values, and applicable exemptions, ultimately calculating the net HMF due. It is mandatory for entities such as shippers of domestic movements, entities involved with Foreign Trade Zone (FTZ) admissions, and operators of passenger-carrying vessels to accurately complete and submit this form. Failure to report or incorrect reporting can lead to significant penalties, making understanding and compliance with the CBP Form 349 not just a financial duty but a legal necessity as well. Additionally, the form emphasizes the importance of accurate identification through either an Employer Identification Number (EIN) or Social Security Number (SSN), underscoring the meticulous nature of regulatory compliance in maritime operations.

| Question | Answer |

|---|---|

| Form Name | Cbp Form 349 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | cbp_form_349_2 us customs and border protection form 349 |

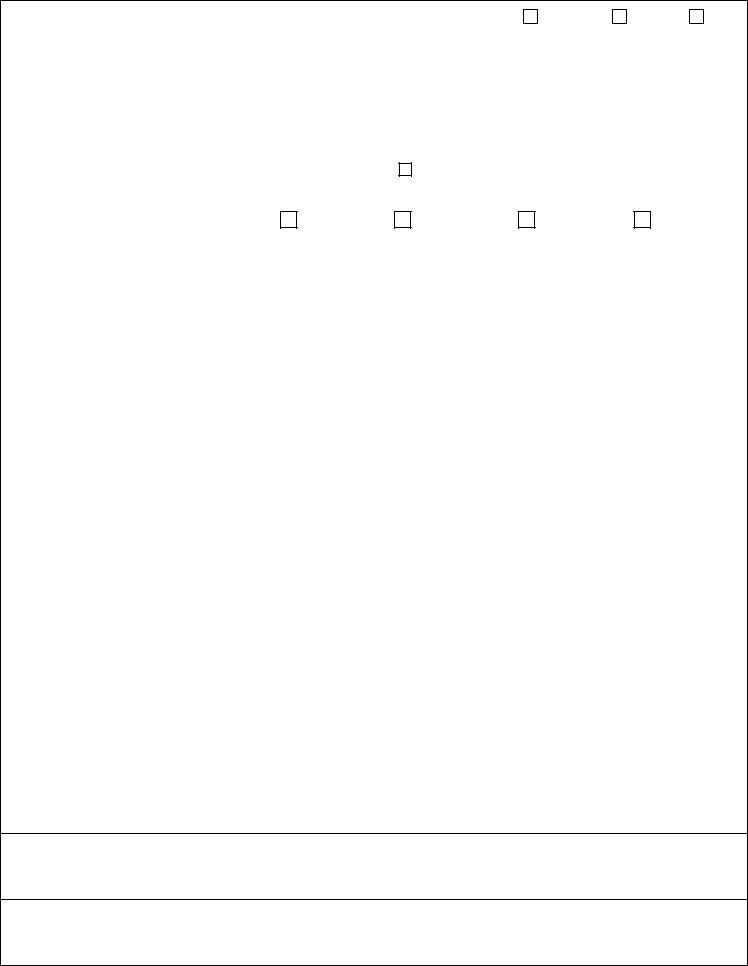

Approved OMB No.

Exp. 11/30/2011

|

DEPARTMENT OF HOMELAND SECURITY |

|

1. |

Identifying Number |

|

|

EIN or IRS |

|

CBP |

|

|

SSN |

|||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

U.S. Customs and Border Protection |

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

Number |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

HARBOR MAINTENANCE FEE |

|

|

|

2. Name of Company or Individual |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

QUARTERLY SUMMARY REPORT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

19 CFR 24.24 |

|

|

|

3. |

Complete Mailing Address |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

SEND TO: U.S. Customs and Border Protection |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Office of Finance, Revenue Division |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

6650 Telecom Drive |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Indianapolis, IN 46278 |

|

|

|

|

|

|

|

Check here if address has changed since last filing. |

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. REPORTING PERIOD |

|

|

|

|

|

Jan. 1 - |

|

|

|

Apr. 1 - |

|

|

|

|

Jul. 1 - |

|

|

|

Oct. 1 - |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Year |

|

1 |

|

|

|

|

2 Jun. 30 |

|

|

|

|

3 Sep. 30 |

|

|

|

4 Dec. 31 |

|||||||||||||||||||

(One Quarter Only) |

|

|

Mar. 31 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

6. |

|

|

|

|

|

|

|

|

7. |

|

|

|

8. |

|

|

|

|

||||||

|

Type of Shipment |

|

Value of |

|

|

Value of |

|

|

Net Value |

|

|

|

HMF Due |

|

|

||||||||||||||||||||

|

|

With |

|

|

|

Shipments |

|

|

Exemptions |

|

|

(column 5 less |

|

|

|

(multiply the |

|||||||||||||||||||

|

Class Code |

|

|

|

|

|

|

|

|

(from corresponding |

|

|

column 6) |

|

|

|

|

amounts |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

columns |

|

|

|

|

|

|

|

|

|

|

|

|

in column 7 by |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

A to D of line 15) |

|

|

|

|

|

|

|

|

|

|

|

appropriate rate) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

A. Domestic Movements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. FTZ Admissions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

505 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

C. Passengers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Total Line Value 5, |

$ |

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

6, & 7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

9. Total HMF Due (Total of Lines 8A through 8C) |

$ |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEMIZATION OF |

|

A. |

|

|

|

B. |

|

|

|

|

|

|

|

|

C. |

|

|

|

|

D. |

|

|

||||||||||||

|

EXEMPTIONS |

|

|

|

Domestics |

|

|

FTZ(s) |

|

|

Passengers |

|

|

|

|

Total |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

10. Exempt Port |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Inland Waterway |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Fuel Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Intraport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

U.S. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Possession/Territory |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

14. |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

15. TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

(Also enter amounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

in 15A thru 15D in 6A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

thru 6D above). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

CERTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

I hereby under penalties provided by law that the above information regarding the Harbor Maintenance Fee is completed and |

|

|

||||||||||||||||||||||||||||||||

|

accurate to the best of my knowledge. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Please Sign Here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

17. |

Type or print name of person who prepared this report (if same as block 2, write "Same") |

|

18. Telephone Number (country code, if applicable) |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRIVACY ACT NOTICE: The Following information is given pursuant of the Privacy Act of 1974 (Pub. L.

PAPERWORK REDUCTION ACT NOTICE: This request is in accordance with the Paperwork Reduction Act. We ask for the information in order to carry out the Harbor Maintenance Revenue provisions of the Water Resource Development Act of 1988. We need it to ensure that the trade community is complying with this Act, and to allow CBP to determine if the correct amount of Harbor Maintenance Fee (HMF) is collected. It is mandatory. The estimated average burden associated with this collection of information is 30 minutes per respondent plus 10 minutes recordkeeping depending on individual circumstances . Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to U.S. Customs and Border Protection, Asset Management, Washington, DC 20229, and to the Office of Management and Budget, Paperwork Reduction Project

CBP Form 349 (03/09)

FORM INSTRUCTIONS

(Refer to Customs publication No. 548, "Preparation of Harbor Maintenence Fee Forms" for additional instructions; and 19 CFR 24.24.)

The following are specific instructions for most of the items on the form. Items that have no instructions are

Item 1. Identifying Number - Individual summary reports may contain only one identifying number. This does not preclude filing more than one summary report for one identifying number. The identifying number must correspond to Item 2, Name of Company or Individual. Check the appropriate box to indicate the kind of identifying number being used. Enter the following information:

Domestic Movements - Shipper's Internal Revenue Service (IRS) Number listed on the Vessel Operator Report (U.S. Army Corps of Engineers Form 3925).

FTZ Admissions - Applicant for Admission to a Foreign Trade Zone's Internal Revenue Service (IRS) Employer Identification Number (EIN).

Passengers - Vessel Operator's Internal Revenue Service (IRS) Employer Identification Number (EIN).

Item 2. NAME OF COMPANY OR INDIVIDUAL - Enter the following information:

Domestic Movements - Shipper listed on the Vessel Operator Report (U.S. Army Corps of Engineers Form 3925).

FTZ Admissions - Applicant or Firm Name listed on the Application for Foreign Trade Zone Admission and/or Status Designation (CBP Form 214 Box 24).

Passengers - Operator of the Passenger Carrying Vessel.

Item 3. ADDRESS - Street Address or P. O. Box number, city, state, and zip code where company or individual may be contacted.

Item 4. REPORTING PERIOD - Check only one box. A

separate summary report is required for each quarter reported.

Item 5. VALUE OF SHIPMENTS - Figures inserted in Items 5A through 5C shall represent quarterly totals.

(5A) Domestic Movement - Total Value at the time of l oading. (Free Alongside Ship (FAS) value, which includes selling price, inland freight, insurance, and all other charges to transport the cargo to the dock alongside the vessel.)

(5B) FTZ Admissions - Total entered value listed on the Application for Foreign Trade Zone Admission and/or Status Designation (CBP Form 214, total of Block 21).

(5C) Passengers - Actual charge for transportation paid by the passengers or the prevailing charge for comparable service if no actual charge is paid. The HMF is paid only once per journey for each passenger. Crewmembers are not subject to the HMF.

Item 6. VALUES OF EXEMPTIONS - Exemptions are to be itemized in Items 10 through 14. Totals shall be inserted in Items 6A through 6C.

Item 7. NET VALUE - Net value shall be calculated by subtracting Items 6A through 6C from Items 5A through 5C. Enter the total net value (sum of Lines A - C, Column 7) on Line E, Columns 5, 6 and 7.

Item 8. HMF DUE - To calculate the HMF, multiply the amount on Lines 8A, 8B and 8C times the rate in effect for the period being reported. The rate is 0.0004 (.04%) through December 31, 1990 and 0.00125 (.125%) beginning January 1, 1991.

Item 9. TOTAL HMF DUE - Total of lines 8A, 8B and 8C. Remit a check or money order payable to the U.S. Customs and Border Protection. Payments must be received no later than 31 days after the close of the quarter being paid.

ITEMIZATION OF EXEMPTIONS

Only one exemption per movement may be claimed. (See definition of "movement" in Item 5 of the General Instructions in Customs Publication No. 548). Figures inserted In Items 10 through 15 shall represent quarterly totals.

Item 10. Exempt Port - Total value of shipments, for each type of movement (e.g., domestics, FTZ admissions, etc.), loaded and/or unloaded at an exempt port. See Customs Publication No. 548 "Preparation of Harbor Maintenance Fee Forms" for list of

Item 11. Inland Waterw ay Fuel Tax - Total value of shipments transported by vessels using fuel subject to the Inland Waterway Fuel Tax. Applies only to domestic movements.

Item 12. Intraport - Total value of cargo moved within a single CBP port. Applies only to domestic movements.

Item 13. U.S.

the following:

Cargo, other than Alaskan crude oil, loaded on a vessel in Hawaii, Alaska, or Puerto Rico, and unloaded in the state or territory in which loaded.

Cargo, other than Alaskan crude oil, transported from the U.S. mainland to Alaska, Hawaii, Puerto Rico, or the U.S. possessions for ultimate use or consumption: and/or

Cargo, other than Alaskan crude oil, transported from Alaska, Hawaii, or any U.S. possession to the U.S. mainland, Alaska, Hawaii, or such possession for ultimate use or consumption in the mainland, Alaska, Hawaii, or such possession.

U.S. mainland includes the 48 contiguous states and the District of Columbia.

The U.S. possessions and territories include the following:

American Samoa

Baker Island

Guam

Howland Island

Jarvis Island

Johnston Atoll

Kingman Reef

Midway

Northern Marianna Islands including:

Agrihan

Aguijan

Guguan

Pagan

Rota

Saipan

Tinian

Palmyra Island

Puerto Rico

U.S. Virgin Islands

Wake Island

Item 14. Other - The total value of cargo, for each type of movement, subject to the following exemptions:

Cargo entering the U. S.

Fish and other aquatic animal life caught by a vessel, and not previously landed on shore, regardless of the extent to which it has been processed.

Passengers transported on ferries. Ferries are defined as vessels engaged primarily in the transport of passengers and their vehicles between ports in the U.S. or between ports in the U.S. and ports in Canada or Mexico. The vessel must arrive in the U.S. on a regular schedule during its operating season.

Item 16. CERTIFICATION - Insert signature of shipper, application for FTZ admission, or operator of passenger carrying vessel.

CBP Form 349 (03/09)