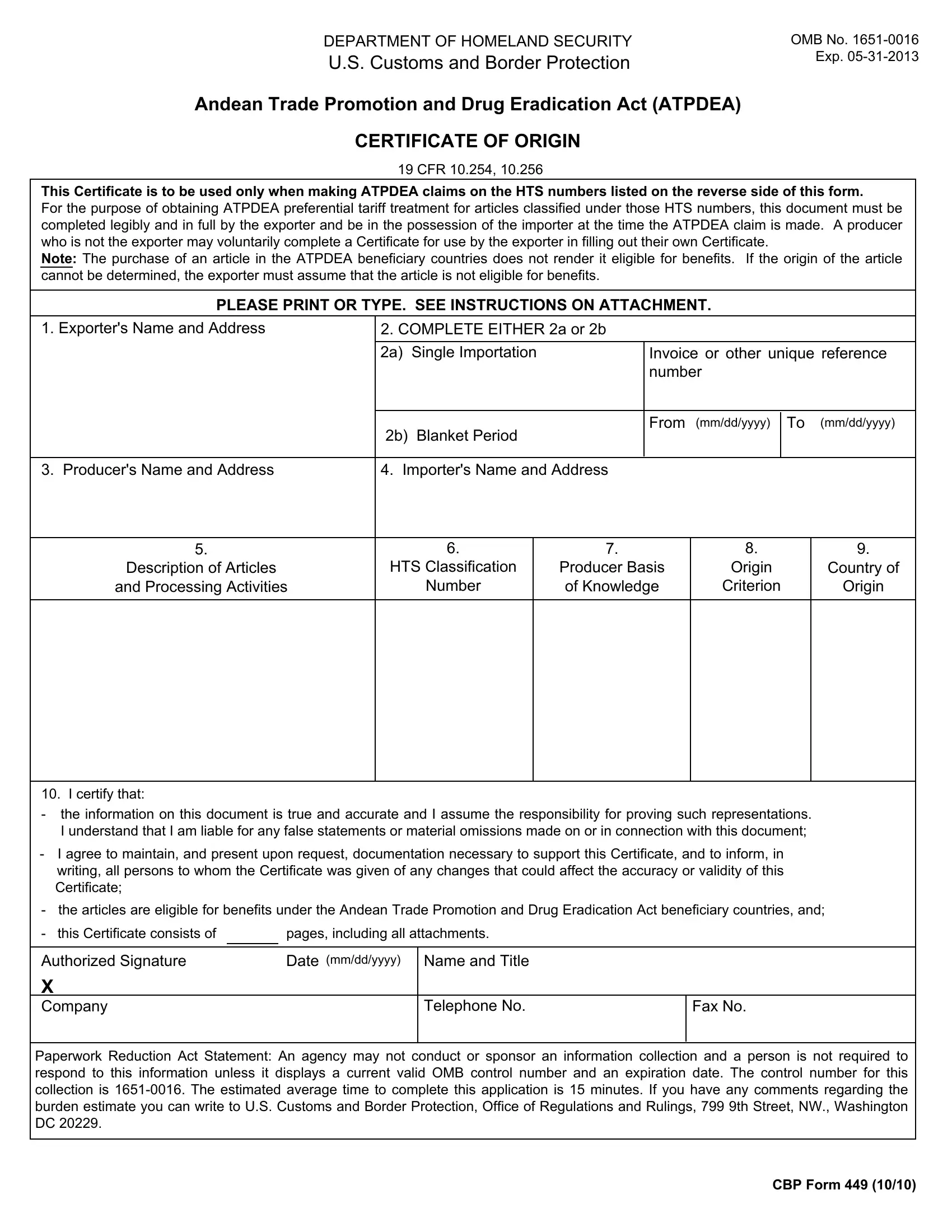

DEPARTMENT OF HOMELAND SECURITY |

OMB No. 1651-0016 |

U.S. Customs and Border Protection |

Exp. 05-31-2013 |

|

Andean Trade Promotion and Drug Eradication Act (ATPDEA)

CERTIFICATE OF ORIGIN

19 CFR 10.254, 10.256

This Certificate is to be used only when making ATPDEA claims on the HTS numbers listed on the reverse side of this form.

For the purpose of obtaining ATPDEA preferential tariff treatment for articles classified under those HTS numbers, this document must be completed legibly and in full by the exporter and be in the possession of the importer at the time the ATPDEA claim is made. A producer who is not the exporter may voluntarily complete a Certificate for use by the exporter in filling out their own Certificate.

Note: The purchase of an article in the ATPDEA beneficiary countries does not render it eligible for benefits. If the origin of the article cannot be determined, the exporter must assume that the article is not eligible for benefits.

PLEASE PRINT OR TYPE. SEE INSTRUCTIONS ON ATTACHMENT.

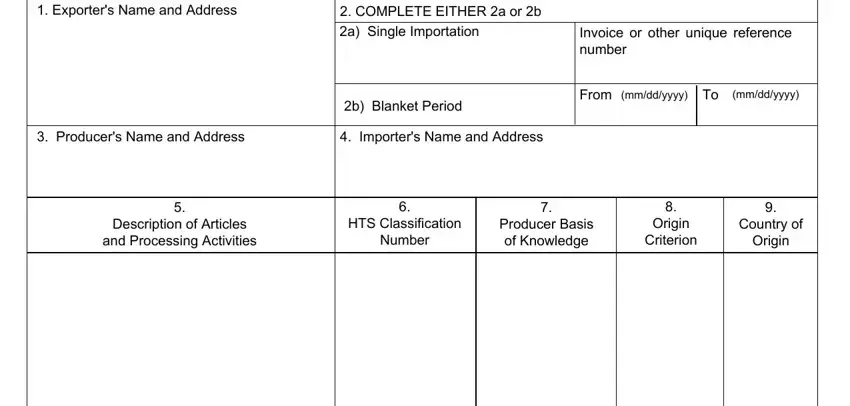

1. Exporter's Name and Address |

2. COMPLETE EITHER 2a or 2b |

|

|

|

|

|

|

|

|

2a) |

Single Importation |

Invoice or other unique reference |

|

|

|

number |

|

|

|

|

|

|

2b) |

Blanket Period |

From (mm/dd/yyyy) |

To (mm/dd/yyyy) |

|

|

|

|

|

|

|

3. Producer's Name and Address |

4. Importer's Name and Address |

|

|

5. |

6. |

|

7. |

|

8. |

9. |

|

Description of Articles |

|

HTS Classification |

|

Producer Basis |

Origin |

Country of |

|

and Processing Activities |

|

Number |

|

of Knowledge |

Criterion |

Origin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

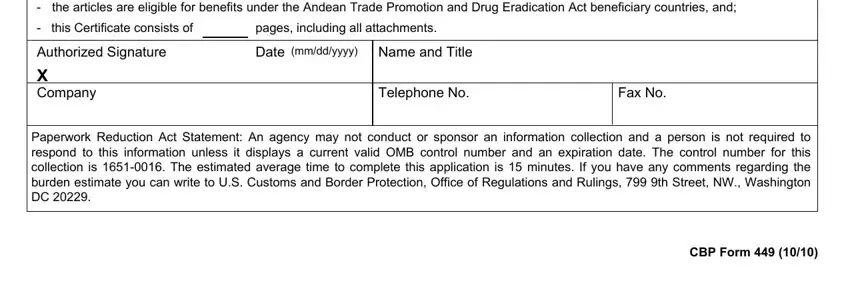

10. I certify that:

-the information on this document is true and accurate and I assume the responsibility for proving such representations. I understand that I am liable for any false statements or material omissions made on or in connection with this document;

-I agree to maintain, and present upon request, documentation necessary to support this Certificate, and to inform, in writing, all persons to whom the Certificate was given of any changes that could affect the accuracy or validity of this Certificate;

-the articles are eligible for benefits under the Andean Trade Promotion and Drug Eradication Act beneficiary countries, and;

- this Certificate consists of |

|

pages, including all attachments. |

|

|

|

|

|

|

|

|

|

|

|

Authorized Signature |

|

Date (mm/dd/yyyy) |

Name and Title |

|

X |

|

|

|

|

Company |

|

|

Telephone No. |

Fax No. |

|

|

|

|

|

Paperwork Reduction Act Statement: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number and an expiration date. The control number for this collection is 1651-0016. The estimated average time to complete this application is 15 minutes. If you have any comments regarding the burden estimate you can write to U.S. Customs and Border Protection, Office of Regulations and Rulings, 799 9th Street, NW., Washington DC 20229.

CBP Form 449 (10/10)

The following Harmonized Tariff Schedule (HTS) item numbers are eligible for Preferential Tariff Treatment under the Andean trade Promotion and Drug Eradication Act. For a detailed description of each tariff item number below, please refer to the current edition of the Harmonized Tariff Schedule of the United States. DO NOT USE THIS CERTIFICATE WITH HTS ITEM NUMBERS

NOT INCLUDED IN THE LIST BELOW.

2709 Petroleum oils and oils obtained from bituminous materials, crude: 2709.00.10 -.20

2710 Petroleum oils and oils obtained from bituminous minerals, other than crude; preparations not elsewhere specified or included, containing by weight 70 percent or more of petroleum oils or of oils obtained from bituminous minerals, these oils being the basic constituents of the preparations; waste oils:

2710.11.15-.45 2710.19.05-.45 2710.91.00 2710.99.05-.45

4202 Trunks, suitcases, vanity cases, attache cases, briefcases school satchels, ... and similar containers, of leather or of composition leather, of sheeting of plastics, of vulcanized fiber, or of paperboard, or wholly or mainly covered with such

materials or with paper: |

|

|

|

4202.11.00 |

4202.19.00 |

4202.22.15 |

4202.31.60 |

4202.92.45 |

4202.12.20 |

4202.21.30-.90 |

4202.29.90 |

4202.91.00 |

4202.99.90 |

4203 Articles of apparel and clothing accessories, of leather or of composition leather: |

|

4203.10.40 |

4203.29.08 |

4203.29.18 |

|

|

4602 Basketwork, wickerwork, and other articles, made directly to shape from plaiting materials or made up from articles of heading 4601; articles of loofah;

4602.10.21-.22 4602.10.25-.29

6116 Gloves, mittens and mitts, knitted or crocheted, containing over 50% by weight of plastics or rubber:

6116.10.44 6116.10.65

6216 Gloves, mittens and mitts, containing over 50% by weight of plastics or rubber:

6216.00.19 6216.00.19

6401 Waterproof footwear with outer soles and uppers of rubber or plastics, the uppers of which are neither fixed to the sole nor assembled by stitching, riveting, nailing, screwing, plugging or similar processes:

6401.92.60 |

|

|

|

6402 Other footwear with outer soles & uppers of rubber or plastics: |

|

6402.19.05-.15 |

6402.30.30 |

6402.91.40 |

6402.99.05-.18 |

6402.19.50-.90 |

6402.30.60-.90 |

6402.91.60-.70 |

6402.99.30-.70 |

6403 Footwear with outer soles of rubber, plastics, leather or composition leather and uppers of leather: |

6403.19.10 |

6403.40.30-.60 |

6403.59.15-.90 |

6403.99.20-.90 |

6403.19.30-.50 |

6403.51.30-.90 |

6403.91.30-.90 |

|

6404 Footwear with outer soles of rubber, plastics, leather or composition leather and uppers of textile materials:

6404.11.20-.80 |

6404.19.15 |

6404.19.25-.90 |

6404.20.20-.60 |

6405 Other footwear: |

|

|

|

6405.10.00 |

6405.20.30 |

6405.20.90 |

6405.90.90 |

6406 Parts of footwear (including uppers whether or not attached to soles other than outer soles); removable insoles, heel cushions and similar articles; gaiters, leggings and similar articles, and parts thereof:

6406.10.05-.50

9101 Wrist watches, pocket watches and other watches..., with cases of precious metal or of metal clad with precious metal:

9101.11.40-.80 |

9101.21.10-.30 |

9101.19.10-.80 |

|

|

9101.19.40-.80 |

9101.21.80 |

9101.99.40 |

|

|

9102 Wrist watches, pocket watches and other watches, other than those of heading 9101: |

|

9102.11.10-.95 |

9102.21.10-.90 |

9102.91.20-.80 |

|

|

9102.19.20-.80 |

9102.29.02-.60 |

|

|

|

9108 Watch movements, complete and assembled: |

|

|

9108.11.40-.80 |

9108.12.00 |

9108.19.40-.80 |

9108.90.10-.80 |

9108.90.90-.95 |

9110 Complete watch...movements, unassembled of partly assembled...; incomplete watch...movements, assembled; rough

watch...movements: |

|

|

|

9110.11.00-.12 |

9110.19.00 |

|

|

9111 Watch cases and parts thereof: |

|

|

9111.10.00 |

9111.20.20-.40 |

9111.80.00 |

9111.90.90-.70 |

9113 Watch bands, watch straps and watch bracelets, and parts thereof: |

9113.10.00 |

9113.20.20-.90 |

9113.90.40 |

9113.90.80 |

9114 Other...watch parts: |

|

|

9114.10.40 |

9114.30.80 |

9114.40.60 |

9114.90.40 |

9114.30.40 |

9114.40.20 |

9114.90.15 |

|

9821 Articles imported from a designated ATPDEA beneficiary country enumberated in U.S. note 1(a) to this subchapter; Tuna harvested by United States or ATPDEA beneficiary country vessels (19 CFR 10.252), that is prepared or preserved in any manner, in an ATPDEA beneficiary country, in foil or in other flexible airtight containers weighing with their contents not more than 6.8 kg each:

9821.01.01