You may prepare form ccc 855 usda effectively with our PDFinity® PDF editor. We are focused on giving you the perfect experience with our editor by regularly introducing new functions and upgrades. Our editor has become a lot more user-friendly thanks to the most recent updates! So now, filling out PDF forms is simpler and faster than ever before. To begin your journey, take these simple steps:

Step 1: Access the form inside our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: With this handy PDF tool, you'll be able to do more than merely complete blanks. Try each of the features and make your docs look great with custom text put in, or tweak the file's original input to excellence - all that comes along with an ability to incorporate almost any images and sign the file off.

Filling out this document generally requires care for details. Make sure that each blank field is filled in properly.

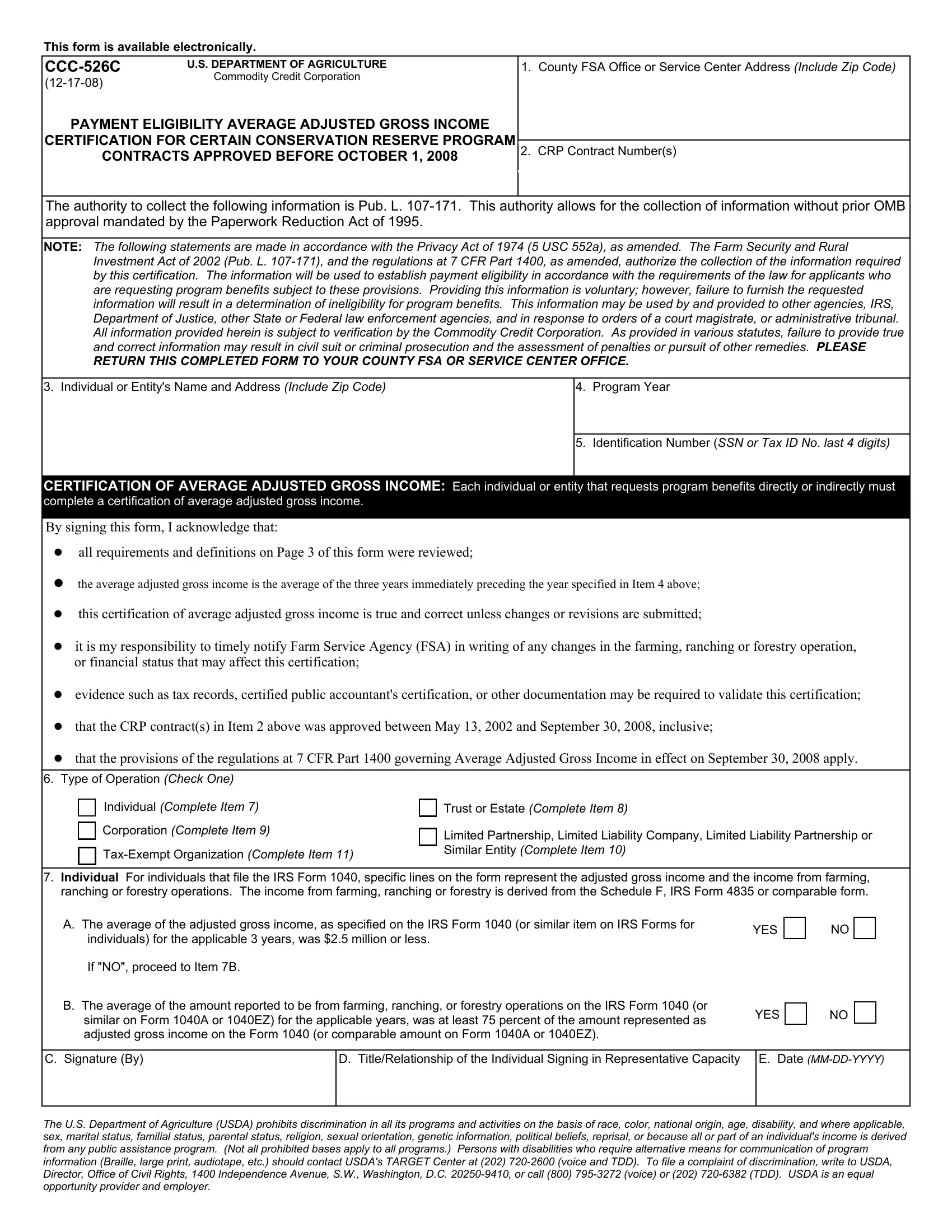

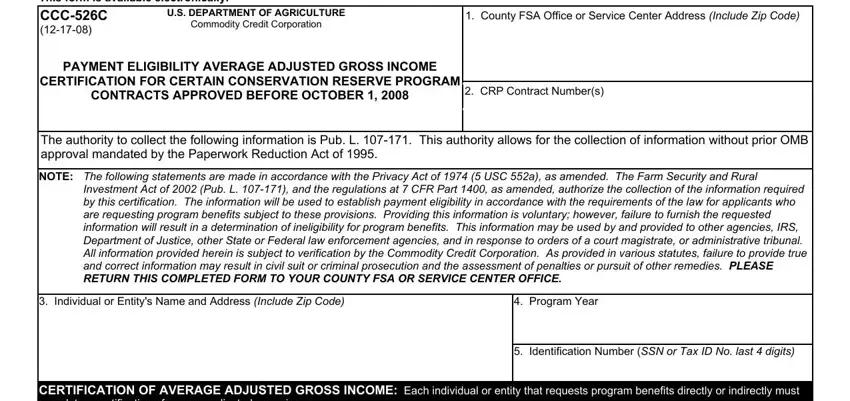

1. You will need to fill out the form ccc 855 usda properly, hence pay close attention while filling out the areas containing all of these blanks:

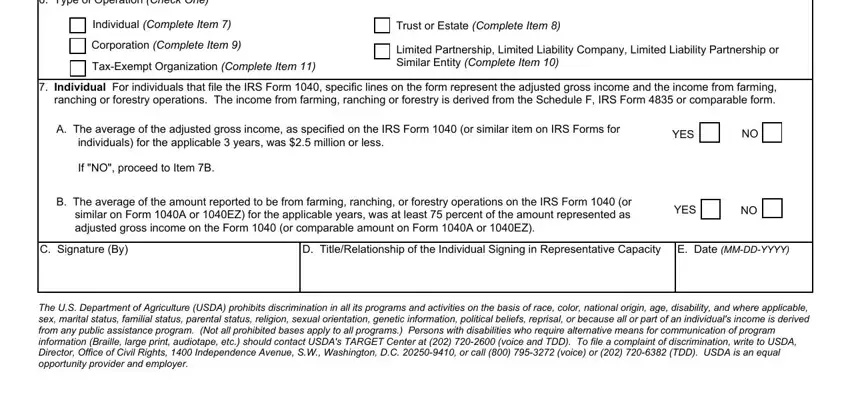

2. Now that this array of fields is finished, you're ready to add the required specifics in Type of Operation Check One, Individual Complete Item, Corporation Complete Item, TaxExempt Organization Complete, Trust or Estate Complete Item, Limited Partnership Limited, Individual For individuals that, A The average of the adjusted, YES, If NO proceed to Item B, B The average of the amount, YES, C Signature By, D TitleRelationship of the, and E Date MMDDYYYY in order to progress further.

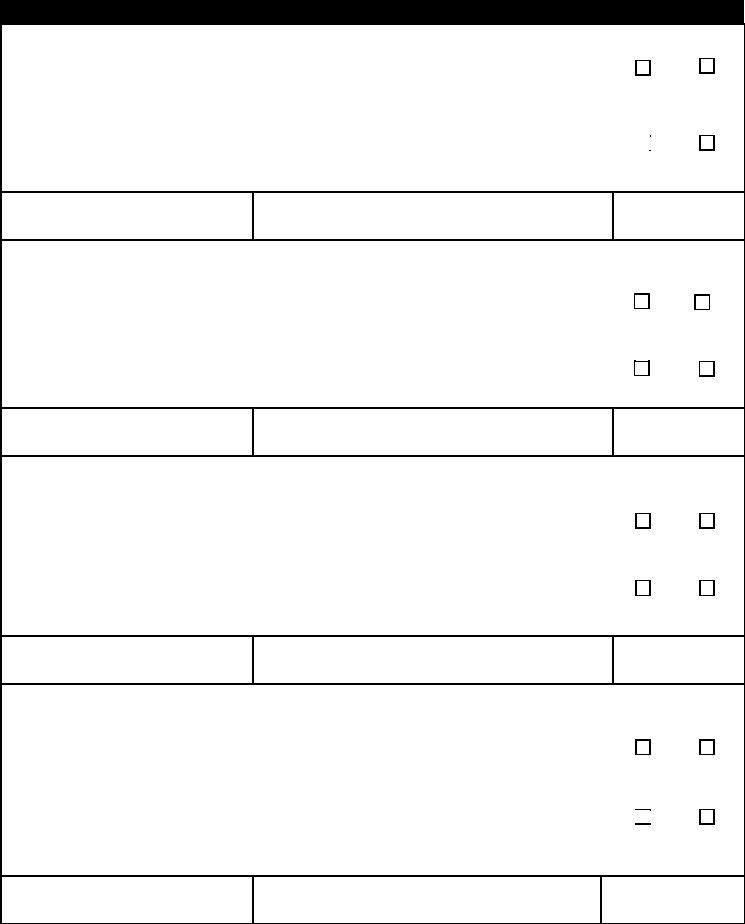

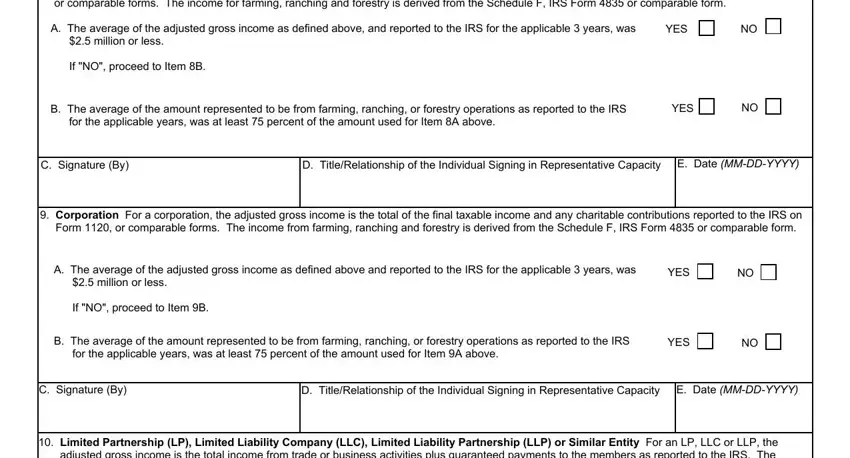

3. In this particular step, examine Trust or Estate For a trust or, A The average of the adjusted, YES, If NO proceed to Item B, B The average of the amount, YES, C Signature By, D TitleRelationship of the, E Date MMDDYYYY, Corporation For a corporation the, A The average of the adjusted, YES, If NO proceed to Item B, B The average of the amount, and YES. Each of these need to be filled in with utmost accuracy.

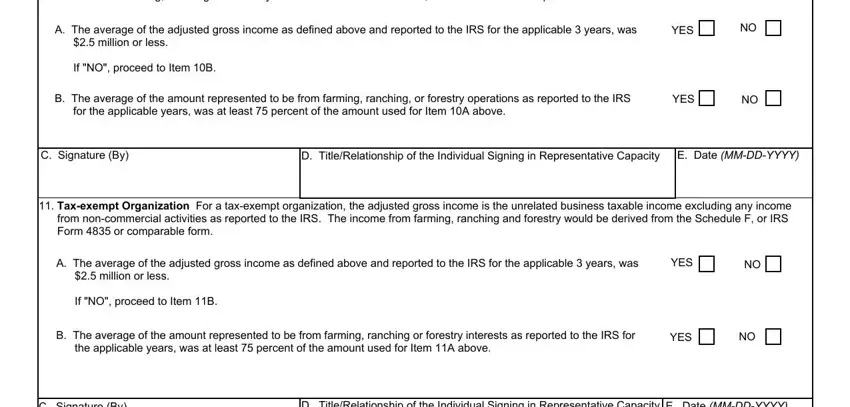

4. This next section requires some additional information. Ensure you complete all the necessary fields - Limited Partnership LP Limited, A The average of the adjusted, YES, If NO proceed to Item B, B The average of the amount, YES, C Signature By, D TitleRelationship of the, E Date MMDDYYYY, Taxexempt Organization For a, A The average of the adjusted, YES, If NO proceed to Item B, B The average of the amount, and YES - to proceed further in your process!

5. The last step to complete this form is crucial. You need to fill in the required blanks, for instance C Signature By, D TitleRelationship of the, and E Date MMDDYYYY, before using the file. Or else, it may lead to an incomplete and probably unacceptable form!

You can certainly make errors when completing your E Date MMDDYYYY, and so make sure to go through it again prior to when you finalize the form.

Step 3: Just after double-checking the fields and details, hit "Done" and you're all set! Right after setting up afree trial account here, it will be possible to download form ccc 855 usda or email it at once. The PDF will also be readily available in your personal account page with all of your changes. At FormsPal, we aim to make sure your details are maintained private.