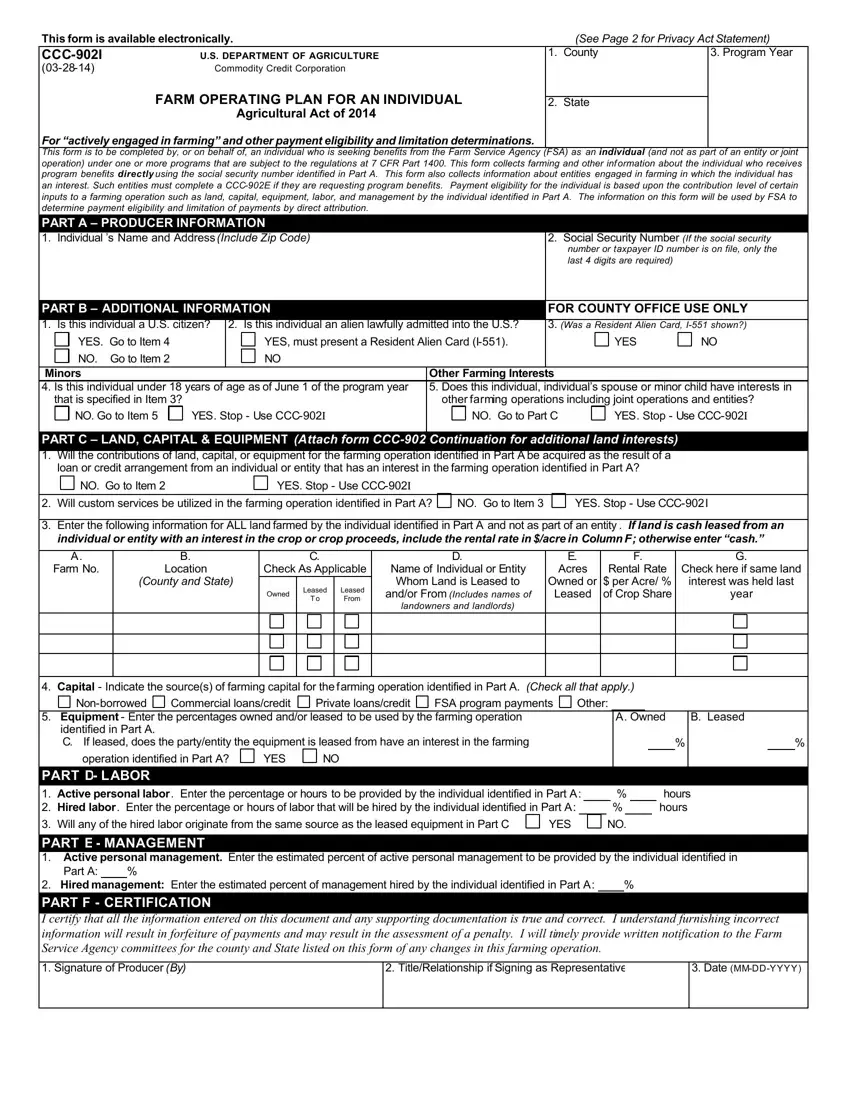

This form is available electronically. |

|

(See Page 2 for Privacy Act Statement) |

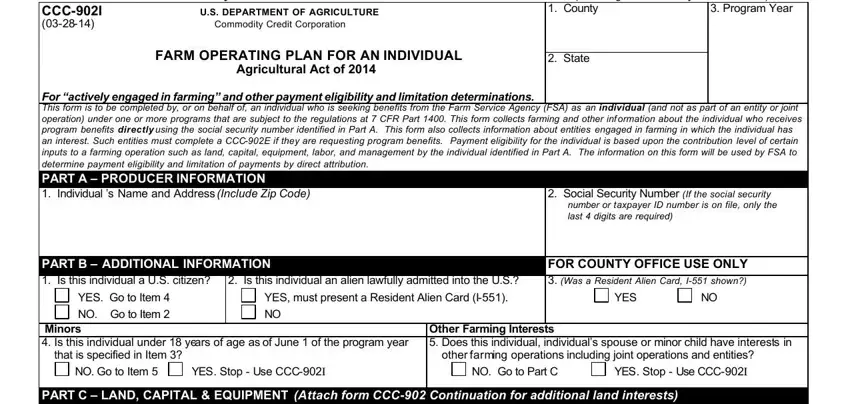

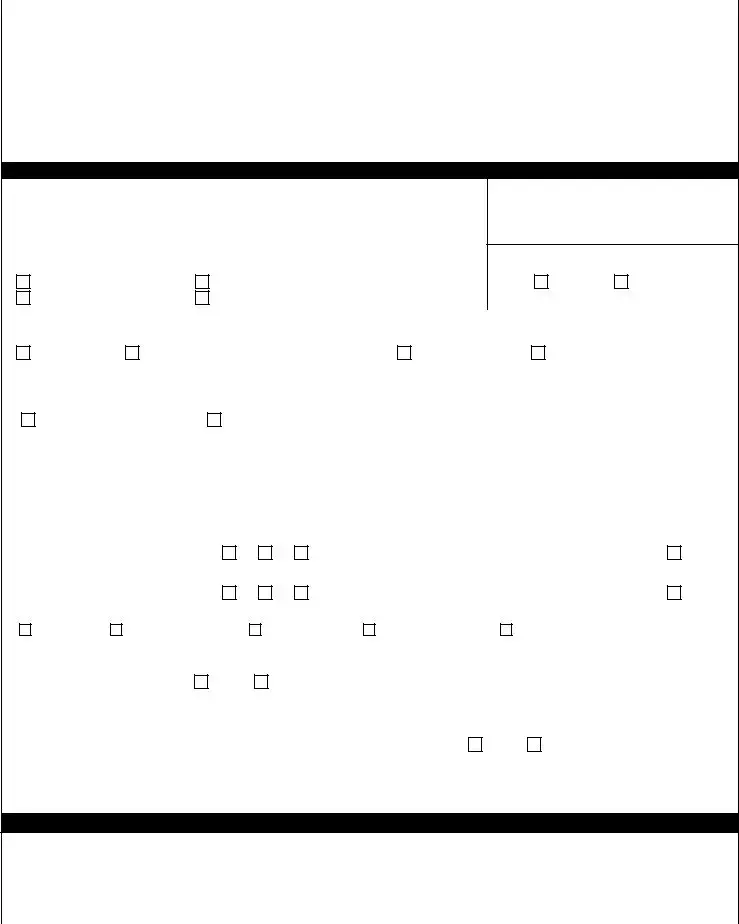

CCC-902I |

U.S. DEPARTMENT OF AGRICULTURE |

1. |

County |

3. Program Year |

(03-28-14) |

Commodity Credit Corporation |

|

|

|

|

FARM OPERATING PLAN FOR AN INDIVIDUAL |

|

|

|

|

2. |

State |

|

|

Agricultural Act of 2014 |

|

|

|

For “actively engaged in farming” and other payment eligibility and limitation determinations. |

|

|

|

This form is to be completed by, or on behalf of, an individual who is seeking benefits from the Farm Service Agency (FSA) as an individual (and not as part of an entity or joint operation) under one or more programs that are subject to the regulations at 7 CFR Part 1400. This form collects farming and other information about the individual who receives program benefits directly using the social security number identified in Part A. This form also collects information about entities engaged in farming in which the individual has an interest. Such entities must complete a CCC-902E if they are requesting program benefits. Payment eligibility for the individual is based upon the contribution level of certain inputs to a farming operation such as land, capital, equipment, labor, and management by the individual identified in Part A. The information on this form will be used by FSA to determine payment eligibility and limitation of payments by direct attribution.

PART A – PRODUCER INFORMATION

1. Individual ’s Name and Address(Include Zip Code) |

2. Social Security Number (If the social security |

|

number or taxpayer ID number is on file, only the |

|

last 4 digits are required) |

|

PART B – ADDITIONAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

FOR COUNTY OFFICE USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Is this individual a U.S. citizen? |

2. |

Is this individual an alien lawfully admitted into the U.S.? |

3. (Was a Resident Alien Card, I-551 shown?) |

|

|

YES. Go to Item 4 |

|

|

YES, must present a Resident Alien Card (I-551). |

|

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

|

NO |

|

|

NO. |

Go to Item 2 |

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Farming Interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Is this individual under 18 years of age as of June 1 of the program year |

5. Does this individual, individual’s spouse or minor child have interests in |

|

|

that is specified in Item 3? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

other farming operations including joint operations and entities? |

|

|

NO. Go to Item 5 |

YES. Stop - Use CCC-902I |

|

|

|

|

|

|

|

NO. Go to Part C |

|

|

|

|

|

|

|

|

YES. Stop - Use CCC-902I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART C – LAND, CAPITAL & EQUIPMENT (Attach form CCC-902 Continuation for additional land interests) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

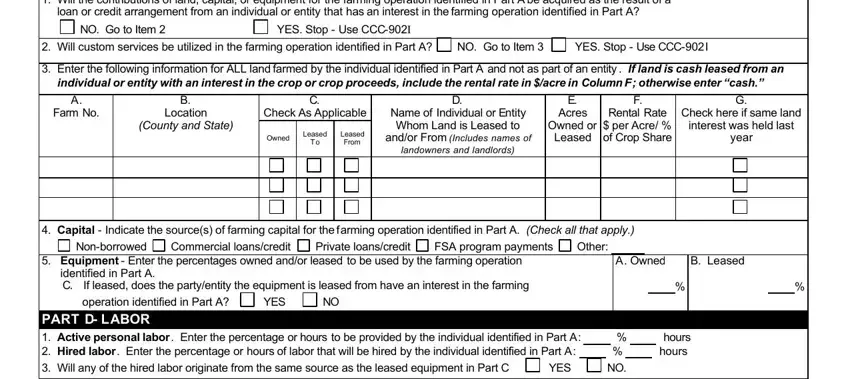

1. |

Will the contributions of land, capital, or equipment for the farming operation identified in Part A be acquired as the result of a |

|

|

|

|

|

|

|

loan or credit arrangement from an individual or entity that has an interest in the farming operation identified in Part A? |

|

|

|

|

|

|

|

|

|

|

|

|

NO. Go to Item 2 |

|

|

YES. Stop - Use CCC-902I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Will custom services be utilized in the farming operation identified in Part A? |

|

|

NO. Go to Item 3 |

|

|

|

YES. Stop - Use CCC-902I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Enter the following information for ALL land farmed by the individual identified in Part A and not as part of an entity . If land is cash leased from an |

|

|

individual or entity with an interest in the crop or crop proceeds, include the rental rate in $/acre in Column F; otherwise enter “cash.” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

|

|

|

B. |

|

|

|

|

|

C. |

|

|

|

|

|

|

|

D. |

|

|

|

E. |

|

|

|

|

|

F. |

|

|

|

|

|

|

G. |

|

|

Farm No. |

|

|

|

Location |

|

Check As Applicable |

Name of Individual or Entity |

|

|

Acres |

|

Rental Rate |

Check here if same land |

|

|

|

|

|

(County and State) |

|

|

|

|

Leased |

|

Leased |

Whom Land is Leased to |

Owned or |

$ per Acre/ % |

|

interest was held last |

|

|

|

|

|

|

|

|

|

Owned |

|

and/or From (Includes names of |

|

Leased |

of Crop Share |

|

year |

|

|

|

|

|

|

|

|

|

|

To |

|

From |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

landowners and landlords) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Capital - Indicate the source(s) of farming capital for the farming operation identified in Part A. (Check all that apply.) |

|

|

|

|

|

|

|

|

|

|

|

|

Non-borrowed |

Commercial loans/credit |

|

Private loans/credit |

|

FSA program payments |

|

Other: |

|

|

|

|

|

|

|

|

|

|

5. |

Equipment - Enter the percentages owned and/or leased to be used by the farming operation |

|

|

|

|

|

|

|

|

|

|

A. Owned |

B. Leased |

|

|

identified in Part A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. If leased, does the party/entity the equipment is leased from have an interest in the farming |

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

% |

|

|

operation identified in Part A? |

|

YES |

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART D- LABOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Active personal labor. Enter the percentage or hours to be provided by the individual identified in Part A: |

|

|

% |

|

|

|

|

hours |

2. |

Hired labor. Enter the percentage or hours of labor that will be hired by the individual identified in Part A: |

|

|

% |

|

|

|

|

|

hours |

|

|

|

|

|

3. |

Will any of the hired labor originate from the same source as the leased equipment in Part C |

YES |

|

NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

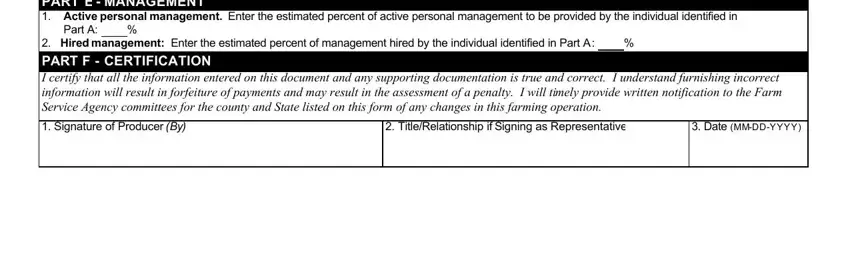

PART E - MANAGEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Active personal management. Enter the estimated percent of active personal management to be provided by the individual identified in |

|

|

Part A: |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Hired management: Enter the estimated percent of management hired by the individual identified in Part A: |

|

|

% |

|

|

|

|

|

|

|

|

|

|

PART F - CERTIFICATION

I certify that all the information entered on this document and any supporting documentation is true and correct. I understand furnishing incorrect information will result in forfeiture of payments and may result in the assessment of a penalty. I will timely provide written notification to the Farm Service Agency committees for the county and State listed on this form of any changes in this farming operation.

1. Signature of Producer (By) |

2. Title/Relationship if Signing as Representative |

3. Date (MM-DD-YYYY) |

|

|

|

CCC-902I Short Form (03-28-14) |

Page 2 of 2 |

DEFINITIONS

The following definitions apply to Form CCC-902I Short Form.

1.ACTIVELY ENGAGED IN FARMING – means providing both: 1) significant contributions of capital, equipment, or land, or combination thereof to the farming operation; and 2) significant contributions of active personal labor or active personal management, or a combination thereof, to the farming operation as described. Further, for a person or legal entity to be considered actively engaged in farming for program payment purposes, the contributions of the person or legal entity must be at-risk and commensurate with the person's or legal entity's claimed share of the profit and loss of the farming operation. Failure to meet these requirements will result in the determination of ineligibility for payments under programs specified in 7 CFR Part 1400.

2.INTEREST IN A FARMING OPERATION– a person or legal entity is considered to have an interest in a particular farming operation if the person or legal entity owns or rents land to or from that farming operation; has an interest in the agricultural commodities produced on the operation; or is a member of a joint operation that either owns or rents land to or from the farming operation, or has an interest in the agricultural commodities produced on that operation.

3.JOINT OPERATION- is a general partnership, joint venture, or similar organization.

4.PERSON – is a natural person (an individual) and does not include a legal entity.

5.ACTIVE PERSONAL LABOR – a person is considered to be providing active personal labor with respect to a farming operation if that person is directly and personally providing physical activities necessary to conduct the farming operation, including land preparation, planting, cultivating, harvesting, and marketing of agricultural commodities. Other qualifying physical activities include establishing and maintaining conserving covers and those physical activities necessary for livestock production for the farming operation.

6.ACTIVE PERSONAL MANAGEMENT– a person is considered to be providing active personal management with respect to a farming operation if that person is directly and personally providing the general supervision and direction of activities and labor involved in the farming operation; or providing services (whether performed on-site or off-site) reasonably related and necessary to the farming operation.

7.CAPITAL – with respect to afarming operation is the funding provided by a person or legal entity to the farming operation in order for such operation to conduct farming activities. To be considered a countable contribution for a person or legal entity, the capital must have been derived from a fund or account separate and distinct from that of any other person or entity involved in such operation. Countable capital does not include the value of any labor or management which is contributed to the farming operation. A capital contribution may be a direct non-borrowed (out -of-pocket) input of a specified sum or an amount borrowed by the person or entity. Capital does not include advance program payments.

8.CONTRIBUTION – with respect to a farming operation isthe provision of land, capital or equipment assets, and providing active personal labor, or active personal management to the farming operation in exchange for, or the expectation of, deriving benefits based solely on the success of the farming operation.

9.CUSTOM SERVICES – with respect to a farming operation is the hiring of a contractor or vendor that is in the business of providing such specialized services to perform services for the farming operation in exchange for the payment of a fee for such services performed.

10.ENTITY - is a corporation, joint stock company, limited liability company, association, limited partnership, limited liability partnership, irrevocable trust, revocable trust, estate, charitable organization, or other similar organization including any such organization participating in the farming operation as a partner in a general partnership, participant in a joint venture, a grantor of a revocable trust, or as a participant in a similar organization.

11.EQUIPMENT – with respect to a farming operation is the machinery and implements needed to conduct activities of the farming operation including machinery and implements used for land preparation, planting, cultivating, harvesting or marketing crops. Equipment also includes machinery and implements needed to establish and maintain conserving covers.

12.FAMILY MEMBER – a person is considered to be a family member of another person in the farming operation of that person is related to the other as a lineal ancestor, lineal descendant, sibling, spouse, or otherwise by marriage.

13.FARMING OPERATION - is a business enterprise engaged in the production of agricultural products which is operated by a person or a formal or informal entity which is eligible to receive payments, directly or indirectly.

14.LAND – with a respect to a contribution to a farming operation is farmland consisting of cropland, pastureland, wetland, or rangeland which meets the specific requirements of the applicable program for which payments or benefits are sought.

15.SUPPORTING DOCUMENTATION– is any information that supports the relevant representations made such as, but not limited to: articles of incorporation; corporate meeting minutes; stock certificates; organizational papers; trust agreement; last will or testament or a deceased individual; affidavit of heirship approved by Office of General Counsel; partnership agreement; property lease agreement; purchase agreement; land deed; lending security agreement; and financial statement.

16.All other terms utilized in this form shall be defined pursuant to 7 CFR Part 1400.

NOTE: The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a – as amended). The authority for requesting the information identified on this form is 7 CFR Part 1400, the Commodity Credit Corporation Charter Act (15 U.S.C. 714 et seq.), and the Agricultural Act of 2014 (Pub. L. 113-79). The

information will be used to identify the farm operating plan data needed to determine an individual’s eligibility for program benefits. The information collected on this form may be disclosed to other Federal, State, Local government agencies, Tribal agencies, and nongovernmental entities that have been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses identified in the System of Records Notice for USDA/FSA-2, Farm Records File (Automated). Providing the requested information is voluntary. However, failure to furnish the requested information will result in a determination of ineligibility for program benefits.

This information collection is exempted from the Paperwork Reduction Act as specified in the Agricultural Act of 2014 (Pub. L. 113-79, Title I, Subtitle F, Administration). The provisions of criminal and civil fraud, privacy and other statutes may be applicable to the information provided. RETURN THIS COMPLETED

FORM TO YOUR COUNTY FSA OFFICE.

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers, employees, and applicants for employment on the basis of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited bases will apply to all programs and/or employment activities.) Persons with disabilities, who wish to file a program complaint, write to the addres s below or if you require alternative means of communication for program information (e.g., Braille, large print, audiotape, etc.) please contact USDA’s TARGET Center at (202) 720-2600 (voice and TDD). Individuals who are deaf, hard of hearing, or have speech disabilities and wish to file either an EEO or program complaint, please contact USDA through the Federal Relay Service at (800) 877-8339 or (800) 845-6136 (in Spanish).

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866) 632-9992 to request the form. You may also write a letter containing all of the information requested in the form. Send your completed complaint form or letter by mail to U.S. Department of Agriculture, Director, Office of Adjudication, 1400 Independence Avenue, S.W., Washington, D.C. 20250-9410, by fax (202) 690-7442 or email at program.intake@usda.gov. USDA is an equal opportunity provider and employer.