When using the online PDF tool by FormsPal, you may complete or alter department agriculture 931 here. Our development team is continuously endeavoring to enhance the tool and help it become much easier for users with its handy features. Discover an constantly revolutionary experience now - check out and find out new possibilities as you go! All it takes is several basic steps:

Step 1: Press the orange "Get Form" button above. It is going to open our editor so you can start filling in your form.

Step 2: This editor allows you to change PDF files in various ways. Transform it by adding any text, adjust what's originally in the PDF, and add a signature - all doable within minutes!

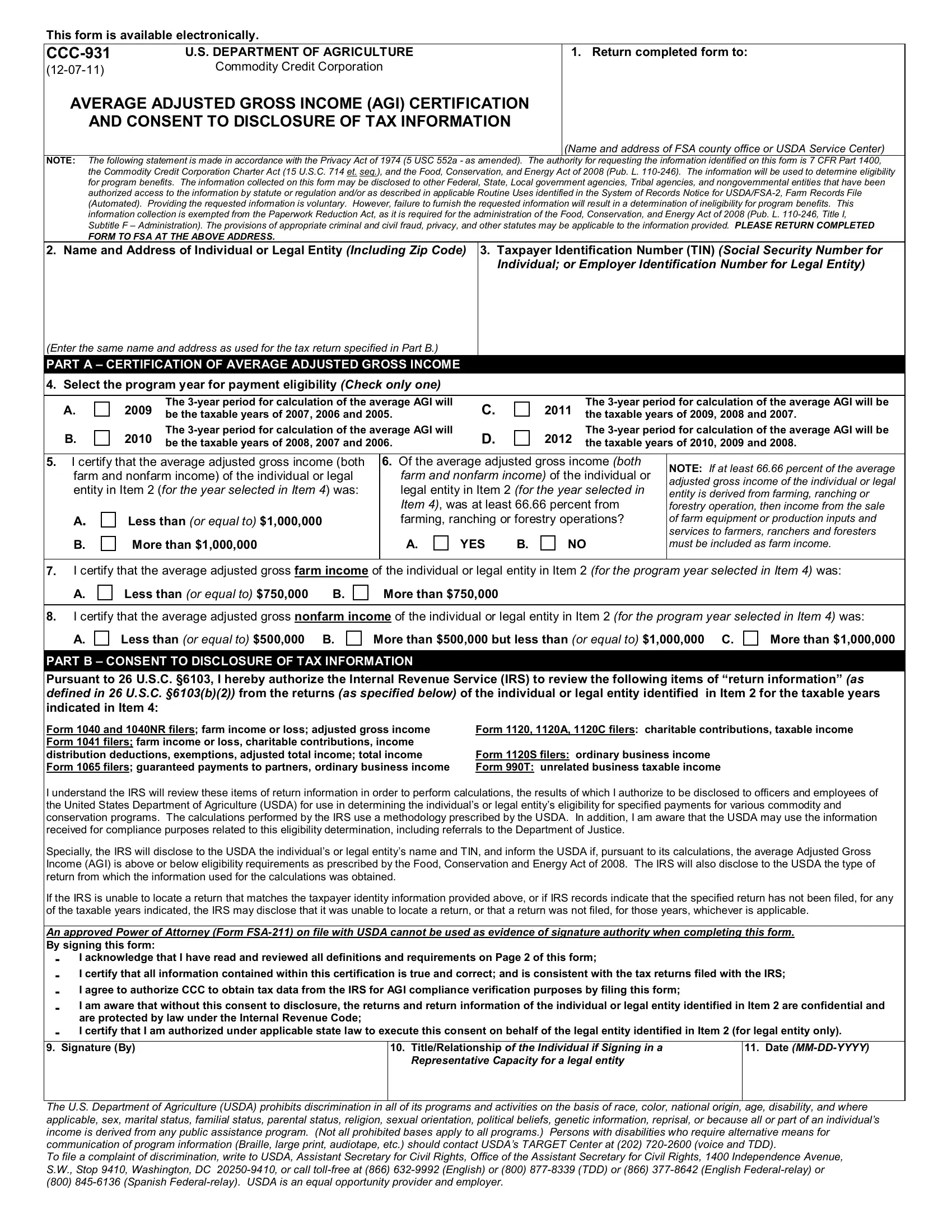

This form will need particular details to be entered, so you need to take the time to type in exactly what is asked:

1. For starters, while completing the department agriculture 931, begin with the area that has the following fields:

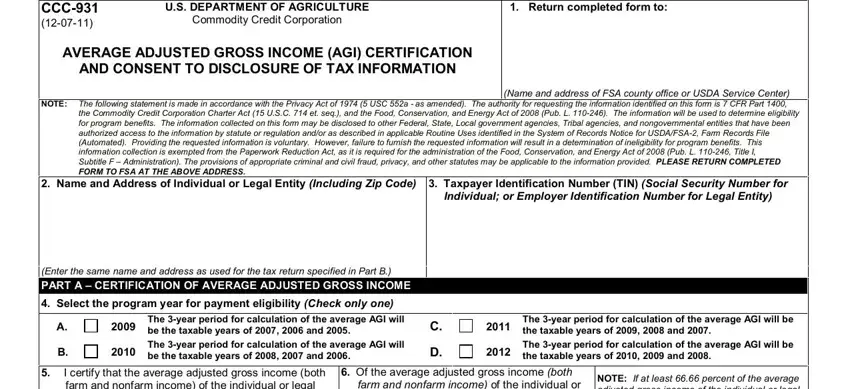

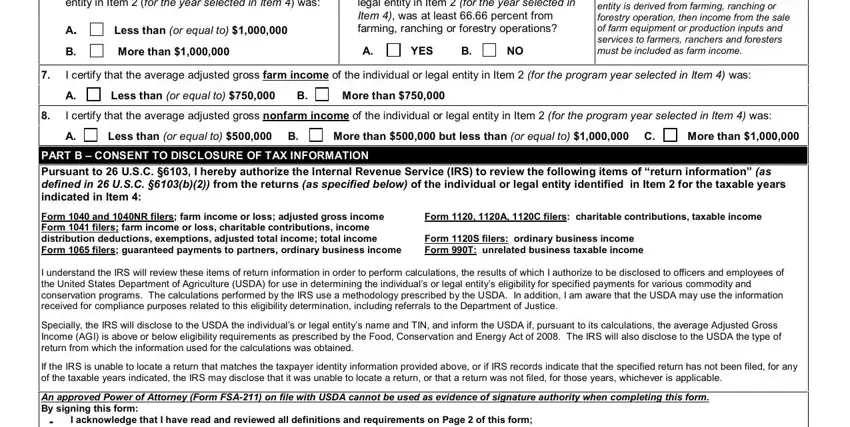

2. Once your current task is complete, take the next step – fill out all of these fields - farm and nonfarm income of the, Less than or equal to, More than, YES B, farm and nonfarm income of the, NOTE If at least percent of the, I certify that the average, Less than or equal to B, More than, I certify that the average, Less than or equal to B, More than but less than or equal, More than, PART B CONSENT TO DISCLOSURE OF, and Form and NR filers farm income or with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

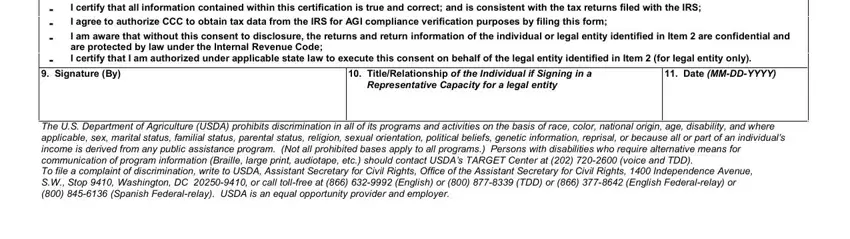

3. Completing I certify that all information, I agree to authorize CCC to obtain, I am aware that without this, Signature By, TitleRelationship of the, Date MMDDYYYY, Representative Capacity for a, and The US Department of Agriculture is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

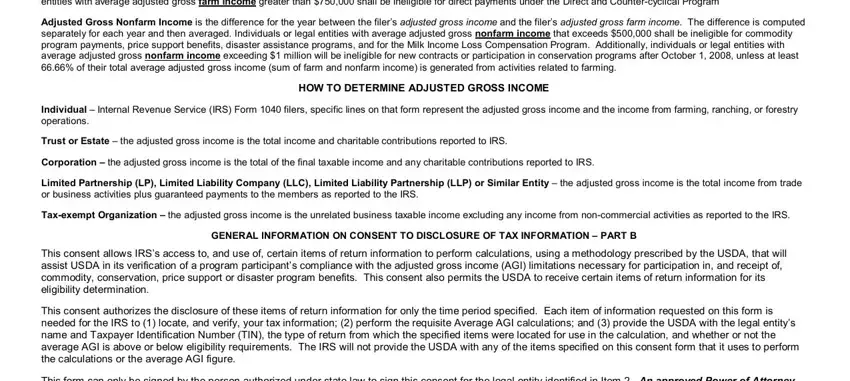

4. Completing Adjusted Gross Farm Income is the, Adjusted Gross Nonfarm Income is, Individual Internal Revenue, HOW TO DETERMINE ADJUSTED GROSS, Trust or Estate the adjusted, Corporation the adjusted gross, Limited Partnership LP Limited, Taxexempt Organization the, GENERAL INFORMATION ON CONSENT TO, This consent allows IRSs access to, This consent authorizes the, and This form can only be signed by is vital in the fourth step - make sure you be patient and take a close look at each and every blank area!

It is possible to make errors while completing your Individual Internal Revenue, therefore make sure that you reread it prior to when you submit it.

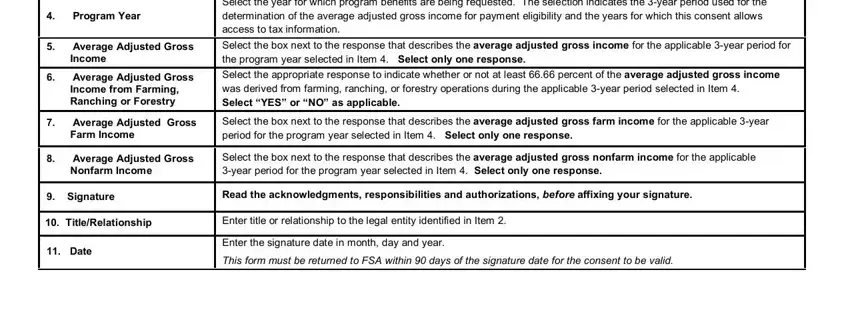

5. Last of all, the following last part is precisely what you'll want to wrap up before finalizing the form. The blanks at issue include the following: Program Year, Select the year for which program, Average Adjusted Gross, Income, Select the box next to the, Average Adjusted Gross, Income from Farming Ranching or, Average Adjusted Gross, Farm Income, Select the appropriate response to, Average Adjusted Gross, Nonfarm Income, Select the box next to the, Signature, and Read the acknowledgments.

Step 3: Before finishing the form, check that blank fields have been filled in the correct way. Once you establish that it is fine, click “Done." Make a 7-day free trial account with us and gain instant access to department agriculture 931 - with all transformations preserved and accessible in your personal cabinet. With FormsPal, you can certainly fill out documents without having to get worried about information incidents or records being distributed. Our protected software ensures that your personal information is maintained safely.