Florida can be filled out online without any problem. Just open FormsPal PDF editor to complete the task promptly. Our tool is constantly evolving to grant the best user experience attainable, and that is thanks to our dedication to continuous improvement and listening closely to user feedback. To get the ball rolling, go through these simple steps:

Step 1: First of all, access the tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: This editor allows you to change your PDF file in a range of ways. Modify it with personalized text, adjust what is already in the PDF, and place in a signature - all readily available!

This PDF form will need you to enter specific information; in order to ensure accuracy, make sure you consider the tips hereunder:

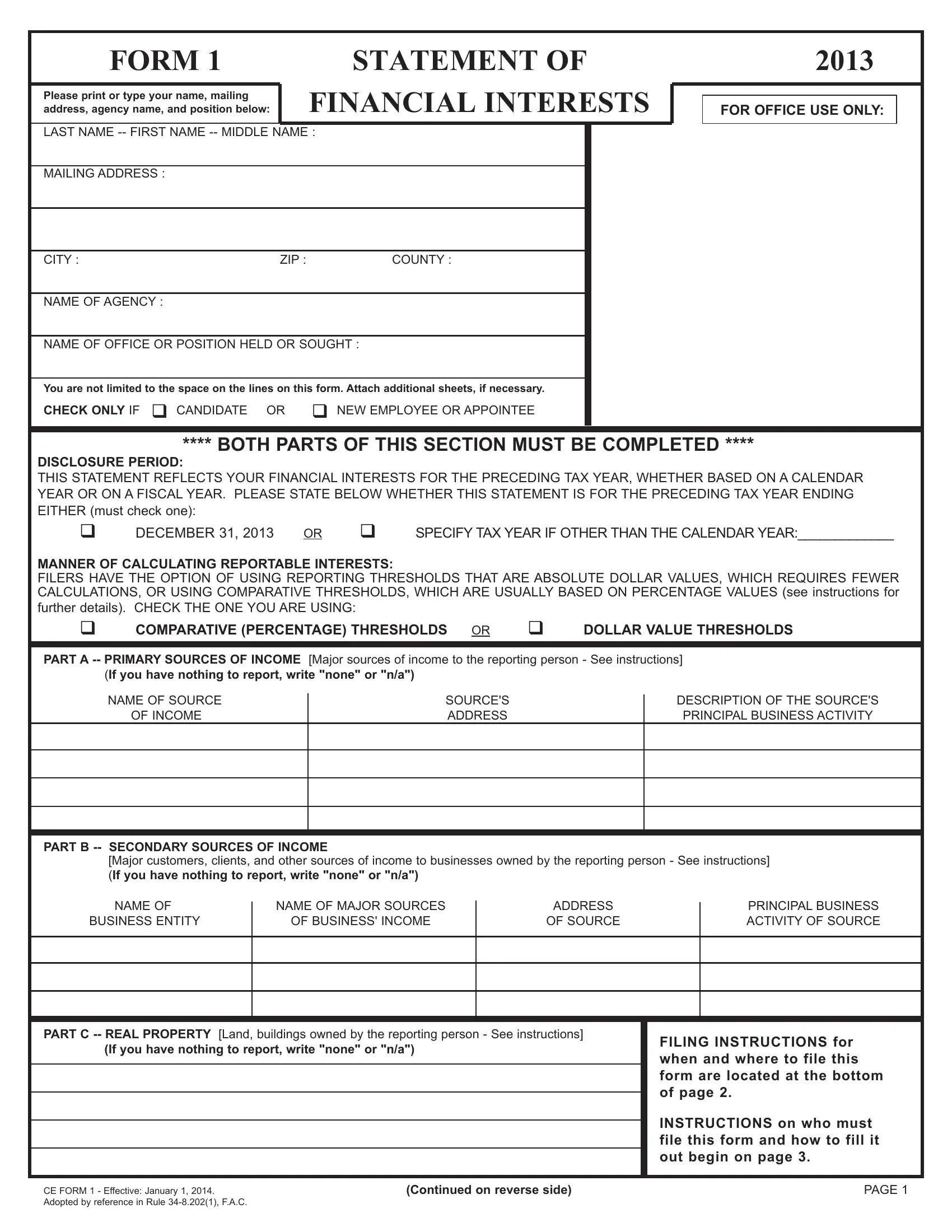

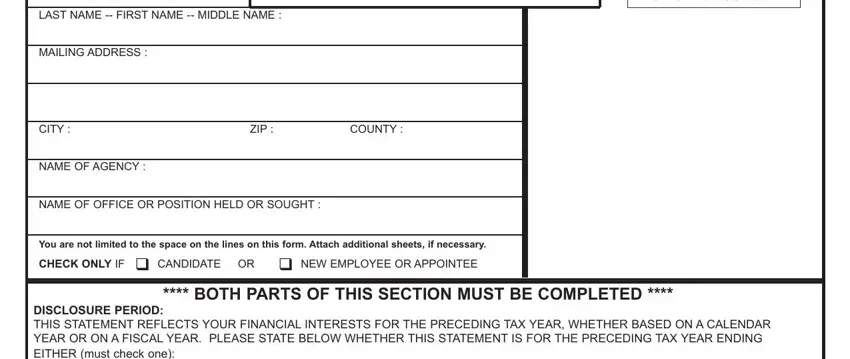

1. First of all, when completing the Florida, beging with the section with the following fields:

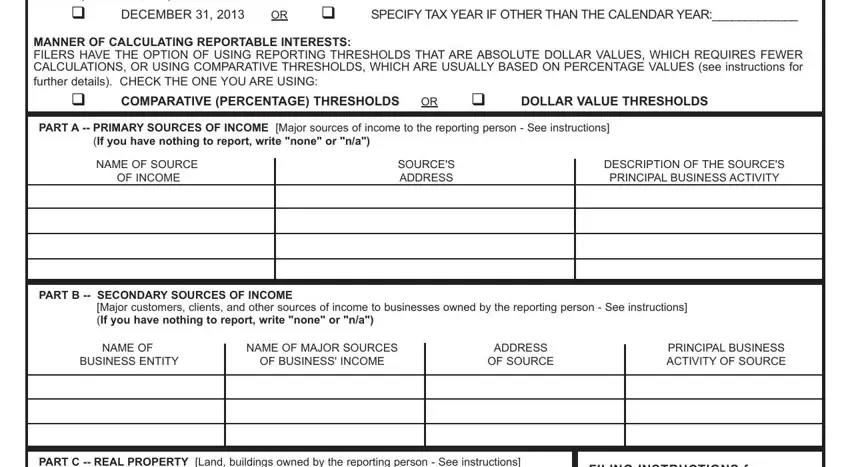

2. The subsequent part is to complete all of the following blank fields: DISCLOSURE PERIOD THIS STATEMENT, OR cid SPECIFY TAX YEAR IF OTHER, MANNER OF CALCULATING REPORTABLE, cid DOLLAR VALUE THRESHOLDS, PART A PRIMARY SOURCES OF INCOME, NAME OF SOURCE, OF INCOME, SOURCES ADDRESS, DESCRIPTION OF THE SOURCES, PRINCIPAL BUSINESS ACTIVITY, PART B SECONDARY SOURCES OF INCOME, Major customers clients and other, NAME OF, BUSINESS ENTITY, and NAME OF MAJOR SOURCES.

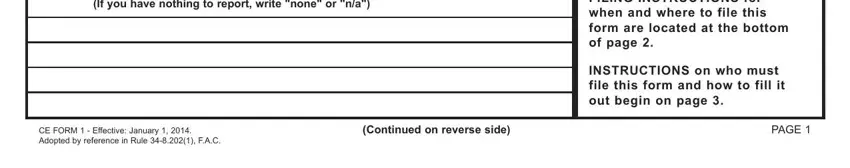

3. The following part is typically rather simple, PART C REAL PROPERTY Land, FILING INSTRUCTIONS for when and, INSTRUCTIONS on who must file this, CE FORM Effective January, Continued on reverse side, and PAGE - all of these fields has to be filled out here.

Lots of people often make errors when filling in INSTRUCTIONS on who must file this in this area. You need to read again everything you enter right here.

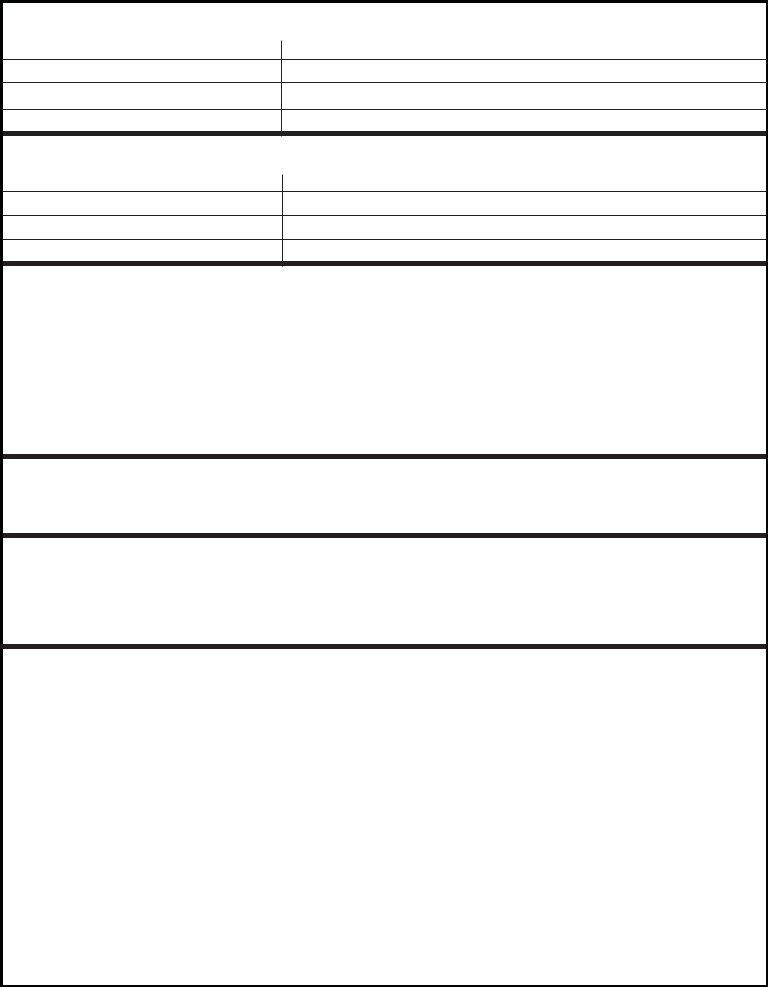

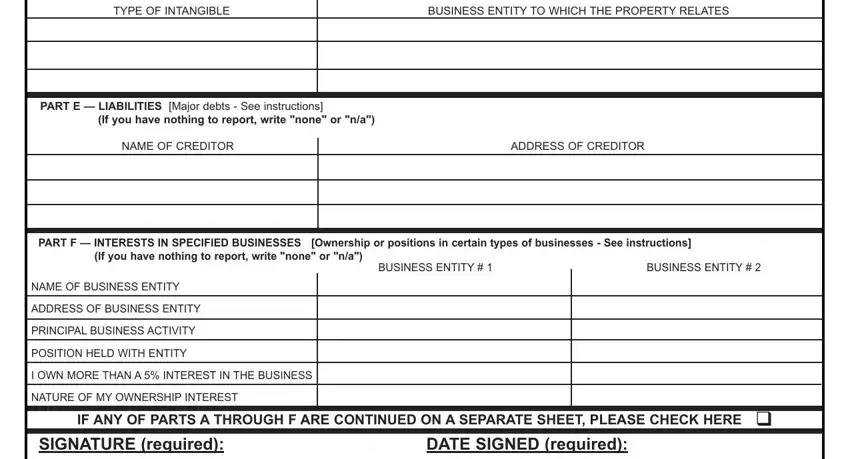

4. This next section requires some additional information. Ensure you complete all the necessary fields - TYPE OF INTANGIBLE, BUSINESS ENTITY TO WHICH THE, PART E LIABILITIES Major debts, NAME OF CREDITOR, ADDRESS OF CREDITOR, PART F INTERESTS IN SPECIFIED, BUSINESS ENTITY, If you have nothing to report, BUSINESS ENTITY, NAME OF BUSINESS ENTITY, ADDRESS OF BUSINESS ENTITY, PRINCIPAL BUSINESS ACTIVITY, POSITION HELD WITH ENTITY, I OWN MORE THAN A INTEREST IN THE, and NATURE OF MY OWNERSHIP INTEREST - to proceed further in your process!

Step 3: Check what you've entered into the blanks and then hit the "Done" button. Join us today and instantly get access to Florida, available for download. All modifications you make are preserved , enabling you to edit the document later on if necessary. When you work with FormsPal, you're able to fill out forms without worrying about information leaks or entries getting distributed. Our secure platform makes sure that your private information is maintained safely.