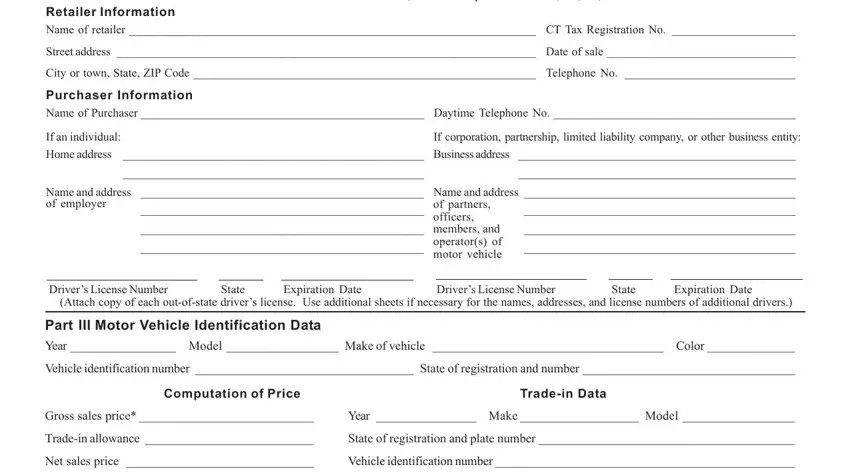

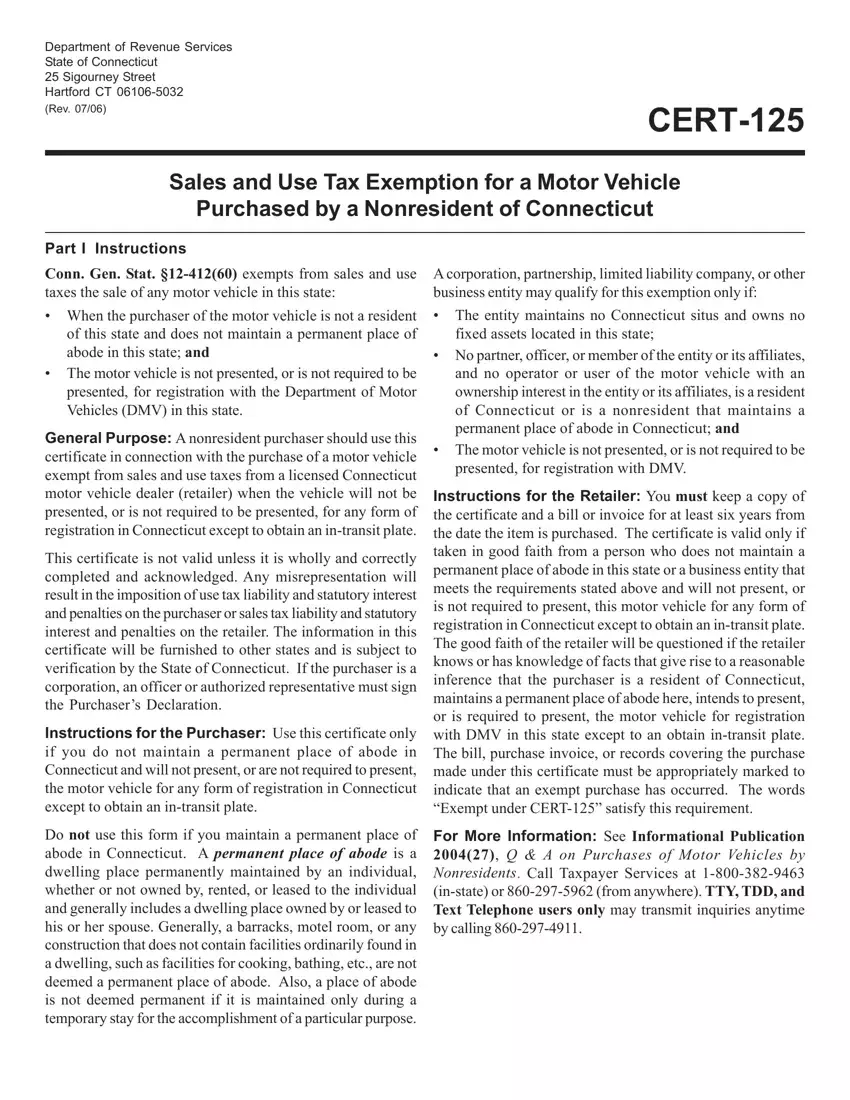

Part II Retailer and Purchaser - Read instructions first, then complete Parts II, III, IV, and V.

Retailer Information

Name of retailer _____________________________________________________________________ |

CT Tax Registration No. _____________________ |

Street address _______________________________________________________________________ |

Date of sale ________________________________ |

City or town, State, ZIP Code __________________________________________________________ |

Telephone No. _____________________________ |

Purchaser Information

Name of Purchaser ________________________________________________ |

Daytime Telephone No. _________________________________________ |

If an individual: |

|

|

|

|

|

|

If corporation, partnership, limited liability company, or other business entity: |

Home address |

___________________________________________________ |

Business address |

_______________________________________________ |

|

___________________________________________________ |

|

|

_______________________________________________ |

Name and address ________________________________________________ |

Name and address ______________________________________________ |

of employer |

________________________________________________ |

of partners, |

______________________________________________ |

|

|

|

|

|

|

|

officers, |

|

|

|

|

|

|

________________________________________________ |

members, and |

______________________________________________ |

|

________________________________________________ |

operator(s) of |

______________________________________________ |

|

|

|

|

|

|

|

motor vehicle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver’s License Number |

|

State |

|

Expiration Date |

|

Driver’s License Number |

|

State |

|

Expiration Date |

(Attach copy of each out-of-state driver’s license. Use additional sheets if necessary for the names, addresses, and license numbers of additional drivers.)

Part III Motor Vehicle Identification Data

Year _________________ Model __________________ Make of vehicle _____________________________________ Color ______________

Vehicle identification number ___________________________________ State of registration and number __________________________________

Computation of Price |

Trade-in Data |

Gross sales price* ____________________________ |

Year ________________ Make ___________________ Model __________________ |

Trade-in allowance ___________________________ |

State of registration and plate number _________________________________________ |

Net sales price ______________________________ |

Vehicle identification number ________________________________________________ |

* Do not deduct manufacturer’s rebates from the gross sales price.

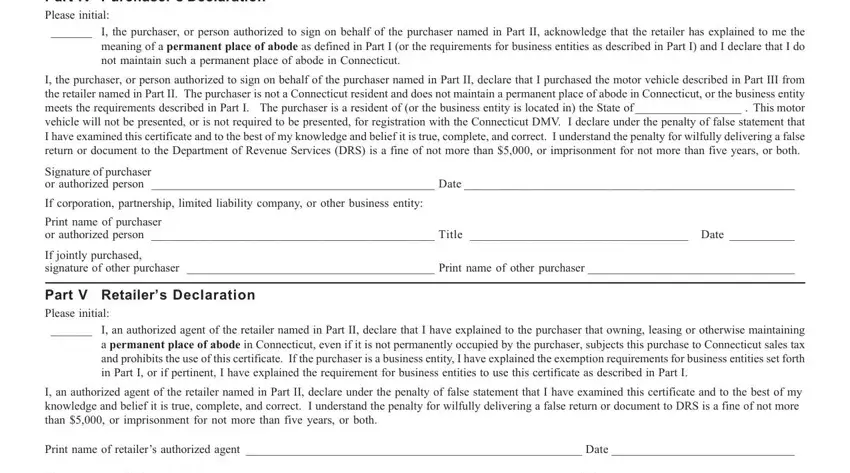

Part IV Purchaser’s Declaration

Please initial:

_______ I, the purchaser, or person authorized to sign on behalf of the purchaser named in Part II, acknowledge that the retailer has explained to me the

meaning of a permanent place of abode as defined in Part I (or the requirements for business entities as described in Part I) and I declare that I do not maintain such a permanent place of abode in Connecticut.

I, the purchaser, or person authorized to sign on behalf of the purchaser named in Part II, declare that I purchased the motor vehicle described in Part III from the retailer named in Part II. The purchaser is not a Connecticut resident and does not maintain a permanent place of abode in Connecticut, or the business entity meets the requirements described in Part I. The purchaser is a resident of (or the business entity is located in) the State of __________________ . This motor

vehicle will not be presented, or is not required to be presented, for registration with the Connecticut DMV. I declare under the penalty of false statement that I have examined this certificate and to the best of my knowledge and belief it is true, complete, and correct. I understand the penalty for wilfully delivering a false return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Signature of purchaser

or authorized person ________________________________________________ Date ________________________________________________________

If corporation, partnership, limited liability company, or other business entity:

Print name of purchaser

or authorized person ________________________________________________ Title _____________________________________ Date ___________

If jointly purchased,

signature of other purchaser __________________________________________ Print name of other purchaser ___________________________________

Part V |

Retailer’s Declaration |

Please initial: |

_______ |

I, an authorized agent of the retailer named in Part II, declare that I have explained to the purchaser that owning, leasing or otherwise maintaining |

|

a permanent place of abode in Connecticut, even if it is not permanently occupied by the purchaser, subjects this purchase to Connecticut sales tax |

|

and prohibits the use of this certificate. If the purchaser is a business entity, I have explained the exemption requirements for business entities set forth |

|

in Part I, or if pertinent, I have explained the requirement for business entities to use this certificate as described in Part I. |

I, an authorized agent of the retailer named in Part II, declare under the penalty of false statement that I have examined this certificate and to the best of my knowledge and belief it is true, complete, and correct. I understand the penalty for wilfully delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Print name of retailer’s authorized agent _________________________________________________________ Date _______________________________

Signature of retailer’s authorized agent ___________________________________________________________ Title _______________________________