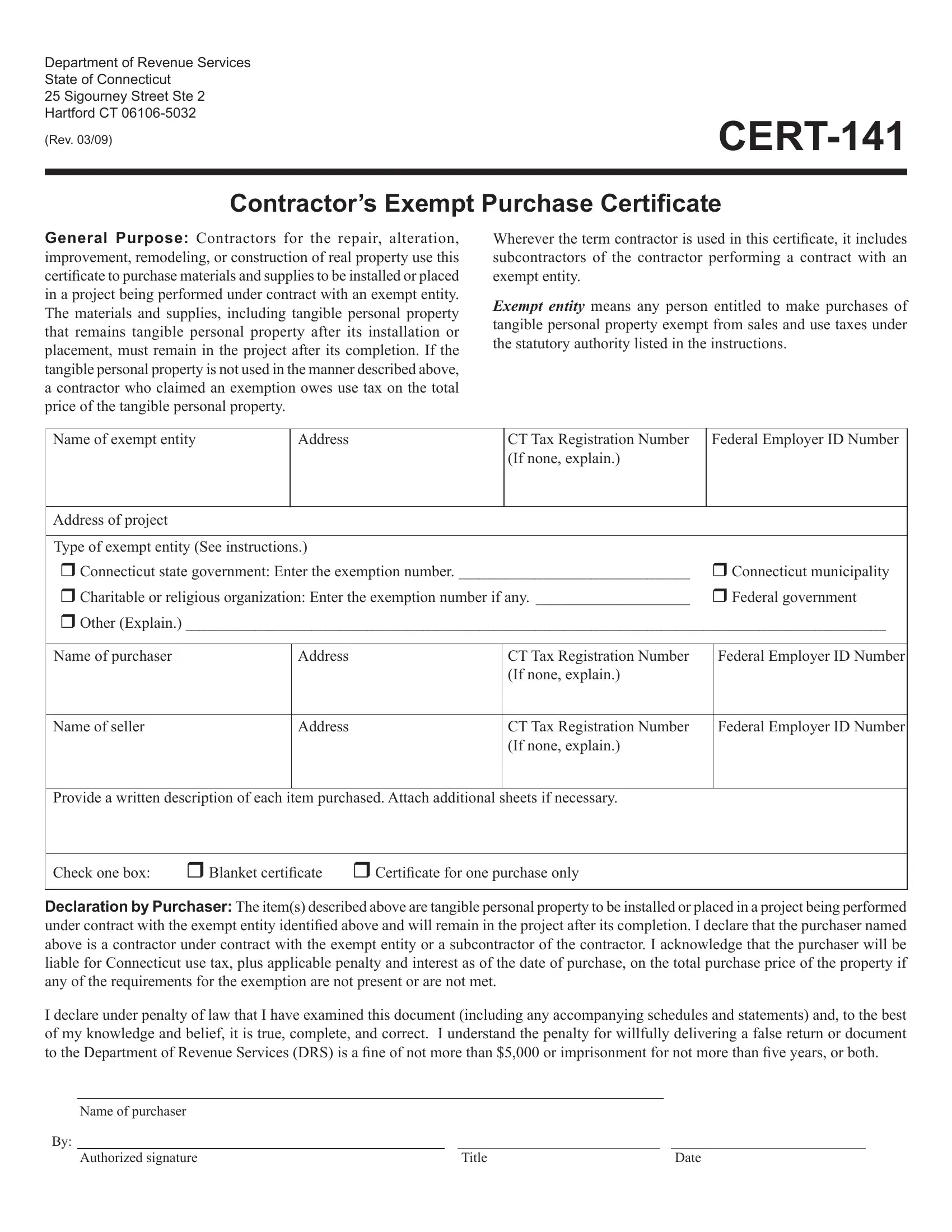

ct drs cert 141 can be filled out easily. Simply try FormsPal PDF editor to complete the task quickly. Our editor is continually evolving to present the best user experience attainable, and that is due to our commitment to continuous enhancement and listening closely to comments from users. Here's what you would want to do to get going:

Step 1: Just click the "Get Form Button" in the top section of this site to access our pdf file editor. There you'll find all that is required to work with your file.

Step 2: After you access the online editor, you'll notice the form ready to be completed. Apart from filling out different fields, you may as well perform various other things with the Document, such as writing any words, changing the original textual content, inserting illustrations or photos, affixing your signature to the form, and more.

Be attentive while filling in this document. Make sure that every field is completed accurately.

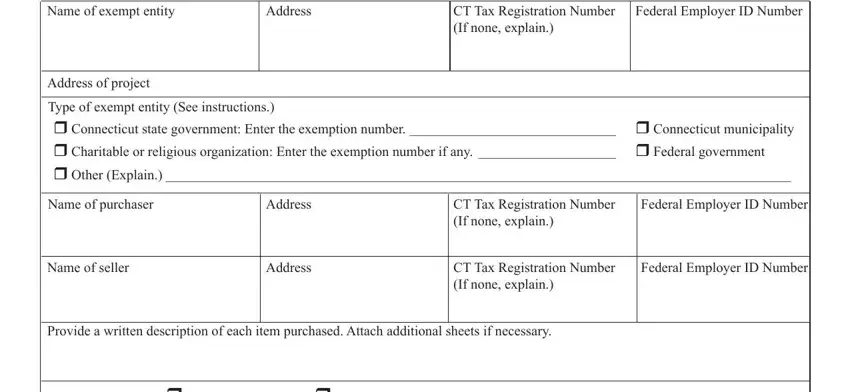

1. The ct drs cert 141 necessitates certain information to be typed in. Ensure the following blank fields are finalized:

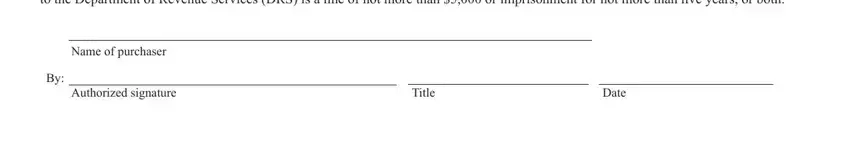

2. After the last section is complete, you have to include the required specifics in I declare under penalty of law, Name of purchaser, Authorized signature, Title, and Date so you're able to go further.

Regarding Name of purchaser and Date, be certain that you do everything correctly here. Both these could be the most significant ones in this file.

Step 3: After you've looked over the information you filled in, simply click "Done" to finalize your form at FormsPal. Get hold of the ct drs cert 141 when you sign up for a free trial. Conveniently get access to the document from your FormsPal account page, along with any modifications and changes being conveniently preserved! We don't sell or share any details that you type in when dealing with documents at our website.