Secretary of State |

1500 11th Street, 3rd Floor |

Business Entities |

Business Programs Division |

Sacramento, CA 95814 |

(916) 657-5448 |

Domestic Stock Corporation

Dissolution Filing Requirements

The voluntary dissolution of a domestic stock corporation is initiated by an election to dissolve. The election to dissolve may be made by the vote or written consent of at least fifty percent of the outstanding shares of the corporation, by the board of directors if no shares have been issued or in limited circumstances, by a majority of the incorporators if no directors were named in the original Articles of Incorporation and none have been elected. Following this election the corporation must file documents with the Secretary of State, as discussed below.

To dissolve, the corporation must file a Certificate of Election to Wind Up and Dissolve (Form ELEC STK) prior to or together with a Certificate of Dissolution (Form DISS STK). However, if the election to dissolve is made by the vote of all the outstanding shares, only the Certificate of Dissolution is required.

Note: In lieu of the above-mentioned certificates, a domestic stock corporation can file a Short Form Certificate of Dissolution (Form DSF STK) if the following requirements are met:

1)The Short Form Certificate of Dissolution is being filed within 12 months from the date the Articles of Incorporation were filed;

2)The corporation has no debts and liabilities (other than tax liability);

3)The tax liability will be satisfied on a taxes paid basis or the tax liability will be assumed;

4)The final tax return has been or will be filed with the Franchise Tax Board;

5)The corporation has not conducted any business;

6)The corporation has not issued shares, and if the corporation has received payments for shares from investors, those payments have been returned to those investors;

7)The majority of the directors (or incorporators, if directors were not named and none have been elected) authorized the dissolution and elected to dissolve the corporation; and

8)The assets have been distributed to the persons entitled thereto or no assets have been acquired.

Upon the filing of the Certificate of Dissolution or Short Form Certificate of Dissolution by the Secretary of State, the corporation will be completely dissolved and its corporate existence will cease.

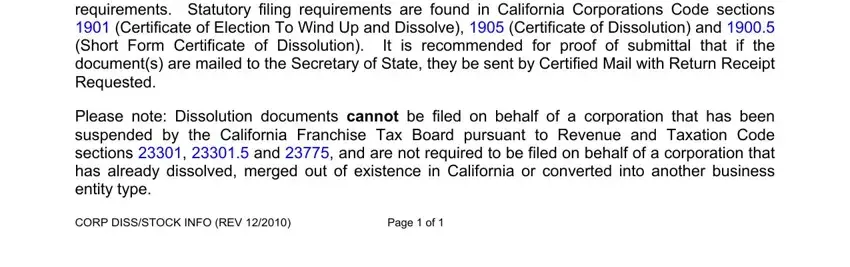

Filing instructions along with the above-mentioned forms are enclosed. The preprinted forms were created for ease in filing, however, any format may be used, provided it meets statutory requirements. Statutory filing requirements are found in California Corporations Code sections 1901 (Certificate of Election To Wind Up and Dissolve), 1905 (Certificate of Dissolution) and 1900.5 (Short Form Certificate of Dissolution). It is recommended for proof of submittal that if the document(s) are mailed to the Secretary of State, they be sent by Certified Mail with Return Receipt Requested.

Please note: Dissolution documents cannot be filed on behalf of a corporation that has been suspended by the California Franchise Tax Board pursuant to Revenue and Taxation Code sections 23301, 23301.5 and 23775, and are not required to be filed on behalf of a corporation that has already dissolved, merged out of existence in California or converted into another business entity type.

CORP DISS/STOCK INFO (REV 12/2010) |

Page 1 of 1 |

ELEC STK

State of California

Secretary of State

Domestic Stock Corporation

Certificate of Election to Wind Up and Dissolve

NOTE: To complete the dissolution process, the corporation must also file a Certificate of

Dissolution pursuant to Corporations Code section 1905.

There is no fee for filing a Certificate of Election To Wind Up and Dissolve.

IMPORTANT – Read instructions before completing this form. |

This Space For Filing Use Only |

Corporate Name (Enter the name of the domestic stock corporation exactly as it is of record with the California Secretary of State.)

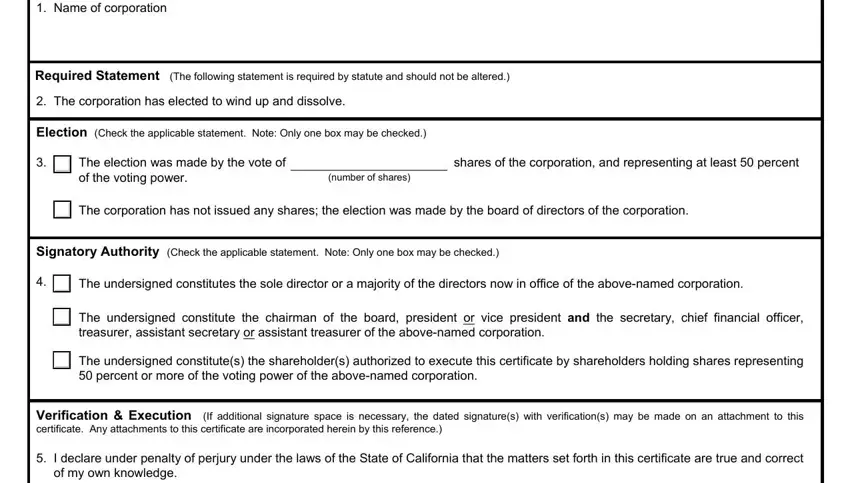

1. Name of corporation

Required Statement (The following statement is required by statute and should not be altered.)

2. The corporation has elected to wind up and dissolve.

Election (Check the applicable statement. Note: Only one box may be checked.)

3. |

|

The election was made by the vote of |

|

shares of the corporation, and representing at least 50 percent |

|

|

of the voting power. |

(number of shares) |

|

|

The corporation has not issued any shares; the election was made by the board of directors of the corporation.

Signatory Authority (Check the applicable statement. Note: Only one box may be checked.)

4. The undersigned constitutes the sole director or a majority of the directors now in office of the above-named corporation.

The undersigned constitute the chairman of the board, president or vice president and the secretary, chief financial officer, treasurer, assistant secretary or assistant treasurer of the above-named corporation.

The undersigned constitute(s) the shareholder(s) authorized to execute this certificate by shareholders holding shares representing 50 percent or more of the voting power of the above-named corporation.

Verification & Execution (If additional signature space is necessary, the dated signature(s) with verification(s) may be made on an attachment to this certificate. Any attachments to this certificate are incorporated herein by this reference.)

5.I declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct of my own knowledge.

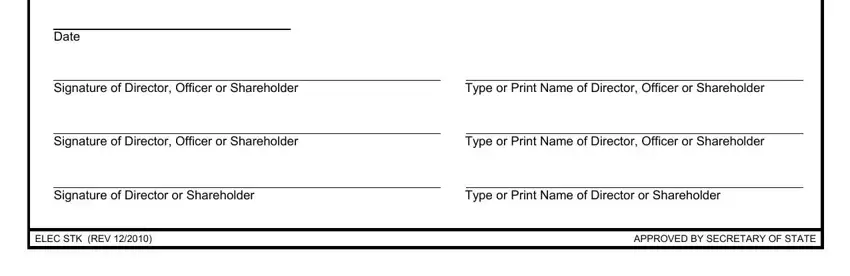

Date

|

Signature of Director, Officer or Shareholder |

Type or Print Name of Director, Officer or Shareholder |

|

|

|

|

|

|

Signature of Director, Officer or Shareholder |

Type or Print Name of Director, Officer or Shareholder |

|

|

|

|

|

|

Signature of Director or Shareholder |

Type or Print Name of Director or Shareholder |

|

|

|

|

|

|

|

|

ELEC STK (REV 12/2010) |

|

APPROVED BY SECRETARY OF STATE |

Instructions for Completing the

Certificate of Election to Wind Up and Dissolve (Form ELEC STK)

Where to File: For easier completion, this form is available on the Secretary of State's website at www.sos.ca.gov/business/be/forms.htm and can be viewed, filled in and printed from your computer. The completed form can be mailed to Secretary of State, Document Filing Support Unit, 1500 11th Street, 3rd Floor, Sacramento, CA 95814 or delivered in person (drop off) to the Sacramento office. If you are not completing this form online, please type or legibly print in black or blue ink. This form is filed only in the Sacramento office.

It is recommended for proof of submittal that if the Certificate of Election to Wind Up and Dissolve is mailed to the Secretary of State, it be sent by Certified Mail with Return Receipt Requested. To facilitate the processing of documents mailed to the Secretary of State, a self-addressed envelope and a letter referencing the corporate name and number as well as the sender’s name, return address and telephone number should be included with the submittal.

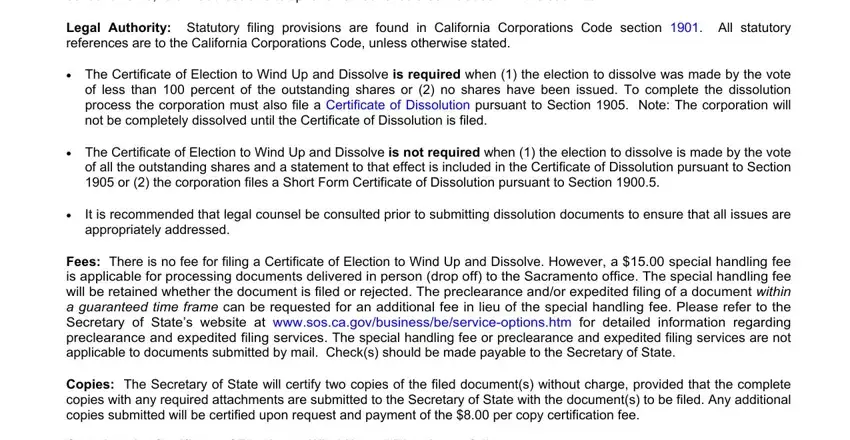

Legal Authority: Statutory filing provisions are found in California Corporations Code section 1901. All statutory references are to the California Corporations Code, unless otherwise stated.

The Certificate of Election to Wind Up and Dissolve is required when (1) the election to dissolve was made by the vote of less than 100 percent of the outstanding shares or (2) no shares have been issued. To complete the dissolution process the corporation must also file a Certificate of Dissolution pursuant to Section 1905. Note: The corporation will not be completely dissolved until the Certificate of Dissolution is filed.

The Certificate of Election to Wind Up and Dissolve is not required when (1) the election to dissolve is made by the vote of all the outstanding shares and a statement to that effect is included in the Certificate of Dissolution pursuant to Section 1905 or (2) the corporation files a Short Form Certificate of Dissolution pursuant to Section 1900.5.

It is recommended that legal counsel be consulted prior to submitting dissolution documents to ensure that all issues are appropriately addressed.

Fees: There is no fee for filing a Certificate of Election to Wind Up and Dissolve. However, a $15.00 special handling fee is applicable for processing documents delivered in person (drop off) to the Sacramento office. The special handling fee will be retained whether the document is filed or rejected. The preclearance and/or expedited filing of a document within a guaranteed time frame can be requested for an additional fee in lieu of the special handling fee. Please refer to the Secretary of State’s website at www.sos.ca.gov/business/be/service-options.htm for detailed information regarding preclearance and expedited filing services. The special handling fee or preclearance and expedited filing services are not applicable to documents submitted by mail. Check(s) should be made payable to the Secretary of State.

Copies: The Secretary of State will certify two copies of the filed document(s) without charge, provided that the complete copies with any required attachments are submitted to the Secretary of State with the document(s) to be filed. Any additional copies submitted will be certified upon request and payment of the $8.00 per copy certification fee.

Complete the Certificate of Election to Wind Up and Dissolve as follows:

Item 1. Enter the name of the domestic stock corporation exactly as it is of record with the California Secretary of State.

Item 2. This statement is required by statute and should not be altered.

Item 3. Check the box next to the applicable statement. Only one box may be checked. If the first box is checked, specify the number of shares voting for the election to dissolve in the space provided.

Item 4. Check the box next to the applicable statement. Only one box may be checked.

Item 5. If the first box of Item 4 was checked, the certificate must be dated, signed and verified under penalty of perjury by a majority of the directors of the corporation now in office or by the sole director, if there is only one.

If the second box of Item 4 was checked, the certificate must be dated, signed and verified under penalty of perjury by two of the corporate officers authorized by Section 173 (i.e., the chairman of the board, the president or any vice president and by the secretary, the chief financial officer, the treasurer or any assistant secretary or assistant treasurer).

If the third box of Item 4 was checked, the certificate must be dated, signed and verified under penalty of perjury by the shareholder(s) authorized to execute the certificate by shareholders holding shares representing 50 percent or more of the voting power.

If additional signature space is necessary, the dated signature(s) with verification(s) may be made on an attachment to the certificate. All attachments should be 8½’’ x 11’’, one-sided and legible.

DISS STK

State of California

Secretary of State

Domestic Stock Corporation

Certificate of Dissolution

There is no fee for filing a Certificate of Dissolution.

IMPORTANT – Read instructions before completing this form. |

This Space For Filing Use Only |

Corporate Name (Enter the name of the domestic stock corporation exactly as it is of record with the California Secretary of State.)

1. Name of corporation

Required Statements (The following statements are required by statute and should not be altered.)

2.A final franchise tax return, as described by California Revenue and Taxation Code section 23332, has been or will be filed with the California Franchise Tax Board, as required under the California Revenue and Taxation Code, Division 2, Part 10.2 (commencing with Section 18401). The corporation has been completely wound up and is dissolved.

Debts & Liabilities (Check the applicable statement. Note: Only one box may be checked.)

3. The corporation's known debts and liabilities have been actually paid.

The corporation's known debts and liabilities have been paid as far as its assets permitted.

The corporation's known debts and liabilities have been adequately provided for by their assumption and the name and address

The corporation’s known debts and liabilities have been adequately provided for as far as its assets permitted.

(Specify in an attachment to this certificate (incorporated herein by this reference) the provision made and the address of the corporation, person or governmental agency that has assumed or guaranteed the payment, or the name and address of the depositary with which deposit has been made or other information necessary to enable creditors or others to whom payment is to be made to appear and claim payment.)

The corporation never incurred any known debts or liabilities.

Assets (Check the applicable statement. Note: Only one box may be checked.)

4. The known assets have been distributed to the persons entitled thereto.

The corporation never acquired any known assets.

Election (Check the “YES” or “NO” box, as applicable. Note: If the “NO” box is checked, a Certificate of Election to Wind Up and Dissolve pursuant to Corporations Code section 1901 must be filed prior to or together with this Certificate of Dissolution.)

5. The election to dissolve was made by the vote of all the outstanding shares. |

|

YES |

|

NO |

Verification & Execution (If additional signature space is necessary, the dated signature(s) with verification(s) may be made on an attachment to this certificate. Any attachments to this certificate are incorporated herein by this reference.)

6.The undersigned constitute(s) the sole director or a majority of the directors now in office. I declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct of my own knowledge.

|

Date |

|

|

|

|

|

|

|

|

|

Signature of Director |

|

Type or Print Name of Director |

|

|

|

|

|

|

Signature of Director |

Type or Print Name of Director |

|

|

|

|

|

|

Signature of Director |

|

Type or Print Name of Director |

|

|

|

DISS STK (REV 12/2010) |

|

APPROVED BY SECRETARY OF STATE |

These statements are required by statute and should not be altered. For information regarding final tax returns, contact the Franchise Tax Board at (800) 852-5711 (from within the U.S.) or (916) 845-6500 (from outside the U.S.) or visit their website at www.ftb.ca.gov.

Check the box next to the applicable statement. Only one box may be checked. If the third box is checked, specify the name and address of the assumer in the space provided. If the fourth box is checked, specify in an attachment to this certificate, the provision made and the address of the corporation, person or governmental agency that has assumed or guaranteed the payment, or the name and address of the depositary with which deposit has been made or other information necessary to enable creditors or others to whom payment is to be made to appear and claim payment.

Check the box next to the applicable statement. Only one box may be checked.

Check the appropriate box. NOTE: If the dissolution was not made by the vote of all the outstanding shares, a Certificate of Election to Wind Up and Dissolve pursuant to Section 1901 must be filed prior to or together with the Certificate of Dissolution.

The certificate must be dated, signed and verified under penalty of perjury by a majority of the directors of the corporation now in office or by the sole director, if there is only one.

If additional signature space is necessary, the dated signature(s) with verification(s) may be made on an attachment to the certificate. All attachments should be 8½’’ x 11’’, one-sided and legible.

Enter the name of the domestic stock corporation exactly as it is of record with the California Secretary of State.

Instructions for Completing the

Certificate of Dissolution (Form DISS STK)

Where to File: For easier completion, this form is available on the Secretary of State's website at www.sos.ca.gov/business/be/forms.htm and can be viewed, filled in and printed from your computer. The completed form can be mailed to Secretary of State, Document Filing Support Unit, 1500 11th Street, 3rd Floor, Sacramento, CA 95814 or delivered in person (drop off) to the Sacramento office. If you are not completing this form online, please type or legibly print in black or blue ink. This form is filed only in the Sacramento office.

It is recommended for proof of submittal that if the Certificate of Dissolution is mailed to the Secretary of State, the document be sent by Certified Mail with Return Receipt Requested. To facilitate the processing of documents mailed to the Secretary of State, a self-addressed envelope and a letter referencing the corporate name and number as well as the sender’s name, return address and telephone number should be included with the submittal.

Legal Authority: Statutory filing provisions are found in California Corporations Code section 1905. All statutory references are to the California Corporations Code, unless otherwise stated.

The Certificate of Dissolution must be filed after or together with a Certificate of Election to Wind Up and Dissolve pursuant to Section 1901. However, if the election to dissolve was made by the vote of all the outstanding shares, only the Certificate of Dissolution is required.

Upon filing the Certificate of Dissolution the corporation will be dissolved and its powers, rights and privileges will cease.

It is recommended that legal counsel be consulted prior to submitting dissolution documents to ensure that all issues are appropriately addressed.

Fees: There is no fee for filing a Certificate of Dissolution. However, a $15.00 special handling fee is applicable for processing documents delivered in person (drop off) to the Sacramento office. The special handling fee will be retained whether the document is filed or rejected. The preclearance and/or expedited filing of a document within a guaranteed time frame can be requested for an additional fee in lieu of the special handling fee. Please refer to the Secretary of State’s website at www.sos.ca.gov/business/be/service-options.htm for detailed information regarding preclearance and expedited filing services. The special handling fee or preclearance and expedited filing services are not applicable to documents submitted by mail. Check(s) should be made payable to the Secretary of State.

Copies: The Secretary of State will certify two copies of the filed document(s) without charge, provided that the complete copies with any required attachments are submitted to the Secretary of State with the document(s) to be filed. Any additional copies submitted will be certified upon request and payment of the $8.00 per copy certification fee.

Complete the Certificate of Dissolution as follows:

Item 1.

Item 2.

Item 3.

Item 4.

Item 5.

Item 6.

|

DSF STK |

|

|

|

|

State of California |

|

Secretary of State |

|

Domestic Stock Corporation |

|

Short Form Certificate of Dissolution |

|

|

|

There is no fee for filing a Short Form Certificate of Dissolution. |

|

|

This Space For Filing Use Only |

IMPORTANT – Read instructions before completing this form. |

|

|

|

Corporate Name (Enter the name of the domestic stock corporation exactly as it is of record with the California Secretary of State.)

1. Name of corporation

Required Statements (The following statements are required by statute and should not be altered.)

2.a) This Short Form Certificate of Dissolution is being filed within twelve (12) months from the date the Articles of Incorporation were filed with the Secretary of State;

b)The corporation does not have any debts or other liabilities, except as provided in Item 2(c);

c)The tax liability of the corporation will be satisfied on a taxes paid basis, or a person or corporation or other business entity assumes the tax liability, if any, of the dissolving corporation and is responsible for additional corporate taxes, if any, that are assessed and that become due after the date of the assumption of the tax liability.

d)A final franchise tax return, as described by Section 23332 of the Revenue and Taxation Code, has been or will be filed with the Franchise Tax Board, as required under Part 10.2 (commencing with Section 18401) of Division 2 of the Revenue and Taxation Code.

e)The corporation has not conducted any business from the time of the filing of the Articles of Incorporation with the Secretary of State.

f)The corporation has not issued any shares, and if the corporation has received payments for shares from investors, those payments have been returned to those investors.

g)The corporation is dissolved.

Assets (Check the applicable statement. Note: Only one box may be checked.)

3. The known assets of the corporation remaining after payment of, or adequately providing for, the known debts and liabilities have been distributed to the persons entitled thereto.

The corporation acquired no known assets.

Dissolution (Check the applicable statement. Note: Only one box may be checked. )

4. The sole director or a majority of the directors now in office has authorized the dissolution and elected to dissolve the corporation. The undersigned constitutes the sole director or a majority of the directors now in office.

No directors were named in the original Articles of Incorporation and none have been elected. The sole incorporator or a majority of the incorporators has authorized the dissolution and elected to dissolve the corporation. The undersigned constitutes the sole incorporator or a majority of the incorporators of the corporation.

Verification & Execution (If additional signature space is necessary, the dated signature(s) with verification(s) may be made on an attachment to this certificate. Any attachments to this certificate are incorporated herein by this reference.)

5.I declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct of my own knowledge.

|

Date |

|

|

|

|

|

|

|

|

|

Signature of Director or Incorporator |

Type or Print Name of Director or Incorporator |

|

|

|

|

|

|

Signature of Director or Incorporator |

|

Type or Print Name of Director or Incorporator |

|

|

|

|

|

|

Signature of Director or Incorporator |

|

Type or Print Name of Director or Incorporator |

|

|

|

|

|

|

|

|

DSF STK (REV 12/2010) |

|

APPROVED BY SECRETARY OF STATE |

|

|

|

|

|

Instructions for Completing the

Short Form Certificate of Dissolution (Form DSF STK)

Where to File: For easier completion, this form is available on the Secretary of State's website at www.sos.ca.gov/business/be/forms.htm and can be viewed, filled in and printed from your computer. The completed form can be mailed to Secretary of State, Document Filing Support Unit, 1500 11th Street, 3rd Floor, Sacramento, CA 95814 or delivered in person (drop off) to the Sacramento office. If you are not completing this form online, please type or legibly print in black or blue ink. This form is filed only in the Sacramento office.

It is recommended for proof of submittal that if the Short Form Certificate of Dissolution is mailed to the Secretary of State, it be sent by Certified Mail with Return Receipt Requested. To facilitate the processing of documents mailed to the Secretary of State, a self-addressed envelope and a letter referencing the corporate name and number as well as the sender’s name, return address and telephone number should be included with the submittal.

Legal Authority: Statutory filing provisions are found in California Corporations Code section 1900.5. All statutory references are to the California Corporations Code, unless otherwise stated.

The Short Form Certificate of Dissolution may be used to dissolve a domestic stock corporation if it is filed within twelve

(12)months from the date the Articles of Incorporation were filed with the Secretary of State, and if the corporation meets the remaining criteria specified by Section 1900.5. Upon filing the Short Form Certificate of Dissolution, the corporation will be dissolved and its powers, rights and privileges will cease. Note: A Certificate of Election to Wind Up and Dissolve pursuant to Section 1901 is not required when filing the Short Form Certificate of Dissolution.

If the corporation does not meet all of the requirements of Section 1900.5, the Short Form Certificate of Dissolution cannot be used and the corporation must file dissolution documents in compliance with Sections 1901 and 1905.

It is recommended that legal counsel be consulted prior to submitting dissolution documents to ensure that all issues are appropriately addressed.

Fees: There is no fee for filing a Short Form Certificate of Dissolution. However, a $15.00 special handling fee is applicable for processing documents delivered in person (drop off) to the Sacramento office. The special handling fee will be retained whether the document is filed or rejected. The preclearance and/or expedited filing of a document within a guaranteed time frame can be requested for an additional fee in lieu of the special handling fee. Please refer to the Secretary of State’s website at www.sos.ca.gov/business/be/service-options.htm for detailed information regarding preclearance and expedited filing services. The special handling fee or preclearance and expedited filing services are not applicable to documents submitted by mail. Check(s) should be made payable to the Secretary of State.

Copies: The Secretary of State will certify two copies of the filed document(s) without charge, provided that the complete copies with any required attachments are submitted to the Secretary of State with the document(s) to be filed. Any additional copies submitted will be certified upon request and payment of the $8.00 per copy certification fee.

Complete the Short Form Certificate of Dissolution as follows:

Item 1. Enter the name of the domestic stock corporation exactly as it is of record with the California Secretary of State.

Item 2. These statements are required by statute and should not be altered. Note: If any of the statements are not applicable, the Short Form Certificate of Dissolution may not be used to dissolve the corporation. For information regarding final tax returns, contact the Franchise Tax Board at (800) 852-5711 (from within the U.S.) or (916) 845-6500 (from outside the U.S.) or visit their website at www.ftb.ca.gov.

Item 3. Check the box next to the applicable statement. Only one box may be checked.

Item 4. The dissolution must be made by a majority of the directors or sole director if there is only one OR if no directors were named in the original Articles of Incorporation and none have been elected, by a majority of the incorporators or sole incorporator if there was only one. The “incorporators” are the persons who signed the Articles of Incorporation. Check the box next to the applicable statement. Only one box may be checked.

Please note: If the corporation has already filed a Statement of Information pursuant to Section 1502 with the Secretary of State, the dissolution must be made by a majority of the directors now in office or sole director if there is only one, and the first box of Item 4 must be checked.

Item 5. If the first box of Item 4 was checked, the certificate must be dated, signed and verified under penalty of perjury

by a majority of the directors of the corporation now in office or by the sole director, if there is only one.

If the second box of Item 4 was checked, the certificate must be dated, signed and verified under penalty of perjury by a majority of the incorporators or sole incorporator, if there was only one.

If additional signature space is necessary, the dated signature(s) with verification(s) may be made on an attachment to the certificate. All attachments should be 8½’’ x 11’’, one-sided and legible.