Dealing with PDF forms online is always easy with our PDF tool. You can fill in schwab ira esa distribution form here effortlessly. The editor is continually maintained by our staff, getting awesome functions and turning out to be better. To get the ball rolling, consider these basic steps:

Step 1: Click on the "Get Form" button above. It is going to open up our editor so you could start completing your form.

Step 2: The editor gives you the opportunity to customize PDF documents in many different ways. Improve it by writing personalized text, correct what is already in the document, and include a signature - all at your convenience!

It will be straightforward to complete the document with our practical guide! This is what you should do:

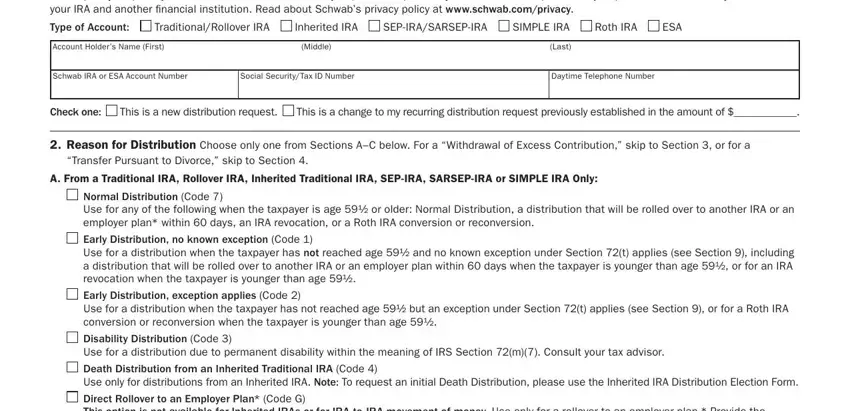

1. Start filling out the schwab ira esa distribution form with a selection of necessary blanks. Get all of the information you need and make sure not a single thing forgotten!

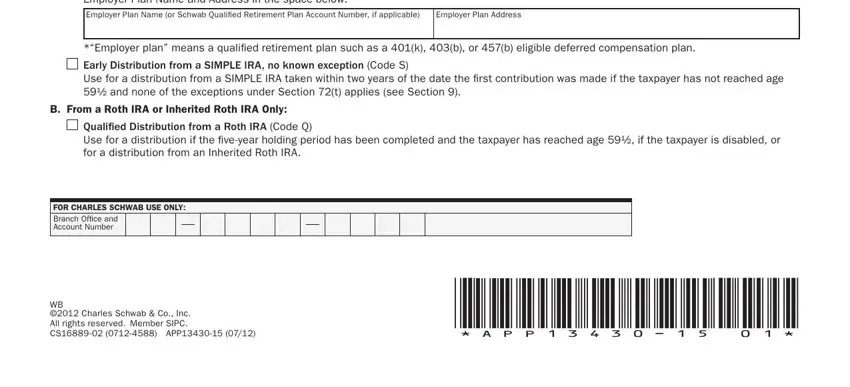

2. Immediately after the prior selection of blanks is done, go on to type in the applicable information in all these: This option is not available for, Employer Plan Name or Schwab, Employer Plan Address, Employer plan means a qualiied, Early Distribution from a SIMPLE, Use for a distribution from a, B From a Roth IRA or Inherited, Qualiied Distribution from a Roth, Use for a distribution if the, FOR CHARLES SCHWAB USE ONLY, Branch Ofice and Account Number, WB Charles Schwab Co Inc All, and APP.

It's simple to make an error while filling in the APP, and so be sure you look again prior to when you send it in.

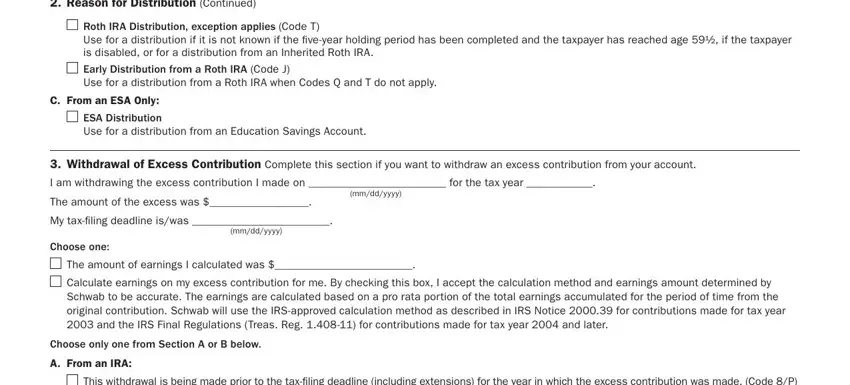

3. Completing Reason for Distribution Continued, Roth IRA Distribution exception, Use for a distribution if it is, Early Distribution from a Roth IRA, Use for a distribution from a Roth, C From an ESA Only, ESA Distribution, Use for a distribution from an, Withdrawal of Excess Contribution, I am withdrawing the excess, mmddyyyy, My taxiling deadline iswas, mmddyyyy, Choose one, and The amount of earnings I is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

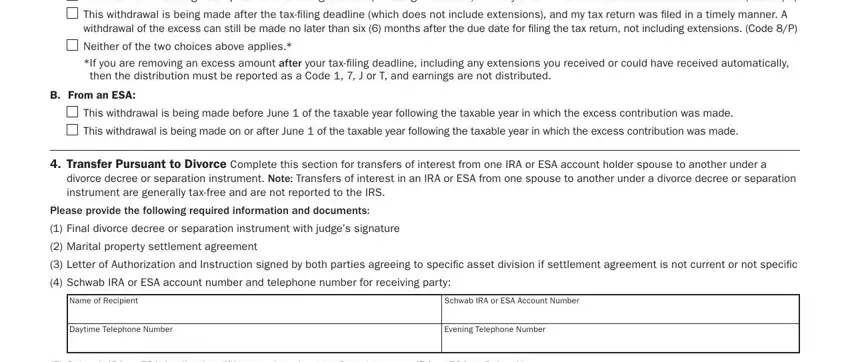

4. Filling in This withdrawal is being made, This withdrawal is being made, withdrawal of the excess can still, Neither of the two choices above, If you are removing an excess, then the distribution must be, B From an ESA, This withdrawal is being made, This withdrawal is being made on, Transfer Pursuant to Divorce, divorce decree or separation, Please provide the following, Final divorce decree or, Marital property settlement, and Letter of Authorization and is vital in this next step - make sure you don't hurry and fill in every single field!

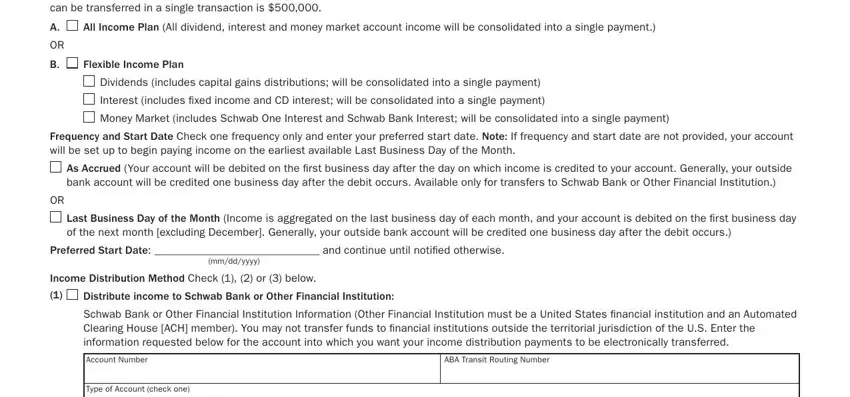

5. This form has to be finished by dealing with this area. Here you will find an extensive list of fields that require appropriate details to allow your document usage to be complete: Income Options Choose All Income, All Income Plan All dividend, Flexible Income Plan, Dividends includes capital gains, Interest includes ixed income and, Money Market includes Schwab One, Frequency and Start Date Check one, As Accrued Your account will be, bank account will be credited one, Last Business Day of the Month, of the next month excluding, Preferred Start Date and continue, mmddyyyy, Income Distribution Method Check, and Distribute income to Schwab Bank.

Step 3: Immediately after going through your form fields, hit "Done" and you are good to go! Right after setting up a7-day free trial account with us, it will be possible to download schwab ira esa distribution form or email it at once. The PDF form will also be readily accessible from your personal cabinet with your edits. FormsPal provides safe form completion with no personal information recording or distributing. Be assured that your data is in good hands here!