The PDF editor that you may apply was designed by our main web programmers. It is possible to get the chase request mortgage file immediately and conveniently applying our software. Simply keep up with this instruction to get started.

Step 1: The initial step will be to click the orange "Get Form Now" button.

Step 2: After you have entered the chase request mortgage edit page, you will notice all options you can take concerning your document at the top menu.

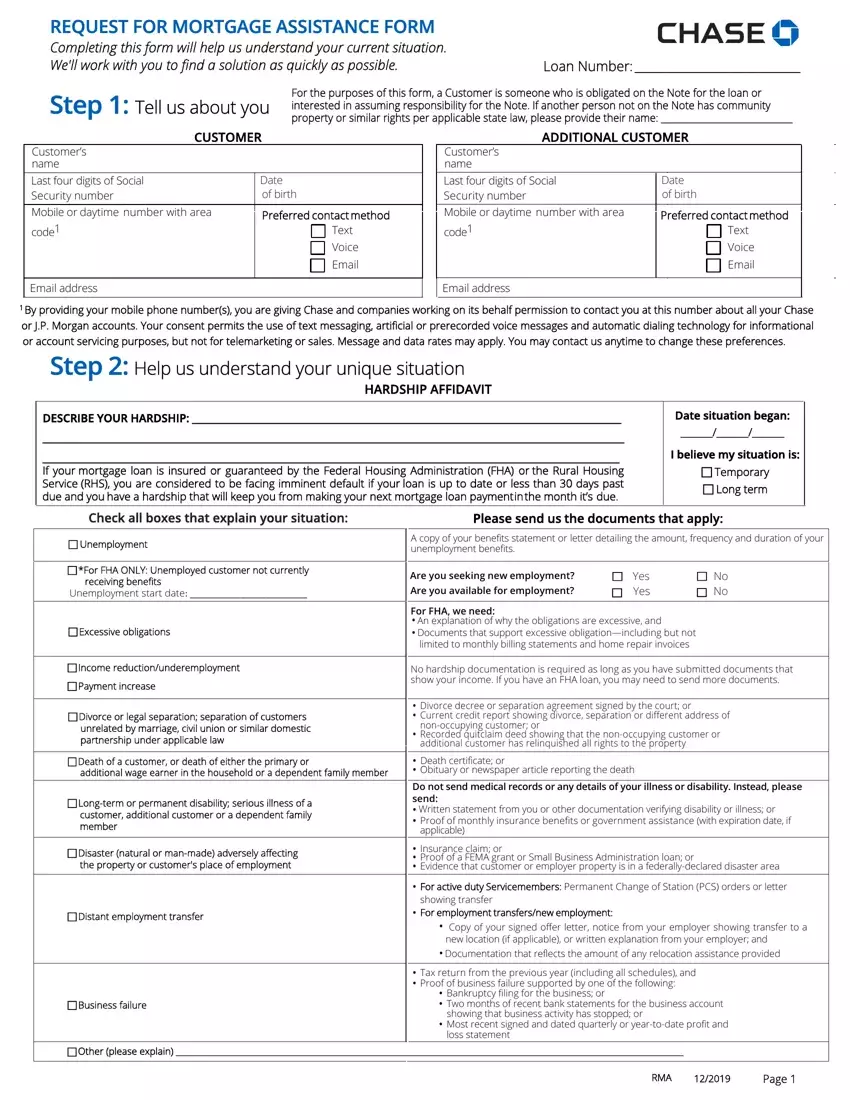

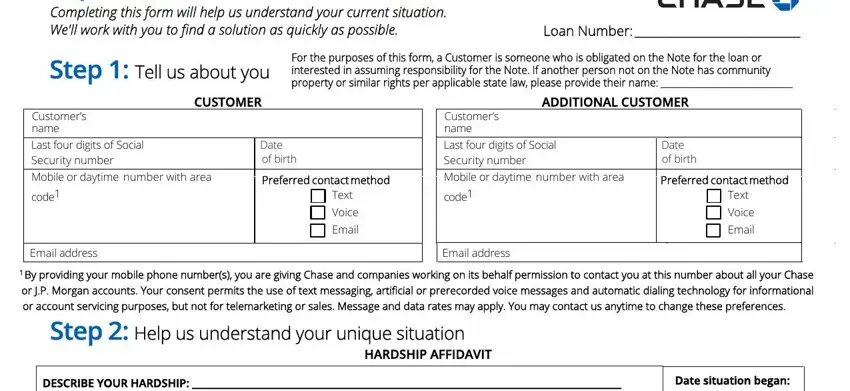

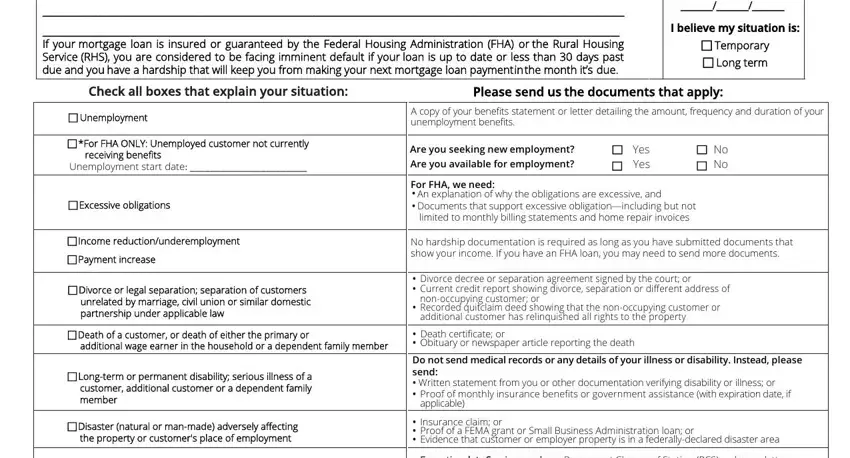

The particular sections will help make up the PDF form:

Note the demanded particulars in the area If your mortgage loan is insured, Date situation began, I believe my situation is n, Check all boxes that explain your, Please send us the documents that, Unemployment, n For FHA ONLY Unemployed customer, receiving benefits, Unemployment start date, n Excessive obligations, n Income reductionunderemployment, n Payment increase, n Divorce or legal separation, A copy of your benefits statement, and Are you seeking new employment Are.

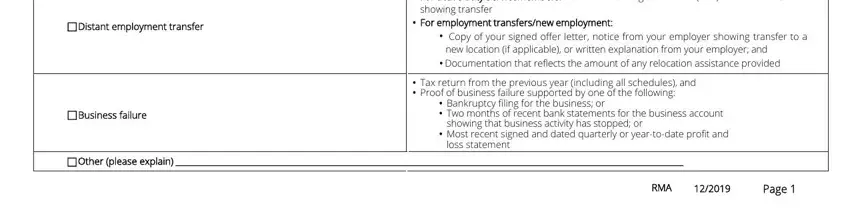

Write down the essential data in n Distant employment transfer, n Business failure, For active duty Servicemembers, showing transfer, For employment transfersnew, Copy of your signed offer letter, new location if applicable or, Tax return from the previous year, Bankruptcy filing for the, showing that business activity has, Most recent signed and dated, loss statement, n Other please explain, RMA, and Page section.

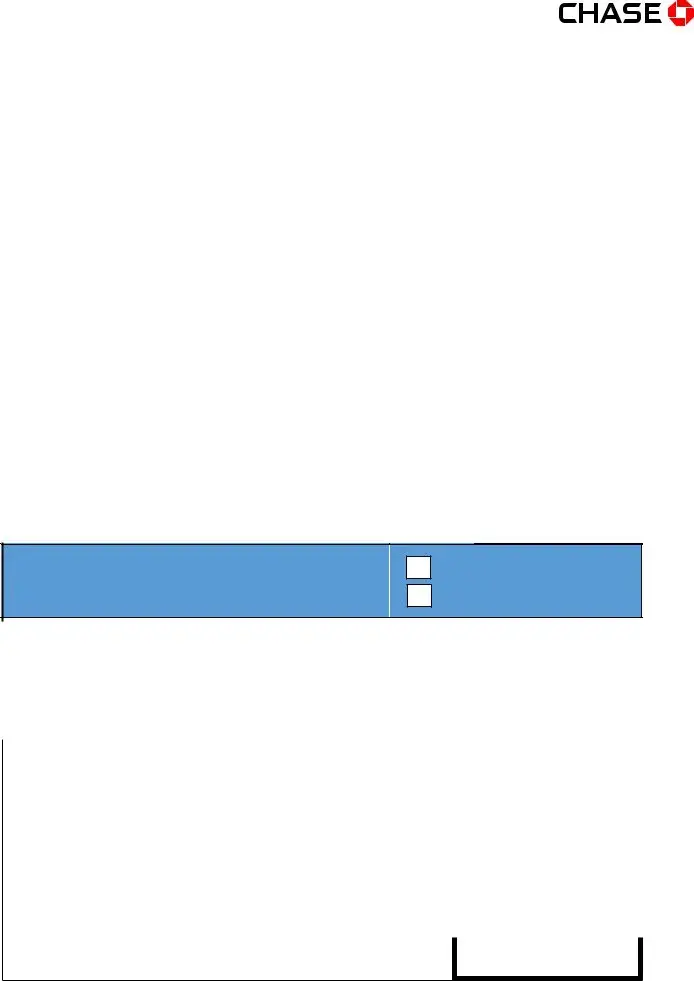

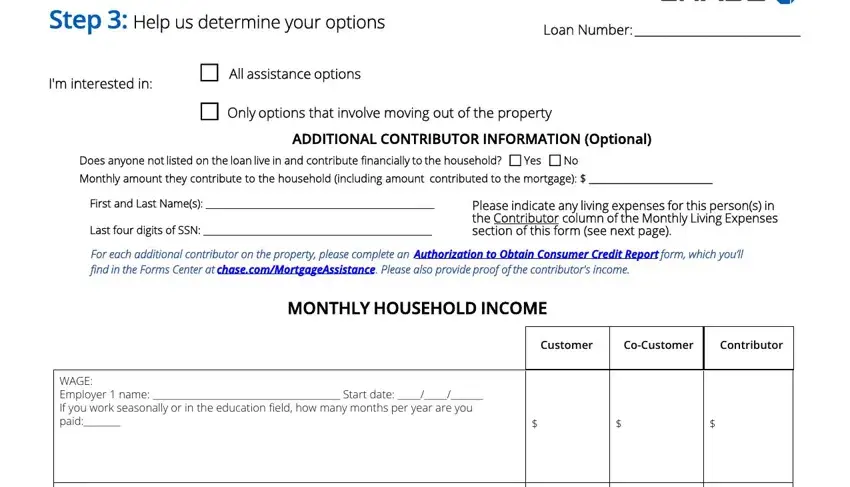

The Step Help us determine your, Im interested in, n All assistance options, Loan Number, n Only options that involve moving, Does anyone not listed on the loan, n No, ADDITIONAL CONTRIBUTOR INFORMATION, First and Last Names, Last four digits of SSN, Please indicate any living, For each additional contributor on, MONTHLY HOUSEHOLD INCOME, Customer, and CoCustomer area is the place to add the rights and responsibilities of all sides.

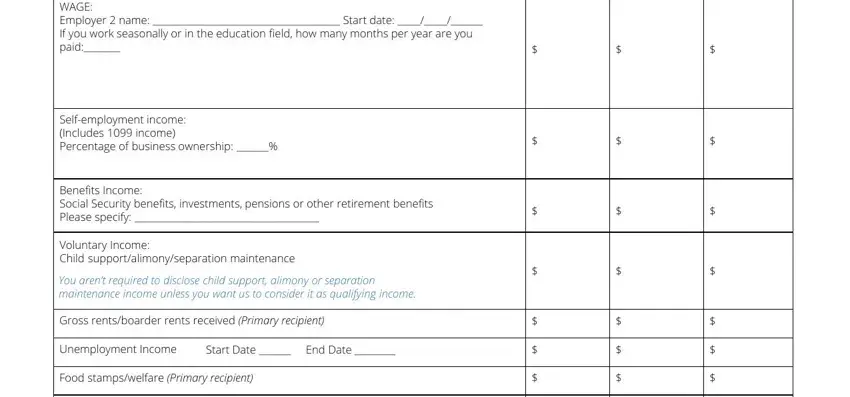

Finalize by reviewing the following fields and filling them in accordingly: WAGE Employer name Start date, Selfemployment income Includes, Benefits Income Social Security, Voluntary Income Child, You arent required to disclose, Gross rentsboarder rents received, Unemployment Income, Start Date, End Date, and Food stampswelfare Primary.

Step 3: When you click the Done button, your finalized file can be exported to each of your gadgets or to email given by you.

Step 4: You can create copies of the file toremain away from any type of potential challenges. Don't worry, we cannot distribute or track your data.