In the heart of Kentucky, businesses operating within the City of Owensboro are required to navigate the complexities of local taxation through the City of Owensboro Tax form. This pivotal document, known officially as Form NP-1, serves a dual purpose for both the City of Owensboro and Daviess County. It captures a wide array of information, starting from identifying data like Social Security or Federal ID numbers, to business types ranging from individuals and corporations to various forms of partnerships and LLCs. Acknowledging the fluctuating nature of businesses, it accommodates changes in addresses and allows entities to declare a cessation of operations within the jurisdictions. The form intricately ties together federal and personal business data, requesting attachments of federal forms or schedules to ensure accurate tax computation. This computation calculates the net profit, taking into account business apportionment and occupational license fees, subsequently adjusting for payments made or credits earned throughout the fiscal year. Critical to its completion are declarations concerning employee presence in Owensboro or Daviess County, business activity levels, and whether the entity disposes of or continues operations. Including specific worksheets for different types of business entities—be it individual, corporate, or partnership—this comprehensive form culminates in a declaration signed under penalty of perjury, signifying the truthful completion of the document. Its meticulous design reflects the city's commitment to fair taxation while streamlining the process for both the businesses and the governing fiscal court.

| Question | Answer |

|---|---|

| Form Name | City Of Owensboro Tax Form |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | city of owensboro occupational tax form, form e 1 owensboro, owensboro occupational tax, occupational tax administrator owensboro ky |

|

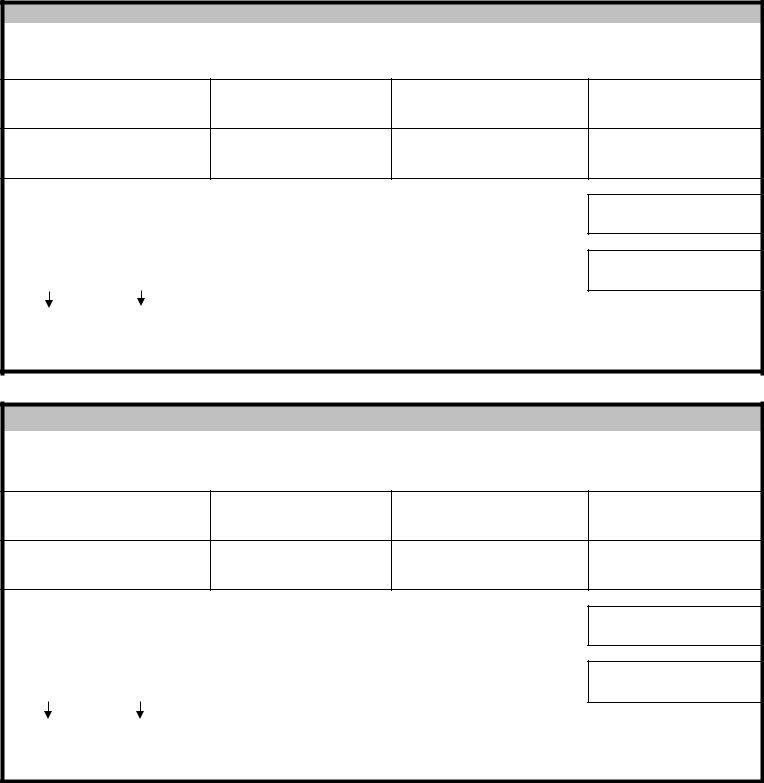

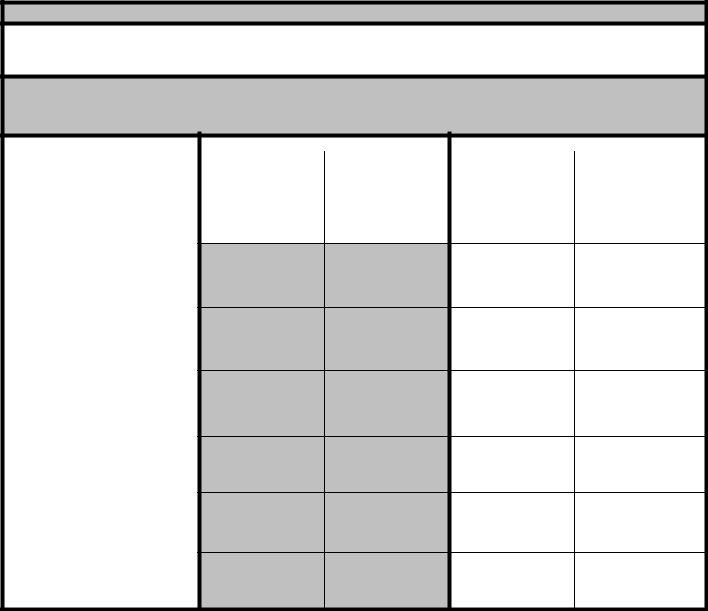

City of Owensboro/Daviess County Fiscal Court |

Social Security # or Federal ID# |

FORM |

Net Profit License Fee Return |

|

|

|

|

Account Number |

Name and Address |

Business Type |

|

|

____ Individual |

|

|

____ Corporation |

|

|

____ Partnership |

|

|

____ LLC/Individual |

|

|

____ LLC/Partnership |

|

Change of Address |

____ Other _______________ |

Period Ending |

||

|

|

|

____ Final return (Check only to inactivate the

____ No activity in jurisdictions during tax year. Account will remain open. (Check only if no activity in both jurisdictions) Zero Due

|

A) |

Business telephone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B) |

If business activity was discontinued within both jurisdictions during the year, state when: |

/ |

/ |

|

|

|

|||||||||

|

______ If sold, enter name and address of successor: |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

C) |

Did you have employees working in either jurisdiction during the tax year? ____ YES ____ NO |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make check payable |

FILING STATUS >>> ATTACH APPLICABLE FEDERAL FORM OR SCHEDULE(S) |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

and mail to: |

____Worksheet I |

Schedule C, Schedule E, Schedule F, |

||||||||||||

|

Occupational Tax Administrator |

____Worksheet P |

Form 1065, Schedule K, rental schedule(s) |

|||||||||||||

|

|

PO BOX 10008 |

____Worksheet C |

Form 1120, 1120A, 1120S, Schedule K, rental schedule(s) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

OWENSBORO, KY |

(See pages 3 thru 5 of Instructions) |

TAX COMPUTATION |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City of |

|

Daviess |

||||||

|

PHONE: (270) |

|

|

|

|

Owensboro |

|

County |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COLUMN A |

|

COLUMN B |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) Total Net Profit from applicable Worksheet………………………. |

|

|

|

|

|

|

|

|

|

|

|

||||

|

2) Pre Apportionment adjustments (READ INSTRUCTIONS)…….. |

|

|

|

|

|

|

|

|

|

|

|

||||

|

3) Adjusted Net Profit (line 1 plus line 2)……………………………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4) Business Apportionment (Complete Worsheet Y if applicable)…………… |

|

|

% |

|

% |

||||||||||

|

5) Taxable Net Profit (line 3 multiplied by line 4)……………………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6) Occupational license fee Rate |

(If for period before 12/31/07 see Instructions to |

|

|

1.33% |

|

|

|

0.35% |

|

||||||

|

Determine Daviess County Rate for Column B) |

|

|

|

|

|

|

|||||||||

|

7) Total license fee Due (line 5 x line 6)……………………………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

8) Minimum License Fee (see instructions)…………………………. |

|

|

$47 |

|

|

|

|

$0 |

|

||||||

|

9) Enter the Larger amount from Line 7 or Line 8 …… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

10) Payments/Credits and first year registration fee……… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

11) If Line 10 is larger than Line 9, Difference is Refund Credit…… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

12) If Line 9 is larger than Line 10, Difference is License Fee Due |

|

|

|

|

|

|

|

|

|

|

|

||||

|

13) Penalty (5% per calendar month or portion thereof |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

not to exceed 25%) Minimum $25………… |

|

|

|

|

|

|

|

|

|

|

|

|||

|

14) Interest (1% per calendar month or fraction thereof)… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

15) Total Amount Due (add lines 12, 13 and 14)………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

16) Payment Amount (Add line 15 Column A to line 15 Column B)…………… |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETURN MUST BE SIGNED - I hereby certify, under penalty of perjury, that the statements made herein and any |

|

|

|

|

|

||||||||||

|

supporting schedules are true, correct, and complete to the best of my knowledge. |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Preparer's Signature |

Phone |

Taxpayer's signature |

|

|

Date |

||||||||||

1

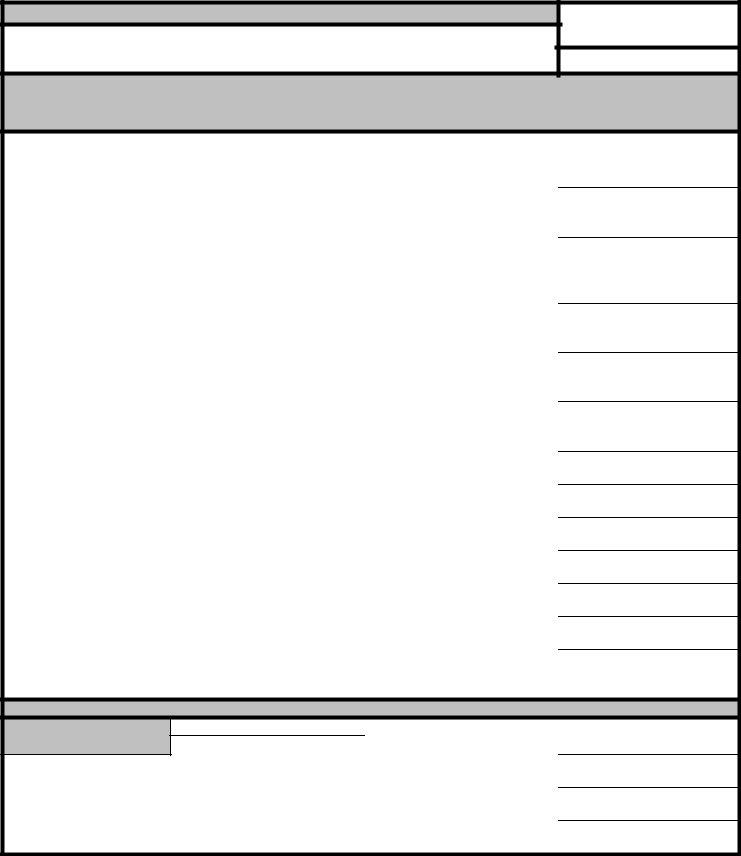

City of Owensboro

Daviess County Fiscal Court

WORKSHEET Y

BUSINESS APPORTIONMENT

PART I - CITY OF OWENSBORO (See Page 6 of Instructions)

|

|

|

DIVIDE↓ |

|

APPORTIONMENT FACTORS |

COLUMN A |

COLUMN B |

COLUMN C |

|

|

CITY OF OWENSBORO |

TOTAL EVERYWHERE |

A ÷ B = C |

|

1)PAYROLL FACTOR

Compensation paid or payable to employees (also complete Worksheet R)

2) SALES REVENUE FACTOR

Receipts from the sale, lease, or rental

of goods, services, or property

%

%

3) TOTAL PERCENTAGES ( Line 1 of Column C plus Line 2 of Column C)………………..

%

4) BUSINESS APPORTIONMENT Enter here and on FORM

%

HOW TO CALCULATE LINE 4; BUSINESS APPORTIONMENT:

If you had both a payroll factor and a sales revenue factor, then divide line 3 by two (2).

If you had a payroll factor or sales revenue factor, but not both, then enter the percentage from line 3.

PART II - DAVIESS COUNTY (See Page 7 of Instructions)

|

|

|

DIVIDE↓ |

|

APPORTIONMENT FACTORS |

COLUMN A |

COLUMN B |

COLUMN C |

|

|

DAVIESS COUNTY |

TOTAL EVERYWHERE |

A ÷ B = C |

|

1)PAYROLL FACTOR

Compensation paid or payable to employees (also complete Worksheet R)

2) SALES REVENUE FACTOR

Receipts from the sale, lease, or rental

of goods, services, or property

%

%

3) TOTAL PERCENTAGES ( Line 1 of Column C plus Line 2 of Column C)………………..

%

4) BUSINESS APPORTIONMENT Enter here and on FORM

%

HOW TO CALCULATE LINE 4; BUSINESS APPORTIONMENT:

If you had both a payroll factor and a sales revenue factor, then divide line 3 by two (2).

If you had a payroll factor or sales revenue factor, but not both, then enter the percentage from line 3.

2

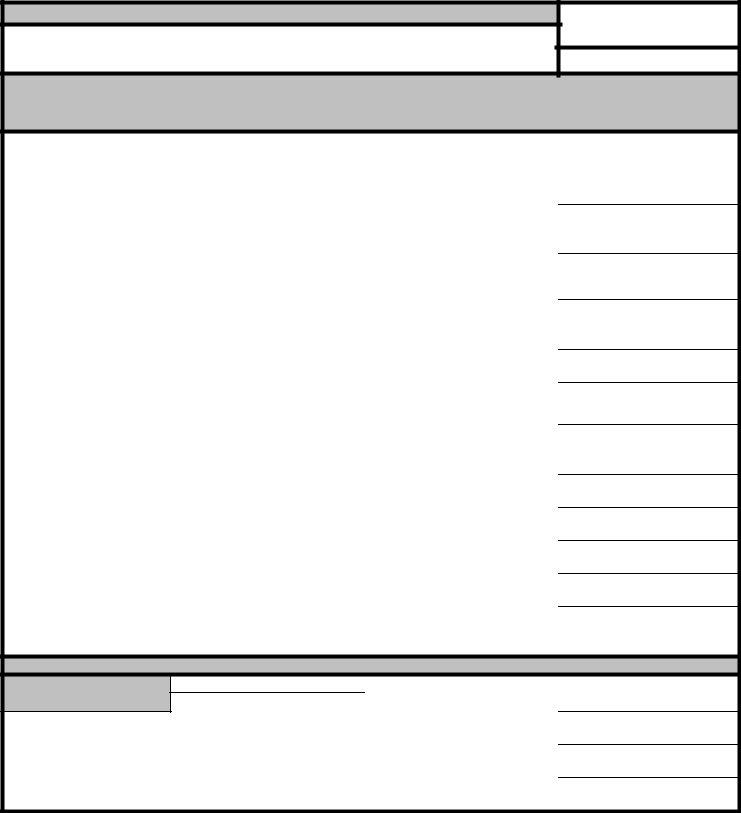

City of Owensboro

Daviess County Fiscal Court

****IMPORTANT****

This Worksheet along with copies of all applicable federal forms and schedules MUST

be attached to FORM

Federal ID # or

Social Security #

WORKSHEET I (See Page 8 of Instructions)

COMPUTATION OF TOTAL NET PROFIT

FOR BUSINESS ENTITIES REQUIRED TO FILE INDIVIDUAL U.S. INCOME TAX RETURN

1)

"Other Income" on Federal Form 1040 (Attach Page 1 of Form 1040 and Form 1099)

2)Net profit or (loss) per Federal Schedule C, or

3)Gain or (loss) on sales of business property used in a trade or business from Federal Form 4797 or Form 6252 reported on Schedule D of Form 1040 (Attach Form 4797 Pages 1 and 2 and/or Form 6252)

4)Rental income or (loss) per Federal Schedule E of Form 1040. Include all Rental Income.(See instructions for details)(Attach Schedule E)

5)Net farm profit or (loss) per Federal Schedule F, or Form 4835, of Form 1040 (Attach Schedule F Pages 1 and 2 or Form 4835 if applicable)

6)State income taxes and occupational license fees (taxes) based upon income deducted on the Federal Schedule

7)Other Items not Deductible(Attach full explanation and applicable schedule(s))

8)Total Income (Add lines 1 through 7)

9)Alcoholic Beverage Sales Deduction (Worksheet X, Line 3)

10)Local/other adjustments (Attach full explanation and applicable schedule(s))

11)Total adjustments (Add lines 9 and 10)

12)Total Net Profit (Subtract line 11 from line 8) Enter here and on line 1 Column A and Column B of FORM

City of Owensboro is less than $3,500 do not enter this amount in Column A; instead complete Worksheet E.

WORKSHEET X: ALCOHOLIC BEVERAGE SALES DEDUCTION

1)DIVIDE→

Kentucky Alcoholic Beverage Sales |

|

Total sales |

% |

2)Enter "Total Income" from line 8 of Worksheet I

3)Alcoholic Beverage Sales Deduction (multiply line 1 by line 2) Enter here and on line 9 above

3

City of Owensboro

Daviess County Fiscal Court

****IMPORTANT****

This Worksheet along with copies of all applicable federal forms and schedules MUST be attached to FORM

Federal ID # or

Social Security #

WORKSHEET C (See Page 9 of Instructions)

COMPUTATION OF TOTAL NET PROFIT

FOR BUSINESS ENTITIES REQUIRED TO FILE U.S. CORPORATE INCOME TAX RETURN

1)Taxable income or (loss) per Federal Form 1120 or 1120A or Ordinary income or (loss) per Federal Form 1120S (Attach the applicable 1120 or 1120A, Pages 1 and 2 or 1120S Pages 1, 2 and 3, Schedule of Other Deductions and rental schedule(s), if applicable)

2)State income taxes and occupational fees (taxes) based on income deducted on the Federal Form 1120, 1120A or 1120S (Attach schedule)

3)Net operating loss deducted on Form 1120 (add as positive number)

4)Additions from Schedule K of Form 1120S (See instructions) (Attach Schedule K of Form 1120S and rental schedule(s), if applicable)

5)Other Items Not Deductible(Attach full explanation and applicable schedule(s))

6)Total Income (Add lines 1 through 5)

7)Subtractions from Schedule K of Form 1120S (See instructions) (Attach Schedule K of Form 1120S and rental schedule(s), if applicable)

8)Alcoholic Beverage Sales Deduction (Worksheet X, Line 3)

9)Local/other adjustments (Attach full explanation and applicable schedule(s))

10)Total adjustments (Add lines 7 through 9)

11)Total Net Profit (Subtract line 10 from line 6) Enter here and on line 1 Column A and Column B of Form

City of Owensboro is less than $3,500 do not enter this amount in Column A; instead complete Worksheet E.

WORKSHEET X: ALCOHOLIC BEVERAGE SALES DEDUCTION

1)DIVIDE→

Kentucky Alcoholic Beverage Sales |

|

Total sales |

% |

2)Enter "Total Income" from line 6 of Worksheet C

3)Alcoholic Beverage Sales Deduction (multiply line 1 by line 2) Enter here and on line 8 above

4

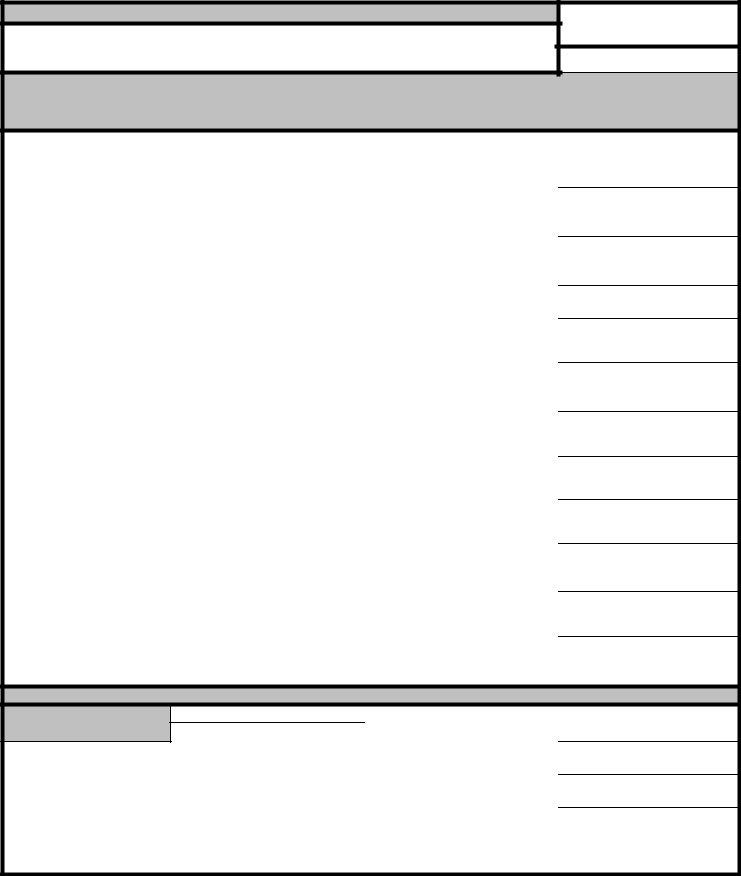

City of Owensboro

Daviess County Fiscal Court

****IMPORTANT****

This Worksheet along with copies of all applicable federal forms and schedules MUST be attached to FORM

Federal ID # or

Social Security #

WORKSHEET P (See page 10 of Instructions)

COMPUTATION OF TOTAL NET PROFIT

FOR BUSINESS ENTITIES REQUIRED TO FILE U.S. RETURN OF PARTNERSHIP INCOME TAX RETURN

1)Ordinary income or (loss) per Federal Form 1065 (Attach Form 1065, Pages 1, 2 and 3, Schedule of Other Deductions, and rental schedule(s), if applicable)

2)State income taxes and occupational fees (taxes) based on income deducted on the Federal Form 1065 (Attach schedule)

3)Additions from Schedule K of Form 1065 (See instructions) (Attach Schedule K of Form 1065 and rental schedule(s), if applicable)

4)Other Items not Deductible (Attach full explanation and applicable schedule(s))

5)Total income (Add lines 1 through 4)

6)Subtractions from Schedule K of Form 1065 (See instructions) (Attach Schedule K of Form 1065 and rental schedule(s), if applicable)

7)Alcoholic Beverage Sales Deduction (Worksheet X, Line 3)

8)Local/other adjustments (Attach full explanation and applicable schedule(s))

9)Professional expenses not reimbursed by the partnership (Attach schedule of expenses)

10)Total adjustments (Add lines 6 through 9)

11)Total Net Profit (Subtract line 10 from line 5) Enter here and on line 1 Column A and Column B of FORM

City of Owensboro are less than $3,500 do not enter this amount in Column A; instead complete Worksheet E.

WORKSHEET X: ALCOHOLIC BEVERAGE SALES DEDUCTION

1)DIVIDE→

Kentucky Alcoholic Beverage Sales |

|

Total sales |

% |

2)Enter "Total Income" from line 5 of Worksheet P

3)Alcoholic Beverage Sales Deduction (multiply line 1 by line 2) Enter here and on line 7 above

5

City of Owensboro

Daviess County Fiscal Court

****IMPORTANT****

This Worksheet MUST be attached to FORM

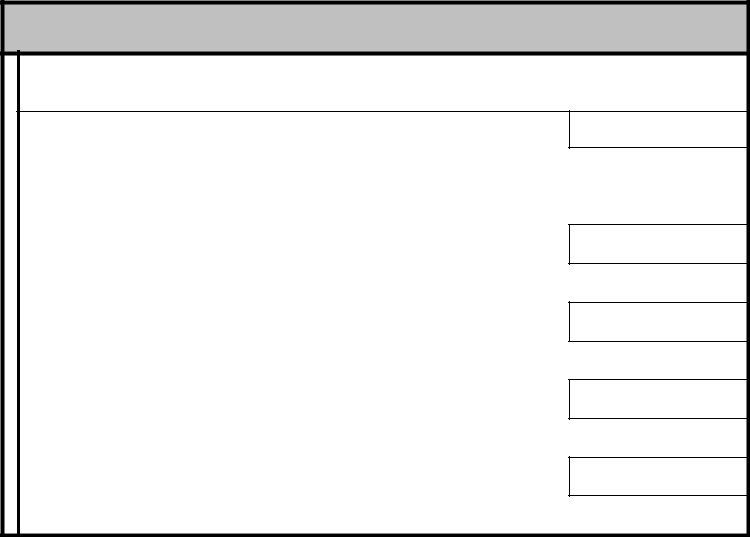

WORKSHEET R (See Page 11 of Instructions)

RECONCILIATION OF PAYROLL FACTOR

FOR BUSINESS ENTITIES COMPLETING THE PAYROLL APPORTIONMENT FACTOR

|

City of Owensboro |

Daviess County |

|

||

|

City of Owensboro |

Total Everywhere |

Daviess County |

Total Everywhere |

|

|

Payroll |

Payroll |

Payroll |

Payroll |

|

|

|

|

|

|

|

1) Compensation paid or payable to |

|

|

|

|

|

employees per Worksheet Y |

|

|

|

|

|

|

|

|

|

|

|

2)Prior year accrual adjustment

3)Other additions (attach schedule)

4)Subtotal (Add lines 1 through 3)

5)Current year accrual adjustment

6)Other subtractions

(attach schedule)

7) Compensation paid or payable to employees (line 4 minus lines 5 and 6)

6

City of Owensboro

WORKSHEET E (See Page 11 of Instructions)

1.

2.

3.

4.

5.

Only complete this worksheet if Gross Receipts/Sales Revenue in the City of Owensboro is less than $3,500, otherwise complete Worksheet C, I, or P, whichever is applicable.

Enter Gross Receipts/Sales Revenues earned in the City of Owensboro…………….…………

(Only enter amount if less than $3,500)(If amount is less than $600 and no compensation was paid to employees working in the City of Owensboro during the year, skip lines 2 through 5 of this worksheet and enter

Enter wages, salaries, and other employee compensation paid to employees working

in the City of Owensboro during the year…………………………………………………

If line 2 above is zero enter the amount from line 1 here, otherwise enter 0…………..………

If line 3 is zero or is equal to or greater than $3,500, STOP HERE. You are required to complete worksheet I, P or C, and Column A of Form

Multiply the amount from Line 3 of this worksheet by 1.33%. Enter result here and on

Line 9, Column A of Form

(Please attach completed Worksheet E to Form

7