notice to cosigner form can be completed easily. Just open FormsPal PDF editing tool to do the job right away. To keep our tool on the forefront of convenience, we work to put into practice user-oriented features and improvements regularly. We are always looking for suggestions - assist us with revolutionizing how you work with PDF forms. To get the ball rolling, consider these easy steps:

Step 1: First of all, open the editor by pressing the "Get Form Button" above on this page.

Step 2: With our advanced PDF editing tool, you can accomplish more than just complete blank fields. Try all the functions and make your documents look high-quality with customized textual content added in, or optimize the file's original content to excellence - all supported by an ability to incorporate your personal images and sign the document off.

Completing this PDF demands care for details. Ensure all mandatory areas are completed properly.

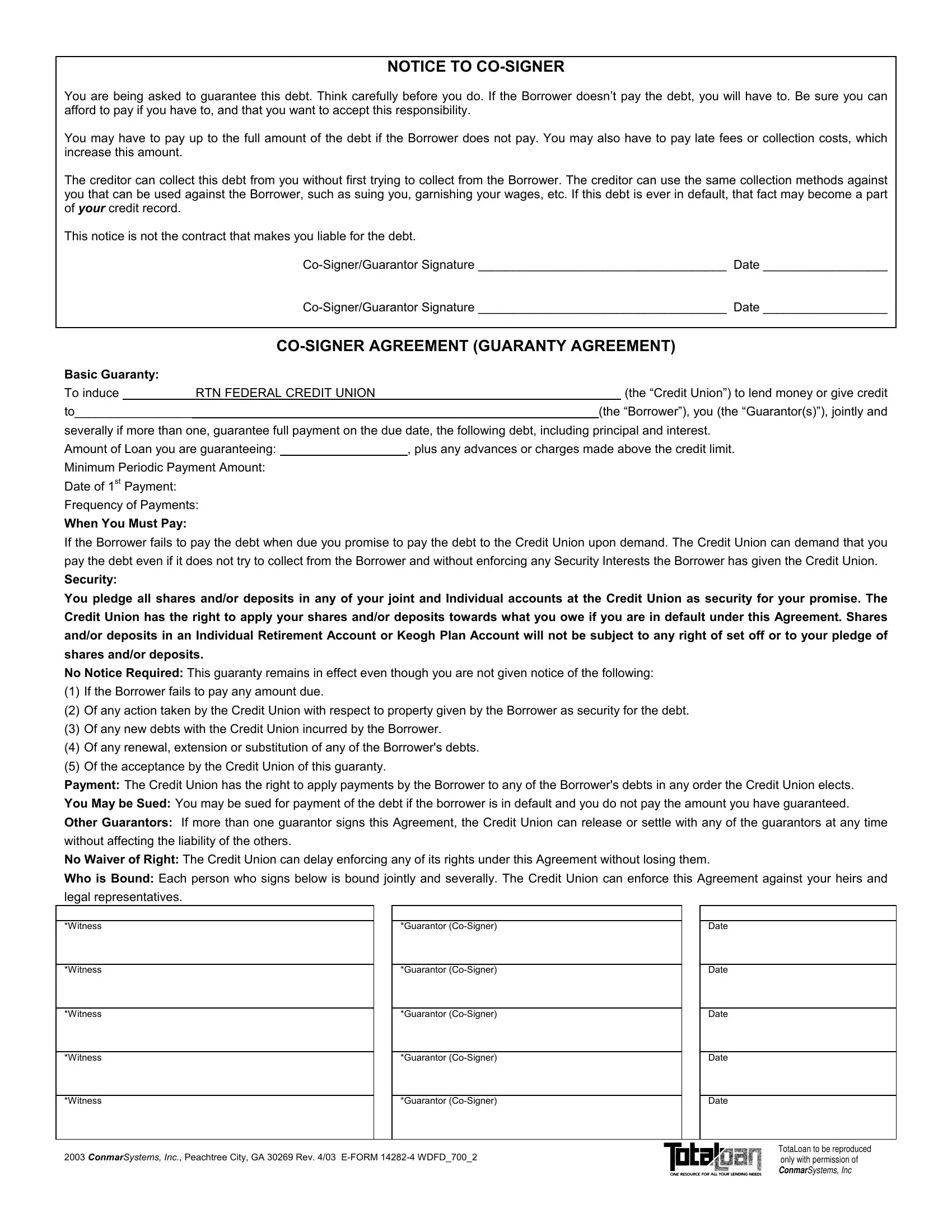

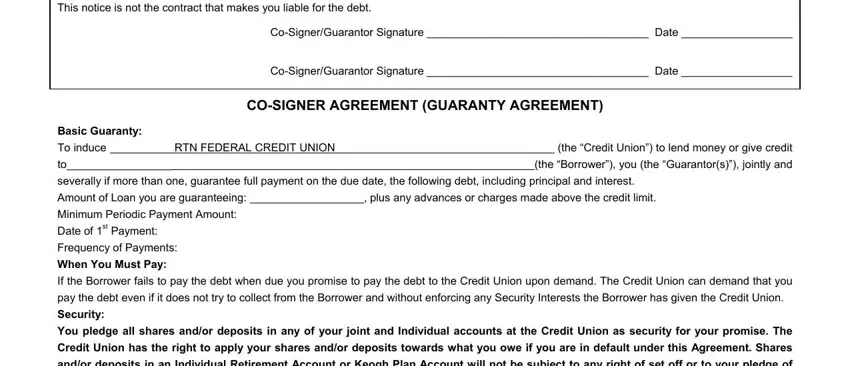

1. It's important to complete the notice to cosigner form accurately, thus be attentive while filling in the parts including all of these blanks:

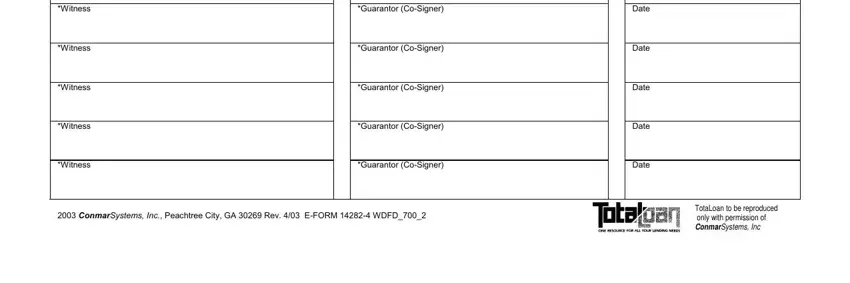

2. Your next stage is to fill out the next few blank fields: legal representatives Witness, Guarantor CoSigner, Guarantor CoSigner, Guarantor CoSigner, Guarantor CoSigner, Guarantor CoSigner, Date, Date, Date, Date, Date, ConmarSystems Inc Peachtree City, and TotaLoan to be reproduced only.

It's simple to make an error when filling out the Guarantor CoSigner, so make sure you look again before you decide to submit it.

Step 3: After you have reviewed the information in the document, click on "Done" to complete your form. Try a free trial plan with us and obtain direct access to notice to cosigner form - download, email, or change in your FormsPal account. FormsPal is dedicated to the confidentiality of our users; we ensure that all information processed by our system continues to be secure.