Using the online PDF editor by FormsPal, you can easily fill in or change colorado real estate property disclosure forms right here and now. FormsPal is dedicated to giving you the absolute best experience with our tool by regularly releasing new functions and upgrades. With all of these improvements, using our tool gets better than ever before! With just several simple steps, you'll be able to start your PDF journey:

Step 1: Press the "Get Form" button above on this webpage to open our tool.

Step 2: After you access the tool, you will see the form all set to be completed. In addition to filling out different blanks, you might also do many other actions with the form, that is putting on any textual content, editing the original textual content, inserting illustrations or photos, affixing your signature to the form, and more.

Completing this PDF will require care for details. Make certain all required blank fields are filled out correctly.

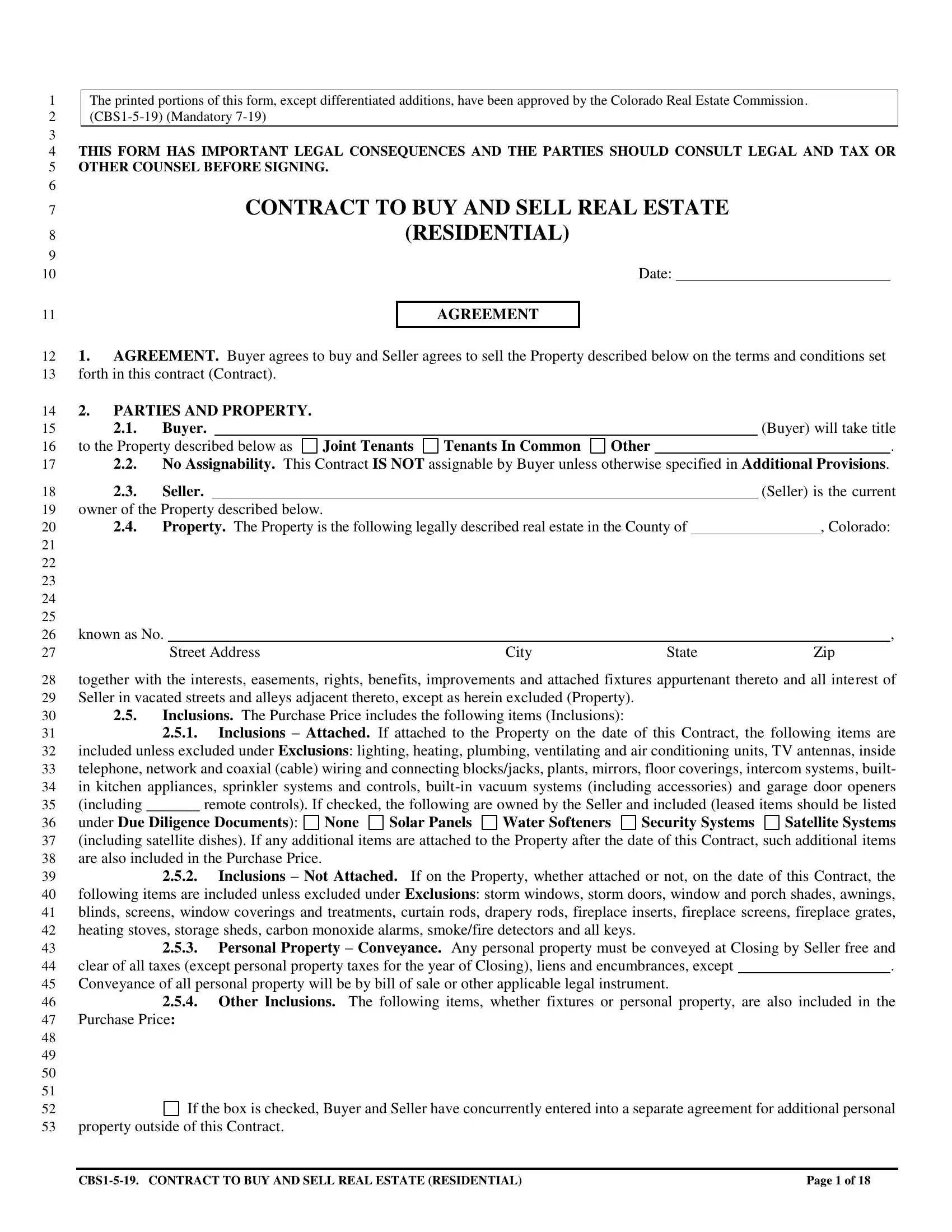

1. It is critical to complete the colorado real estate property disclosure forms accurately, therefore pay close attention when working with the sections including all of these blanks:

2. When the previous section is finished, it is time to insert the essential details in None, Solar Panels, Water Softeners, together with the interests, Personal Property Conveyance Any, Other Inclusions The following, If the box is checked Buyer and, Security Systems, CBS CONTRACT TO BUY AND SELL REAL, and Page of so that you can progress to the next step.

3. This subsequent step should also be rather uncomplicated, and the use or ownership of the, Parking and Storage Facilities, Note to Buyer If exact rights to, Exclusions The following items are, Water RightsWell Rights, Deeded Water Rights The following, Any deeded water rights will be, deed at Closing, will be transferred to Buyer at, Well Rights Seller agrees to, Water Stock Certificates The, and Conveyance If Buyer is to receive - all these empty fields needs to be filled out here.

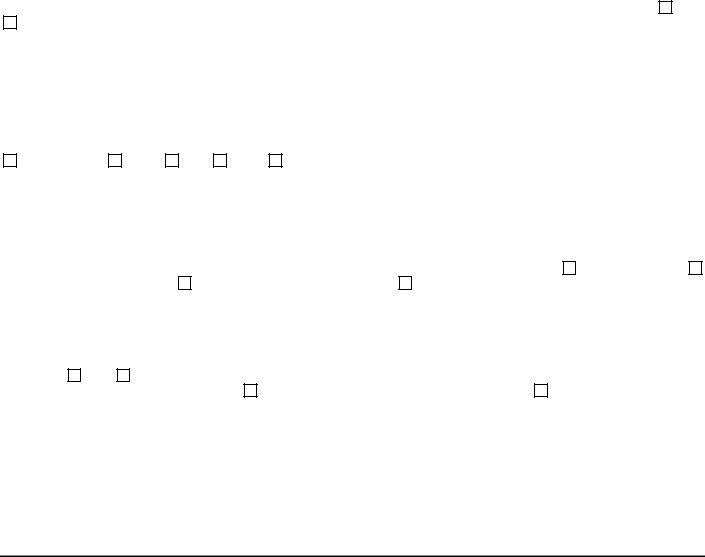

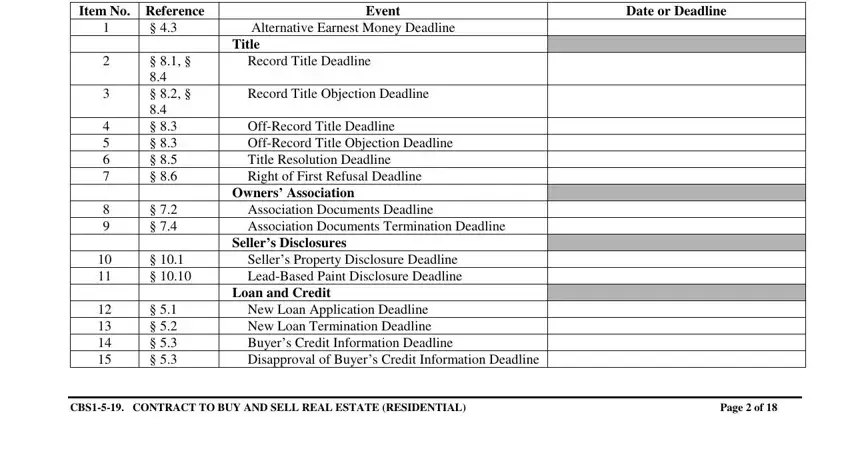

4. This fourth subsection arrives with these form blanks to focus on: Item No Reference, Event, Date or Deadline, Alternative Earnest Money Deadline, Title, Record Title Deadline, Record Title Objection Deadline, OffRecord Title Deadline OffRecord, Owners Association, Association Documents Deadline, Sellers Disclosures, Sellers Property Disclosure, Loan and Credit, New Loan Application Deadline New, and CBS CONTRACT TO BUY AND SELL REAL.

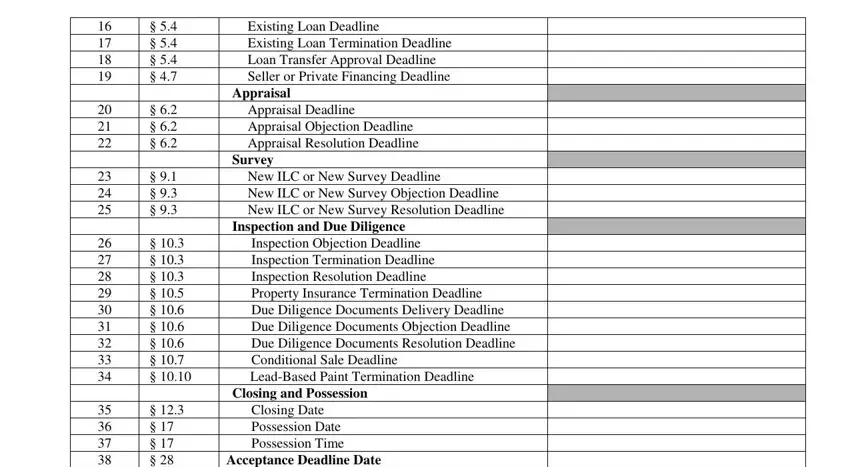

5. When you come near to the finalization of the form, you will find a couple more requirements that need to be satisfied. Particularly, Existing Loan Deadline Existing, Appraisal, Appraisal Deadline Appraisal, Survey, New ILC or New Survey Deadline New, Inspection and Due Diligence, Inspection Objection Deadline, Closing and Possession, Closing Date Possession Date, and Acceptance Deadline Date should all be filled in.

People frequently get some things wrong while completing Closing Date Possession Date in this section. Ensure that you review everything you enter here.

Step 3: When you have looked over the information in the document, click "Done" to conclude your form. Try a 7-day free trial option at FormsPal and gain immediate access to colorado real estate property disclosure forms - with all adjustments preserved and available from your personal cabinet. FormsPal provides risk-free document editing with no personal information recording or any sort of sharing. Be assured that your data is secure here!