Navigating the complexities of estimated tax payments can be daunting, especially when trying to avoid penalties for underpayment. The Colorado Department of Revenue's DR 0204 form is a crucial tool for individuals who need to calculate potential penalties related to underpaid estimated taxes. This form is particularly relevant if your income does not come in evenly throughout the year, or if you derive a significant portion of your income from farming or fishing, as special rules apply. By laying out the computation of penalties step by step, the DR 0204 enables taxpayers to determine if they owe a penalty for underpayment of estimated taxes, and if so, how much that penalty might be. It takes into account various exceptions and provides a methodological approach through its sections, including the Exception Number, Required Annual Payment, Penalty Computation, and the Annualized Installment Method Schedule. Understanding each part of the DR 0204 is essential for Colorado residents aiming to comply with state tax regulations while minimizing their penalty risks. The form outlines specific criteria under which taxpayers can be exempted from penalties, offers a detailed guide for calculating the necessary annual payment to avoid penalties, and illustrates how to compute any penalties due. It also includes provisions for those with uneven income streams, allowing them to use the Annualized Installment Method to calculate their payments and possibly reduce penalty amounts.

| Question | Answer |

|---|---|

| Form Name | Colorado Dr 0204 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Underpayment, dr0204, 2012, co form dr 0204 |

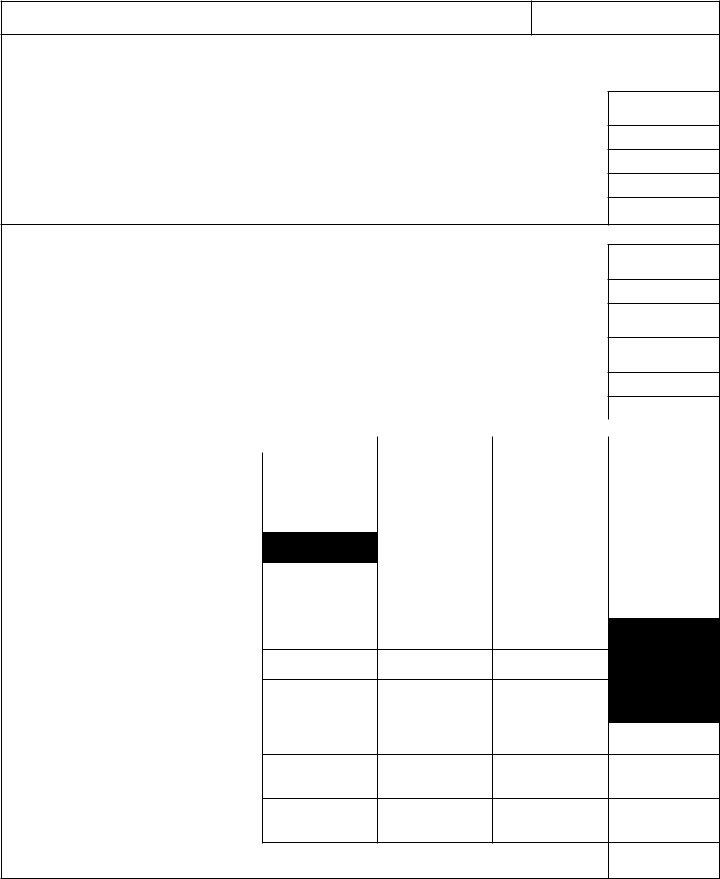

DR 0204 (10/18/12) Web |

2012 |

COLORADO DEPARTMENT OF REVENUE |

Denver, CO |

|

WWW.TAXCOLORADO.COM |

Computation of Penalty Due Based on |

|

|

|

Underpayment of Colorado Individual Estimated Tax |

Taxpayer’s Name

Social Security Number

Part 1 — Exception Number 1 If at least

Exception Number 2

1.Enter your 2012 tax liability (including alternative minimum tax and any credit recapture) after reduction for all credits other than withholding tax and estimated tax payments and credits .............

2.(a) Statutory exemption .....................................................................................................................

(b)2012 Colorado income tax withheld..............................................................................................

(c)Total of lines 2(a) and 2(b) ............................................................................................................

3.Line 1 minus line 2(c). If 2(c) is larger, enter 0 and you are not subject to the penalty ......................

$

$1,000.00

$

$

$

Part 2 — Required Annual Payment

4.(a) Enter your 2012 tax liability (including alternative minimum tax and any credit recapture) after reduction for all credits other than withholding tax and estimated tax payments and credits..............

(b)Enter 70% of the amount on line 4(a) ...........................................................................................

5.(a) Enter your 2011 tax liability (including alternative minimum tax and any credit recapture) after reduction for all credits other than withholding tax, estimated tax payments and credits ...................

(b)If your 2011 federal adjusted gross income is greater than $150,000 (greater than $75,000 if married iling separate), enter 10% of line 5(a). If not, enter 0 .......................................................

(c)Enter total of lines 5(a) and 5(b) ...................................................................................................

6.Required payment. Enter the smaller of lines 4(b) or 5(c)..................................................................

$

$

$

$

$

$

Part 3 — Penalty Computation |

|

Payment Due Dates |

|

||

7. Divide the amount on line 6 by four. |

April 17, 2012 |

June 15, 2012 |

Sept 17, 2012 |

January 15, 2013 |

|

|

|

|

|

||

Enter the result in the appropriate |

$ |

$ |

$ |

$ |

|

columns |

|||||

8. |

Amounts paid in estimated tax |

$ |

$ |

$ |

$ |

9. |

Amount of tax withheld |

$ |

$ |

$ |

$ |

10.Overpayment (on line 12) from

previous period |

|

$ |

$ |

$ |

11. Total of lines 8, 9, and 10 |

$ |

$ |

$ |

$ |

12.Underpayment (line 7 minus line 11) or

<overpayment> (line 11 minus line 7) |

$ |

$ |

$ |

$ |

13.Date of payment or December 31, 2012, whichever is earlier....................

14.Number of days from due date of payment to date on line 13..................

15.Underpayment on line 12 multiplied by 6% multiplied by number of days on

line 14 divided by 365 |

$ |

$ |

$ |

16.Date of payment or April 15, 2013, whichever is earlier..............................

17.Number of days from December 31, 2012 or due date of payment, whichever is later, to date on line 16 ...

18.Underpayment on line 12 multiplied by 6% multiplied by number of days on

line 17 divided by 365 |

$ |

$ |

$ |

$ |

19.Total penalty. Add all amounts on lines 15 and 18. Include this amount as estimated tax

penalty on line 48 of Form 104 |

$ |

Part 4 — Annualized Installment Method Schedule

20. Ending date of annualization period |

March 31, 2012 |

May 31, 2012 |

August 31, 2012 |

Dec 31,2012 |

21. Colorado taxable income computed |

$ |

$ |

$ |

$ |

through the date on line 20 |

||||

22. Annualization factor |

4 |

2.4 |

1.5 |

1 |

|

|

|

|

|

23. Annualized taxable income |

$ |

$ |

$ |

$ |

Line 21 times line 22 |

||||

24. Annualized Colorado tax |

$ |

$ |

$ |

$ |

Line 23 times 4.63% |

||||

25. Applicable percentage |

17.5% |

35% |

52.5% |

70% |

|

|

|

|

|

26. Installment payment due. |

|

|

|

|

Line 24 multiplied by line 25, minus |

|

|

|

|

amounts entered on line 26 in earlier |

|

|

|

|

quarters.Enter here and on line 7 |

$ |

$ |

$ |

$ |

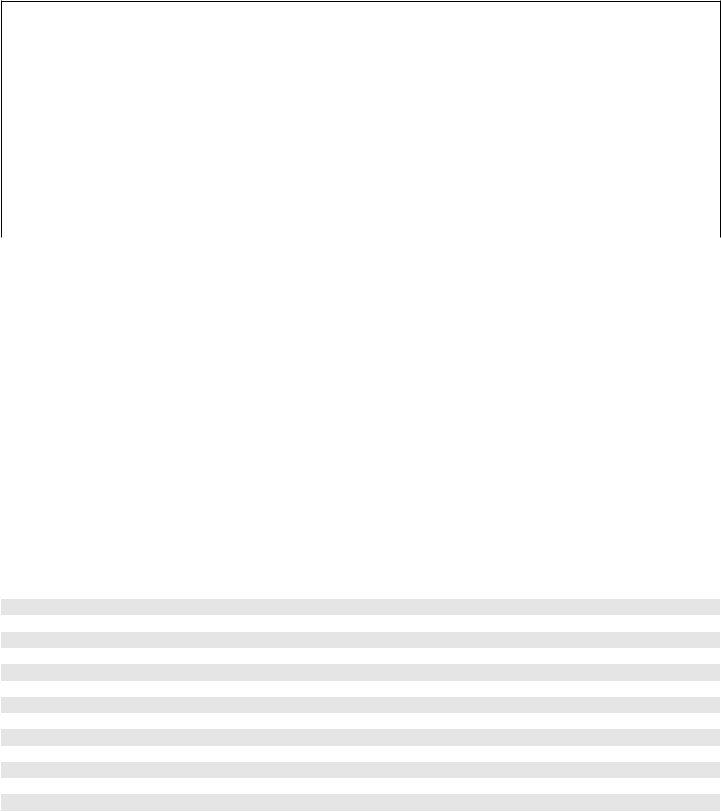

Instructions for DR 0204

Part 1 Generally you are subject to an estimated tax penalty if your 2012 estimated tax payments are not paid in a timely manner. The estimated tax penalty will not be assessed if either of the exceptions are met.

Part 2 The required annual amount to be paid is the lesser of:

1.70% of actual 2012 net Colorado tax liability.

2.100% of preceding year’s net Colorado tax liability.

(This amount only applies if the preceding year was a

3.110% of preceding year’s net Colorado tax liability.

(This amount only applies if the preceding year was a

Colorado return.)

Part 3 If neither exception applies to you, compute your penalty on lines 7 through 19 of Form 204. Complete each column before going on to the next column. See FYI

Income 51, Estimated Income Tax, regarding estimated tax payment allocation on line 8. The amount entered on line 10 is the net overpayment from the preceding period.

On line 17, if the payment was made prior to January 1,

2013, enter “0.” If the tax return is iled and any tax due is paid by January 31, 2013, no penalty will be computed

in column four. Estimated tax payments from a farmer or isherman are due in a single payment by January 17,

2013 and only column four is used to compute the penalty.

Part 4 Taxpayers who do not receive income evenly during the year may elect to use the annualized income installment method to compute their estimated tax payments if they elect annualized installments for the payment of their federal income tax. Complete the annualized installment method schedule to compute the amounts to enter on line

7. See FYI Income 51 regarding this computation method.

Example: Taxpayer's net tax liability for 2012 is $10,000. He had $1,000 withholding and none of the exceptions apply. He paid $4,000 on June 12, 2012, and made no additional estimated tax payments.

|

April 17 |

June 15 |

September 17 |

January 15 |

Line 7 |

$1,750 |

$1,750 |

$1,750 |

$1,750 |

Line 8 |

$0 |

$4,000 |

$0 |

$0 |

Line 9 |

$250 |

$250 |

$250 |

$250 |

Line 10 |

— |

— |

$1,000** |

— |

Line 11 |

$250 |

$4,250 |

$1,250 |

$250 |

Line 12 |

$1,500 |

$(2,500) |

$500 |

$1,500 |

Line 13 |

6/12/12 |

6/12/12 |

12/31/12 |

— |

Line 14 |

56 |

— |

107 |

— |

Line 15 |

$13.81 |

— |

$8.79 |

— |

Line 16 |

6/12/12 |

6/12/12 |

4/15/13 |

4/15/13 |

Line 17 |

0 |

0 |

108 |

91 |

Line 18 |

0 |

0 |

$8.85 |

$22.38 |

Line 19 |

$53.83 |

|

|

|

** June 12 Payment |

|

$4,000 |

April withholding |

|

250 |

June withholding |

|

250 |

|

|

$4,500 |

April installment |

$1,750 |

|

June installment |

1,750 |

3,500 |

Overpayment to September |

$1,000 |

|

For additional information regarding the estimated tax penalty see FYI Income 51, which is available at WWW.TAXCOLORADO.COM