DBA can be filled out effortlessly. Simply make use of FormsPal PDF editor to get the job done quickly. Our development team is always endeavoring to expand the tool and insure that it is much faster for users with its cutting-edge features. Benefit from today's modern opportunities, and find a heap of new experiences! To begin your journey, consider these easy steps:

Step 1: Hit the orange "Get Form" button above. It's going to open our editor so that you can begin completing your form.

Step 2: The tool allows you to modify PDF forms in various ways. Transform it by writing your own text, adjust what's originally in the file, and add a signature - all manageable within minutes!

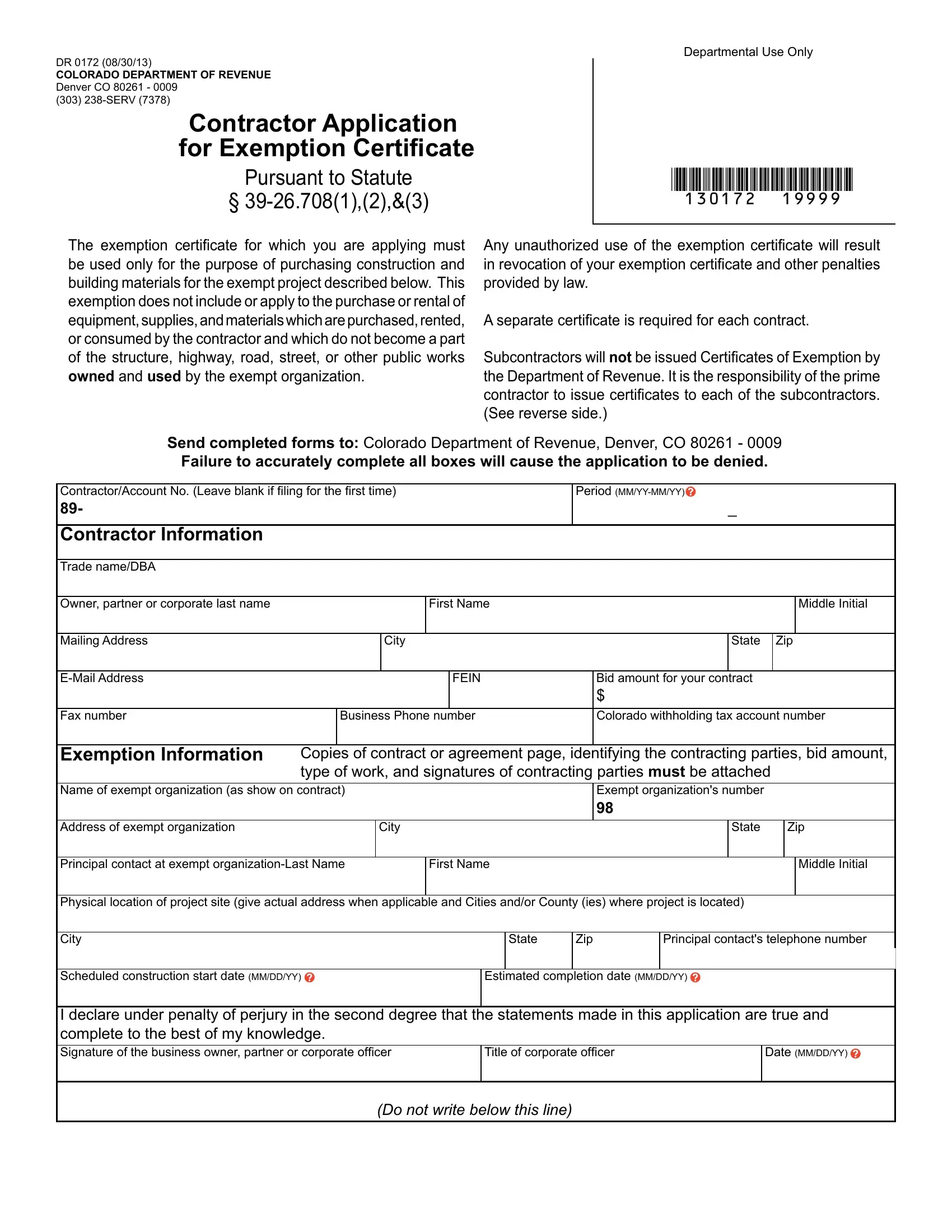

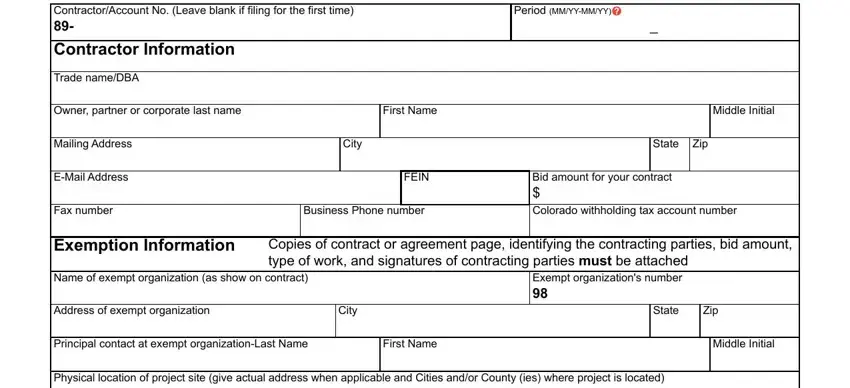

This document requires specific information; in order to ensure accuracy, be sure to consider the tips further down:

1. When filling in the DBA, make certain to complete all needed fields within its corresponding section. It will help to facilitate the process, making it possible for your information to be processed quickly and accurately.

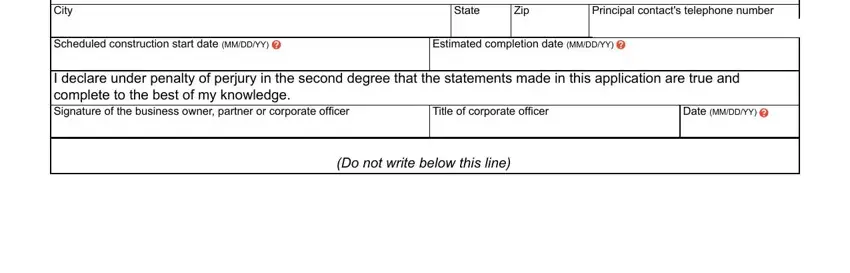

2. The next part would be to complete the following blanks: City, State, Zip, Principal contacts telephone, Scheduled construction start date, Estimated completion date MMDDYY, I declare under penalty of perjury, Title of corporate oficer, Date MMDDYY, and Do not write below this line.

Always be very attentive when completing Estimated completion date MMDDYY and City, as this is where most people make some mistakes.

Step 3: You should make sure the information is accurate and simply click "Done" to finish the task. After getting afree trial account here, you'll be able to download DBA or email it immediately. The form will also be easily accessible via your personal account page with all of your modifications. We do not sell or share the information you type in when filling out documents at our site.