Filing taxes in different states can become complex, especially for those who have lived as part-year residents or nonresidents within a tax year. The Colorado 104PN form is designed to navigate through these complexities. Specifically crafted for individuals who have spent part or all of the tax year 2012 outside of Colorado, this form ensures that taxpayers appropriately calculate and report their Colorado income, thereby paying the correct amount of state income tax. It comes into play after completing the initial lines of Form 104, helping to apportion gross income so that only income attributable to Colorado is taxed according to the state's laws. Important considerations for completing this form include distinguishing between full-year and part-year residency, understanding which type of federal form was filed (e.g., 1040, 1040NR), and correctly entering all sources of income, be it from employment within Colorado or other earnings linked to the state. Additionally, the form allows for certain adjustments and deductions that directly impact one's taxable income in Colorado, taking into account specific expenses and contributions that affect one's adjusted gross income. Overall, Form 104PN serves as a crucial tool for ensuring fairness and accuracy in tax calculations for those with Colorado income but varied residency statuses throughout the year.

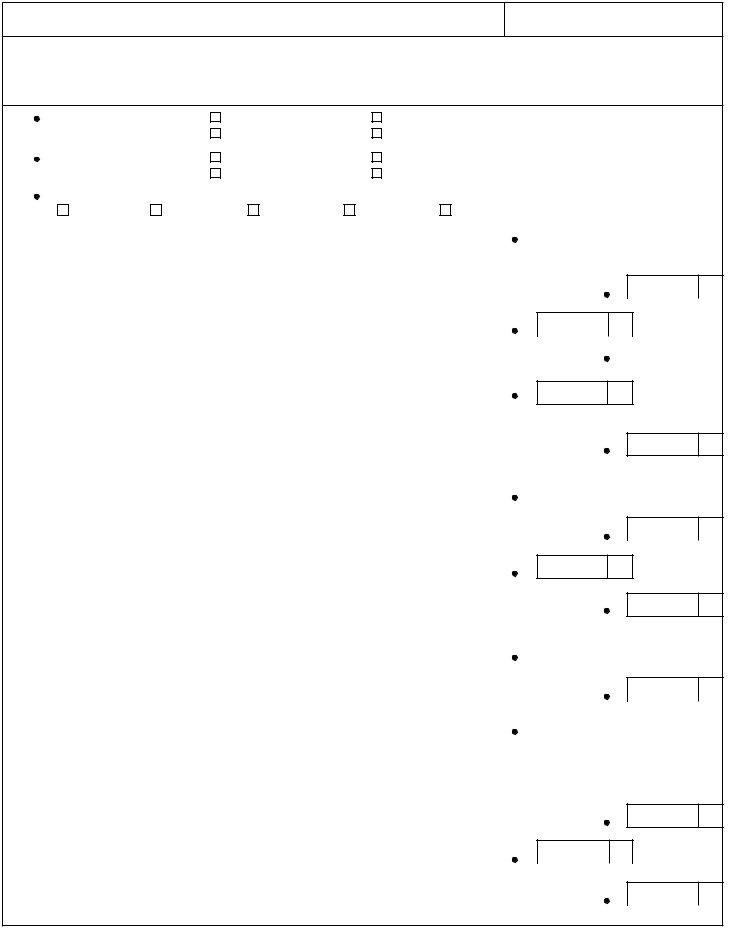

| Question | Answer |

|---|---|

| Form Name | Colorado Form 104Pn |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | colorado surplus lines forms, colorado 2017 form 104, colorado tax form 104pn 2017, colorado 104 fillable |

(03/13/13) Web

Form

Taxpayer’s Name

Social Security Number

Use this form if you and/or your spouse were a resident of another state for all or part of 2012. This form apportions your gross income so the Colorado tax computed from the tax table on your total 2012 income will be reduced to relect only the tax on your Colorado income. Complete this form after you have illed out lines 1 through 18 of Form 104. If you iled

federal form 1040NR, see Income 6 and for military service persons, Income 21.

1. |

Taxpayer is (mark one): |

to ____/____/12; |

|||||||||

|

|

|

Nonresident |

|

|

|

|||||

2. |

Spouse is (mark one): |

to ____/____/12; |

|||||||||

|

|

|

Nonresident |

|

|

|

|||||

3. |

Mark the federal form you iled: |

|

|

|

|

|

|

||||

|

|

|

Federal |

|

Colorado |

||||||

|

1040 |

1040 A |

1040 EZ |

1040 NR |

Other |

|

Information |

|

Information |

||

|

|

|

|

|

|

|

|

|

|

|

|

4. Enter all income from form 1040 line 7; 1040A line 7; or form 1040EZ line1 |

4 |

|

|

00 |

|

|

|||||

5.Enter income from line 4 that was earned while working in Colorado AND/OR earned while you were a Colorado resident.

expense reimbursements only if paid for moving into Colorado |

5 |

00 |

6.Enter all interest/dividend income from form 1040 lines 8a and 9a; form 1040A

lines 8a and 9a; or form 1040EZ line 2 |

6 |

00 |

|

|

|

|

|

|

|

|

|

7. Enter income from line 6 that was earned while you were a resident of Colorado |

7 |

|

|

00 |

|

8.Enter all income from form 1040 line 19; form 1040A line 13; or form 1040EZ

line 3 |

8 |

00 |

9.Enter income from line 8 that is from State of Colorado unemployment beneits;

AND/OR is from another state’s beneits that were received while you were a

Colorado resident |

9 |

00 |

If you iled federal form 1040EZ, go to line 24. All others continue with line 10.

...............10. Enter all income from form 1040 lines 13 and 14; or form 1040A line 10 |

10 |

|

00 |

11.Enter income from line 10 that was earned during that part of the year you were a

Colorado resident AND/OR was earned on property located in Colorado |

11 |

00 |

12.Enter all income from form 1040 lines 15b, 16b, and 20b; or form 1040A lines 11b,

12b, and 14b |

12 |

00 |

13.Enter income from line 12 that was received during that part of the year you were

a Colorado resident |

13 |

00 |

If you iled federal form 1040A, go to line 20. If you iled form 1040, continue with line 14.

.....................14. Enter all business and farm income from form 1040 lines 12 and 18 |

14 |

|

00 |

15.Enter income from line 14 that was earned during that part of the year you were a

Colorado resident AND/OR was earned from a Colorado operation. |

................................................. |

15 |

|

00 |

|

16. Enter all Schedule E income from form 1040 line 17 |

16 |

|

|

|

|

|

00 |

|

|||

17.Enter income from line 16 that was earned from Colorado sources; AND/OR rent and royalty income received or credited to your account during that part of the year you

were a Colorado resident; AND/OR partnership/S corporation/iduciary income |

|

|

apportioned based on the number of days of Colorado residency during the |

17 |

|

corporation/partnership/iduciary tax year |

00 |

18.Enter all other income from form 1040 lines 10, 11 and 21,

(list type _________________________________________________) |

18 |

00 |

19.Enter income from line 18 that was earned or received during that part of the year

you were a Colorado resident AND/OR was received from Colorado sources |

19 |

00 |

(list type_________________________________________________) |

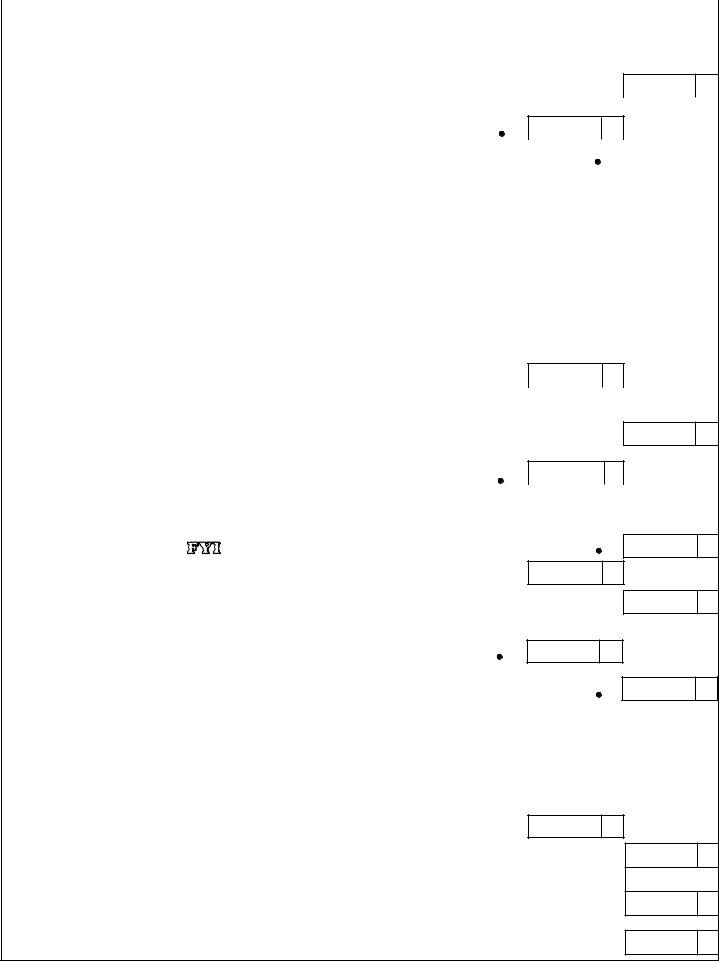

|

|

|

|

Federal |

Colorado |

|

|

|

Information |

Information |

|

20. Total Income. Enter amount from form 1040 line 22; or form 1040A line 15 |

20 |

|

|

|

|

00 |

|

||

21.Total Colorado Income. Enter the total from the Colorado column, lines 5, 7, 9, 11,

13, 15, 17 and 19 |

21 |

00 |

22.Enter all federal adjustments from form 1040 line 36, or form 1040A line 20

(list type______________________________________________________) .. |

22 |

00 |

|

|

23. Enter adjustments from line 22 as follows: (list type_____________________) |

23 |

|

|

|

|

00 |

|||

•Educator expenses, IRA deduction, business expenses of reservists, performing artists and

in the ratio of Colorado wages and/or

•Student loan interest deduction, alimony, and tuition and fees deduction are allowed

in the Colorado to federal total income ratio (line 21/ line 20).

•Domestic production activities deduction is allowed in the Colorado to Federal QPAI ratio.

•Penalty paid on early withdrawals made while a Colorado resident.

•Moving expenses if you are moving into Colorado, not if you are moving out.

•For treatment of other adjustments reported on form 1040 line 36, see Income 6.

24.Adjusted Gross Income. Enter amount from form 1040 line 37; or form 1040A line 21;

or form 1040EZ line 4 |

24 |

00 |

25.Colorado Adjusted Gross Income. If you iled form 1040 or 1040A, subtract the amount on line 23 of Form 104PN from the amount on line 21 of Form 104PN . If you

iled form 1040EZ, enter the total of lines 5, 7 and 9 of Form 104PN |

25 |

26.Additions to Adjusted Gross Income. Enter the amount from line 3 of Colorado

Form 104 excluding any charitable contribution adjustments |

26 |

00 |

27.Additions to Colorado Adjusted Gross Income. Enter any amount from line 26 that is

from

AND/OR any

|

a Colorado resident. (See |

Income 6 for treatment of other additions) |

.................................. |

27 |

28. |

Total of lines 24 and 26 |

28 |

00 |

|

29. |

Total of lines 25 and 27 |

|

29 |

|

30.Subtractions from Adjusted Gross Income. Enter the amount from line 17 of Colorado

Form 104 excluding any qualifying charitable contributions |

30 |

00 |

31.Subtractions from Colorado Adjusted Gross Income. Enter any amount from line 30

as follows: |

31 |

•The state income tax refund subtraction to the extent included on line 19 above,

•The federal interest subtraction to the extent included on line 7 above,

•The pension/annuity subtraction and the PERA or School District Number One retirement subtraction to the extent included on line 13 above,

•The Colorado capital gain subtraction to the extent included on line 11 above,

•For treatment of other subtractions, see Income 6.

32.Modiied Adjusted Gross Income. Subtract the amount on line 30 from the amount

on line 28 |

32 |

00 |

00

00

00

00

33.Modiied Colorado Adjusted Gross Income. Subtract the amount on line 31 from the

|

amount on line 29 |

33 |

34. |

Amount on line 33 divided by the amount on line 32 |

34 |

35. |

Tax from the tax table based on income reported on Colorado Form 104 line 18 |

35 |

36. |

Apportioned tax. Amount on line 35 multiplied by the percentage on line 34. Enter |

|

|

here and on Form 104 line 19 |

36 |

00

%

00

00