Handling PDF documents online is certainly simple with this PDF tool. You can fill in Colorado Form 1Dr 0112Ep here and try out a number of other functions we offer. The tool is consistently maintained by our team, receiving cool features and growing to be better. Starting is simple! What you need to do is take these simple steps directly below:

Step 1: Hit the orange "Get Form" button above. It's going to open up our pdf tool so that you can start filling out your form.

Step 2: This tool offers the capability to modify PDF files in a variety of ways. Enhance it by including customized text, correct what is already in the PDF, and place in a signature - all when it's needed!

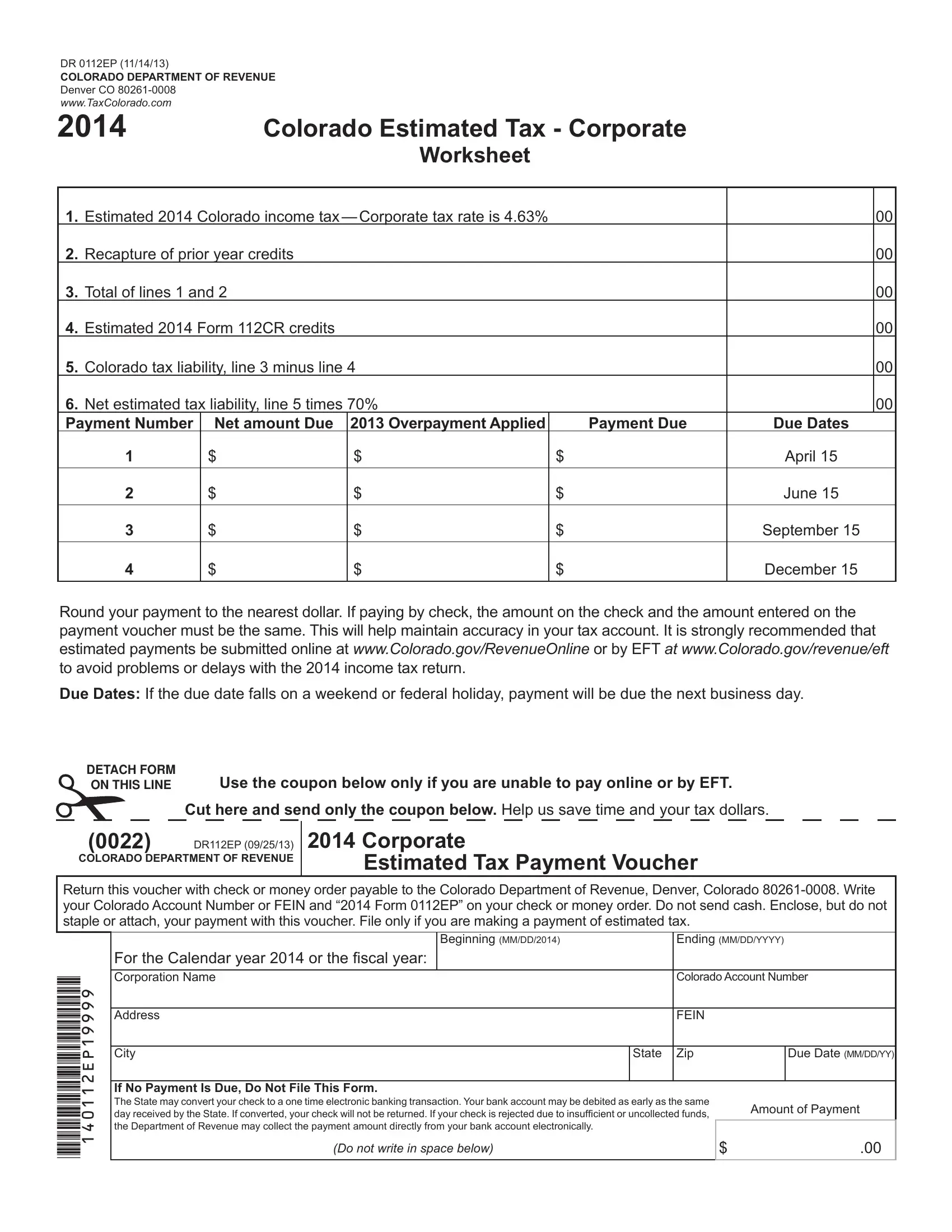

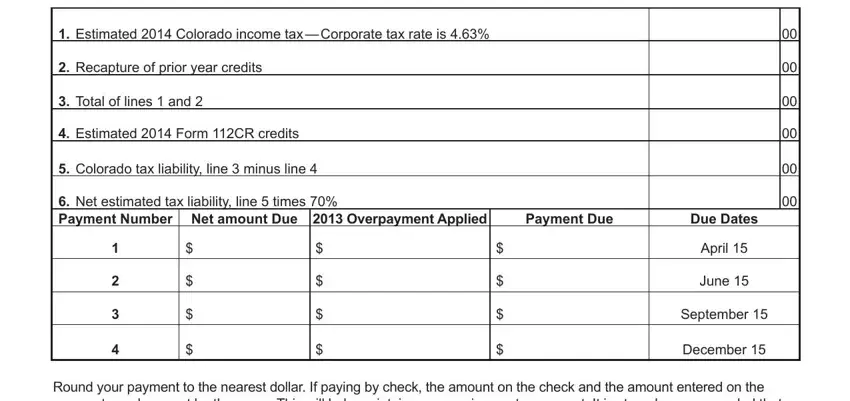

This PDF will need specific data to be typed in, so be certain to take some time to provide precisely what is requested:

1. Complete the Colorado Form 1Dr 0112Ep with a group of essential fields. Note all of the information you need and be sure not a single thing omitted!

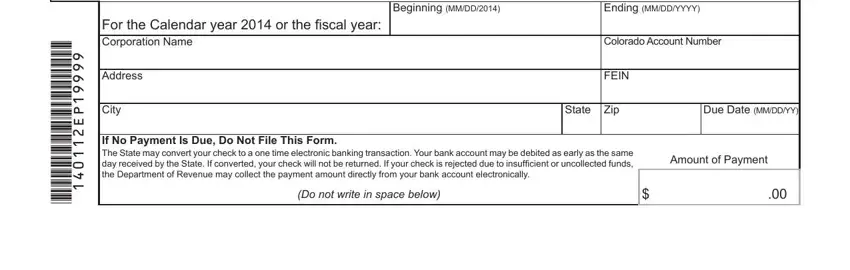

2. When this array of blanks is completed, go on to enter the applicable information in these - Beginning MMDD, Ending MMDDYYYY, For the Calendar year or the, Address, City, Colorado Account Number, FEIN, State Zip, Due Date MMDDYY, If No Payment Is Due Do Not File, Amount of Payment, Do not write in space below, and P E.

Always be extremely mindful when filling in State Zip and Beginning MMDD, because this is where many people make errors.

Step 3: Go through what you have inserted in the blanks and then click on the "Done" button. Make a free trial plan with us and gain direct access to Colorado Form 1Dr 0112Ep - which you'll be able to then work with as you would like in your FormsPal account. We don't share or sell the information you use whenever dealing with forms at our site.