It is possible to complete the Colorado Form 26 document using our PDF editor. The next steps will assist you to immediately create your document.

Step 1: To start out, choose the orange button "Get Form Now".

Step 2: At this point, you can start modifying your Colorado Form 26. Our multifunctional toolbar is at your disposal - add, remove, alter, highlight, and conduct various other commands with the content material in the form.

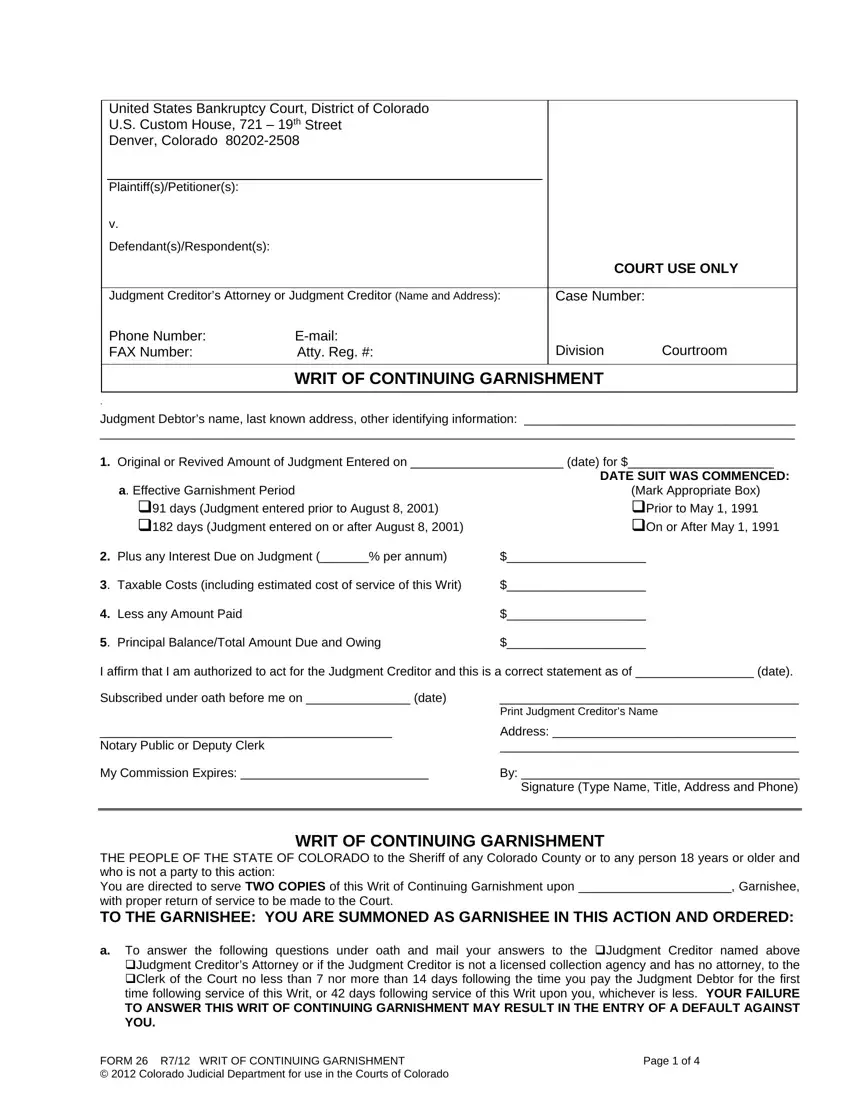

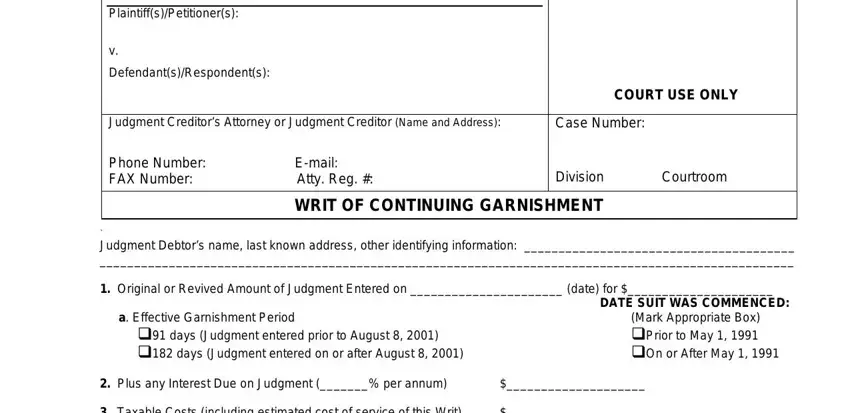

Provide the requested data in every single part to prepare the PDF Colorado Form 26

The application will need you to fill out the Taxable Costs including estimated, Less any Amount Paid, Principal BalanceTotal Amount Due, I affirm that I am authorized to, Subscribed under oath before me on, Notary Public or Deputy Clerk, My Commission Expires, Print Judgment Creditors Name, Address, By Signature Type Name Title, WRIT OF CONTINUING GARNISHMENT THE, and a To answer the following field.

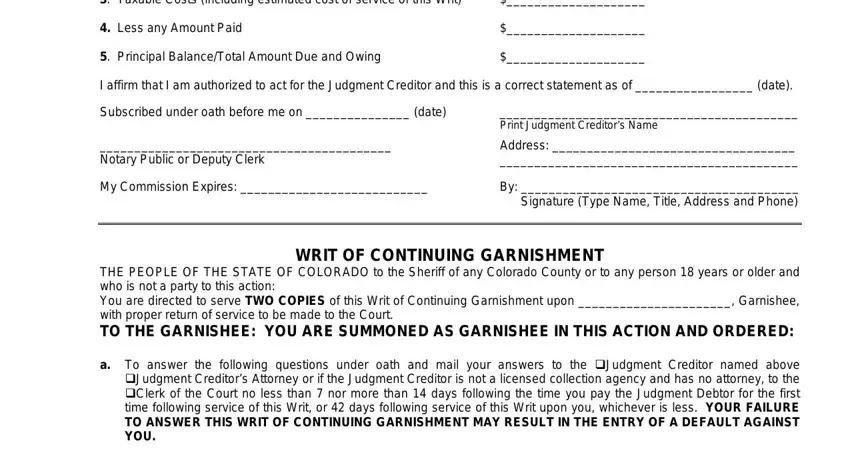

The system will ask you to provide specific important information to easily complete the segment you pay the Judgment Debtor for, e MAKE CHECKS PAYABLE AND MAIL TO, By Deputy Clerk, Kenneth S Gardner, Date, NOTICE TO GARNISHEE a This Writ, Earnings includes all forms of, In no case may you withhold any, Judgment Debtors Name, QUESTIONS TO BE ANSWERED BY, The following questions MUST be, and a On the date and time this Writ.

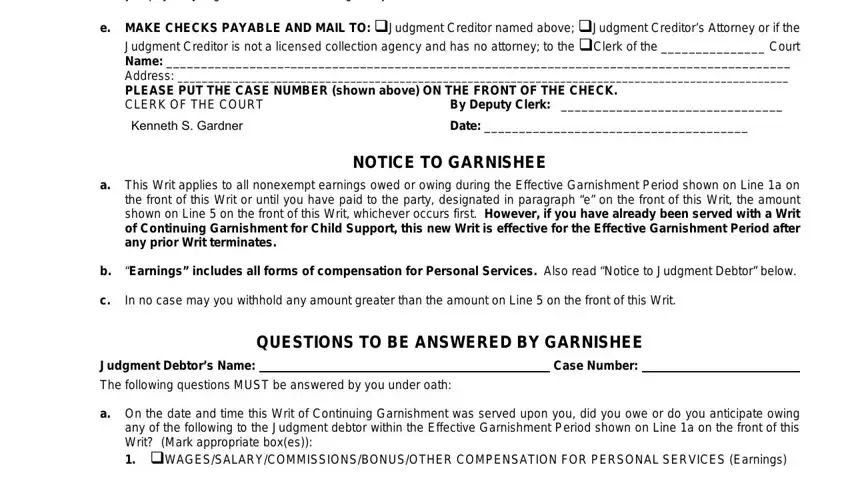

Inside of space Health Accident or Disability, Pension or Retirement Benefits, b Are you under one or more of the, Writ of Continuing Garnishment, Writ of Garnishment for Support, If you marked Box and you did NOT, FORM R WRIT OF CONTINUING, and Page of, identify the rights and obligations.

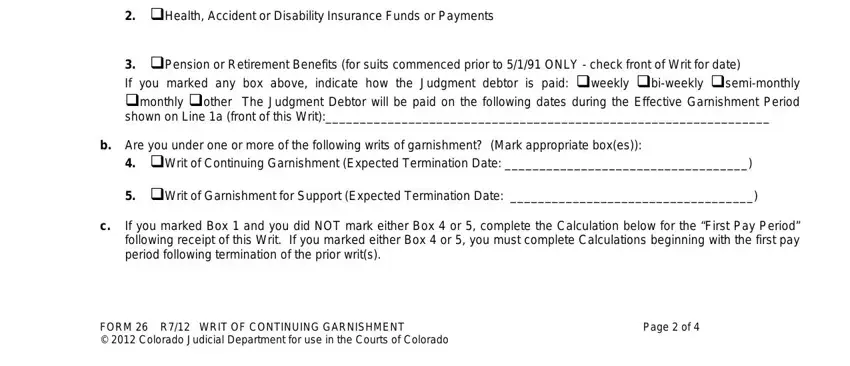

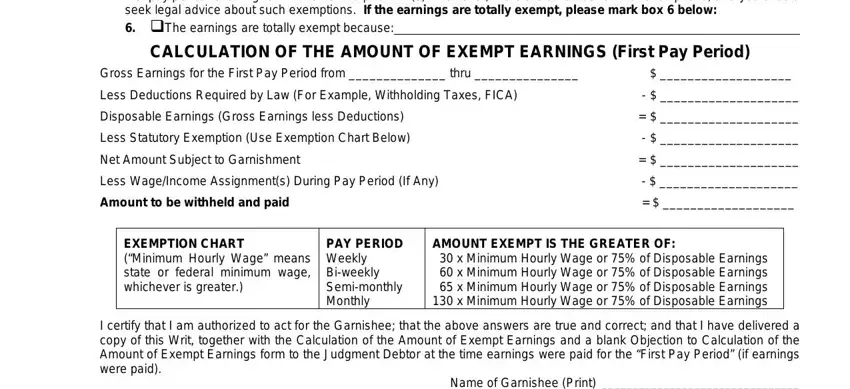

End by checking the next areas and filling them out as required: If you marked Box or and you did, CALCULATION OF THE AMOUNT OF, Gross Earnings for the First Pay, Less Deductions Required by Law, Disposable Earnings Gross Earnings, Less Statutory Exemption Use, Net Amount Subject to Garnishment, Less WageIncome Assignments During, Amount to be withheld and paid, EXEMPTION CHART Minimum Hourly, PAY PERIOD Weekly Biweekly, AMOUNT EXEMPT IS THE GREATER OF x, I certify that I am authorized to, and Name of Garnishee Print Address.

Step 3: When you select the Done button, your final document is simply transferable to any type of of your devices. Or, you can send it through mail.

Step 4: It can be easier to prepare copies of the file. There is no doubt that we are not going to display or read your information.