By using the online tool for PDF editing by FormsPal, you are able to complete or modify Colorado Form Cr0100 here and now. In order to make our editor better and easier to utilize, we continuously develop new features, considering feedback from our users. Getting underway is effortless! All you have to do is follow the following easy steps directly below:

Step 1: First, access the pdf tool by clicking the "Get Form Button" at the top of this site.

Step 2: When you launch the file editor, you will notice the document made ready to be filled out. Other than filling out different fields, you could also do several other actions with the form, that is adding any textual content, editing the initial textual content, adding illustrations or photos, placing your signature to the form, and more.

It's an easy task to fill out the document using out practical guide! This is what you want to do:

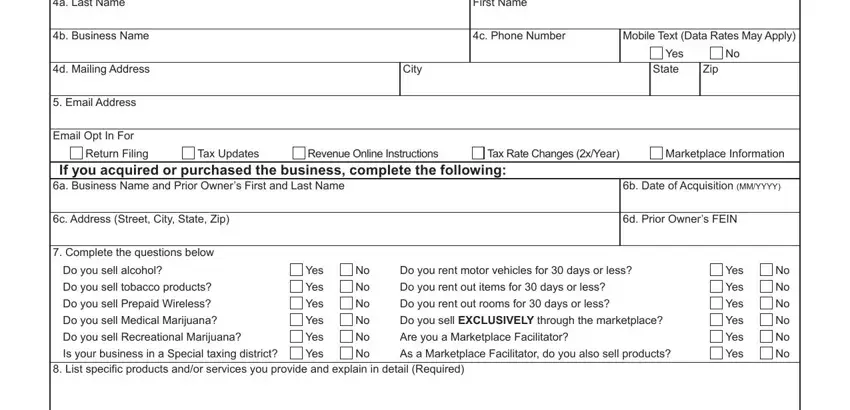

1. You'll want to fill out the Colorado Form Cr0100 accurately, hence take care when working with the parts that contain all these fields:

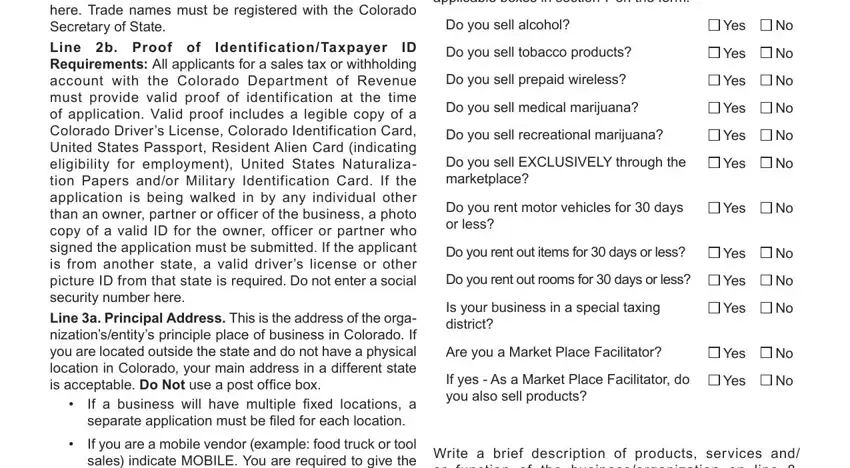

2. Soon after this section is completed, go to enter the suitable details in these: Original Application, Change of Ownership, Additional Location, Reason for Filing This Application, Do you have a Colorado Account, If Yes the Account Number, Indicate Type of Organization If, Yes, IndividualSole Proprietor General, Limited Liability Company LLC, CorporationS Corp Association, Government Joint Venture Nonprofit, a Last Name If registering as SSN, First Name, and b SSN Required.

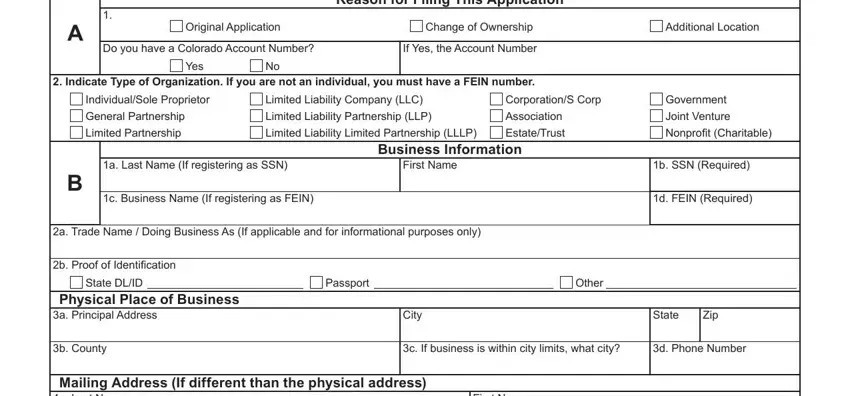

3. The next part will be easy - fill in all of the fields in Mailing Address If different than, First Name, b Business Name, d Mailing Address, Email Address, Email Opt In For, c Phone Number, Mobile Text Data Rates May Apply, City, Yes State, Zip, Return Filing, Tax Updates, Revenue Online Instructions, and Tax Rate Changes xYear in order to finish this segment.

In terms of First Name and Email Opt In For, ensure you double-check them here. These are surely the most significant fields in the form.

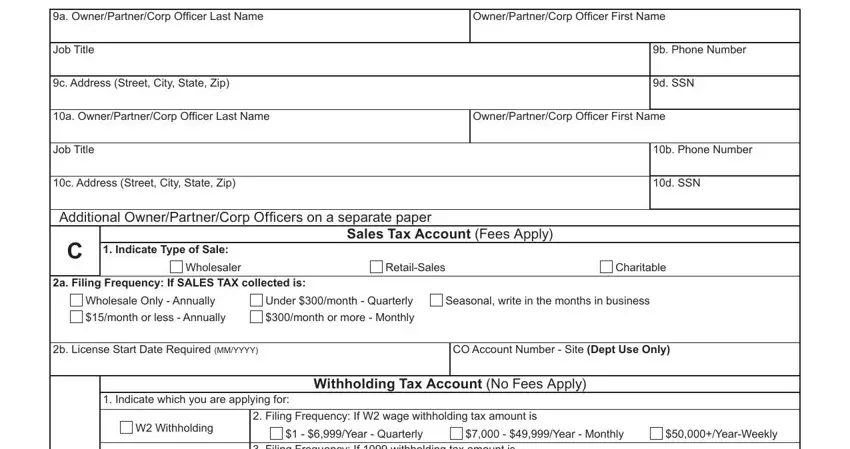

4. This part comes with all of the following blanks to type in your particulars in: a OwnerPartnerCorp Officer Last, OwnerPartnerCorp Officer First Name, Job Title, c Address Street City State Zip, b Phone Number, d SSN, a OwnerPartnerCorp Officer Last, OwnerPartnerCorp Officer First Name, Job Title, c Address Street City State Zip, b Phone Number, d SSN, Additional OwnerPartnerCorp, Indicate Type of Sale, and Sales Tax Account Fees Apply.

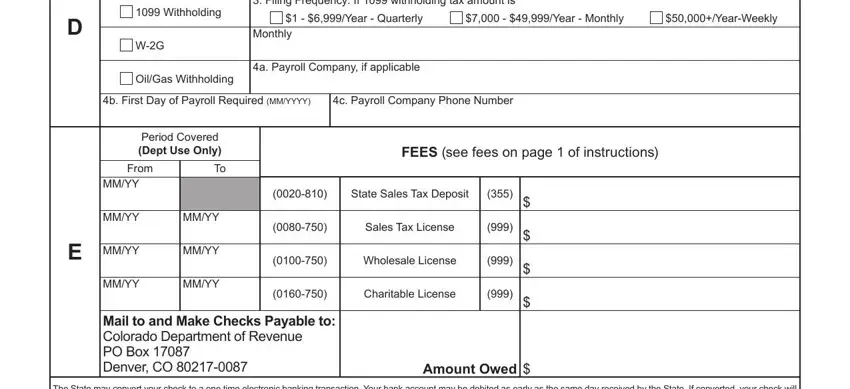

5. To finish your form, this last part requires a number of additional blanks. Entering Withholding, OilGas Withholding, Filing Frequency If withholding, Year Quarterly, Year Monthly, YearWeekly, Monthly, a Payroll Company if applicable, b First Day of Payroll Required, c Payroll Company Phone Number, Period Covered Dept Use Only, From, MMYY, MMYY, and MMYY should conclude the process and you'll be done in a short time!

Step 3: Make certain the information is right and then just click "Done" to finish the process. Acquire your Colorado Form Cr0100 once you subscribe to a free trial. Conveniently gain access to the pdf file within your FormsPal account page, with any modifications and changes conveniently preserved! At FormsPal, we do our utmost to guarantee that all your information is kept private.