form dr 8453 colorado can be filled in easily. Simply try FormsPal PDF tool to get the job done in a timely fashion. To have our editor on the leading edge of convenience, we strive to implement user-oriented capabilities and enhancements on a regular basis. We're routinely grateful for any feedback - play a pivotal role in revolutionizing PDF editing. Starting is easy! All you should do is take the following easy steps directly below:

Step 1: Access the PDF form inside our tool by clicking the "Get Form Button" above on this webpage.

Step 2: The editor provides the ability to modify PDF forms in a range of ways. Modify it by writing any text, correct what's originally in the document, and include a signature - all at your fingertips!

This PDF doc needs some specific information; to ensure correctness, you need to pay attention to the next suggestions:

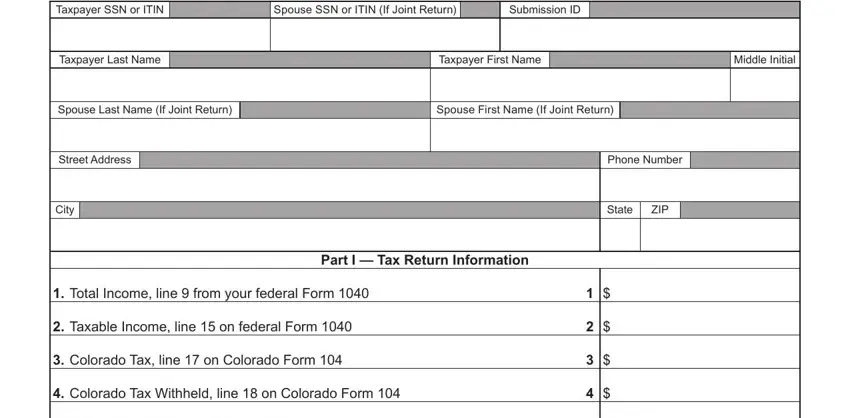

1. It's vital to fill out the form dr 8453 colorado correctly, thus be careful when filling in the segments comprising these particular blank fields:

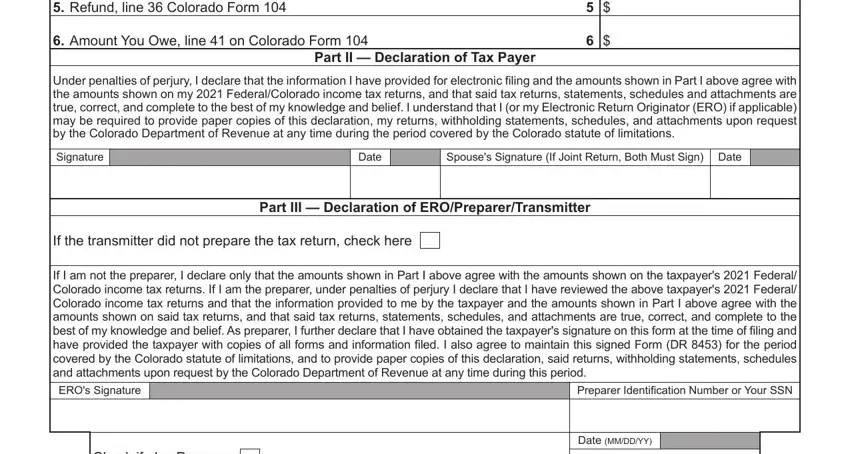

2. After finishing the previous part, head on to the next step and complete all required details in these fields - Refund line Colorado Form, Amount You Owe line on Colorado, Part II Declaration of Tax Payer, Under penalties of perjury I, Signature, Date, Spouses Signature If Joint Return, If the transmitter did not prepare, Part III Declaration of, If I am not the preparer I declare, EROs Signature, Preparer Identification Number or, Check if also Preparer, and Date MMDDYY.

3. Completing Check if also Preparer is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It's simple to make errors while filling in the Check if also Preparer, hence make sure that you look again prior to deciding to submit it.

Step 3: Once you have reread the details you given, press "Done" to conclude your form at FormsPal. Go for a free trial plan at FormsPal and gain instant access to form dr 8453 colorado - download or modify inside your personal account page. Here at FormsPal, we strive to ensure that all your details are stored secure.