Handling PDF files online is very easy with this PDF editor. You can fill in ct vehicle gift form here effortlessly. The tool is continually maintained by our team, acquiring useful functions and growing to be better. Starting is simple! Everything you need to do is take the following easy steps directly below:

Step 1: Firstly, access the tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: The editor offers you the capability to modify your PDF in a variety of ways. Improve it with customized text, correct what's already in the file, and place in a signature - all at your fingertips!

It is straightforward to finish the pdf adhering to this detailed guide! Here is what you should do:

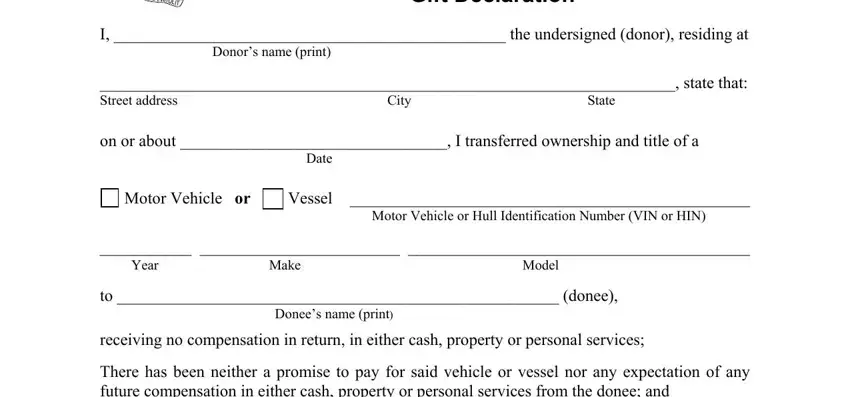

1. The ct vehicle gift form necessitates particular details to be entered. Ensure that the following blanks are completed:

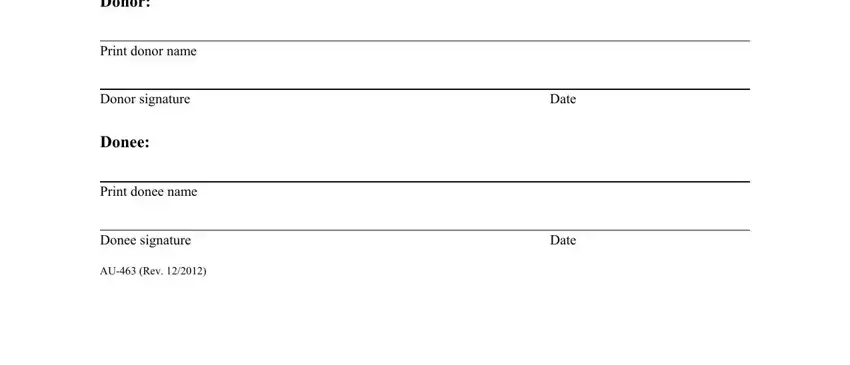

2. When the previous section is complete, you should put in the essential particulars in Donor, Print donor name, Donor signature, Donee, Print donee name, Donee signature, AU Rev, Date, and Date allowing you to progress further.

Be very attentive when completing Donor signature and Donee signature, since this is where most people make some mistakes.

Step 3: Proofread all the details you've entered into the blanks and press the "Done" button. Get the ct vehicle gift form once you subscribe to a 7-day free trial. Readily use the form inside your personal cabinet, together with any edits and adjustments being automatically saved! We don't sell or share any details that you provide while filling out forms at our website.