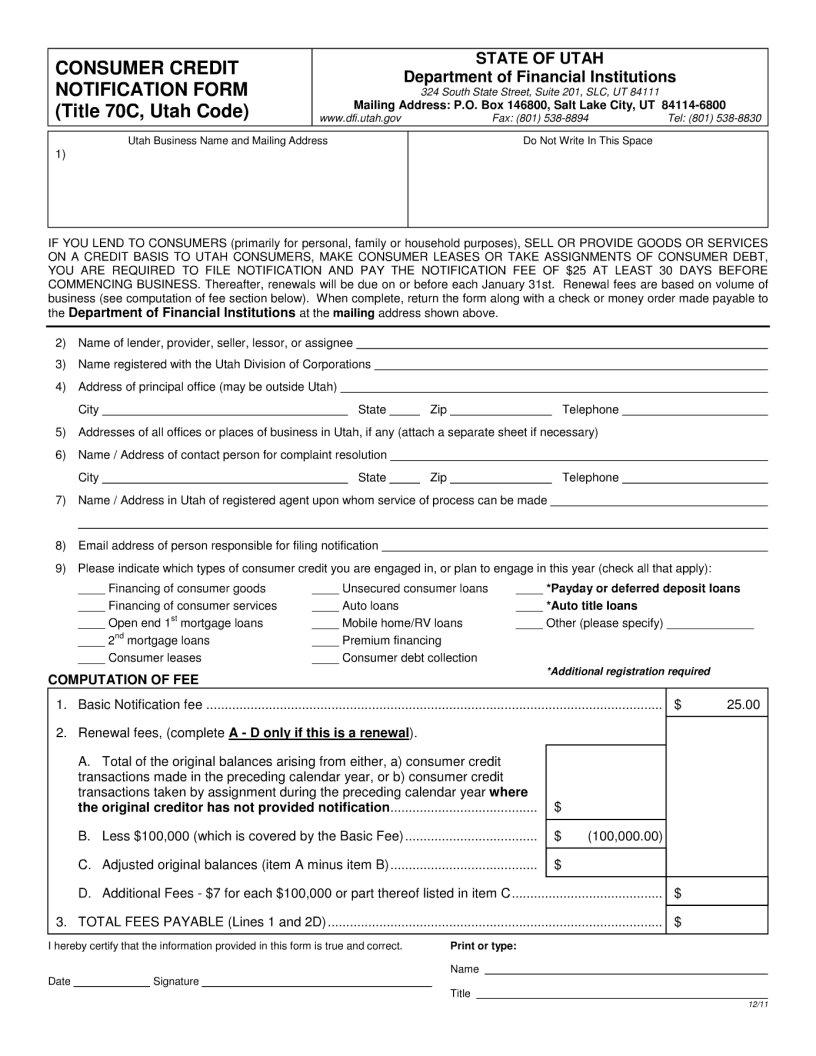

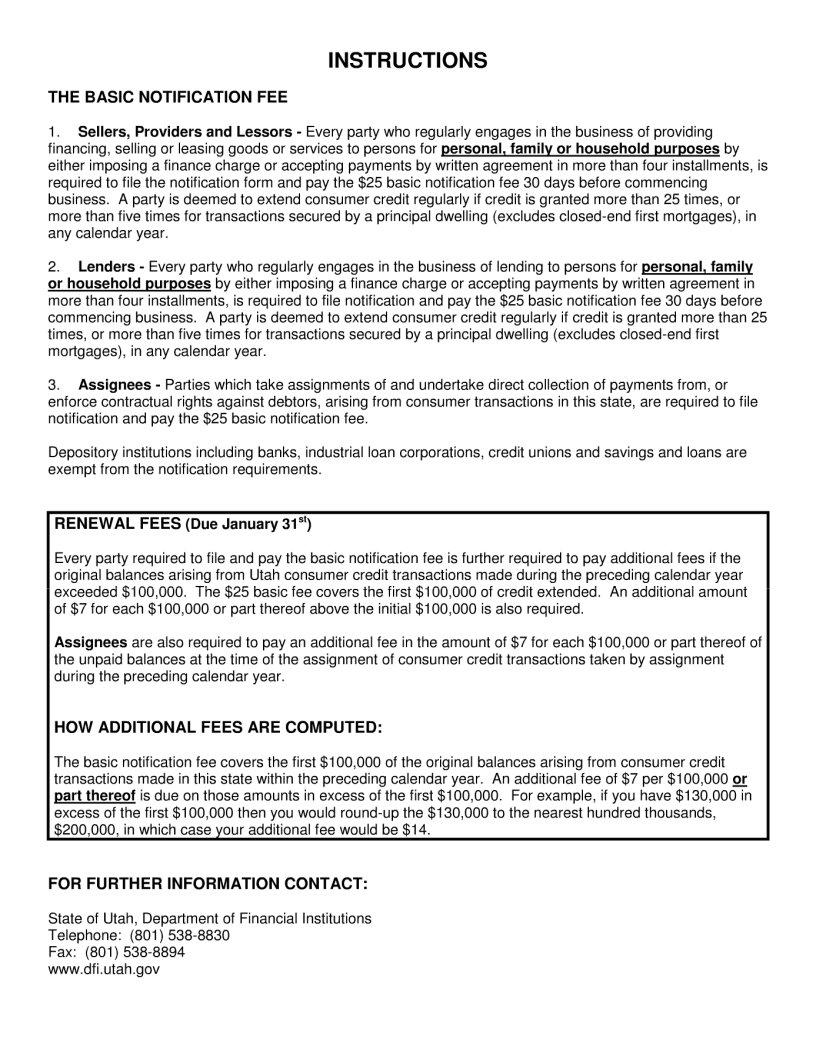

In the world of consumer rights and financial transactions, the Consumer Credit Notification form plays a pivotal role. This critical document serves as a linchpin for communication between financial institutions and consumers, especially when there's a significant decision affecting a consumer's credit report. Whether it's the approval of a loan, a change in credit limits, or adverse action like the denial of credit, this form ensures consumers are promptly informed. It provides a clear explanation of the reasons behind a financial institution's decision, offering insights into how credit information influences their choices. Furthermore, the form guides consumers on how to obtain a copy of their credit report and dispute any inaccuracies, essentially serving as a tool for empowering consumers to maintain accurate credit profiles. By fostering transparency and facilitating better understanding of credit-related decisions, the Consumer Credit Notification form underscores the importance of fair and informed treatment in the consumer credit industry.

| Question | Answer |

|---|---|

| Form Name | Consumer Credit Notification Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | utah credit notification, lessor, ut consumer credit notification form, utah consumer credit notification form |